This article appears in bitcoin Magazine. “The question of registration.” Click here to get your annual subscription to bitcoin Magazine.

Click here to download a PDF of this article.

Ordinals have been a polarizing phenomenon for almost every bitcoin subcommunity except miners.

The meteoric rise of bitcoin's new native nft standard dominated discourse for months as Ordinals flooded the block space and drove transaction fees to multi-year highs. According to critics, these transactions are, at worst, an attack on bitcoin that tarnished the sanctity of the scarce block space; At best, they are shit, in-game items owned by players who belong to casino chains like ethereum.

Well, miners don't give a shit if they're shit. They don't give a shit about making money, and Ordinals gave them a revenue boost at a time when mining revenue was at one of its lowest points. Many miners have adopted, or at least are ambivalent about, ordinals/inscriptions, as they received a much-needed boost to bitcoin mining profitability when many miners were near breakeven or unprofitable.

Hashprice is a measure of the amount of USD (or btc) that miners can expect to earn from a unit of hashrate (for example, at $80/PH/day, a miner with 1 petahash of mining rigs, approximately 10 next-generation ASICs (like the S19j Pro, for example, you can earn $80 per day).

Given its positive impact on the hash price, Ordinals, a dark horse technical breakthrough that few could have predicted last year, have found themselves at the center of discussions about the economics of bitcoin mining, discussions that are more relevant with each block that brings us closer to the fourth bitcoin block. reduce the subsidy by half.

I do not write this to proselytize anyone to become an enjoyer of the Ordinals. I, for one, don't really understand the appeal. But I do think they are important in the context of bitcoin's shrinking block subsidy, so it is worth studying them to understand how they affect the block space and mining economics, and what developments like them might mean in a future where the miners alone subsist. about transaction fees.

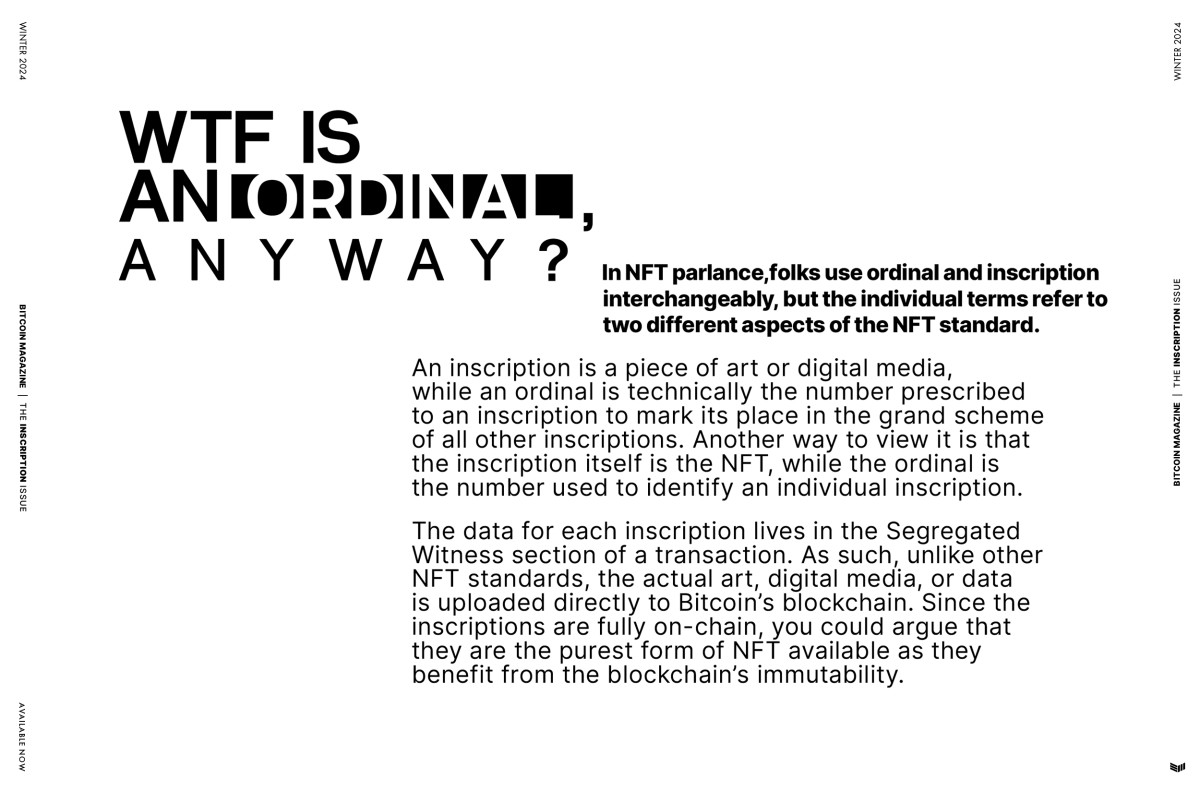

WTF is an ordinal, anyway?

In nft parlance, people use ordinal and inscription interchangeably, but the individual terms refer to two different aspects of the nft standard.

An inscription is a work of art or a digital medium, while an ordinal is technically the number prescribed to an inscription to mark its place in the grand scheme of all other inscriptions. Another way to look at it is that the inscription itself is the nft, while the Ordinal is the number used to identify an individual inscription.

The data for each registration is found in the Segregated Witness section of a transaction. As such, unlike other nft standards, actual art, digital media, or data is uploaded directly to the bitcoin blockchain. Since the inscriptions are completely on-chain, one could argue that they are the purest form of nft available, as they benefit from the immutability of the blockchain.

Not all registrations are the same

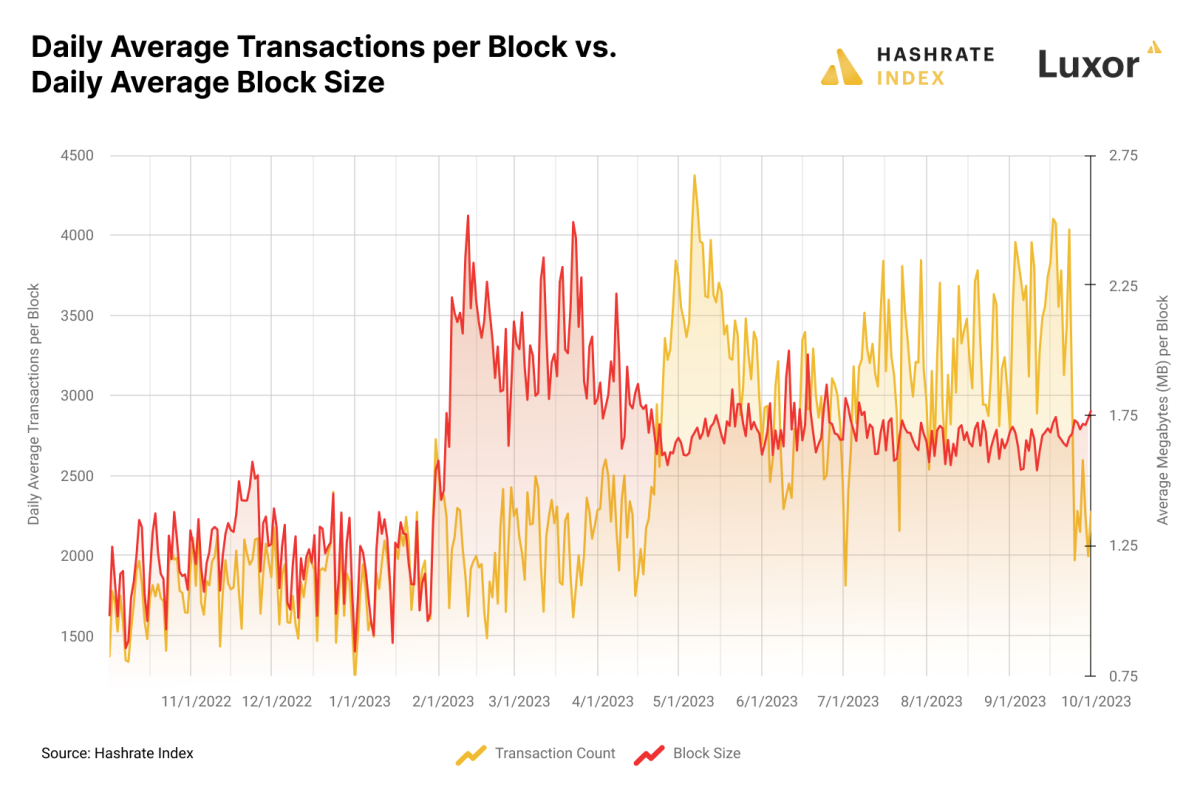

When you understand that inscriptions are real data on the chain, you will be able to appreciate some of the criticisms and concerns of the detractors; If a bunch of nft degens are inscribing JPEGs of monkeys, idiots, and God knows what else onto the chain, then this crowds out economical (and potentially necessary) transactions.

This concern was compounded by the fact that arbitrary data for each registration benefits from a discount on the transaction fee. As a scalability measure, bitcoin's Segregated Witness update modified the transaction structure so that the witness data for a private key signature and a public key was moved from the transaction's hash field to another part of the block. bitcoin discounts SegWit data, so it requires fewer satoshis per byte in transaction fees to make transactions. The arbitrary data of an enrollment is in the SegWit field of a transaction, so it is entitled to the SegWit discount. Cue the pitchforks.

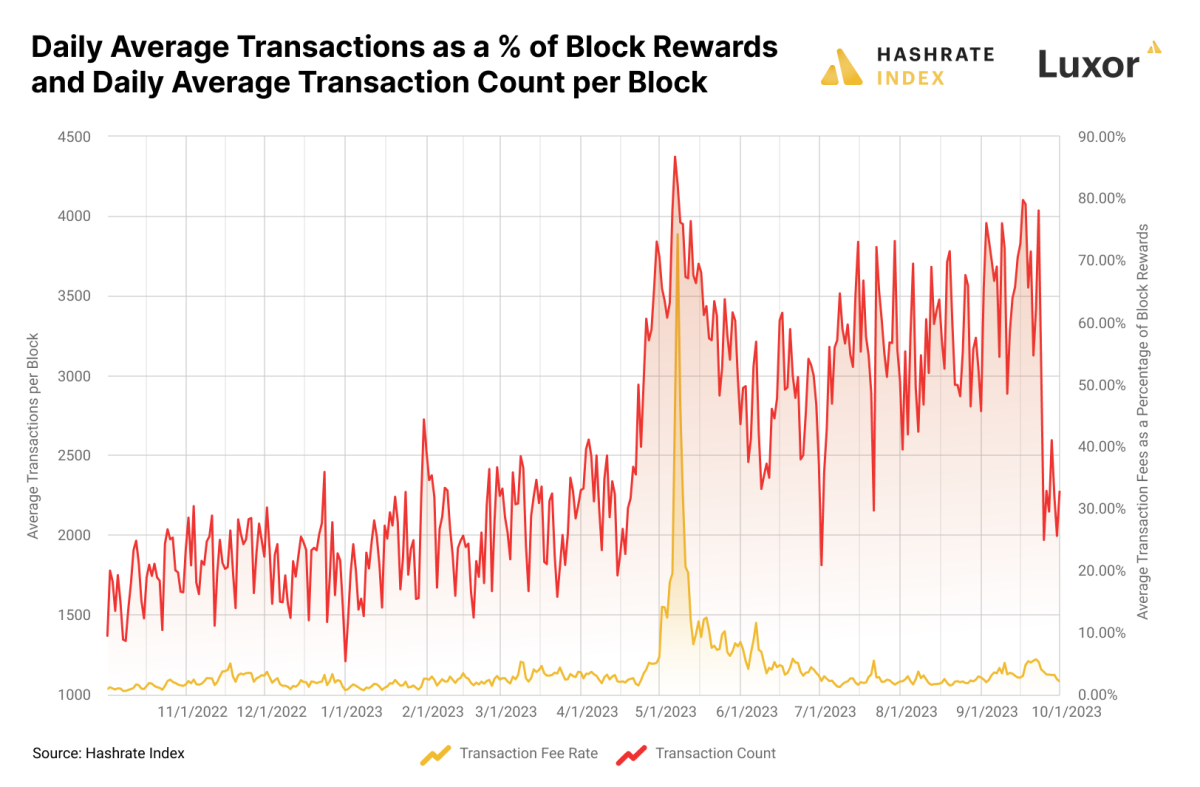

This discount is the reason why, despite the first wave of image-based signups clogging up block space in February/March/April, transaction fees did not increase significantly; Block sizes increased as trendsetting enrollers filled the blockchain with thousands of JPEG files for the first collections of enrollments, but all of these benefited from SegWit's 4-to-1 data discount compared to normal transactions. . Perhaps intuitively, it wasn't until text-based, data-less signups for BRC-20 tokens became the most popular signup type that transaction fees skyrocketed.

So-called BRC-20 (a nod to ethereum's ERC-20 token standard) are a flexible form of token. I say loose because they are really just Ordinals in a series defined by bitcoin's OP_CODE function, where each “token” is itself an OP_CODE transaction that defines the token's place in the specific BRC-20 series. It goes like this: Someone (God only knows who) publishes a transaction OP_CODE that defines the maximum supply of the token series, the ticker and the minting limit per transaction. Once published, anyone with technical knowledge can mint tokens from the series.

These OP_CODE transactions do not benefit from the SegWit data discount, so they cost significantly more than image-based enrollments. But they also have a feature that image inscriptions don't: the minting feature, which provides similar incentives to ethereum NFTs to collect these inscriptions. ethereum nft series typically have minting contracts where anyone can create new NFTs in the series by interacting with the contract. This is part of the appeal, if not all of it. Minting an nft is like opening a digital pack of Pokémon/Baseball/Magic: The Gathering cards: maybe there'll be a rare card in the next one!

And while there isn't necessarily a chance to mint a rare BRC-20 (because they're all the same), there is a chance to mint a bunch of NFTs in a hot new series. Why anyone cares about having ORDI/CUMY/RATS #1 or #100 or whatever, I don't know. It is perhaps the greatest expression of the greater fool theory yet in bitcoin. But the fact is that they do, and the incentives for minting BRC-20 precipitated the largest wave of bitcoin transaction activity in history.

Through a combination of fee wars and the fact that these NFTs do not benefit from the SegWit discount, the BRC-20s have offered a veritable fee feast for bitcoin miners, but not exactly in the way you might think.

Quantifying Transaction Fee Collateral Damage

Most of the increases in transaction fees in 2023 do not come directly from the fees associated with the Ordinals; comes from the indirect pressure of fees on other transactions.

According to data from independent analyst Data Always's Dune dashboard, as of November 12, 2023, miners have collected $70.3 million in fees from Ordinals. It seems like a lot, but it's just 19.4% of the $368.2 million in transaction fees that miners have earned in total since sign-ups began on December 14, 2022. To put this into further perspective, it has There were 40.2 million registration transactions, which is equivalent to 30%. of all transaction volume since December 14. Registrations have therefore accounted for a third of transaction volume over the past year, but only a fifth of all fees.

As for the other fees, many of them are the result of indirect pressure from signups, that is, fees that do not come directly from the signups themselves, but from the pressure that signups put on the average transaction fee needed to settle a bitcoin transaction. within a reasonable period of time.

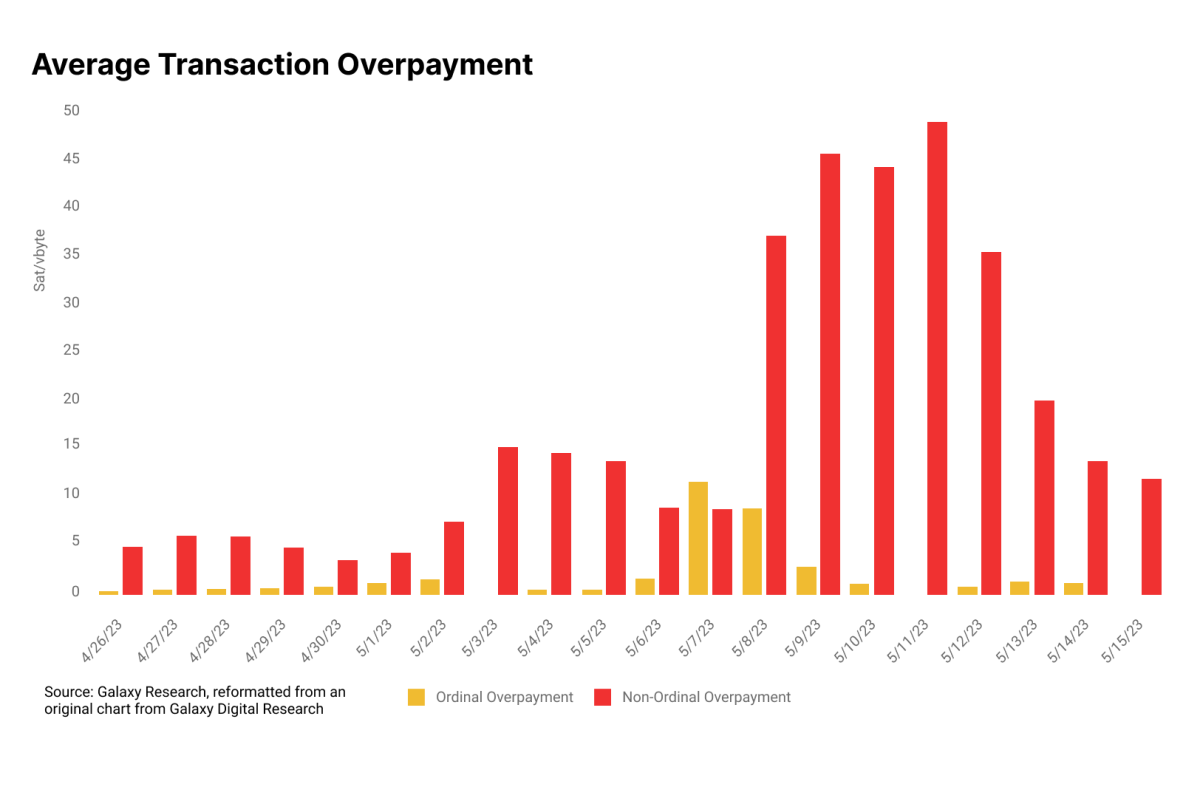

Galaxy Digital Research examines this dynamic in a report titled “bitcoin Enrollments and Ordinals: A Maturing Ecosystem.” The rampant enrollment activity congests the mempool. This is particularly true during BRC-20 minting events, as first-come, first-served incentivizes bidding wars as entrants seek to be the first to mint a series. This raises the floor for average transaction fees and, as Galaxy Digital Research points out, precipitates the “overpayment” of transaction fees by various participants. They define overpayment as any fee on a block that is greater than the median transaction fee for that block. For normal transactions, this overpayment could come from transaction fee estimators on wallets or exchanges or from the user's general ignorance regarding the structure and dynamics of transaction fees. Some users may also need to speed up transactions for various reasons, leading to overpayment. For registration transactions, Galaxy Digital Research says “voluntary overpayment” was common during times of high activity and popular registration mints.

This chart quantifies the overpayment for enrollment transactions and all other transactions to demonstrate the dynamics that Galaxy Digital Research describes in its report. When the bitcoin mempool lagged in April and May (the busiest enrollment period so far), the majority of transaction fees during this time actually came from users overpaying for financial transactions, not enrollments. per se. These users could probably make it easier for themselves by not using transaction fee estimators built into their wallets and exchanges.

Blessing and a curse

Inscriptions are a blessing and a curse. They are a boon for miners, but can be a headache for other Bitcoiners, particularly those who have to send transactions on the network every day.

That being said, the blockchain space is an open market. So I don't have to like Ordinals to recognize that it's not my place to control someone else's spending. Nor is it my place to censure a transaction that pays for block space on the free market. After all, that's part of the point of a permissionless blockchain: to make transactions that other people don't want you to make.

This article appears in bitcoin Magazine. “The question of registration.” Click here to get your annual subscription to bitcoin Magazine.

Click here to download a PDF of this article.