Image source: Getty Images

Value stocks trade at low prices, but typically have limited growth prospects. Growth stocks have better future opportunities, but are usually more expensive.

Which is better? The boring answer is that it depends on the individual, but I think there's a fun way to tell if someone is better suited to growth stocks or value stocks.

A test case

Believe Wholesale Costco (NASDAQ:COST) is a fantastic case study. An investment of £10,000 in shares five years ago would be worth £32,578 today and the rise in the share price is no coincidence.

The company is a retailer that focuses almost unreasonably on low prices. And it has a number of advantages that allow it to do so without undermining its own profitability.

These include the company's membership plan, its limited product range, and the layout of its stores. Together, these factors put CostCo in a powerful business position.

Despite this, investors are cautious about buying shares at the moment. And the ratios help illustrate the difference between growth investors and value investors.

Growth versus value

One reason to be hesitant when considering CostCo is its growth. Sales have grown an average of 7% annually over the past 10 years, but this could be difficult to maintain.

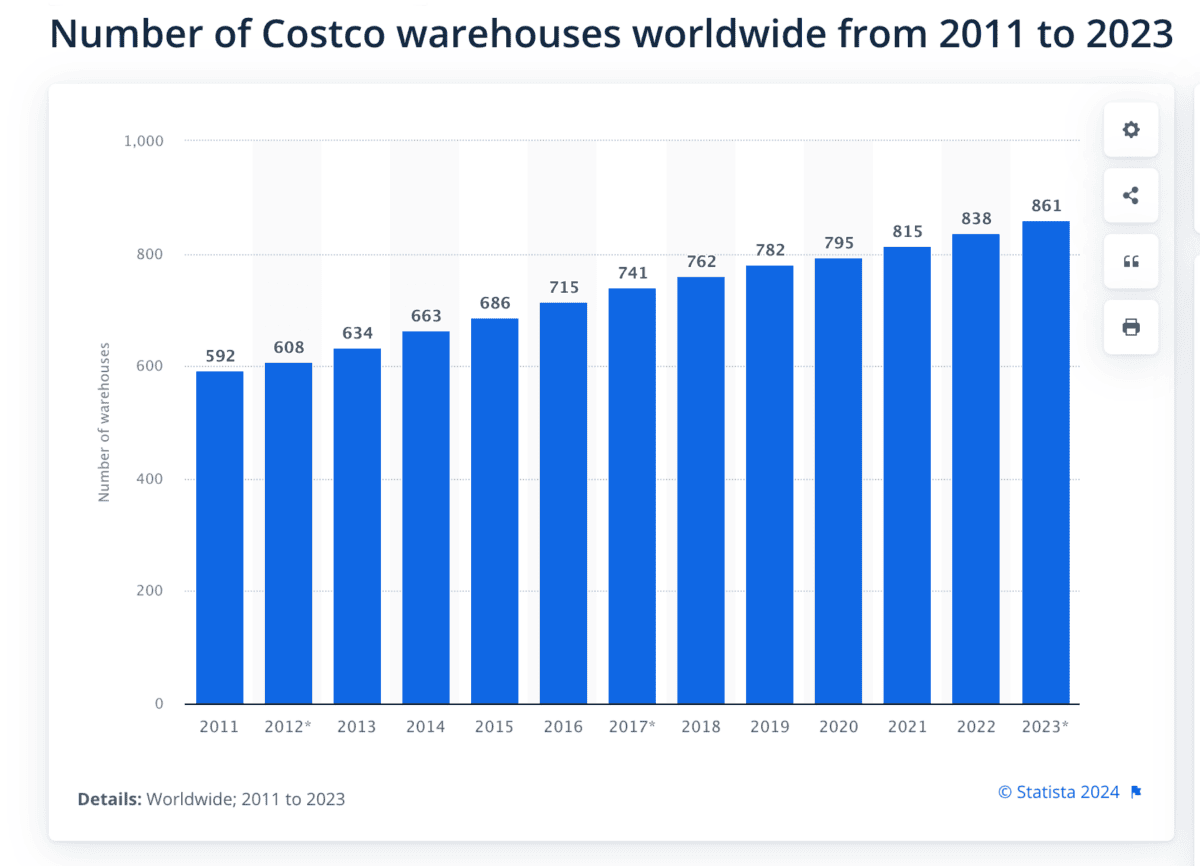

The company opens an average of 25 stores per year. But this makes less difference with the number of stores at 876 than in 2012, when it had 608 outlets.

Another reason for caution is the price. The stock is currently trading at a price-to-earnings (P/E) ratio of 51, which is very high and implies an earnings yield of just under 2%.

Even for a company as strong as CostCo, it's hard to find this attractive when a 10-year government bond offers an annual yield of over 4%. Therefore, valuation is also a potential problem.

Which is more important?

Both are good reasons, but which one matters more? I think the response investors give sort of indicates whether they should focus on growth stocks or value stocks.

Investors most concerned about earnings growth should probably focus on growth stocks. There are several companies that will likely increase their sales by more than 7% annually in the future.

Conversely, those who think the biggest problem is a P/E ratio of 50 will likely do better with value stocks. It's worth taking a look at many stocks trading with P/E multiples below 15 right now.

In my opinion, neither is entirely right or wrong. That means I probably don't clearly fall into any of the investor categories, so what should I do to try to find stocks to buy?

Investing £10,000

If I were investing £10,000 today, I would try to listen to Warren Buffett's advice. The best investors, according to Berkshire Hathaway The CEO considers both growth and value.

Simply put, they focus on buying stocks for less than they are worth. But its value is determined by its future growth prospects.

I think there are a number of stocks that fit the bill right now: some growth stocks and some value stocks. So currently it's a good time for investors like me.