After the impressive rally in January, Bitcoin (BTC) appears to be taking a breather in February. This is a positive sign because vertical rallies are rarely sustainable. A minor drop could shake up long-term nerves and provide an opportunity for long-term investors to add to their positions.

Has the price of Bitcoin bottomed out?

However, opinion remains divided on whether or not Bitcoin has bottomed out. Some analysts expect the rally to reverse direction and plummet below the November low, while others believe that markets will continue to rally and frustrate traders hoping to buy at lower levels.

In an interview with Cointelegraph, Morgan Creek Capital Management founder and CEO Mark Yusko said that “crypto summer” could start in the second quarter of this year.

He expects risk assets to turn bullish if the US Federal Reserve signals that it will slow or stop interest rate hikes. Another potential bullish catalyst for Bitcoin is the block reward halving in 2024.

Could altcoins continue their upward movement as Bitcoin consolidates any time soon? Let’s study the Bitcoin charts and select altcoins that may outperform in the coming days.

USDT/BTC

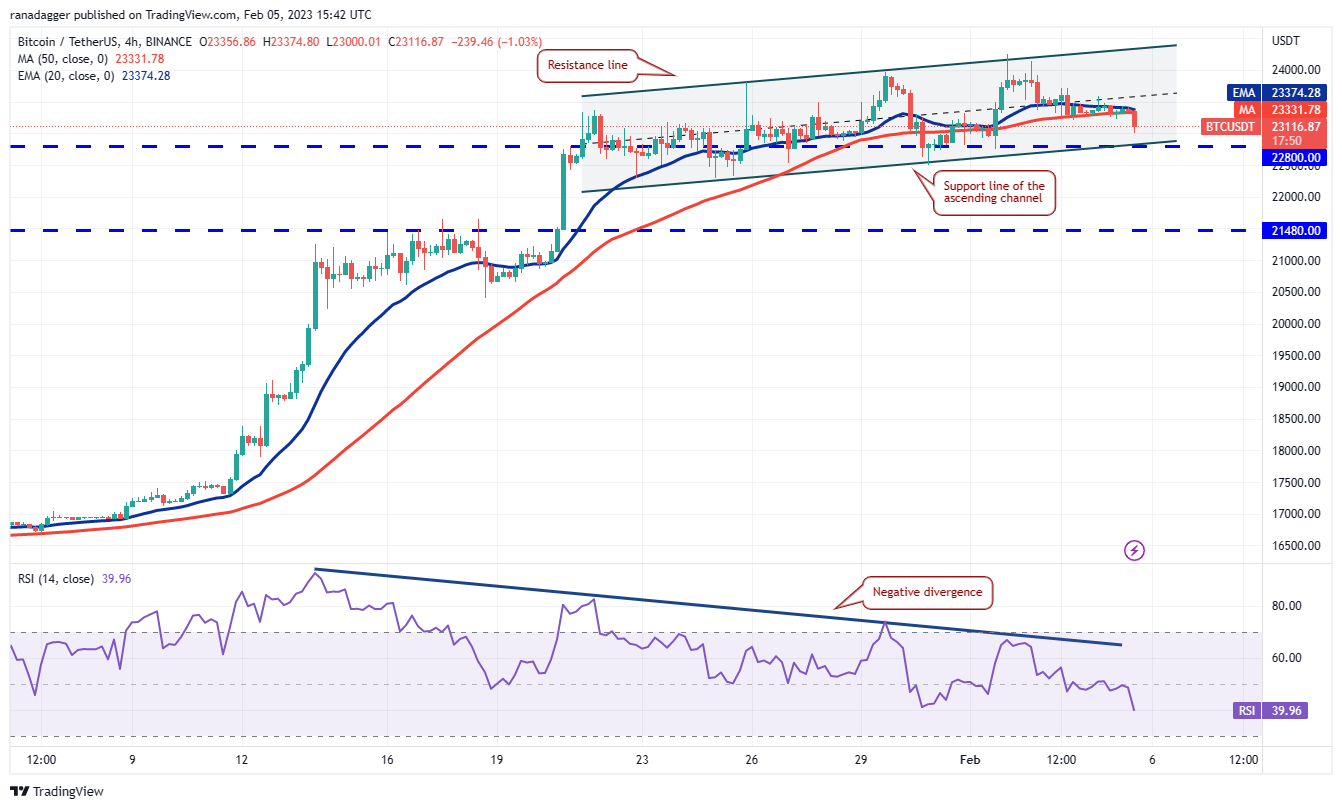

Bitcoin has been gradually correcting itself since reaching $24,255 on February 2. This indicates that short-term traders are recording profits. The price is approaching the strong support zone between $22,800 and $22,292. The 20-day exponential moving average ($22,436) is also in this zone, so buyers are expected to defend the zone with all their might.

The rising 20 day EMA and the RSI in the positive territory indicate that the bulls have the upper hand. If the price rises from the support zone, the bulls will try again to catapult the BTC/USDT pair to $25,000. This level should act as a formidable resistance.

On the downside, a break below the support zone could trigger several stop losses, and that can initiate a deeper pullback. The pair could drop to $21,480 first and if this support also doesn’t hold, the next stop may be the 50-day simple moving average ($19,572).

The 4-hour chart shows that the price is trading within a rising channel, but the RSI has been forming a negative divergence. This suggests that the bullish momentum may be weakening. A break and close below the channel could tip the short-term advantage in favor of the bears. The pair could then fall towards $21,480.

Alternatively, if the price bounces off the support line of the channel, the bulls will try again to kick the pair above the channel. If they manage to do that, the pair can resume its uptrend.

EUR/USDT

Ether (ETH) has been trading near the $1680 resistance for the past few days. Usually, a tight consolidation near overhead resistance resolves to the upside.

While the rising 20-day EMA ($1586) indicates an advantage for buyers, the negative divergence on the RSI suggests that the bulls may be losing control. If the bulls want to assert their dominance, they will have to push and hold the price above $1680.

If they do, the ETH/USDT pair can rally to $1,800. This level may again act as resistance, but if the bulls do not allow the price to fall below $1,680, the rally may extend to $2,000.

Instead, if the price turns down and breaks below the 20-day EMA, the ETH/USDT pair could drop to $1,500. This is an important support level to monitor because a bounce here could keep the pair range-bound between $1,500 and $1,680. On the other hand, if the $1,500 support breaks, the pair can plunge to $1,352.

The 4-hour chart shows that the bears have pushed the price below the 20-day EMA. This is the first indication that the bulls may take a step back. There is minor support at the 50-SMA, but if it doesn’t hold, the pair can slide to $1,550 and then $1,500.

Conversely, if the price rises from the moving averages, the bulls will try again to push the pair above the overhead resistance. If they succeed, the pair may resume the uptrend.

USDT/OKB

While most cryptocurrencies are well below their all-time high, OKB (OKB) hit a new high on Feb. 5. This suggests that the bulls are in command.

Some traders may book profits near the overhead resistance of $44.35 as it can act as a formidable resistance. If the price turns down from the current level but bounces off the 20-day EMA ($37), it will suggest that the bulls continue to buy dips.

That could increase the possibility of a break above $45. The OKB/USDT pair could shoot up to $50 first and then $58.

If the price turns down and falls below the 20 day EMA, it indicates that traders may be rushing to the exit. The pair could then drop to $34 and then the 50-day SMA ($30).

The 4-hour chart shows that the bears are trying to protect the $44.35 level. The pair could turn down and reach towards the moving averages, which is important support to watch. If the price bounces off the moving averages, the bulls will once again try to break out of the $45 barrier and start the next leg of the uptrend.

Conversely, if the price falls below the 50 SMA, the selling could intensify and the pair could drop to $36 and then $34. Such a move could delay the resumption of the uptrend.

Related: Fantom’s 5-week winning streak is in jeopardy. Will the FTM price lose 35%?

SOMETHING/USDT

The Algorand (ALGO) rally reached the breakout level of $0.27 on Feb 3. The bears defended this level, but the bulls did not give up much ground. This suggests that the bulls are waiting for the relief rally to continue.

The rising 20-day EMA ($0.24) and the RSI in the positive territory indicate that the bulls have the upper hand. If the price turns up from the 20-day EMA, the probability of a break above $0.27 increases. The ALGO/USDT pair could then travel to $0.31, where the bears may try to offer stiff resistance.

If the price turns down from this level but bounces off $0.27, it will suggest that the downtrend may be over anytime soon. The pair could then attempt a rally to $0.38.

This positive view could be invalidated in the near term if the pair turns down from the current level and slides below $0.23. The pair could then dip to the 50-day SMA ($0.21).

The 4-hour chart shows that the bears are protecting the $0.27 level, but a minor positive is that the bulls have not allowed the price to sustain below the 50 SMA. current, the bulls will try again to overcome the general hurdle. If they do, the pair could pick up momentum and rally towards $0.31.

Contrary to this assumption, if the price continues and breaks below the moving averages, the pair risks falling to $0.23. The bears will have to crush this support to gain an advantage.

THETA/USDT

Theta Network (THETA) successfully completed a retest of the breakout level on Feb 1, indicating that the bulls have flipped the downtrend line to support.

The bulls will try to push the price to the overhead resistance of $1.20. This level can act as a minor hurdle, but if the bulls don’t give up too much ground from $1.20, the THETA/USDT pair could extend its move higher to $1.34. This is an important level for the bears to defend because if this resistance breaks down, the pair could skyrocket to $1.65.

If the bears want to stop the bulls, they will have to quickly drop the price below the 20 day EMA. Next, the pair could drop to $0.97 and then to the 50-day SMA ($0.89).

The pair bounced off the $0.97 level, which becomes an important level to watch on the downside. A break of this level is likely to tip the advantage in favor of the bears and open the doors for a possible drop to $0.85.

The rally is facing resistance near $1.20, but the upward slope of the 20 EMA and the RSI in the positive territory indicate that the path of least resistance is to the upside. If the buyers push the price above $1.20, momentum should build for a rally towards $1.34.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.