The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

As we inch closer to bitcoin's impending halving, the combined pressures of wildly increasing demand and shrinking supply have created an unusual market, turning a historically positive omen into an explosive profit opportunity.

The approval of the bitcoin ETF has changed the face of bitcoin as we know it. Since the SEC made its fateful decision in January, the resulting events have caused global upheaval; Billions have flown into these new investment opportunities, and regulators in many countries are considering bitcoin's role in the financial establishment. Despite some early setbacks, the market has recovered comfortably bitcoin-hits-new-heights-between”>hit new all-time highs and the price has remained in a very impressive range even despite the fluctuations.

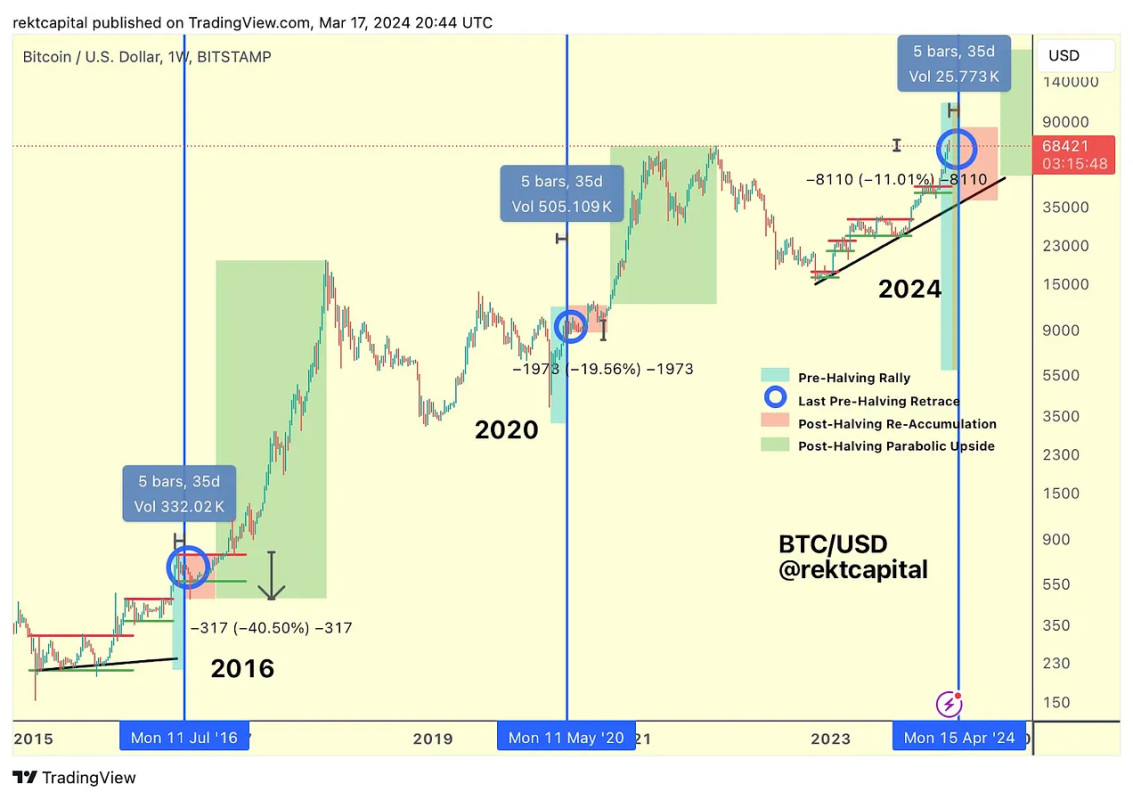

However, we are in a unique situation that can impact the market in unpredictable ways. The next bitcoin halving is coming in April, and this will be the bitcoin-halvings”>first time throughout its history that the halving will coincide with an all-time high in prices. Although there have been many differences between each of the major halvings, overall one trend has been noted: Even if there are huge consistent gains, it will take between a year and 18 months before bitcoin breaks all records with any real impact. . price increase. A year after the halving in June 2016, bitcoin had more than doubled; However, a few months later, the growth was approaching 30 times.

There is a lot of optimism from major industry players, such as Standard Chartered's bold prediction that the value of bitcoin will double to $150,000 before the end of the year. However, his analysis of the situation is based not primarily on halving trends but on the runaway success of the bitcoin ETF, and that success has also thrown us a curve ball. As a community bitcoin/comments/1bgxnpz/interesting_numbers_halving_next_month/”>discussion was quick to point out, these major ETF issuers have been investing billions in bitcoin, buying at bitcoin-passing-michael-saylors-microstrategy/”>amazing rates and amassing some of the world's largest bitcoin supplies virtually overnight. If they collectively buy more than the global community, how will they react when the spigot of new currencies turns off to a trickle?

In other words, we are heading towards a bitcoin-halving-cryptocurrency-markets-investors-etf-spot-btc-supply-demand-2024-3″>situation where demand is at its highest and there is not enough supply to satisfy it. Business Insider called the upcoming halving a “momentous event,” considering that the ETF had made “permanent changes to bitcoin’s underlying infrastructure.” bitcoin-positive-demand-shock-registered-investment-advisors”>echoed these sentiments with the warning of a positive demand shock, as head of research James Butterfill stated: “The launch of multiple spot bitcoin ETFs on January 11 has led to an average daily demand of 4,500 bitcoins (trading days only). ), while only an average of 921 new bitcoins were minted per day.” And that's just taking into account pre-halving mining rates. ETF issuers already rely on second-hand bitcoin sales to fill their coffers, and this trend seems certain to increase in the foreseeable future.

Isn't this a good thing? Positive demand shocks, as a rule, are generally associated with jumps in price. Furthermore, although shocks like this to critical commodities like oil can lead to inflation, bitcoin is not yet an essential component of the entire global economy. It is unlikely that the same drawbacks will occur yet. In other words, the general answer is yes, but the situation may still lead to alarming trends. For example, on the night of March 18, a truly disconcerting event occurred. bitcoin-flash-crashed-to-89k-on-bitmex/”>development– Reaching highs of around $70,000, the value of bitcoin on BitMEX fell below $9,000 in the blink of an eye. The price recovered quickly and was in any case isolated from this exchange, but it is still an unprecedented development.

BitMEX announced that the culprit for this negative price surge was a series of large sell orders in the middle of the night and that they were investigating the activity. In particular, several unnamed whales have emerged as possible candidates for these sales. We still have no idea who exactly they are or who was buying bitcoin at such a prodigious rate, but it's just one example of how large sell-offs can torpedo market confidence. In any case, this episode is just a particularly clear example of a widespread situation. bitcoin-traders-60k-btc-price-support-futures-gap”>trend; Spot selling 'steady' as bitcoin price gets nosebleed. The market hit lows of $62,000 on Tuesday afternoon, while it was almost at $72,000 the previous Friday morning.

However, traders have remained entirely optimistic that these price declines are nothing more than the “bear trap” associated with the pre-halving environment, and are not the only ones. Prominent executives including Binance CEO Richard Teng and crypto.com CEO Kris Marszalek have bitcoin-entering-pre-halving-danger-zone-binance-crypto-ceos-bullish”>backed up the view that these types of price declines are a perfectly natural and temporary component of a scheduled halving. There is a clearly observable trend of substantial price drops, of 20% to 40%, in the weeks immediately preceding the most recent halvings. And yet, the price recovered quickly and completely, and reached new all-time highs.

In other words, some of the recent sudden price drops are completely explainable using data from bitcoin's history. The relevant question for us, then, is whether the future of bitcoin will follow the same line. The truth is that all available indications point to an optimistic long-term forecast. A positive demand shock caused by ETF acquisitions and the halving may very well make it more difficult for an average consumer to buy bitcoin, but how will that difficulty manifest itself? The highest prices. Additionally, a selling point of the ETF is that many average consumers will use it to seek exposure to bitcoin profits, rather than direct custody. This alone will encourage ETF issuers to keep their buying pressure high. It is impossible to say how long this market situation will continue or what it will mean for the use of bitcoin as a real currency, but there is nothing in the current situation to suggest that bitcoin will not continue to grow.

Is it any wonder, then, that the community is preparing for welcome Halving with bated breath? Prominent industry figures are taking great care to prepare for “bitcoin's Biggest Celebration” with live coverage and meetup events in 7 countries (and counting), and the halving isn't even expected for another month. . It's entirely possible that 2024 will be remembered as the year bitcoin truly became trapped in the global financial infrastructure, if January's surprising regulatory victories translate into unprecedented growth in December. In reality, the main concern is whether or not bitcoin will see diminished use as a currency when its value in fiat currency is so valuable. However, the signs now seem quite clear: bitcoin is ready to blaze a path into the future.