The cryptocurrency world is abuzz with speculation after a deep learning model projected a dramatic rise in the price of bitcoin (btc) over the next month. However, despite the bullish outlook for ai, financial experts urge investors to approach the prediction with a healthy dose of skepticism.

bitcoin price is stagnant, but ai model sees a bright future

For the past week, bitcoin has been stuck in a holding pattern, bitcoin” target=”_blank” rel=”nofollow”>stubbornly hovering around the $64,000 mark. This lack of volatility has left many investors scratching their heads, unsure of the market's next move. But a deep learning model developed by CryptoQuant, a leading blockchain analytics platform, has thrown a curveball into the mix.

Source: CryptoQuant

The model, based on a massive data set of historical price movements and on-chain activity, predicts a significant price increase for bitcoin in the coming weeks. According to the analysis, bitcoin could surpass the $77,000 barrier in the next 30 days, marking a new all-time high (ATH).

Bullish Metrics Support ai Vision

While the ai prediction is certainly eye-catching, some analysts are taking a wait-and-see approach. They point to several bullish metrics that appear to align with the model's forecast. The network-to-value ratio (NVT), a metric used to measure the relative valuation of an asset, has decreased significantly, suggesting that bitcoin could be undervalued.

Furthermore, foreign exchange reserves have been falling, indicating a decrease in selling pressure. These factors, along with the model's prediction, paint a potentially optimistic picture for bitcoin's immediate future.

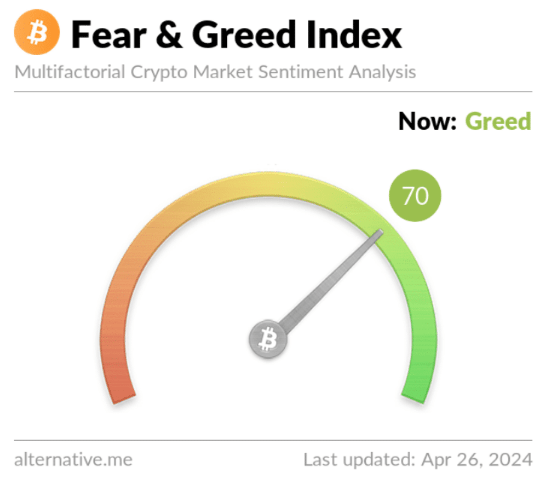

However, a shadow of uncertainty persists. The Fear and Greed Index, a measure of investor sentiment in the cryptocurrency market, currently sits firmly in “greed” territory. Historically, periods of extreme greed have often been followed by market corrections.

This raises concerns that the current price stagnation might not be a prelude to an increase, but rather a sign of an overheated market ready for a pullback.

x/f1rhx96z/” width=”1835″ height=”883″/>

bitcoin is now trading at $62.850. Chart: TradingView

Stagnation before a possible breakup?

Technical analysis of bitcoin's daily chart reveals other complexities. The price has repeatedly failed to break above its 20-day SMA, a key indicator of near-term momentum.

Both the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI) are oscillating sideways, suggesting a lack of clear direction in the market. These indicators imply that investors could have a few more days of slow price movement before a potential breakout occurs, either up or down.

A calculated bet

The deep learning model's prediction offers a glimmer of hope for bitcoin bulls, but it's crucial to remember that ai forecasts are not infallible. The confluence of bullish indicators certainly adds weight to the model's argument, but the ever-present risk of a greed-driven market correction cannot be ignored.

Featured image from Pixabay, TradingView chart

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.