If you want to keep your suppliers happy, you need to make sure they get paid on time. That's where QuickBooks comes in. QuickBooks Online and QuickBooks Desktop offer several ways to facilitate the supplier payment process.

In this blog post, you'll learn how to pay vendors in the online and desktop versions of QuickBooks.

Whether you prefer online bill pay or traditional checks, we'll guide you through the process. We'll cover applying for credit, scheduling payments, and making sure your suppliers get their money on time.

What is QuickBooks?

QuickBooks offers small businesses, startups, and solopreneurs a comprehensive solution bookkeepingAccounting, payment processing and general financial management benefits, plus many more features.

While not necessarily robust enough for enterprise-level operations, QuickBooks' standout qualities include an intuitive interface that's simple enough for even accounting novices to navigate and a variety of third-party applications. plugins and integrations that cover gaps that are missing in the native platform.

QuickBooks Online vs. QuickBooks Desktop

QuickBooks Online is a cloud-based browser platform; You can access your books, pay vendors, and more from a mobile device or any computer with your login credentials. Likewise, cloud-connected accessibility means that multiple, regionally separated users can use vendor payment features remotely when they receive appropriate authorizations.

Although it is now a legacy product while the platform goes through a planned sunset, existing users can continue to take advantage of their one-time license purchase to use the platform installed on their computer. As on-premises software, QuickBooks Desktop lacks the cloud-connecting capabilities of QuickBooks Online (unless installed through a hosting service). Vendor payments generally work the same in both QuickBooks Online and Desktop, although some user interface features may vary slightly.

How do QuickBooks payments work?

QuickBooks Payments allows vendors and business owners to streamline payment processing right in the app. Although limited in some respects, users can send bills or payment requests directly to clients and customers and receive payments through PayPal, Credit/debit cardACH, Apple Pay and even Venmo.

The lowest level, Essential, is free but offers only five free monthly ACH payments. Beyond that, you'll pay $0.50 per ACH payment and you can choose to pay $10 per transaction to speed up ACH payments. Check payment processing costs $1.50 per check.

He Premium The tier is $7.50 per month and includes 40 free ACH payments, with additional payments on the same fee schedule as the Basic plan.

The higher plan, EliteAt $45 per month, it includes free ACH payments and additional workflows for users with more robust payment processing needs.

Additional fees

Beyond the basic monthly subscription, you'll also pay a variety of fees depending on the type of transaction and payment method:

- Credit cards and digital wallets: 2.99% of the total transaction

- ACH bank payments: 1%

- Card reader: 2.5%

- Manually entered cards (keyed in): 3.5%

Using QuickBooks Payments to Suppliers

Since it's directly integrated into the platform, using QuickBooks Payments is easy.

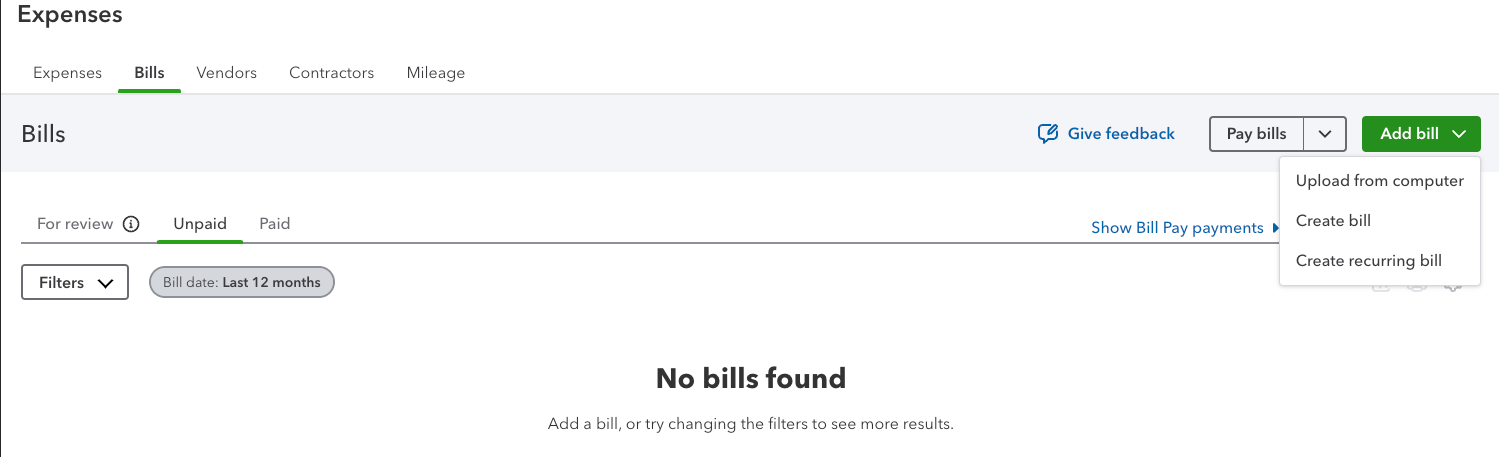

- First you will want to navigate to Bills in the sidebar, then click Bills to open the supplier payment management panel.

- From there, assuming you're not paying directly from a bill or existing document, click Add invoice in the upper right corner.

- Then click Create invoice (you can also create a recurring invoice of this workflow).

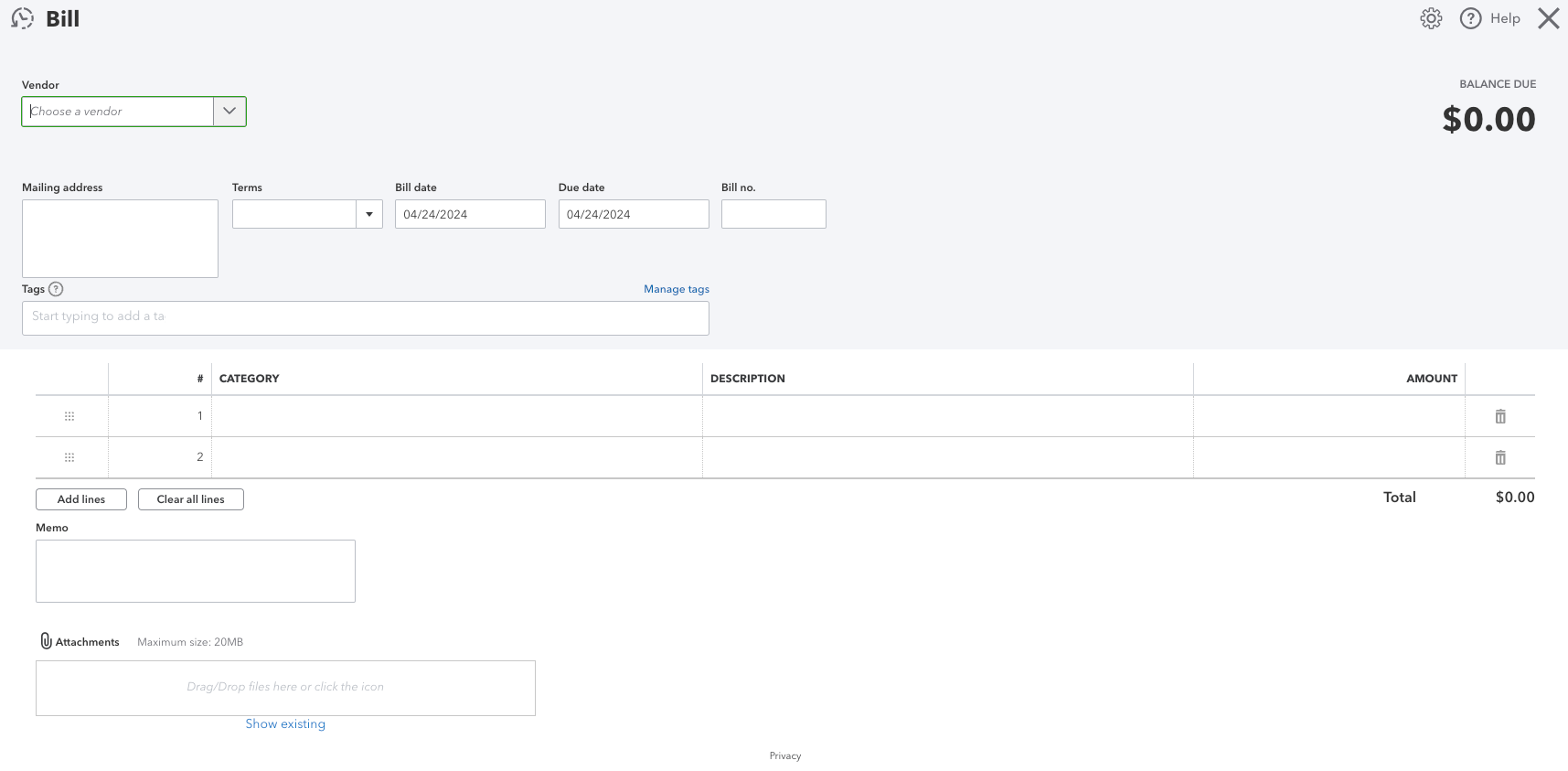

- You will then see a blank invoice window and enter all relevant supplier information into the input fields.

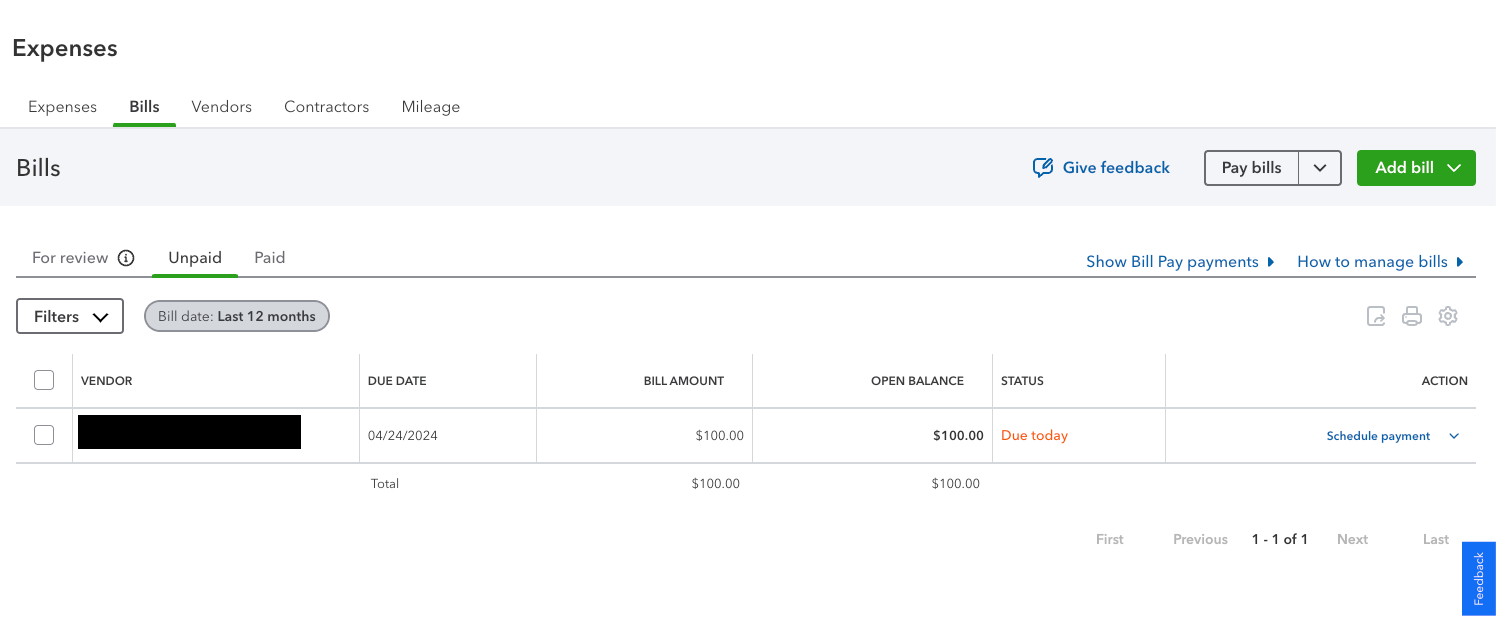

- Once saved, you will be returned to the supplier panel and can schedule the payment.

- You will enter your payment information from the Programmed payment window and schedule payment.

This is also how to pay vendors through ACH when using QuickBooks Online, although you can enter any authorized and available payment method within this window.

Benefits of QuickBooks Vendor Payments

There is something to be said for simplicity and keeping supplier payments nested within your broader framework. accounting and bookkeeping The ecosystem goes a long way in simplifying your financial life. Some of the key features added include:

- Automated Matching – Verify that the details of the purchase orders and associated invoices match so that the invoice can be paid.

- Data centralization: a single source of information to improve decision making

- Payment Scheduling: Describe the timing, frequency and amount of payments.

- Visualization: Present key metrics visually for maximum insight

All of the above serves to streamline workflows and keep an accurate count of the cash leaving your business, while taking advantage of QuickBooks' robust security protocols.

Conclusion

QuickBooks Payments and Invoice Payments are a simple, closed-loop series of vendor payment workflows to streamline and simplify vendor or contractor payment processes. While the ins and outs may take some getting used to, the ease of use and ability to control your entire financial system is underrated as we make our business lives more and more complex.

Frequent questions

Can I pay vendors directly through QuickBooks?

Yeah! You can pay vendors via ACH, debit card, or credit card through QuickBooks easily. You can also select additional payment options through third-party plugins or manual payment management tools within the platform.

Can I create supplier credits in QuickBooks?

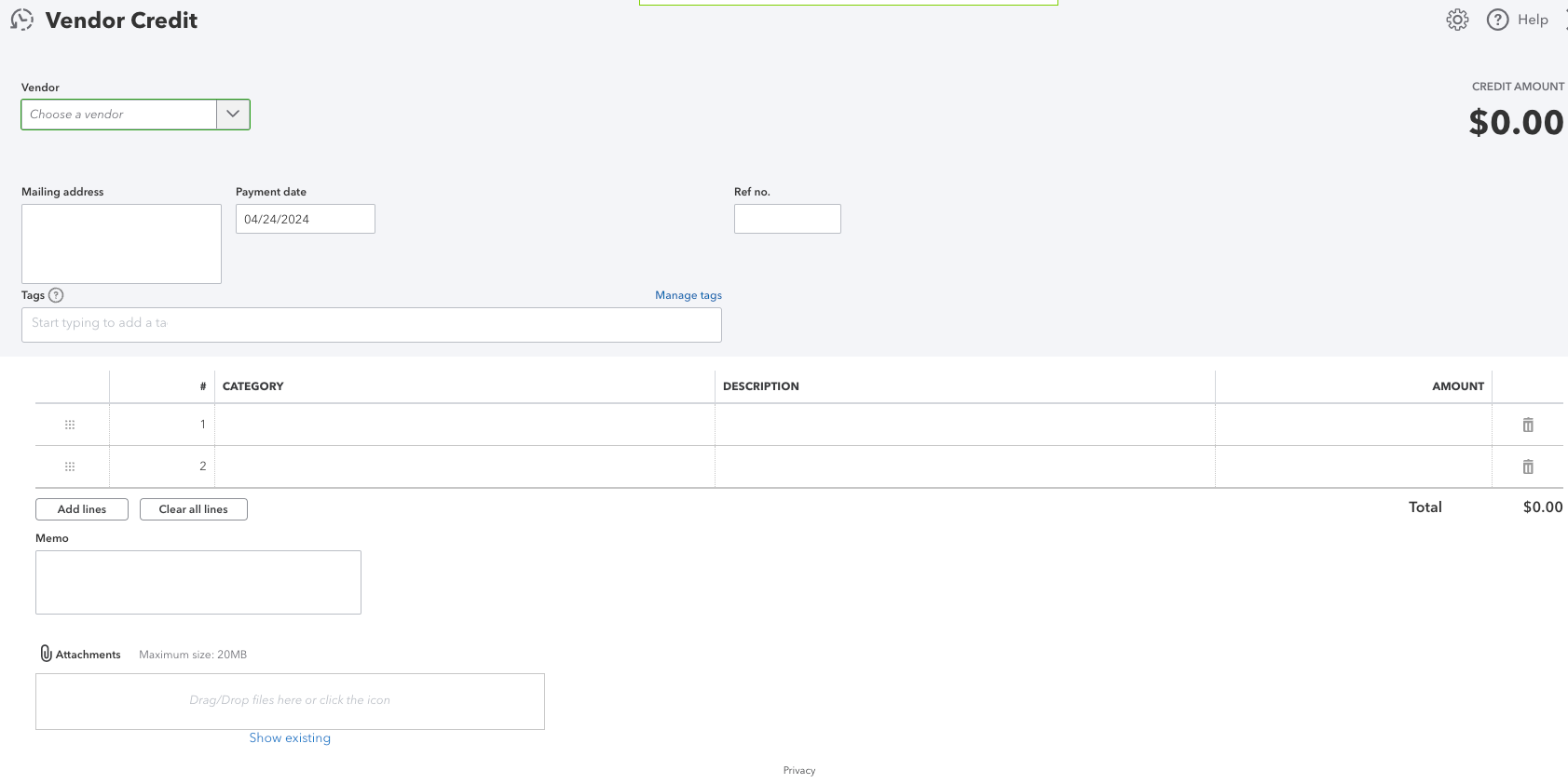

Yeah! To create a supplier credit in QuickBooks Online to pay off the amount due:

- Just click Create

- Then select Seller credit. You will see the supplier portal where you can enter all the relevant data.

- Return to the Bill Pay panel to apply the credit to an existing invoice.

- Then go to Credits and check the appropriate supplier credit before saving and closing the invoice.

However, creating supplier credits in QuickBooks Desktop is very similar

- you will first navigate to Sellers

- and so Pay bills to establish the relevant supplier credit within an existing invoice.

Can I edit or cancel a payment online after I submit it?

Yes, although time is of the essence. Depending on how much time has passed since shipping:

- Can Delete payment, that removes it from your records, or

- Cancel a payment, which sets the payment amount to zero.

Please note that neither of them returns money to your account; In these cases, you will need to request a direct deposit reversal or work with the provider to refund part or all of the payment.

How can I optimize supplier payments with QuickBooks?

A variety of third-party add-ons and integrations can improve vendor payment management in QuickBooks, such as Nanonets accounts payable automation toolsthat uses artificial intelligence to match invoices to purchase orders, streamline approvals, and reduce the time spent (and inevitable errors) associated with manual entries.