About 25% of the startups on Secfi’s platform cut their valuations last year.

last year was painful for startups and their employees. Venture capitalists cut their investments, thousands of people lost their jobs, and company valuations stagnated or fell amid a prolonged bear market.

An estimated 24% of startups on the Secfi platform have reduced their fair market valuations in 2022, according to internal analysis. For the people who work at those startups, that means some (in some cases, all) of their employees’ stock options spent 2022 underwater.

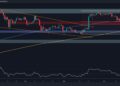

Separately, a Secfi analysis of 1,502 funding rounds at late-stage startups since March 2021 finds that startups are raising more flat rounds and down rounds than before.

Several startups that raised money in 2022 did not disclose their post-money valuations, suggesting that the actual number of startups that cut their valuations in the last 12 months could be even higher than publicly reported.

Employee stock options are a significant factor in startup compensation, and underwater stock options have the potential to negatively affect hiring and retention across the startup ecosystem.

Looking ahead, the data suggests that 2023 will continue to be challenging for late-stage startups.

Submarine Stock Options

An analysis of more than 4,300 stock option grants uploaded to the Secfi platform in 2022 shows that nearly one in four startups reduced their fair market valuations at some point during the year.

The most prominent example of this phenomenon was Klarna, which raised venture capital in mid-2021 at a valuation of $45.6bn, but was forced to raise a new round of funding in mid-2022 at a valuation of $6,700. million dollars, a drop of 85%. Other big companies that lowered their valuations (without raising funds) include Instacart and Checkout.com.

Stock options are a high-risk, high-reward form of compensation and remain one of the most compelling drivers of start-up employment and retention.

A Carta analysis of 2018 employment data suggested that The average startup employee works just two years at a company before jumping on their next opportunity. Underwater stock options are a problem for people who joined a startup in 2020 or 2021, as they now find their shares are worth less than when they were hired.

The average Silicon Valley startup employee received 12-14% of the value of their salary in the form of stock options, for Letter. In other words, a startup worker earning an annual salary of $150,000 could expect to earn an average of $21,000 in stock options as part of the startup’s total compensation package.

When a startup is successful, stock options increase in value, in some cases, by many multiples. Stock options represent 86% of the total net worth of the average startup employee, according to financial data employees voluntarily shared with Secfi.

Underwater stock options can affect employee retention, as employees look to other start-ups with stronger valuation growth. As a result, start-up leaders who want to retain their employees may need to consider cash and retention bonuses, higher salaries, or a stock option appreciation program.

The average cost of exercising stock options remains high

Despite economic hurdles, the cost of exercising stock options remains high.

In 2022, the average Secfi client required $846,000 to exercise their stock options and pay associated taxes. As in previous years, taxes continue to make up the majority of the total cost of the year.

High costs remain one of the main reasons why employees at start-ups don’t exercise their stock options.