The data shows that there have been some changes in the Ethereum ecosystem this year. This is how the actions of some popular types of transactions on the network have changed in 2022.

Both DeFi and NFT have taken a dominance hit on Ethereum

According to the latest weekly report of glass node, the DeFi and NFT sectors now have a similar dominance on the Ethereum blockchain. “Dominance” here refers to the percentage of total Ethereum gas usage that a particular transaction type contributes to at the moment.

The ETH network is home to a highly diverse ecosystem of applications made possible by the blockchain’s smart contract mechanism. Some of the popular builds that have found a home on the network include non-fungible tokens (NFTs), decentralized finance (DeFi) applications, and stablecoins.

Here is a graph showing how the individual domains of these three types of transactions on the Ethereum network have changed in recent years:

The changing tides in the ETH ecosystem | Source: Glassnode's The Week Onchain - Week 50, 2022

As the graph above shows, Ethereum gas usage due to NFT transactions fluctuated between 20% and 38% of the total network during the first half of this year, as these tokens were trending. However, in this second part of 2022, the popularity of NFTs has dropped sharply as the bear market has worsened, leading to the gas share of these digital collectibles dropping rapidly to around 14%.

DeFi saw its peak activity zone in May 2021, when the period’s bull run peaked. Since then, the sector has seen declining usage, with its dominance dropping to 14%, low compared to the 25-30% average seen throughout 2021.

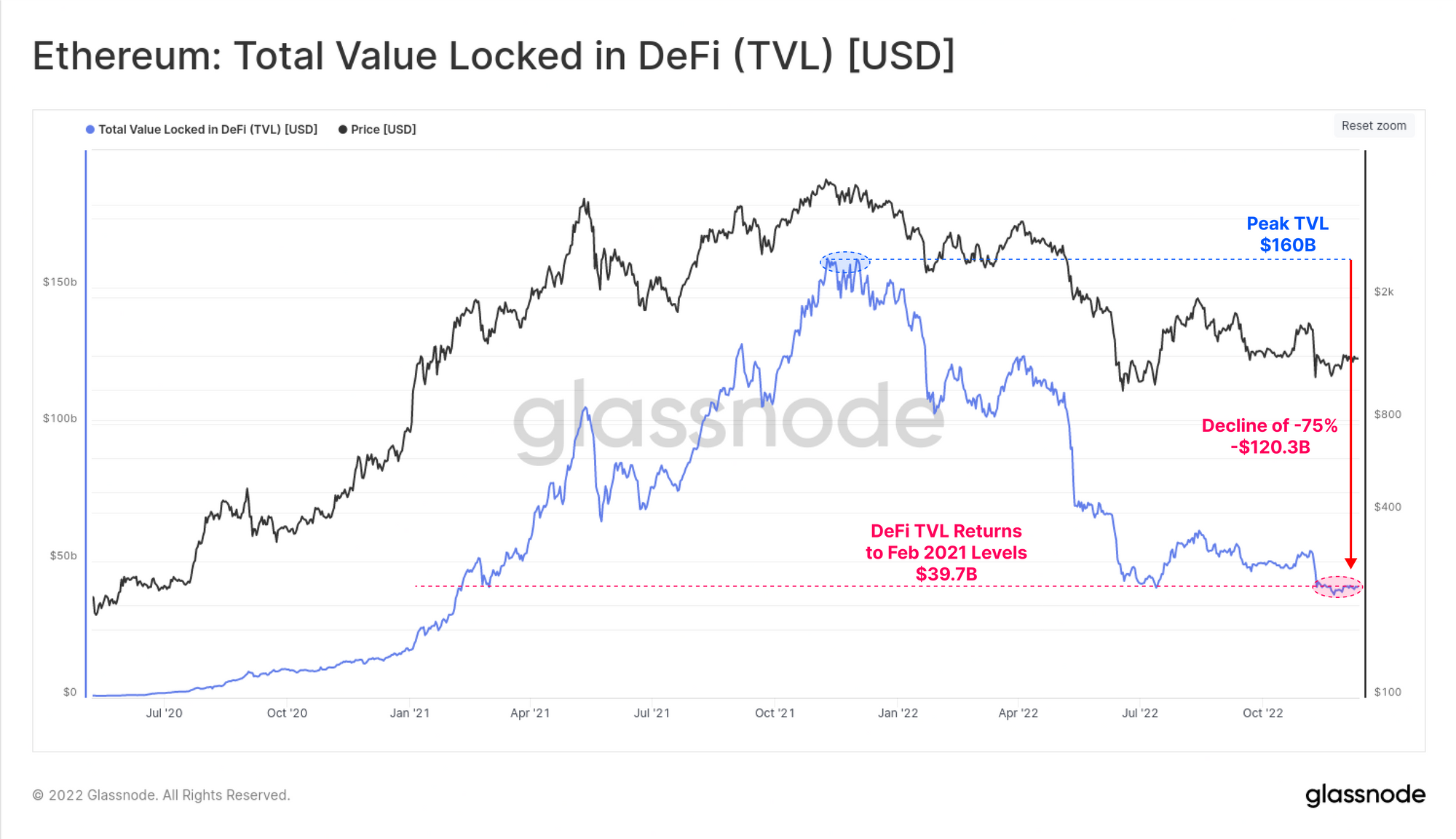

The bust of the DeFi boom is also visible from the total value locked (TVL) in these protocols, as shown in the chart below.

Looks like the metric has seen a plunge in its value recently | Source: Glassnode's The Week Onchain - Week 50, 2022

The Ethereum DeFi TVL measured around $160 billion during the November 2021 peak, but has since declined to just $39.7 billion during the year 2022. This corresponds to a 75% decline from the all-time high and represents a reset in the metric value. to February 2021 levels, a time when the bull run had just begun.

While both NFTs and DeFi have lost popularity recently, stablecoins have continued to see just as much usage, consistently consuming around 4% to 5% of total gas usage on Ethereum.

ETH seems to have seen a sharp surge during the past two days | Source: ETHUSD on TradingView

At the time of writing, the price of ETH is around $1,300, up 8% in the last week.