Bitcoin (BTC) was hovering around $23,000 on February 1 after posting its best January performance in ten years.

The end of the Bitcoin bear market is “default view”

Data from Cointelegraph Markets Pro and TradingView confirmed a monthly close of around $23,100 for BTC/USD, the highest since July 2022.

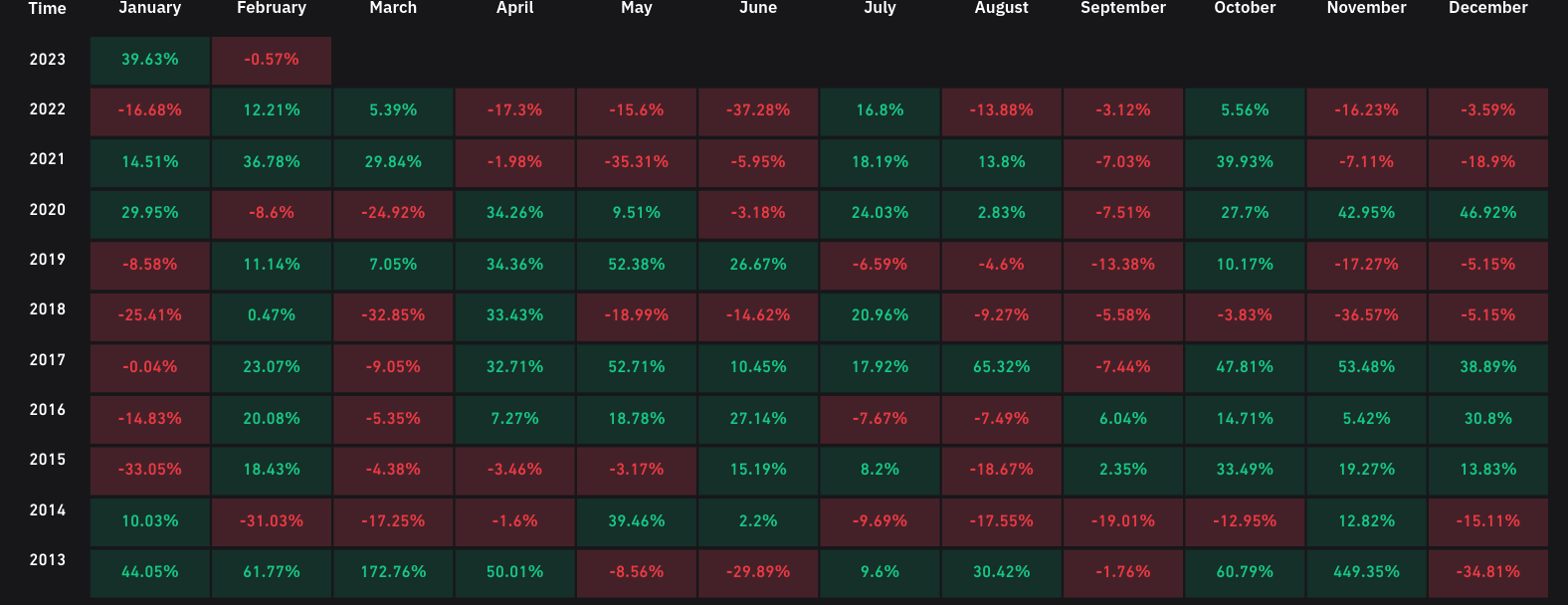

The largest cryptocurrency ended the first month of the year up 39.6%, according to statistics from purse.

The impressive performance emboldened the bulls, many of whom kept the faith despite massive doubts from more conservative market participants.

“Bitcoin closes at a monthly low”, Trader, Entrepreneur and Investor Bob Loukas reacted.

“I mean, anything can happen, right? But the absolute default view must be that the bear market ended in December.”

As Cointelegraph reported, opinions differ considerably on how Bitcoin will perform in February, with one trader expecting “bearish” conditions to return after five-month highs.

The outlook for the coming month continues to be clouded by macroeconomic triggers. In particular, on February 1 the US Federal Reserve will confirm its next interest rate hike, and the European Central Bank will do the same on February 2.

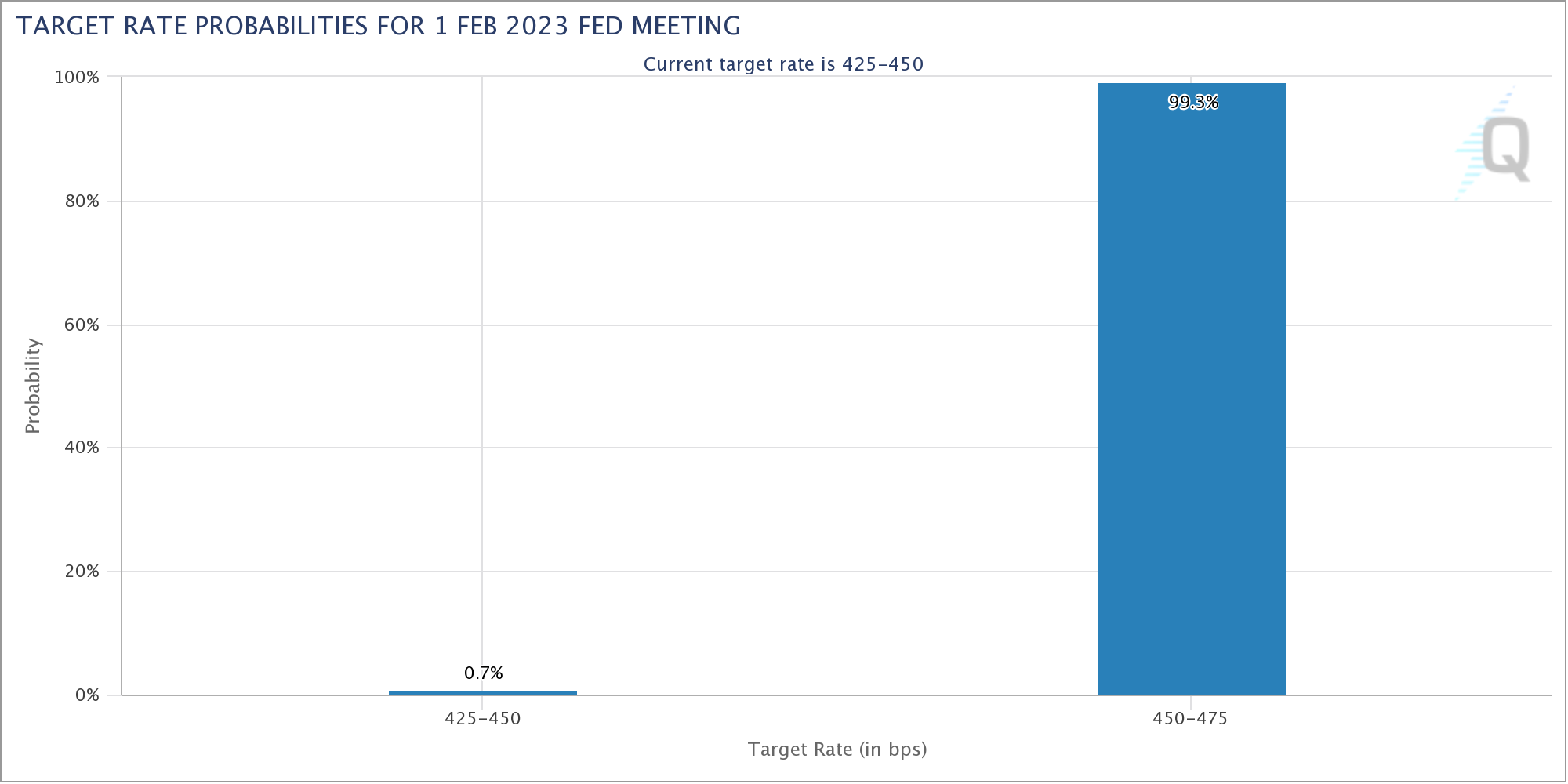

While the previous 25 basis point (bps) rise is priced almost “unanimously,” says cryptocurrency research and analysis firm Arcane Research, the future remains less certain.

“Due to a relatively strong market recovery, Chairman Powell may take advantage of maintaining a hawkish, restrictive background, emphasizing the importance of incoming economic data,” he argued in a statement. blog post posted on January 31, adding that consensus “expects a 25bp rise on Wednesday and another 25bp rise to 475bp on March 22.”

“Currently, zero adjustments during the FOMC meetings on May 3 and June 14 are quoted as the most likely outcome, but a further 25bp increase remains within the realm of possibility,” he noted.

Expectations for a 25 basis point increase totaled 99.3% at the time of writing, according to CME Group. FedWatch Tool.

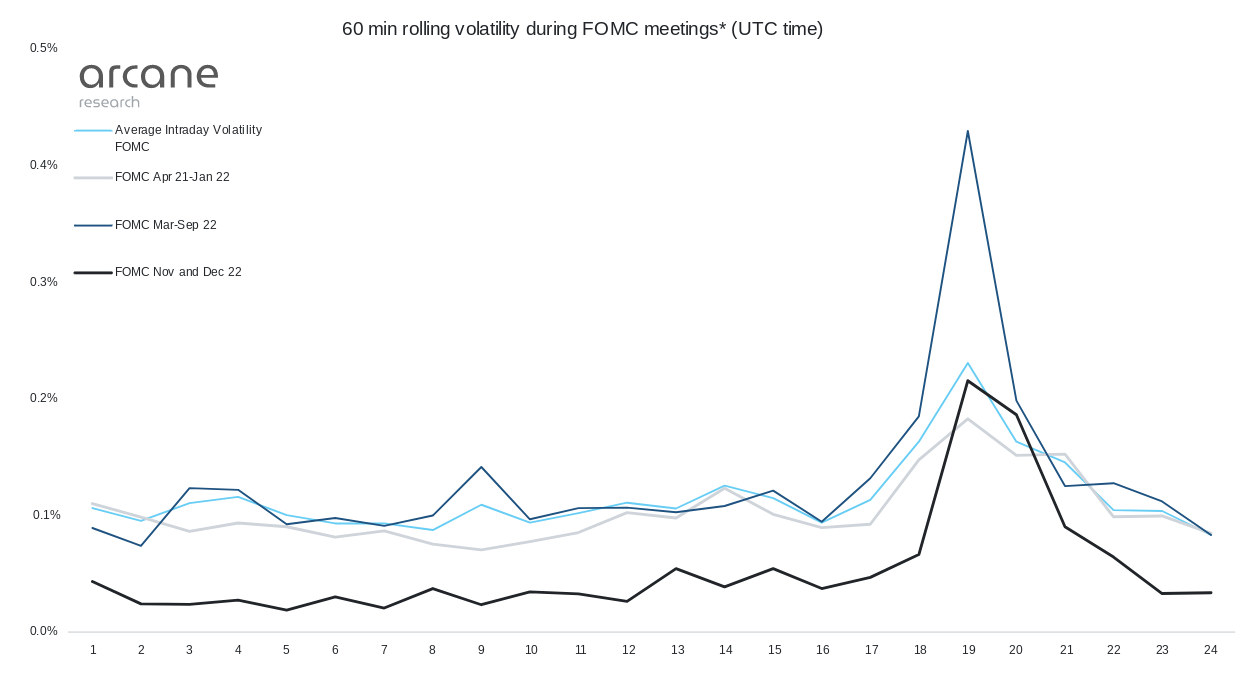

If the door is open for surprises, volatility may rise as a result, and rate hike decisions are already a classic catalyst.

However, Arcane showed that with each passing hike, the volatility around the Fed’s move has cooled.

“This could suggest that the massive FOMC-induced volatility trend in BTC is reversing,” he concluded.

Dollar strength eyes key rebound

Another concern for cryptocurrency performance comes in the form of a stronger US dollar.

Related: Best January since 2013? 5 things to know about Bitcoin this week

in a market update last week, trading firm QCP Capital warned underwriters that a “massive positive divergence” in the US dollar index (DXY) was at stake.

Traditionally inversely correlated with risk assets, DXY has been trending lower since mid-2022 but has reined in losses in the new year.

“This is the same setup we saw in BTC/ETH in December, and as we saw there, any breakout to the top will therefore be extremely sharp and violent,” QCP wrote.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.