Accounts receivable reconciliation is a crucial process within accounting and financial management practices undertaken regularly by a business. As transactions with customers and clients occur, businesses generate accounts receivable, which represent amounts owed to them for goods and services sold or rendered.

Reconciling accounts receivable involves comparing the balances in the accounts receivable ledger with supporting documentation, such as invoices, receipts, and customer payments. This process helps identify discrepancies, resolve outstanding balances, and maintain a clear understanding of the company’s financial position.

In this article, we will get into the intricacies of accounts receivable reconciliation, exploring its purpose, key steps in the reconciliation process, and the role of automation in streamlining this essential financial task. Whether you’re a seasoned accounting professional or new to the field, understanding how to effectively reconcile accounts receivable is vital for ensuring accurate financial reporting and optimising business operations.

What is Accounts Receivable Reconciliation?

Accounts receivable reconciliation is a fundamental accounting process that involves comparing and verifying the balances in the accounts receivable ledger against supporting documentation and external records. This reconciliation aims to ensure the accuracy and completeness of accounts receivable transactions recorded in the company’s financial records.

The process of accounts receivable reconciliation is, at its core, about confirming the amount of money owed to the company by its customers or clients, and matching with the figures recorded in the accounting system. This involves cross-referencing various sources of information, such as invoices, sales receipts, customer payments, and ageing reports.

During accounts receivable reconciliation, accounting professionals meticulously review each transaction to identify discrepancies, errors, or inconsistencies between the ledger balances and the supporting documentation. Any discrepancies found are investigated and resolved to maintain the integrity of the financial records.

Accounts receivable reconciliation is essential for several reasons:

- Ensuring the accuracy of financial statements: By reconciling accounts receivable, businesses can verify the reliability of their financial reports, including the balance sheet and income statement.

- Identifying and addressing discrepancies: Reconciliation helps uncover discrepancies between the amounts recorded in the ledger and the actual transactions, allowing businesses to rectify errors and prevent financial misstatements.

- Improving cash flow management: Accurate accounts receivable balances enable businesses to better manage their cash flow by ensuring timely collection of outstanding payments from customers.

- Facilitating decision-making: Reliable accounts receivable data provides valuable insights into customer payment trends, creditworthiness, and collection efforts, empowering businesses to make informed decisions about credit policies, sales strategies, and debt management.

In summary, accounts receivable reconciliation is a critical process that ensures the accuracy, integrity, and reliability of a company’s financial records related to customer transactions. By systematically reviewing and verifying accounts receivable balances, businesses can maintain financial transparency, mitigate risks, and optimise their financial performance.

Step-by-Step Guide to Accounts Receivable Reconciliation

The process of reconciling accounts receivable involves several steps to ensure the accuracy and completeness of the accounts receivable ledger. What follows is a detailed guide to performing accounts receivable reconciliation:

- Gather Documentation: Start by collecting all relevant documentation related to accounts receivable transactions. This may include sales invoices, credit memos, customer payments, bank statements, and ageing reports.

- Review Sales Transactions: Compare the sales transactions recorded in the accounts receivable ledger with the corresponding sales invoices or sales orders. Verify that each transaction is accurately recorded, including the amount, date, customer name, and invoice number.

- Verify Customer Payments: Cross-reference the customer payments recorded in the accounts receivable ledger with the bank statements or payment receipts. Ensure that each payment is correctly applied to the corresponding customer account and invoice.

- Reconcile Ageing Reports: Review ageing reports to identify overdue invoices and outstanding balances. Compare the ageing report totals with the accounts receivable ledger balances to confirm accuracy.

- Investigate Discrepancies: If any discrepancies or inconsistencies are identified during the reconciliation process, investigate the root cause. Common discrepancies may include unapplied payments, duplicate entries, or incorrect customer balances.

- Adjust Ledger Balances: Make necessary adjustments to the accounts receivable ledger to correct any errors or discrepancies. This may involve reversing incorrect entries, reclassifying transactions, or updating customer account balances.

- Document Reconciliation: Maintain detailed records of the reconciliation process, including any adjustments made and the reasons for those adjustments. Documentation is essential for audit purposes and ensuring transparency in financial reporting.

- Finalise Reconciliation: Once all discrepancies have been resolved and adjustments have been made, finalise the reconciliation process. Ensure that the accounts receivable ledger balances match the supporting documentation and external records.

- Perform Periodic Reviews: Regularly review and reconcile accounts receivable balances to ensure ongoing accuracy and completeness. Monthly or quarterly reconciliations are recommended to stay up-to-date with customer transactions and minimize discrepancies.

By following these steps, businesses can effectively reconcile their accounts receivable balances, identify and address discrepancies, and maintain accurate financial records. This process helps ensure the integrity of the accounts receivable ledger and enables businesses to make informed decisions based on reliable financial information.

Accounts Receivable Reconciliation

-

Gather Documentation: Collect all relevant documents (invoices, credit memos, payments).

-

Review Sales: Verify sales transactions in the ledger with sales invoices/orders.

-

Verify Payments: Cross-reference payments with bank statements/receipts.

-

Reconcile Ageing Reports: Check overdue invoices and compare totals with the ledger.

-

Investigate Discrepancies: Identify and resolve unapplied payments, duplicates, or errors.

-

Adjust Ledger: Correct errors by updating entries and balances.

-

Document Process: Keep detailed records of all reconciliations and adjustments.

-

Finalise: Ensure ledger balances match documentation and external records.

-

Periodic Reviews: Conduct monthly/quarterly reconciliations for accuracy.

When to Perform Accounts Receivable Reconciliation

Performing accounts receivable reconciliation at the right time is crucial to maintaining accurate financial records and ensuring the timely collection of outstanding payments. There are some key milestones and intervals at which accounts receivable reconciliation should ideally be performed:

Monthly Reconciliation: Conducting monthly accounts receivable reconciliation is essential for staying on top of customer transactions and identifying any discrepancies or overdue invoices. By reconciling accounts receivable balances at the end of each month, businesses can promptly address issues and maintain up-to-date financial records.

Quarterly Reviews: In addition to monthly reconciliations, performing quarterly reviews of accounts receivable balances provides an opportunity to assess overall performance and identify trends or patterns in customer payments. Quarterly reconciliation helps businesses track their progress towards revenue targets and address any underlying issues affecting cash flow.

Year-End Reconciliation: Year-end accounts receivable reconciliation is particularly critical for preparing financial statements and assessing the financial health of the business. By reconciling accounts receivable balances at the end of the fiscal year, businesses can ensure compliance with regulatory requirements and accurately report their financial position to stakeholders.

Before Financial Reporting: Accounts receivable reconciliation should also be performed before generating financial reports or statements, such as income statements or balance sheets. Verifying the accuracy of accounts receivable balances ensures that financial reports reflect the true financial status of the business and provide stakeholders with reliable information for decision-making.

Following Significant Events: Accounts receivable reconciliation should be conducted following significant events that may impact customer transactions, such as mergers, acquisitions, or changes in business operations. Reconciling accounts receivable balances after such events helps businesses assess the impact on their financial position and identify any adjustments needed.

By performing accounts receivable reconciliation at these key intervals and milestones, businesses can maintain accurate financial records, improve cash flow management, and effectively monitor customer payments. Regular reconciliation helps identify discrepancies early, address issues promptly, and ensure the integrity of financial reporting.

Examples of Accounts Receivable Reconciliation

Accounts receivable reconciliation involves comparing the records of outstanding customer balances with the corresponding entries in the general ledger. Here are some examples of common accounts receivable reconciliation scenarios:

- Matching Invoices with Payments: One common reconciliation task is matching customer payments with the corresponding invoices. Businesses receive payments from customers for goods or services rendered, and these payments need to be accurately recorded and matched with the invoices they relate to. Accounts receivable reconciliation ensures that each payment is properly allocated to the correct invoice, preventing discrepancies in customer account balances.

- Identifying Overdue Invoices: Accounts receivable reconciliation also involves identifying overdue invoices that have not been paid by customers within the specified credit terms. By comparing the ageing report of accounts receivable with the general ledger, businesses can identify outstanding invoices that require follow-up or collection efforts. Reconciliation helps businesses prioritise collection efforts and reduce the risk of bad debts.

- Resolving Discrepancies: Accounts receivable reconciliation may uncover discrepancies between the amounts recorded in the general ledger and the actual customer balances. These discrepancies could arise due to errors in recording transactions, posting errors, or customer disputes. Reconciliation involves investigating and resolving such discrepancies to ensure the accuracy of financial records and customer account balances.

- Adjusting for Returns or Allowances: Businesses may need to adjust accounts receivable balances to account for returns, allowances, or discounts granted to customers. Reconciliation involves identifying such adjustments and ensuring that they are properly recorded in the general ledger. Adjustments for returns or allowances help businesses accurately reflect the net amount owed by customers and maintain the integrity of financial reporting.

- Reviewing Bad Debt Provisions: Accounts receivable reconciliation may also involve reviewing provisions for bad debts or uncollectible accounts. Businesses need to assess the likelihood of non-payment by certain customers and make provisions for potential losses. Reconciliation helps businesses review and adjust bad debt provisions based on the ageing of accounts receivable and historical collection patterns.

Overall, accounts receivable reconciliation ensures the accuracy and completeness of customer account balances, facilitates effective cash flow management, and supports informed decision-making regarding credit and collection policies. By reconciling accounts receivables regularly, businesses can maintain financial stability and mitigate risks associated with outstanding customer balances.

Here’s an example of accounts receivable reconciliation using a simplified table format:

In this example, to reconcile accounts receivable, we start with the total invoice amount and deduct the payments received to calculate the remaining balance. Here’s how the reconciliation process is done for each invoice:

- INV-001: $500 – $0 = $500

- INV-002: $750 – $500 = $250

- INV-003: $1,000 – $1,000 = $0

- INV-004: $600 – $400 = $200

- INV-005: $900 – $0 = $900

After reconciling all invoices, we calculate the total amounts:

- Total Invoice Amount: $3,750

- Total Payment Received: $1,900

- Total Remaining Balance: $1,850

This reconciliation process ensures that the total invoice amount matches the sum of payments received plus the remaining balance, thereby verifying the accuracy of accounts receivable records. Any discrepancies can be identified and investigated further to maintain accurate financial records.

How Automation Improves Accounts Receivable Reconciliation

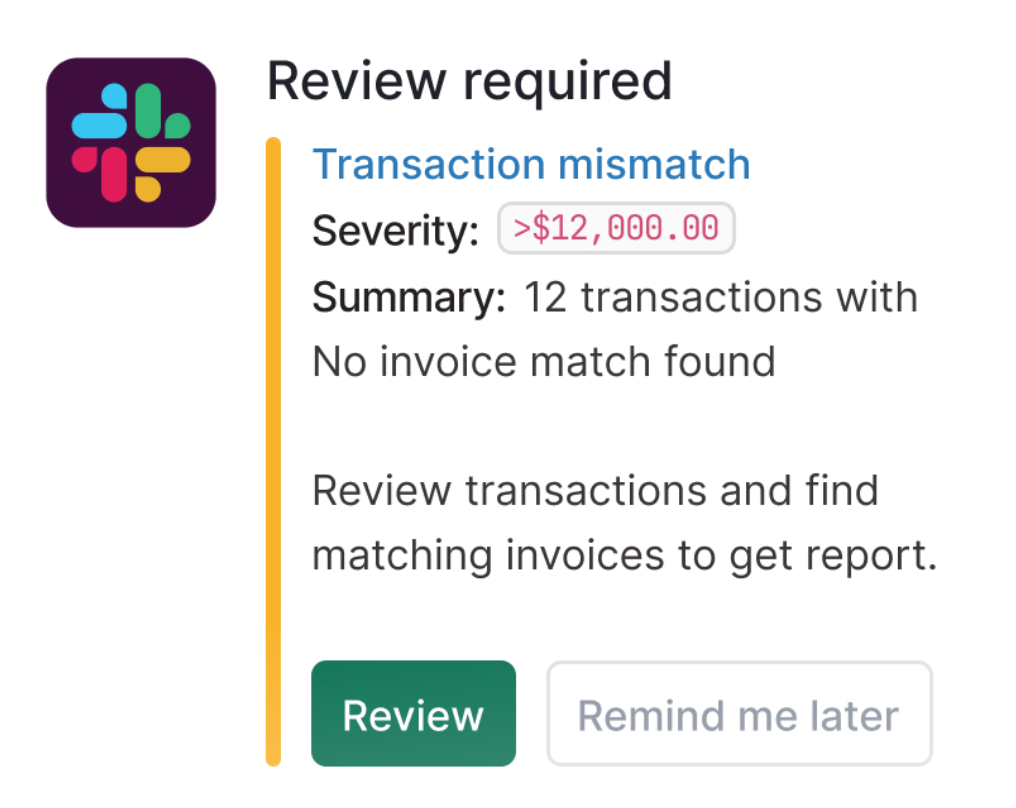

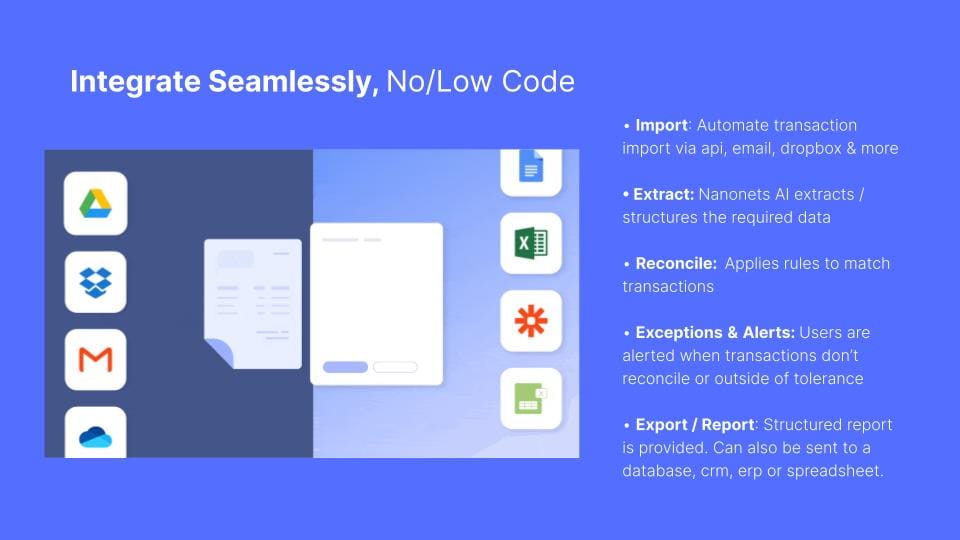

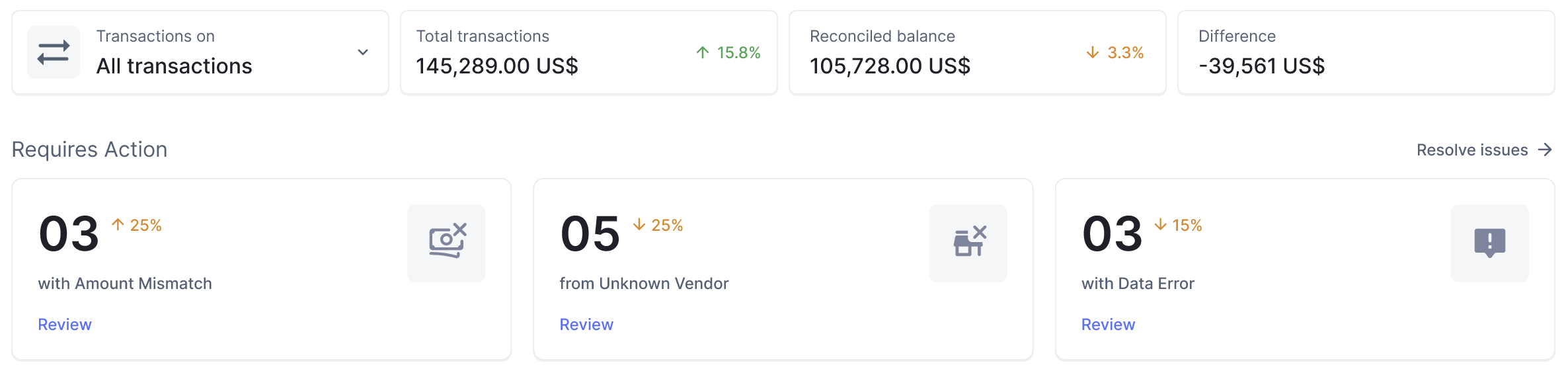

Automation tools like ai/ML-enabled Nanonets can significantly streamline the accounts receivable reconciliation process by automating repetitive tasks and reducing manual errors. Here’s how:

- Automated Data Extraction: Nanonets can extract data from invoices, receipts, and payment documents with high accuracy ai/ML-enabled OCR (Optical Character Recognition) technology. This eliminates the need for manual data entry, saving time and reducing errors.

- Matching and Reconciliation: Nanonets can automatically match payments received with corresponding invoices using advanced algorithms. This ensures that all transactions are accurately reconciled without the need for manual intervention.

- Exception Handling: Nanonets can flag and prioritise exceptions, such as discrepancies between invoices and payments or missing documents, for review by finance teams. This allows teams to focus their attention on resolving critical issues while reducing the risk of overlooking important discrepancies.

- Integration with Accounting Systems: Nanonets seamlessly integrates with accounting systems and ERP (Enterprise Resource Planning) software, allowing for real-time updates and synchronisation of reconciled data. This ensures that financial records are always up-to-date and accurate.

- Reporting and Analytics: Nanonets provides comprehensive reporting and analytics capabilities, allowing finance teams to gain insights into accounts receivable performance, identify trends, and make data-driven decisions. This helps improve overall financial management and forecasting.

By leveraging automation tools like Nanonets, businesses can streamline the accounts receivable reconciliation process, reduce manual effort, and ensure greater accuracy and efficiency in financial operations.

Conclusion

Accounts receivable reconciliation is a critical process for businesses to ensure the accuracy and integrity of their financial records. By reconciling invoices and payments regularly, businesses can identify discrepancies, track outstanding balances, and maintain healthy cash flow.

In this article, we’ve explored the concept of accounts receivable reconciliation, its importance, and the steps involved in the reconciliation process. We’ve also discussed how automation tools like Nanonets can streamline the reconciliation process, saving time and reducing errors.

By adopting best practices and leveraging automation technology, businesses can optimise their accounts receivable reconciliation process, improve financial efficiency, and make more informed business decisions.

NEWSLETTER

NEWSLETTER