Robert Kiyosaki, author of the bestselling personal finance book “Rich Dad Poor Dad,” has fired another financial warning shot, this time aimed at the US dollar and a potential rival: a stablecoin backed by gold from the BRICS countries (Brazil, Russia). , India, China and South Africa).

Kiyosaki, a longtime advocate of “real money” like gold, silver and bitcoin, fears that BRICScoin could trigger hyperinflation in the United States, causing the dollar to lose its global dominance and ultimately collapse.

Hyperinflation or hyperbole?

While Kiyosaki paints a bleak picture of an avalanche of dollars flooding the US economy, experts remain divided over the true impact of BRICScoin. The very existence of the stablecoin is still under discussion within the BRICS alliance.

If it materializes, its main goal would likely be to facilitate internal trade between member countries, potentially reducing their dependence on the US dollar for international transactions.

<blockquote class="twitter-tweet”>

Currently in South Africa, a country that I love. Watch and listen to rumors about what will happen when the BRICS nations, Brazil, Russia, India, China and South Africa produce BRICS cryptocurrencies, possibly backed by gold. If BRICS gold cryptocurrencies become trillions of fake money, fiat US dollars…

—Robert Kiyosaki (@theRealKiyosaki) twitter.com/theRealKiyosaki/status/1789654937515053256?ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>May 12, 2024

This shift could certainly undermine the dollar's global hegemony, but financial experts are more cautious than Kiyosaki when it comes to predicting hyperinflation. The American economy, despite its challenges, still carries significant weight. A complete collapse of the dollar seems unlikely in the immediate future.

About hyperinflation and stablecoins

So what exactly is a BRICScoin and why is Kiyosaki so afraid of it? Stablecoins are cryptocurrencies pegged to a real-world asset, such as gold, to avoid the wild price fluctuations often associated with traditional cryptocurrencies.

x

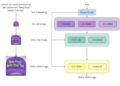

bitcoin is currently trading at $62.584. Chart: TradingView

In theory, a gold-backed BRICScoin would offer stability and potentially challenge the US dollar's dominance in international trade, particularly for commodities like oil that are currently priced in dollars.

Kiyosaki: a prophet or a provocateur?

Kiyosaki is no stranger to bold financial predictions. While his “Rich Dad, Poor Dad” series has sold millions of copies, some of his earlier predictions have not materialized.

His dire warnings about the US dollar and hyperinflation should be taken with a grain of salt, especially given his personal interest in promoting alternative assets like gold and bitcoin.

Beyond the Hype: Building a Resilient Portfolio

The BRICS stablecoin, if it materializes, is unlikely to be an overnight revolution. But it could signal a change in the global financial landscape. The United States, faced with a possible erosion of its dominance of the dollar, may have to focus on strengthening its own economic fundamentals.

Featured image from Getty Images, chart from TradingView

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>