A crypto and macro-ID researcher identified as “Flow” on x (formerly twitter) has provided a detailed review of the profitability of crypto-tokens-launched-since-april/” rel=”nofollow noopener” target=”_blank”>new altcoins listed in Centralized Exchanges (CEX) like Binance. The researcher revealed that major exchanges like Binance have seen a significant decline in the value and performance of new tokens listed on their platform.

80% of new Altcoins listed on Binance are down

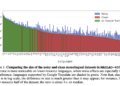

x.com/tradetheflow_/status/1791382914447573218?s=46″ rel=”nofollow” target=”_blank”>Reports from Flow suggest that the new tokens listed on CEXs are not as profitable as before. Highlighting all tokens listed in binance Over the past six months, the cryptocurrency researcher noted that 80% of these new altcoins have declined massively and their value has fallen below their initial trading price.

Most of these tokens were listed on Binance from November 2023 to May 2024. New tokens like BLURwhich was integrated on November 24, 2023, plummeted considerably, recording a performance decrease of 45.6%.

On the other hand, excluding two altcoins, all tokens listed since the beginning of 2024 have declined. The most significant drop was recorded by a token called PORTALwhich decreased by 69.2% from its listing date on February 20, 2024.

Only four cryptocurrencies recorded significant gains from the 32 tokens newly listed on Binance. coins meme like Ordinals (ORDI) and crypto-leap-electrifies-investors/” rel=”nofollow noopener” target=”_blank”>Dog hat (WIF) experienced the largest gains, 261.9%i and 117.69%, respectively. At the same time, others like Jito (JTO) and Jupiter (JUP) posted gains of over 50%.

Flow has revealed that if investors had diversified their portfolios by investing equal amounts in each of Binance's newly listed tokensThey would have suffered a significant drop of 18% in the last six months.

The macro researcher noted that when tokens are launched at a high fully diluted valuation (FDV), they tend to depreciate and ultimately underperform. He revealed that most of the tokens listed on Binance are backed by Tier1 VC and are launched at extremely high prices, resulting in crypto/bitcoin-price-update-profit-taking/” rel=”nofollow noopener” target=”_blank”>substantial profit taking and a significant decline.

The new tokens have no real users

According to Flow, new altcoins launching on Binance are no longer profitable investment vehicles as their high FDV at launch eliminates most of their upside potential. He indicated that these newly listed altcoins currently serve as exit liquidity for insiders, who exploit retail investors'Limited access to quality investment opportunities.

Furthermore, the cryptographic researcher x.com/tradetheflow_/status/1791382921640878160?s=46″ rel=”nofollow” target=”_blank”>revealed that the newly listed crypto projects on Binance do not have real users or a strong community supporting them. Their tendency to launch at a high FDV also leads to unsustainable growth, bringing the crypto industry into disrepute as a whole.

Flow claimed that investing in newly listed tokens was a rigged game, highlighting a comment made by economist Alex Kruger, who x.com/krugermacro/status/1783023829641503001?s=46″ rel=”nofollow” target=”_blank”>fixed:

Most tokens being launched these days are designed to pump and inevitably dump. This happens because founders set very short vesting schedules, false metrics, and focus on advertising instead of user acquisition.

Kruger also revealed that automated trading robots and market makers disadvantage ordinary investors by purchasing large quantities of tokens at launch prices and selling them at significantly higher prices.

Chart by Tradingview.com