ArLawKa AungTun/iStock via Getty Images

Real estate stocks ended the week in the green after three straight weeks of declines, as analysts turned positive and the sector posted strong gains even amid slim chances of a near-term rate cut.

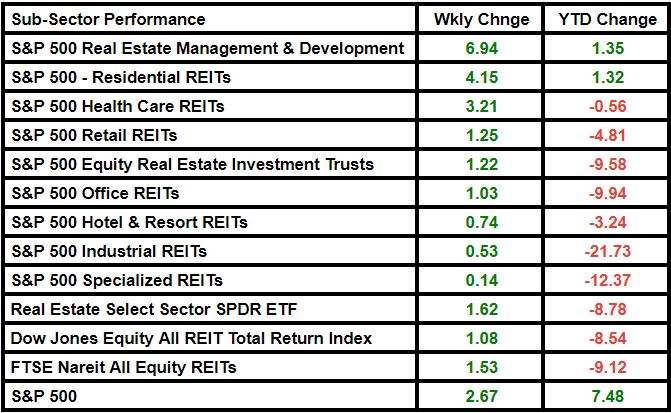

SPDR Select Real Estate Sector ETF (NYSERCA:XLRE) closed 1.62% higher at 36.46, although underperforming the broader S&P 500 index, which rose 2.67% relatively.

Dow Jones Equity All REIT Total Return Index Up 1.08%while the FTSE Nareit All Equity REITs index rose by 1.53%.

The core PCE price index, the Federal Reserve's preferred measure of underlying inflation, rose in line with consensus in March. Investors delayed their rate cut expectations in reaction to the latest data on the US economy, which indicated that GDP only grew at an annual rate of 1.6% in the first quarter, well below the consensus forecast of 2 ,2%. The consensus now is that the first 25 basis point rate cut will take place in December.

However, analysts showed optimism in real estate stocks this week. UDR (UDR) was upgraded at UBS due to growing confidence in its favorable valuation rental growth trajectory. Mizhuo Securities resumed coverage of Healthpeak Properties (DOC) with a Buy rating thanks to its merger with Physicians Realty.

Deutsche Bank upgraded Federal Realty Investment Trust (FRT), believing recent office leasing announcements should ease investor concerns about the office portion of the REIT's mixed-use properties.

BMO Capital Markets upgraded Equity Residential (EQR) ahead of its earnings results. Multifamily REITs, including EQR, are changing hands at discounted valuations, “largely due to supply concerns in the Sunbelt,” analyst John Kim wrote in a note. However, BMO downgraded Prologis (PLD) as Kim believes “shares will be under pressure as long as the demand outlook remains murky.”

Seeking Alpha's Quant Rating system changed its rating on XLRE to Sell from Strong Sell this week, with a score of 1.78 on a scale of 5. SA analysts continue to rate the ETF as a Buy.

Profits:

This week, some big real estate names delivered solid earnings growth, continuing to demonstrate the sector's disciplined balance sheet.

Alexandria Real Estate Equities (ARE) closed 2.49% higher on Monday after posting earnings and revenue that exceeded analysts' average estimate as expenses fell noticeably. Residential equity (EQR) rose 1.3% in after-hours trading Tuesday after first-quarter results. CoStar Group (CSGP) was positively impacted by first-quarter progress as well as the deal with Matterport, particularly closing the day after announcing its results. 8.66% higher.

Healthpeak Properties (DOC) closed on Friday 2.51% higher after releasing momentum and raising 2024 guidance Thursday after market hours. The same was the case for AvalonBay Communities (AVB), and the stock closed slightly higher on Friday. Weyerhaeuser (WY) on Thursday posted first-quarter earnings that were slightly above the Wall Street consensus, but fell noticeably both sequentially and a year ago.

WY was among the worst-performing S&P 500 real estate stocks this week, along with Equinix (EQIX), Crown Castle (CCI), Public Storage (PSA), and Regency Centers (REG). CSGP, EQR and DOC were among the best performing stocks, along with Essex Property Trust (ESS) and Digital Realty Trust (DLR). reAlpha tech (AIRE), Braemar Hotels & Resorts (BHR), Altisource Portfolio Solutions (ASPS), KE Holdings (BEKE) and Ohmyhome (OMH) were among the other top real estate names that posted positive returns during the week.

Top real estate names expected to report next week include WP Carey (WPC), American Tower (AMT), Omega Healthcare Investors (OHI), Iron Mountain (IRM), VICI Properties (VICI) and STAG Industrial (STAG), among others.

Fund flows:

Funds continued to flow out of The Real Estate Select Sector SPDR Fund ETF this week, demonstrating bearish investor sentiment.

XLRE saw net outflows of ~$40.05Min comparison with outflows of ~$36.26M last week, according data solutions provider VettaFi.

Optimism about the near-term outlook for the broader stock market continued to wane, as stable inflation and a flurry of earnings reports from key players weighed on investor sentiment.

Subsector Performance:

Real estate management and development and residential REITs were notable winners among subsectors.

The strength of the residential subsector was particularly evident in the March home sales report, which showed that new home sales exceeded consensus during the month. Buying demand remains stable even as mortgage rates continued to rise.

Here's a look at the subsector's performance:

NEWSLETTER

NEWSLETTER