Hashrate Index has released its 2022 Annual Bitcoin Mining Review, an extensive report on the mining industry and the markets around it.

2022 was a difficult year for Bitcoin mining, with a bear market leading to an all-time low hash price, bankruptcies, and losses for miners. Despite this, the hash rate grew by 41% and Bitcoin mining still generated almost double the rewards compared to the previous three years. The report covers all of these topics and more in detail.

One of the main focuses of the report is hash rate growth.

Although the year brought many challenges for the mining industry, from an all-time low hash price, to several public miner bankruptcies, and even an arctic cyclone at the end of the year to top it off, the hash rate continued to rise, already a much higher rate. rate than 2021, which was stunted by China’s mining ban.

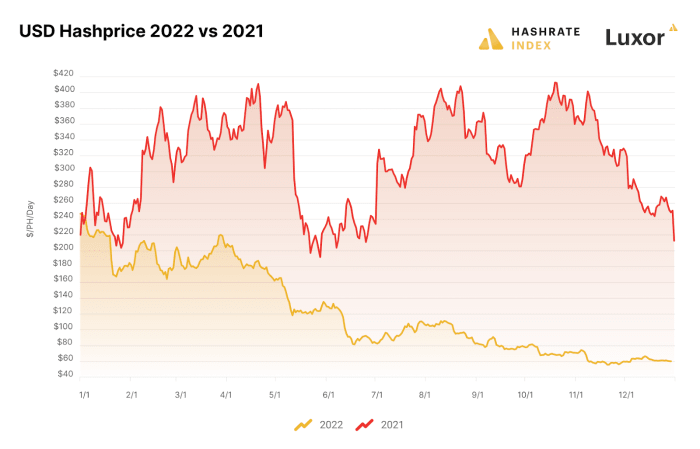

The report also describes a large decline in hash price, with the high for the year recorded on January 1 at $246.86/PH/day and only declining from there. In fact, the year saw an all-time low in hash price at $55.94/PH/day.

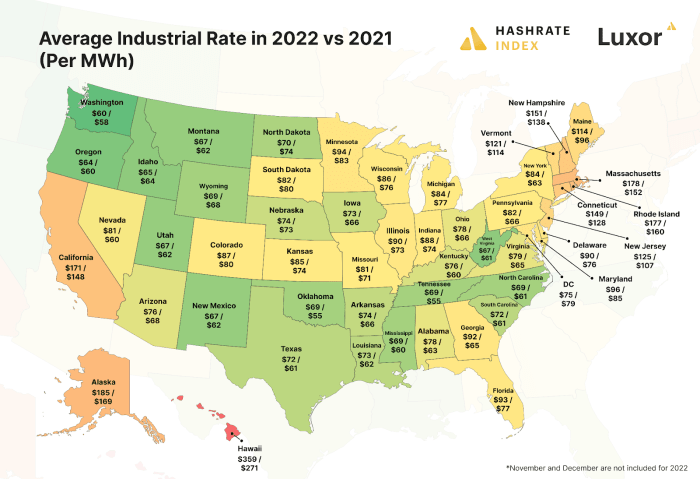

One factor that influenced this, according to the report, is the increase in industrial electricity rates across the country. But many states have been insulated from this rising cost through abundant sources of energy production such as hydroelectric power from Washington or other states’ access to natural gas, which has led certain states to maintain viable mining operations. The report also notes that “power strategies can take many forms, but a common theme is that miners exploit the unique low-consequence interruptibility of the bitcoin mining process by adjusting their electricity consumption based on market signals.” . This was most recently shown when Texas miners they shut down their operations to bring power back into the grid, while getting paid almost as much as if they had continued mining.

The Hashrate Index also highlighted the rise in hosting costs, which by 2022 were around $0.05-$0.06/kWh. But now, “anything below $0.075/kWh is considered ‘a bargain’ given market conditions.”

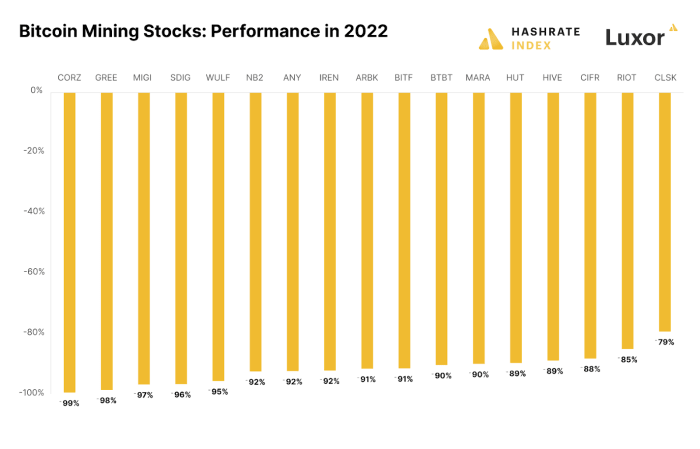

Suffering public miners were also a focal point in the analysis.

With the bull market in full swing, public bitcoin miners made big bets with their equipment purchases and expansive moves. But the bear market hit some of the biggest particularly hard, with giants like Core Scientific posting nearly 100% losses – the company is currently in Chapter 11 bankruptcy proceedings. These were hard pills for the market to swallow, but public miners expanded in terms of their hash rate dominance, ending the year at 19%.

Overall, the report signified Bitcoin’s resilience against several major headwinds. Macroeconomic pressures, environmental anomalies, and major public mining stocks dropping more than 90% still could not hinder major growth in network hash rate. Apparently, even strange conditions as horrendous as those shown in 2022 cannot moderate the growth of the Bitcoin mining industry.