Sage Intacct, a world-renowned ERP solution, is one of the best options for businesses globally. Finance teams and many others use it to facilitate their operations.

In today's fast-paced business environment, it is essential to optimize operations and maximize efficiency. This is especially true for the accounts payable (AP) department, which manages a company's financial obligations to suppliers.

Improving the efficiency of the Accounts Payable (AP) process is a strategic initiative for companies, as complex and resource-intensive work is unsustainable, difficult to scale, and prone to errors.

Automation in accounts payable refers to the use of software to digitize, streamline and optimize the end-to-end accounts payable management process. Addresses challenges of traditional processes by reducing manual handling.

intervention, streamlining processing times and improving visibility. In this blog, we'll discuss Sage Intacct, specifically for finance teams, and how Accounts Payable Automation (APA) is the next step in improving the process.

Sage Intacct: the cloud-based ERP

Sage Intacct, a world-renowned ERP solution, is among the best options for businesses globally. Sage Intacct serves clients across industries and geographies, primarily in North America. While suitable for enterprises, Sage Intaccts' distinction and strength lies in the small and medium-sized business (SMB) market.

Sage Intacct is an AICPA-backed and HIPAA-compliant cloud accounting system. Your ability to quickly “tag” your transactions and operational data with dimensional values is a unique distinction of Sage Intacct.

Here's how Sage Intacct can boost your finance teams:

- Account payable/receivable– Eliminates inefficiencies and gets you paid faster.

- Information about various entities: Intacct provides growing multi-entity businesses with valuable insights for clarity and greater efficiency

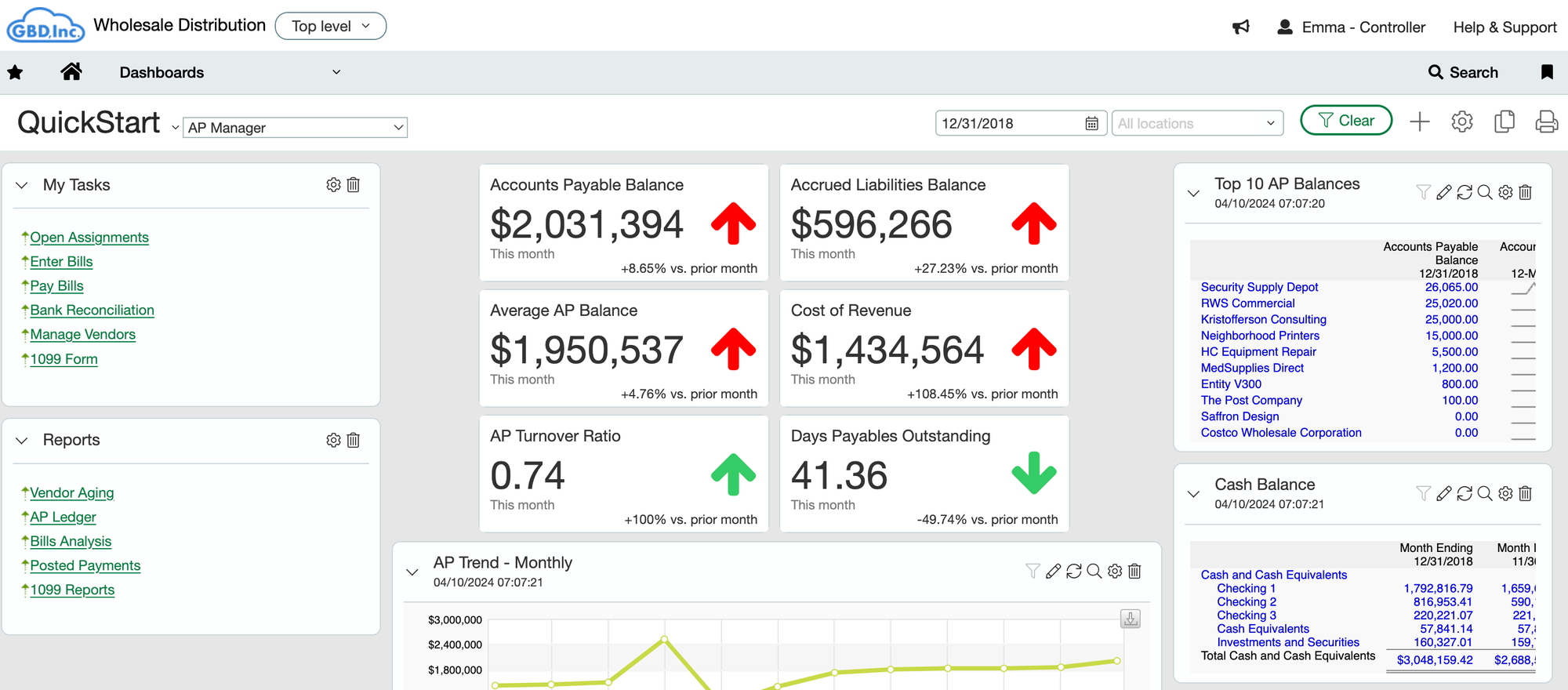

- Control and information panel: Turn data into insights and achieve peak performance with comprehensive, flexible, real-time financial reporting and customizable dashboards.

Understanding Accounts Payable (AP)

Accounts payable, or AP, is the amount of money a company owes its suppliers for goods or services that were delivered but not paid for. The AP department is responsible for maintaining detailed records of invoices, ensuring payments are processed accurately and on time, and maintaining detailed financial records.

Sage Intacct provides valuable insights to the Accounts Payable team. It also allows invoices, reconciliations and other relevant tasks.

Traditionally, AP workflows involve a substantial amount of manual effort. Below is a breakdown of a typical manual AP process:

- Invoice Receipt: Invoices arrive from suppliers through several channels, including email, postal mail, and fax.

- Data entry: Manual data entry involves entering invoice details such as supplier name, invoice date, invoice amount, and due date into accounting software. This repetitive task is prone to errors.

- Approval workflow: Invoices are sent to designated staff for approval based on predefined criteria, often involving physical paperwork and manual submission.

- Processing payment: Once approved, payments are manually initiated via checks or ACH transfers.

- Registry mantenance: Invoices and payment records are meticulously archived for future reference and audit purposes.

The manual AP process could be more active, vulnerable to human error, and laborious. Accounts payable automation or APA becomes crucial to digitize, streamline and optimize

Automating Accounts Payable with Sage Intacct

Sage Intacct offers two main ways to automate the accounts payable (AP) process:

- Intact Sage ai: Sage has a built-in AP automation feature with ai capabilities. This is what you can achieve

- Upload an invoice and Sage will be able to capture invoice data

- Also flag any duplicate invoices.

- Third Party AP Automation Integrations: Sage Intacct boasts a wide range of technology and integration partners, some in its Marketplace. They offer solutions with a wider range of functionality, including:

- Accurately capture invoice data from various sources

- Two-way/three-way matching for purchase orders

- Approval rules and workflows

- Payment integrations

Nanonets: Your AP Automation Champion

Nanonets is a powerful AP automation solution that leverages the magic of artificial intelligence (ai) to streamline invoice processing.

Trusted by over 10,000 brands, Nanonets is a Sage Intacct Marketplace partner with the best ai and invoice recognition software for accurate AP recognition and processing.

Below is how Nanonets automates the AP workflow:

- Automated invoice receipts: Importing invoices into Nanonets from multiple sources is best in class

- Automated data entry: Nanonets extracts structured data from your invoices, regardless of the invoice format and whether the invoice is scanned or digital.

- Automated verification: Two-way pairing and more. Match invoice information to purchase orders, delivery notes, and other open AP documents.

- Multi-stage approval route: Send automatic notifications to the appropriate person in the organization to review invoices before approval.

- Real-time synchronization: Import your Sage chart of accounts and create rules to code documents from your suppliers.

By automating these critical tasks, Nanonets significantly reduces manual effort, minimizes errors, and speeds up the AP process, allowing your team to focus on more strategic tasks.

Unleashing the power of integration

Integrating Nanonets with Sage Intacct offers many benefits for businesses of all sizes. Here are some of the most compelling advantages:

- Reduced effort: Nanonets automates invoice processing, freeing your AP team.

- Improved Accuracy: Integration reduces errors and ensures data integrity.

- Faster processing: Automate tasks for faster approvals and payments.

- Greater visibility: Gain valuable insights with real-time dashboards.

- Improved compliance: Ensures an optimized and auditable AP process.

Nanonets integration with Sage Intacct can automate and streamline accounts payable operations. This combination can streamline the AP process, reduce costs, and empower the team to focus on more strategic initiatives.

Taking the first step towards AP automation

Nanogrids automate accounts payable, driving efficiency, accuracy, and a robust financial process. Leverage ai and machine learning to lead financial management. Eliminate errors, automate tasks, and seamlessly integrate APs. See how Nanonets tailors solutions with a free demo. Delve into the future of finance with Nanonets.