Introduction to Account Reconciliation

Account reconciliation is the critical process of comparing your general ledger with internal and external sources. Each balance should match its corresponding entry in the general ledger for any source. Matching and validating entries would mean data consolidation across sub-ledgers, vendor invoices, bank statements, receipts, and account receivables to ensure timely and accurate month-end and year-end closing of the financial books.

With disconnected data sources and innumerable documentation, accounting teams can face the added task of figuring in interest rates, exchange rates, and timing differences to reconcile balances effectively. Account Reconciliation can be a fairly manual task, especially right before the monthly close.

Automated Accounts Reconciliation software like Nanonets can cohesively consolidate all data sources on one platform, automate the matching logic across external data sources and general ledgers, effectively provide an audit trail, and keep the process transparent for the accounting team personnel involved.

Types of Account Reconciliation

This guide will help you understand the different sub-groups of account reconciliation activities organizations encounter.

Bank Reconciliation

As the name suggests, it involves comparing the ledger balances to the bank statements. Bank service fees, deposits in transit, outstanding checks, and interest rates must be factored into the reconciliation process.

Vendor Reconciliation

Vendor statements are reconciled with accounts payable to ensure all the payments are accounted for and in line with the documentation.

Inter-Company Reconciliation

Reconciliation process of transaction amounts between entities belonging to the same parent company. Businesses with many divisions, subsidiaries, and franchises typically face this type of account reconciliation.

Credit Card Reconciliation

Comparing company credit card receipts with credit card statements is very important to ensure that all transactions are accurately recorded.

Cash Reconciliation

Verifying that the cash balance in company books or registers coincides with cash at hand to detect employee theft and fraud.

Business-Specific Reconciliation

Reconciling specific business transactions, such as cost of goods sold or inventory valuation, to ensure that all transactions are accurately recorded and accounted for.

Why is Account Reconciliation so Important?

Account reconciliation is essential to ensuring the accuracy and integrity of financial reporting. It also helps prevent and detect theft and fraud earlier, assisting organizations to comply with financial regulations such as the Sarbanes-Oxley Act (SOX), which mandates that publicly traded companies establish internal controls and procedures for financial reporting.

Account reconciliation also helps improve transparency and visibility throughout the financial close process. It reduces the risk of misstatement, which hinders a faster financial close, which is critical for decision-making and stakeholders.

The company”s assets are protected via the internal control division, which bases its work on account reconciliations. Keeping track of the right documentation during the audit process can help reduce the time and effort required for auditors to verify financial statements.

Overall, accurate reconciliation is essential for maintaining a business’s financial health. It helps detect and correct errors, ensuring reliable financial statements and compliance with regulations.

Steps in the Account Reconciliation Process

The reconciliation process ensures each entry of the general ledger matches the corresponding external documentation. Account reconciliation generally happens at the end of every reporting period, which in most cases is monthly.

The critical steps in reconciling your accounts involve:

- Determine the Accounts to Reconcile: Identify the general ledger accounts that need to be reconciled, such as cash, accounts receivable, accounts payable, inventory, and fixed assets.

- Gather Necessary Data: Collect all relevant supporting documentation, such as bank statements, vendor invoices, customer statements, and internal accounting records.

- Compare Data: Compare the general ledger balances with the supporting documentation to identify discrepancies or differences.

- Investigate Discrepancies: Investigate the causes of any discrepancies, such as timing differences, missing transactions, or errors in recording.

- Make Adjustments: Make necessary adjustments to the general ledger to correct the discrepancies and ensure the accounts are accurately reconciled.

- Document the Process: Document the reconciliation process, including the steps taken, the discrepancies identified, and the adjustments made. Retain all supporting documentation.

- Repeat Regularly: Perform account reconciliations regularly, such as monthly or quarterly, to ensure the ongoing accuracy and integrity of the financial records.

Determine the Accounts to Reconcile

Gather Necessary Data

Compare Data

Investigate Discrepancies

Make Adjustments

Document the Process

Repeat Regularly

What Happens Without a Proper Account Reconciliation Process?

Without a proper account reconciliation process in place, accounting teams can run into a number of problems; some of them are listed down as to why account reconciliation is necessary.

- Inaccurate financial statements: Your company might face potential legal issues due to less-than-timely and incorrect financial statements, which can also lead to flawed decision-making regarding financial data.

- Difficulty in error resolution: Without a properly documented and structured reconciliation process in place, it can be very difficult to resolve errors effectively.

- Increased Time and Resource Requirements: As your organisation grows, additional balances are meant to be reconciled with their external documentation. This would mean greater resource requirements and an increase in the probability of human manual errors.

- Delayed Fraud Detection: Unauthorised credit card activity, duplicate checks, and other fraudulent activities might go unnoticed due to ineffective account reconciliation.

Hence, timely and accurate account reconciliations are key to enabling your decision-makers and stakeholders to make accurate financial decisions. They are also important in adhering to compliance issues and making sure a clean audit trail is in place for future benchmarking purposes.

Challenges With Manual Account Reconciliation and Excel

Accounting Reconciliations are the main bottleneck in the financial close process. With disconnected data sources and improper documentation, manual, heavy transaction matching can be prone to human error. Accounting firms typically spend 2-3 days on average doing manual reconciliations.

When many accounts have to be analyzed, which means balance matching across different data sources, it can be daunting for accounting teams when challenged without improper supporting documentation in place.

Imagine a scenario where your team has to reconcile hundreds of transactions from various sources, including bank statements, credit card statements, vendor invoices, and internal ledgers. As the financial close deadline approaches, the team faces several challenges:

Volume of Transactions: The sheer volume of transactions is overwhelming. Each transaction must be matched manually, which is time-consuming and tedious.

Data Discrepancies: Inconsistencies and discrepancies often arise between different data sources. Identifying and resolving these discrepancies requires significant effort and attention to detail.

Human Error: Manual reconciliation is prone to human errors. Data entry, matching, or interpretation mistakes can lead to incorrect financial statements.

Limited Resources: The accounting team is limited in size and resources. As the deadline approaches, the pressure increases, leading to potential burnout and an increased likelihood of errors.

Complex Reconciliation Rules: Some transactions involve complex reconciliation rules and multiple steps, further complicating the manual process.

Lack of Real-Time Visibility: The team lacks real-time visibility into the reconciliation status, making it difficult to track progress and identify bottlenecks.

Excel spreadsheets are generally considered the go-to tool when it comes to accounting reconciliations; however, when faced with the above-mentioned issues, they, too, face a lack of:

- Single source of data: No single repository for supporting calculations and comments. Managing different spreadsheets and keeping track across version controls can leads to errors.

- Heavily manual: Excel still does not have any workflow automation capabilities, audit trails, or a database to rely on. Effective resolution of errors is still time-consuming and outdated.

How does Automation Transform the Account Reconciliation Process?

Implementing an automated reconciliation software like Nanonets can significantly resolve these challenges.

- Efficiency and Speed: Automated systems can process and match transactions at a much faster rate than manual methods. As soon as ledger and supporting documentation entries are uploaded for reconciliation, the software extracts data from pdfs, arranges the data into predefined templates and tries to match each balance with its corresponding entry.

- Accuracy and Consistency: By automating manual matching of balances using Machine Learning algorithms, automated software can achieve higher accuracy on transaction matching which reduces the risk of human error. Automated account reconciliation software use predefined rules to match and ensure reliable results.

- Real-Time Processing: Keeping the reconciliation process up-to-date can mean effectively resolving any errors that occur with prompt workflow automation capabilities. Accounting teams can reduce the workload right before the monthly close by reconciling entries in real time and assigning resolutions to entries that did not reconcile as and when they were processed.

- Scalability: Automated Reconciliations are highly scalable, which means as your requirements increase the software is able to adapt with the higher need in demand. As opposed to doing this manually, it would mean hiring more resources to do it manually. Also means, accounting teams can allocate their resources effectively by automating routine and repetitive tasks they can focus on higher value activities.

Automate Account Reconciliation on Nanonets

Nanonets offers a comprehensive solution for automating account reconciliation by addressing the key pain points faced by accounting teams. Here’s how users can leverage Nanonets to streamline their reconciliation processes:

Consolidated Data Sources in One Platform

Nanonets can integrate seamlessly with various data sources, allowing users to consolidate all their transaction data in a single platform. This includes bank statements, credit card statements, vendor invoices and ledgers.

Nanonets can access these files received via email, integration with banks, or accounting tools to directly pull this data on the platform.

Automated Transaction Matching Using NLP Techniques

Nanonets uses advanced Natural Language Processing (NLP) techniques to match transactions automatically. The system can:

- Identify Similar Transactions: Even if the descriptions or formats differ, NLP helps recognize similar transactions across different sources.

- Handle Variations in Data: The system can understand and match transactions despite variations in descriptions, amounts, and dates.

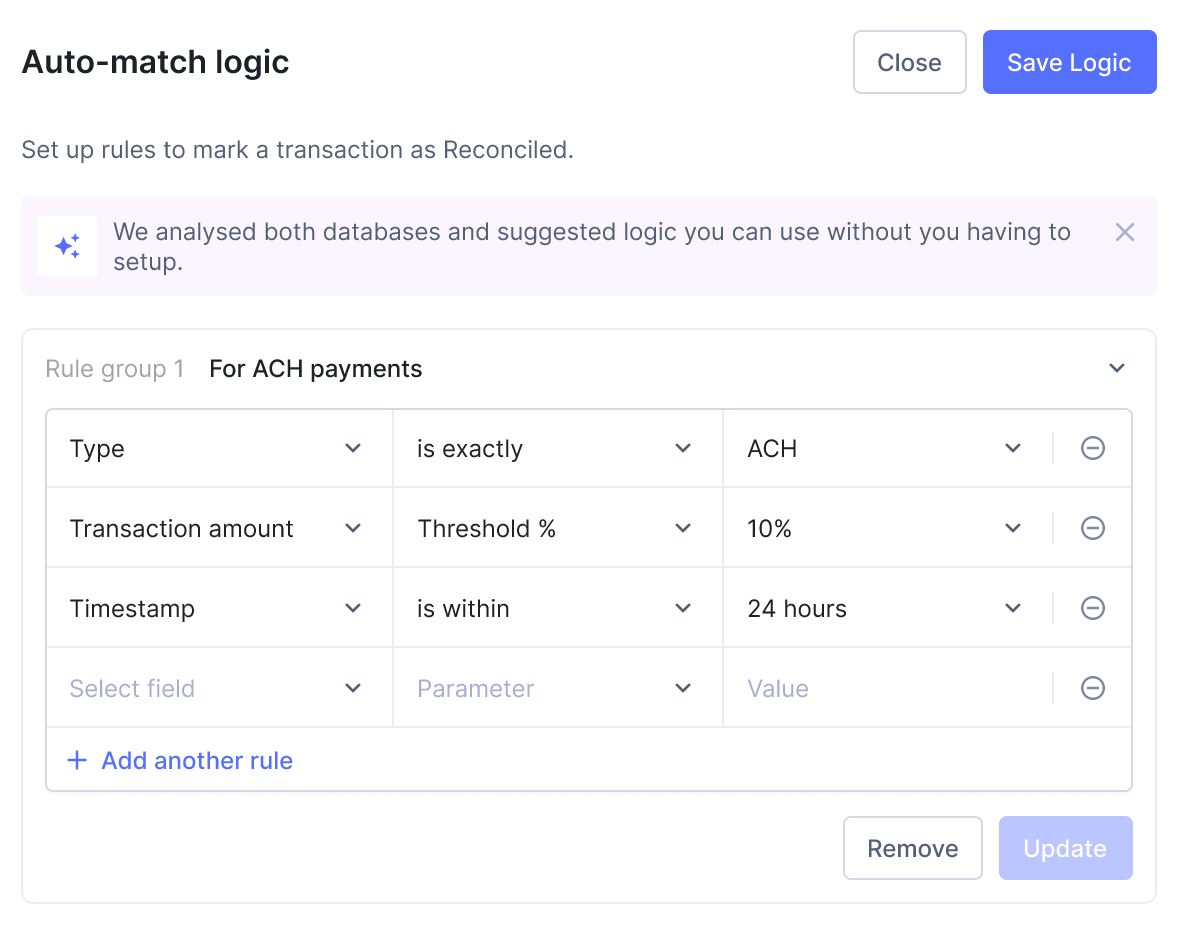

Customizable and Complex Rules for Customized Matching

Users can define and customize complex reconciliation rules to suit their specific needs. Nanonets allows:

- Rule-Based Matching: Create rules based on transaction types, amounts, dates, and descriptions.

- Custom Filters: Apply filters to focus on specific transactions or accounts.

- Multi-Step Matching: Implement multi-step reconciliation processes for complex scenarios.

Continuous Learning with ai for Higher Accuracy

Nanonets’ ai continuously learns from user-defined rules and past reconciliation processes. This results in:

- Improved Accuracy: The system becomes more accurate over time, reducing the need for manual intervention.

- Adaptive Learning: ai adapts to changes in transaction patterns and user preferences, enhancing its effectiveness.

Data Extraction Capabilities

Nanonets excels at extracting data from various documents, including:

- Email Attachments: Automatically extract transaction data from invoices and statements received via email.

- Uploads: Users can directly upload documents to the platform for data extraction.

- Integration with Other Tools: Seamlessly pull data from other accounting tools and systems.

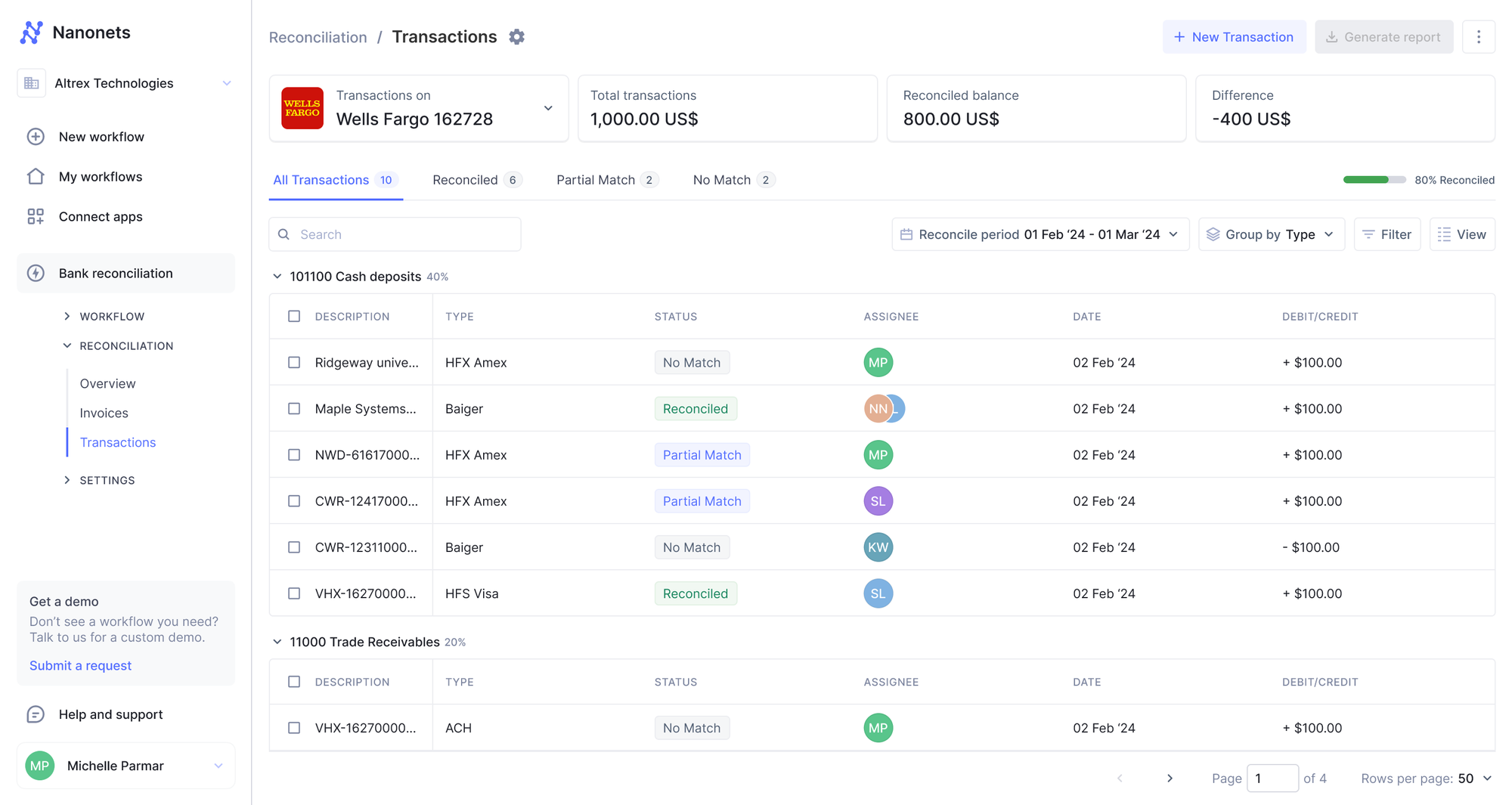

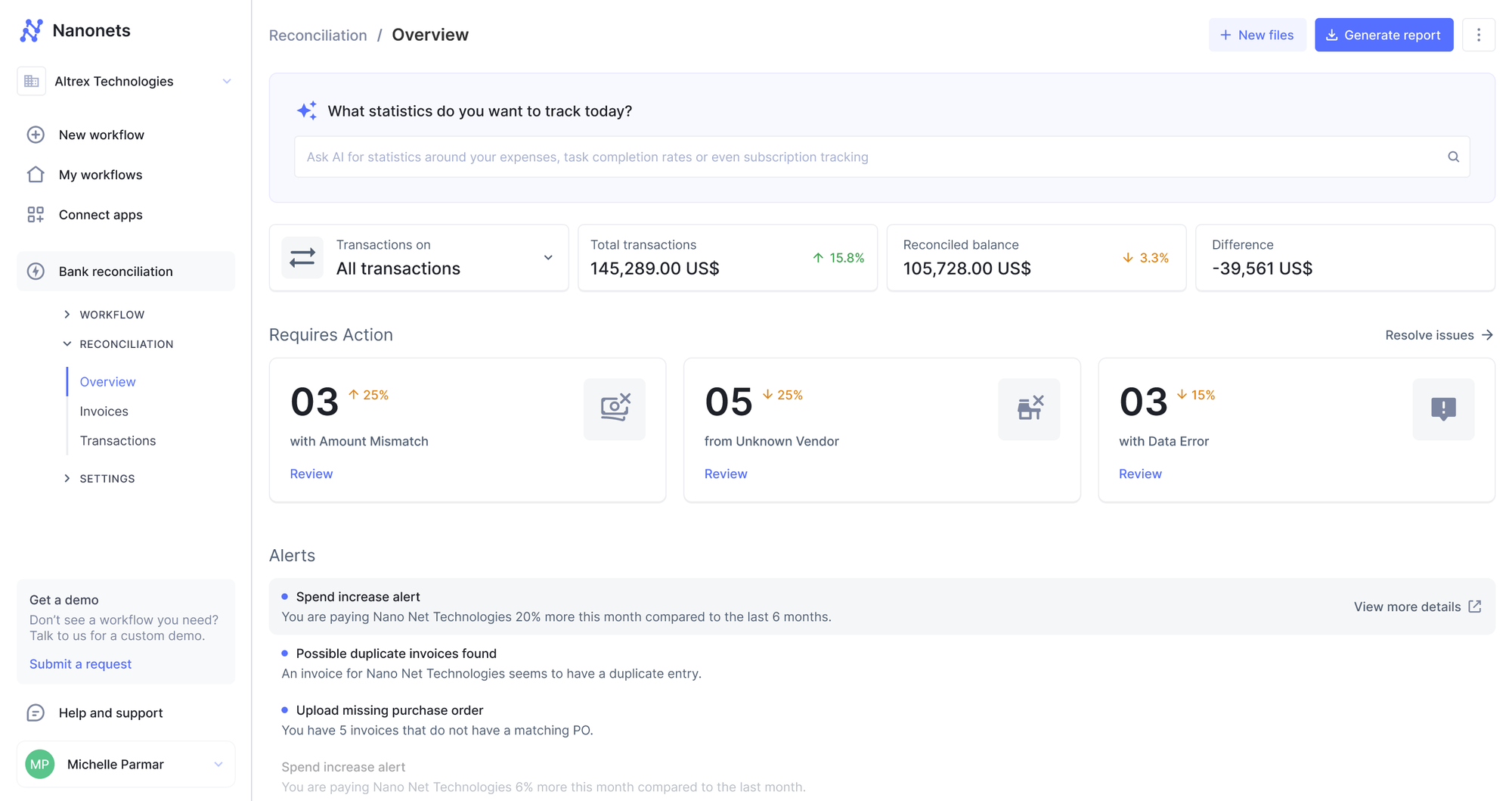

Cohesive Dashboard for Summary and Insights

Nanonets provides a cohesive dashboard that summarizes the entire account reconciliation process. Features include:

- Real-Time Updates: Get real-time insights into the reconciliation status.

- Summary Views: Overview of matched and unmatched transactions.

- Detailed Reports: Access detailed reports and drill down into specific transactions for in-depth analysis.

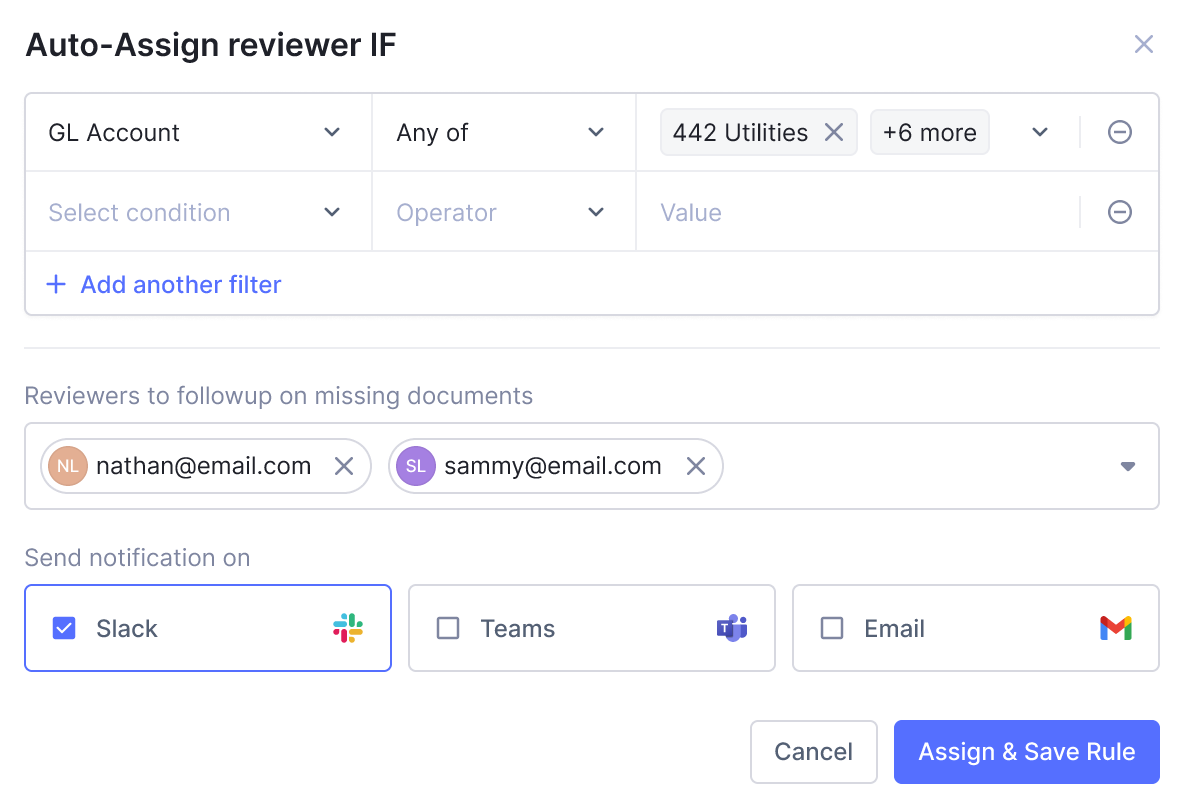

Triggering Workflows for Unmatched Balances

To ensure timely resolution of unmatched balances, Nanonets can trigger automated workflows:

- Alerts and Notifications: Send alerts for unmatched transactions to designated team members.

- Task Assignments: Automatically assign tasks to resolve discrepancies.

- Follow-Up Actions: Schedule follow-up actions and reminders to ensure discrepancies are addressed promptly.

Example Reconciliation Workflow on Nanonets

A leading US-based retailer processing approximately 2 million transactions monthly faced significant challenges in their account reconciliation process before using Nanonets.

The challenges they faced were mainly

- Highly manual process

- Large accounting team

- Complex review process

- Delayed financial closing

Nanonets Solution

To address these issues, the retailer implemented Nanonets’ automated reconciliation solution. Here’s how Nanonets transformed their reconciliation process:

- Data Consolidation and Extraction:

- Document Types: The system handled bank statements and financial records.

- Volume: Efficiently processed 2 million transactions per month.

- Document Classifier: Automatically classified and extracted data from incoming documents, significantly reducing manual data entry.

- Automated Workflows:

- Daily Matching: Nanonets triggered daily workflows to match transactions against bank statements and financial records.

- Flagging and Notification: Invoices and purchase orders (POs) that required attention were flagged and sent to relevant stakeholders.

- Seamless Integration:

- ERP Management: Validated data was seamlessly stored in the retailer’s ERP system.

- Rejected Files: Any rejected files were archived, ensuring no data was lost and all discrepancies were documented for review.

Customer Impact

The implementation of Nanonets resulted in significant improvements across various metrics:

- 75% Time Saved: The Automation of the reconciliation process saved the finance department 75% of the time previously spent on manual reconciliation.

- 10X Faster Turnaround: The speed of processing and matching transactions increased tenfold, enabling quicker financial closings and timely decision-making.

- 95% Reduction in Manual Effort: Automation drastically reduced the manual effort in data extraction, classification, and matching, allowing the finance team to focus on more strategic tasks.

- Cost Savings: Reducing document handling, manual data entry, and error costs led to substantial efficiency gains. While not quantified here, additional benefits included higher data visibility and the effective use of structured data for analysis and reporting.

By leveraging Nanonets, the retailer not only streamlined their reconciliation process but also achieved higher accuracy, faster turnaround times, and significant cost savings. This case study demonstrates the powerful impact of automated reconciliation and how Nanonets can be a game-changer for large-scale transaction management in the retail industry.