Image source: Getty Images

I don't have to invest the money I park in my stocks and Shares ISA straight away. But why wait? There are tons of brilliant value stocks waiting to be bought right now.

So instead of running out of money before the April 5th deadline, I'd rather put it to work right away. This way, I can make my money work for me immediately. And as I say, there are some hot stocks that look hugely undervalued right now.

Here are three I'm thinking of buying before the ISA deadline.

Atlantic Lithium

Atlantic LithiumThe (LSE:ALL) share price has fallen due to falling prices for the silvery white metal. It could also remain in a downward trend for a little longer if China's economy continues to falter.

However, I think this could be a great buying opportunity for long-term investors. He AIM The company is developing the Ewoyaa project in West Africa, an asset that could generate dramatic earnings growth.

New drilling news on Tuesday (March 19) has reminded the market of its bright potential. Atlantic has said that high-quality trial results in 2023 revealed “awesome intersections“This, it notes, should help it achieve another mineral resource estimate (MRE) upgrade in the second half of this year.

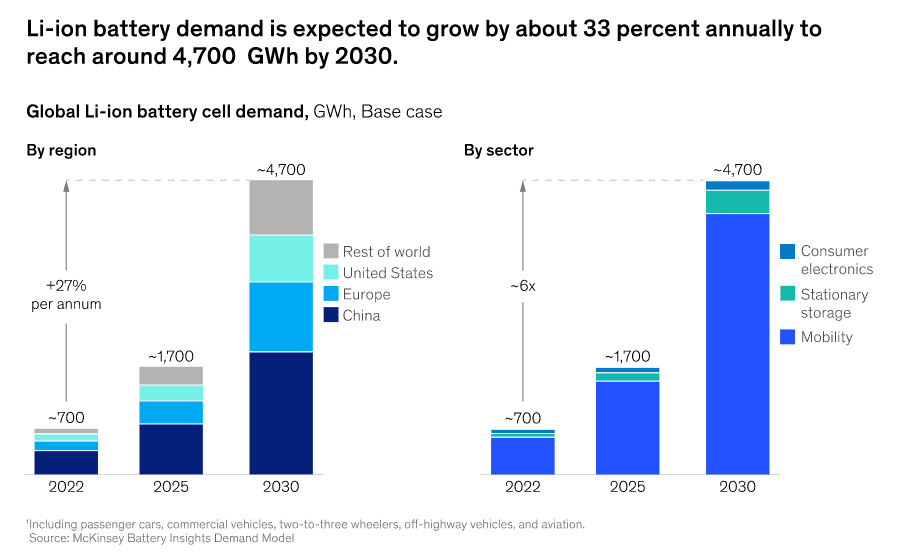

Atlantic Lithium could be in a strong position to exploit the electric vehicle boom once Ewoyaa comes online. The adoption of cleaner cars is believed to increase lithium consumption in the long term, as the graph below shows.

Central Asian metals (LSE:CAML) is another top mining stock on my radar today. This is due to its exceptional overall value.

Today, the Kazakh miner trades with a forward price-to-earnings (P/E) ratio of 8.7 times. It also carries a huge dividend yield of 9.2% by 2024.

Central Asia Metals' flagship asset is the Kounrad copper mine in Kazakhstan. It also owns the Sasa lead-zinc mine in North America. As with lithium, demand for these base metals will skyrocket as the green revolution gains momentum.

Metal mining is an unpredictable and expensive business. Still, at current prices, I think this AIM stock deserves a lot of attention.

Warehouse REIT

I'm also considering adding Warehouse REIT (LSE:WHR) to my portfolio before the ISA deadline. The value of the real estate investment trust (REIT) has fallen again as hopes of imminent interest rate cuts have faded.

This remains a threat in the future. But I'm attracted to the boost that the recent share price declines have given to the FTSE 250 the company's dividend yields. For this year, its profitability is already at 8.2%.

I am confident that Warehouse REIT's earnings will increase significantly in the coming years. Growing e-commerce activity and supply chain evolution will further drive strong demand for warehouses and distribution centers. Therefore, the rents charged by REITs like this should maintain a healthy upward trend, helped by a chronic shortage of new developments across the industry.

Warehouse REIT's comparable rental growth accelerated to 3.7% in the December quarter.