Image source: Getty Images

Greggs (LSE: GRG) shares have torn it apart since the pandemic. I don't have the high street bakery chain in my portfolio, but I wish I did. Now I'm wondering if it's the right time to buy.

The Greggs share price has soared 47.1% in the last two years. The shares would have turned a £10,000 investment into £14,710. With dividends, the total would be closer to £15,500.

Of course, in retrospect, we could all be millionaires. Greggs shares have slowed lately. They have increased only 2.93% in the last 12 months. During the same period, the FTSE 250 As a whole, it grew by 5.72%.

Investors love Greggs, judging by our site traffic, but there's a problem here. Maybe they like it too much.

FTSE 250 growth stocks

There is certainly a lot to like. 2023 saw “another year of rapid growth and strong progress”, in the words of CEO Roisin Currie. Total sales rose 19.6% to £1.81bn as Greggs expanded its store network beyond 3,000. It also sold more per store, with comparable sales increasing a tasty 13.7%. Pre-tax profits rose 13% to £167.7m.

In October 2021, it announced an ambitious plan to double sales in five years and it's off to a good start. If you disappoint, the reaction could be brutal, which brings me to the point I mentioned.

The shares are a bit expensive. Trading at 22.34 times earnings, they are 70% higher than the FTSE 250 average of 13.1 times. The markets have priced in a lot of growth there. If it does not materialize, the share price could be affected.

I'm quite optimistic about Greggs' prospects. It's a fixture on the street now. It survived pandemic lockdowns and thrived during the cost of living crisis. As a purveyor of cheap candy, it could have benefited as buyers shifted.

stocks could do even better when people have a little more cash to spend. Although there is a danger that they could exchange it for something more expensive.

It also pays dividends.

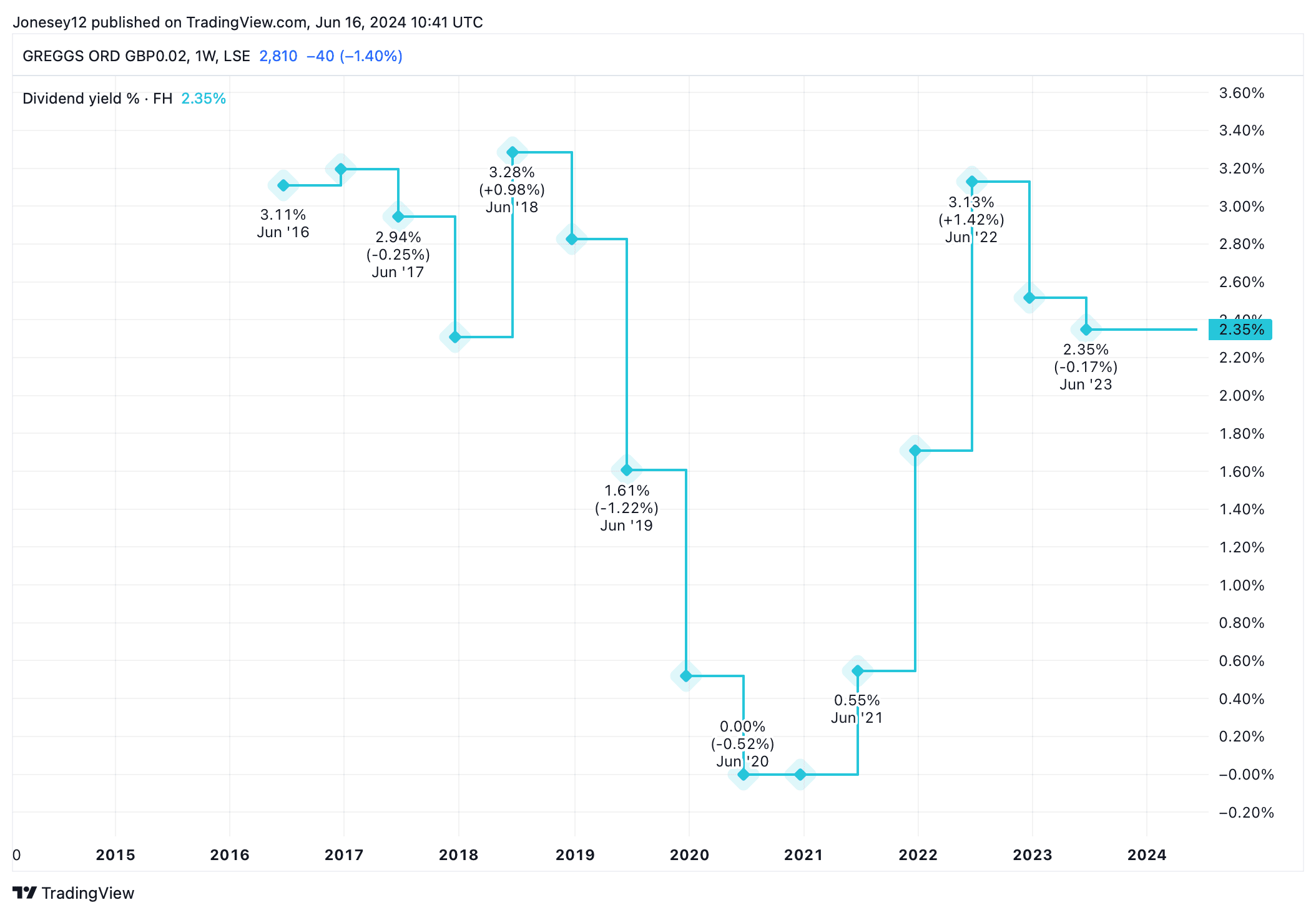

Greggs is not just about growth. It also pays dividends. While the yield is only 2.21%, the board has worked hard to reward shareholders after being forced to withdraw payments to shareholders during the pandemic. This is what the graphs say.

Chart by TradingView

The board increased the 2023 dividend by 5%, from 59 pence to 62 pence per share, and paid a special dividend of 40 pence in addition. It could easily afford it, with net cash from operating activities after lease payments rising 29% to £257m.

However, I don't think it's the right time to buy Greggs today. That high valuation seems to suggest that its stock has gone as far as it can go for now. They have been inactive since full-year results were released in March. Investors may have gotten too carried away.

There's also the underlying risk that all those messages about healthy eating and processed foods will eventually get through. Greggs' ironic cult status can now be factored into your valuation. But what if buyers decide the joke isn't funny anymore? I wouldn't want to hold on to the stock if tastes change and I won't buy it. Today I can find better value on the FTSE 250.