The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

As Argentina's economy is hit by record inflation, its people are turning to bitcoin as a way to protect their economic security.

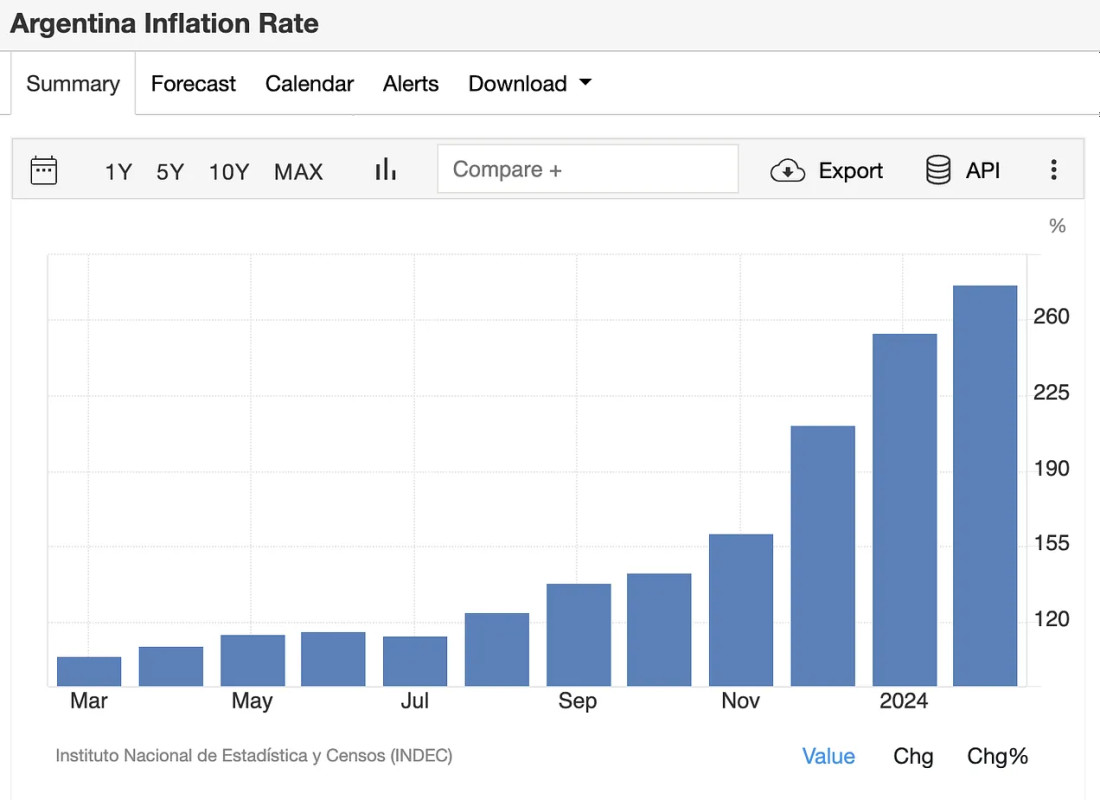

The Argentine Republic is currently experiencing the worst inflation rates in the world. The country's economy has experienced low levels of inflation, around 25%, for decades; However, the pandemic exacerbated a downward trend with devastating effects. The inflation rate reached 70% in 2022 and hit 100% the following February, but 2023 turned out to be an absolutely killer year for the Argentine economy. Inflation rates crossed the 200% point around the time bitcoin–bitcoin“>friendly President Javier Milei first took office in December and the rate currently stands at a mind-blowing 274%. With numbers like these, the salaries and life savings of ordinary citizens have evaporated virtually overnight, and people are looking for more radical solutions to get their lives back on track.

In a particularly encouraging development, ordinary citizens are turning to bitcoin in record numbers for its classic use case as a store of value. It is already a nation with bitcoin-gains-dim-argentines-dollar-refuge-with-276-inflation”>high Despite bitcoin's acceptance rate, Argentina has doubled down on the decentralized currency as the most popular local exchange reports 20-month highs in trading volume. Lemon Cash, the exchange in question, claimed that bitcoin transactions in the first full week of March 2024 were more than double the average rate for all of 2023. Belo, another major exchange based in the country, reported higher year-on-year increases. nearby. ten times. A particularly interesting aspect in the development is that bitcoin is not only replacing dollars, but also dollar-backed stablecoins, whose trading volumes decreased by 60% to 70%. Belo CEO Manuel Beaudroit stated that “the user decides to buy bitcoin when he sees the news that the currency is going up, while the stablecoin is more pragmatic and is often used for transactional purposes, as a vehicle to make payments in abroad”.

Ironically, Bloomberg Some of President Milei's economic positions have actually influenced the shift from the dollar to bitcoin, he claims, but through unexpected and indirect means. The radical libertarian has started his administration with a series of wide-ranging reforms to try to control the situation, reducing spending and attempting to dismantle or privatize a variety of state-owned companies. A particular goal of his administration to date has been to develop a budget surplus for the federal government, for various reasons: to use these funds more deliberately, to achieve goals based on agreements with the International Monetary Fund (IMF) and of course to start a positive trend in Argentina's economic statistics. TO bitcoin.com/argentina-greenback-love-is-being-substituted-by-a-bitcoin-rush/”>component

Reports from Chainalysis shed some concrete numbers on these general trends: Argentina leads all of Latin America in transaction volume and ranks second overall in terms of base adoption. Lemon Cash representatives estimated in this report that the number of Argentines using bitcoin or other digital currencies is around 5 million, out of a population of 45 million! Such impressive figures are not simply the result of a brief period of economic misfortune, but should be considered a turning point of sorts: bitcoin acceptance has been quietly growing for years, and now the crisis is making the leap to become a completely conventional fiduciary alternative. The growth rate has been so prodigious that an unexpected “cousin” to the industry has even been developing, with cryptocurrency-related companies. crypto.news/bitcoin-interest-in-argentina-hits-20-month-high-as-inflation-soars-above-270/”>scam and phishing activity increased fivefold. Clearly, the market is full of new people in the chaotic bitcoin ecosystem.

In connection with the increase in unsavory activities targeting new bitcoin users, Argentina is starting to pass some new regulations on the industry. The Senate unanimously bitcoin.com/argentine-senate-passes-reform-creating-cryptocurrency-entities-registry/”>approved a new law in March, opening up a new set of standards that virtual asset service providers must comply with. The rules are generally related to various consumer protection and anti-fraud precautions, and the country's main securities agency will be responsible for enforcing these new rules. The existing bitcoin community has reacted to these new laws with dismay, fearing that this legislation will lead to market consolidation. After all, large operations would have the resources to meet these new requirements immediately, while smaller startups could be overwhelmed. Still, lawmakers are also working on a series of tax breaks for digital asset holders, which can hopefully help soften some of this animosity.

However, curiously absent from these proceedings is President Milei. The man espoused some pro-bitcoin views during the election campaign and has a general economic philosophy that aligns with some of bitcoin's fundamentals, yet he has had little public presence in many of bitcoin's developments. Even the incidental rise of bitcoin driven by his own policies did not lead him to make public statements about the situation. Still, Milei has had her hands full from a powerful standpoint. series of economic reforms and austerity policies, balancing the confidence of global markets with a worrying increase in poverty in several parameters. Milei has achieved slow inflation soars a little, but at a great cost: the reduction in public spending is pushing more citizens to the brink. As Reuters As reported, the crisis is far from over, with sales, activity and production on a downward slope.

In other words, it seems likely that Milei personally has bitcoin on the back burner, as he has a much higher priority in controlling the economy and moderating the possibility of social unrest. His overall popularity remains despite these adversities, but a controversial topic like bitcoinization may simply be a battle he is unwilling to start. Once things calm down, we can expect her endorsement of bitcoin once again, but nothing is really certain. Still, despite its lack of direct pro-bitcoin initiatives, the legislature is still taking positive steps in its own right. It seems highly unlikely that Argentina will become actively hostile to bitcoin in the face of this inflation, as happened with Nigeria. Campaign in the middle of a lagging badge.

Ultimately, the future of bitcoin in Argentina depends on the Bitcoiners themselves. The economic crisis has presented the community with record levels of adoption, and bitcoin is no longer a household name. Will this trend continue as the economy recovers? Will a fledgling community of bitcoin-related companies and developers transform into a dynamic and profitable industry? There are too many variables to say for sure. However, bitcoin is a chaotic market that was founded in the wake of the United States' own economic problems following the 2008 crash. The global community has demonstrated an innovative and entrepreneurial spirit that can lead to success even in the most marginal situations. In other words, bitcoin has been rising globally, and there is no reason to doubt that it will not continue to rise in Argentina as well.