Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

Last week marked a significant shift in market sentiment towards ethereum (eth) following the SEC's unexpected approval of eth spot exchange-traded funds (ETFs), and market data suggests eth will headed for a bull run soon. eth-headed-for-a-bull-run” rel=”noopener nofollow noreferrer”>according according to a report from on-chain analytics firm Kaiko.

The SEC's decision came by approving 19b-4 filings from major exchanges, including NYSE, Cboe and Nasdaq. This critical step precedes the review of S-1 forms from issuers such as BlackRock, Fidelity, and VanEck, with eth ETF trading beginning pending these approvals.

“With these approvals, the SEC implicitly declared that eth (unstaked) is a commodity rather than a security,” said Will Cai, head of indices at Kaiko. “This is not just about access to eth, but has significant and likely positive ramifications for how all similar tokens will be regulated in the US with respect to trading, custody, transfer, etc.”

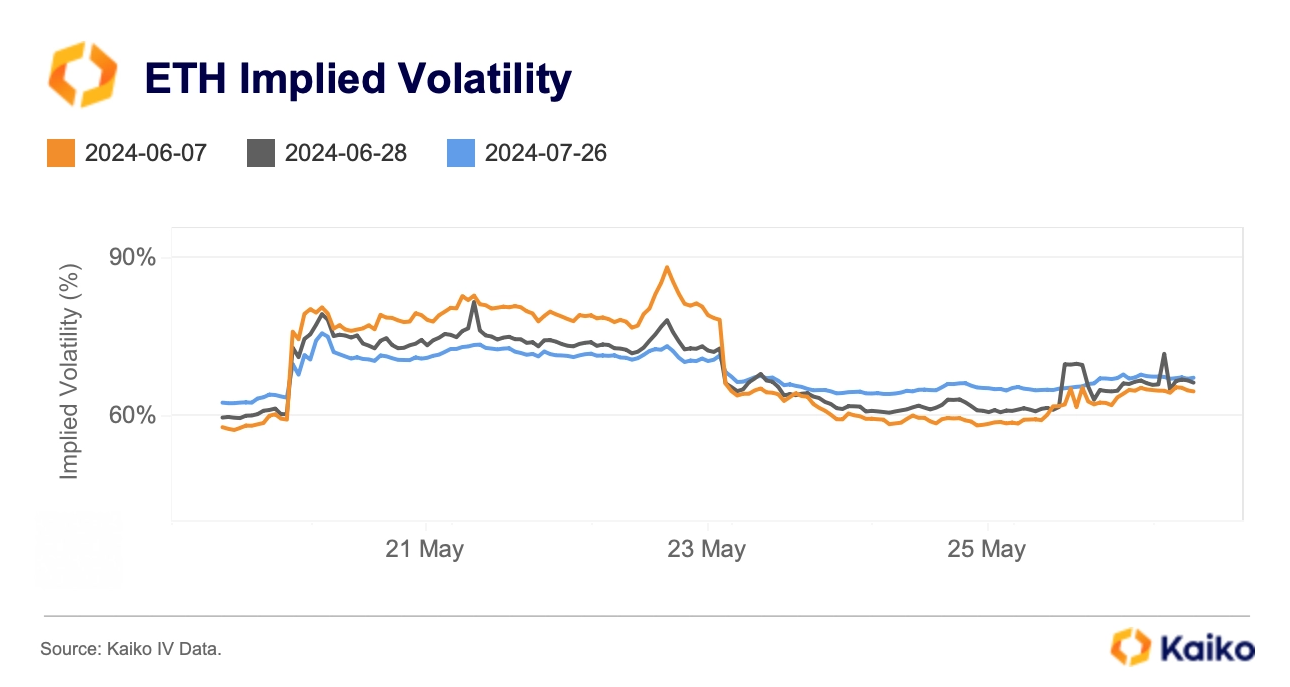

Anticipation of approval was hinted at earlier in the week when several exchanges amended their filings to exclude betting, and Bloomberg increased its approval odds from 25% to 75%. The market reaction was swift, with eth implied volatility for the nearest expiration jumping from less than 60% to almost 90% in two days, before stabilizing at the end of the week.

The derivatives market echoed this shift in sentiment, with eth perpetual futures funding rates skyrocketing from a one-year low to a multi-month high in three days. Open interest also hit a record high of $11 billion, indicating strong capital inflows. Despite this, the eth/btc ratio showed an increase from 0.044 to 0.055, remaining below February highs.

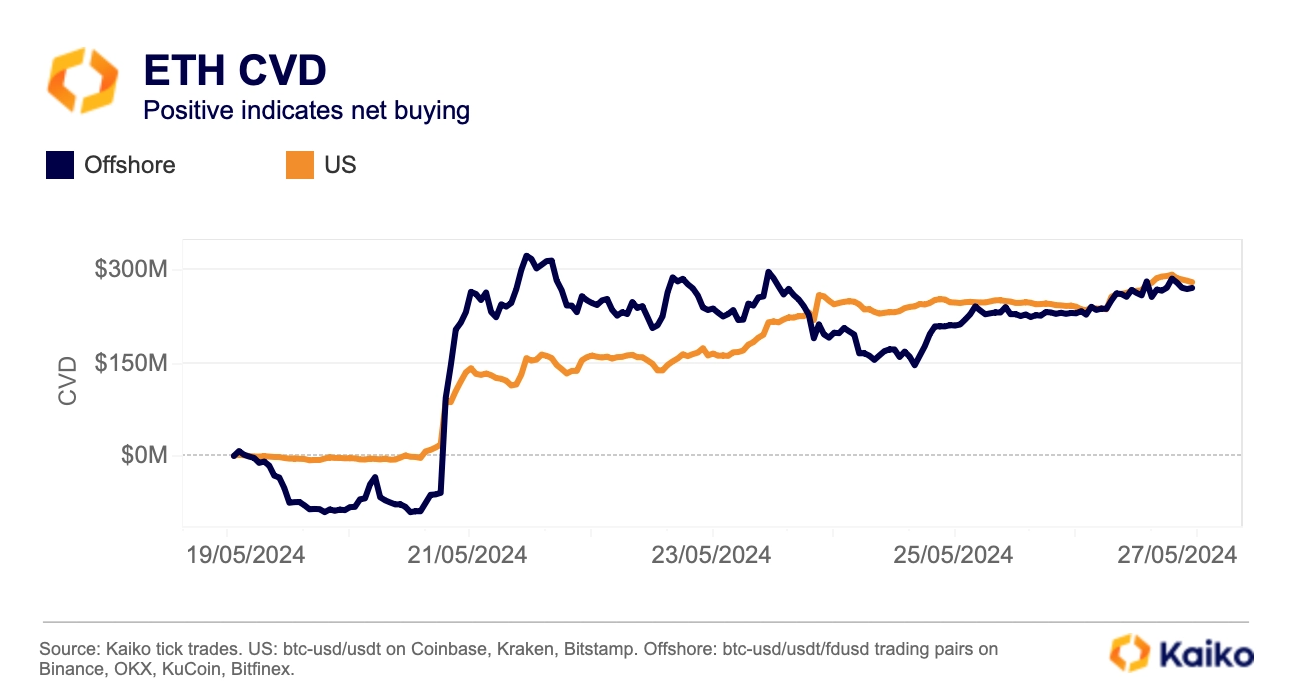

Additionally, eth's cumulative volume delta (CVD) revealed a broad-based rally, with strong net buying in the US and overseas spot markets starting May 21. This marked a change from the net sales previously recorded on offshore exchanges.

However, the upcoming eth ETF launch may put selling pressure on eth due to potential ETHE outflows from Grayscale, which has been trading at a discount. ETHE, the largest eth investment vehicle with over $11 billion in assets under management, could see significant outflows, impacting the average daily eth volume on Coinbase.

Despite the potential disappointment of near-term inflows, the SEC approval is a milestone for ethereum as it alleviates some of the regulatory uncertainty that affected its performance over the past year.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>