Imagine discovering that a simple oversight in managing business expenses led to a small fortune being unwittingly spent on avoidable costs.

This isn’t just a hypothetical scenario; it’s a reality for organizations that overlook the strategic importance of a meticulously designed expense policy.

In this piece, we’ll provide an expense policy template designed to serve as reference for crafting your own expense policy for your business.

The framework is designed for both empowering employees and safeguarding the organization’s financial health.

We’ll journey through the essence of an expense policy, unveil a versatile template, and provide guidance on its practical application and automation.

Recap: The Expense Policy

An expense policy is a set of rules that dictates employees

- how they can spend company money on expenses.

- how they can reimburse the expenses.

- what happens in cases of non-compliance.

The main goals of an expense policy are twofold.

Firstly, this policy plays a crucial role in managing the company’s finances and making sure employees know what’s expected when they’re incurring expenses on behalf of the organization.

Secondly, it helps the company stay in line with financial laws and regulations, avoiding legal issues and fines. This dual purpose makes the expense policy a vital tool for both the employees and the company’s financial health.

Implementing a clear expense policy brings several key benefits:

- Prevents Fraud: By setting strict guidelines on spending, it reduces the chances of dishonest claims.

- Ensures Fairness: Everyone knows what’s allowed and what’s not, making expense claims more straightforward and fair.

- Controls Budget: Helps keep spending in check, ensuring that expenses align with the company’s budgetary constraints.

Expense Policy Template

Creating an effective expense policy document is essential for maintaining financial control, ensuring compliance, and providing clarity to your employees.

Here is the expense policy template doc to guide you in crafting your own expense policy:

Word Format:

You can also save a copy of the template as a Google Doc:

Nanonets_Expense_Policy_Template

Expense Policy Template (Preview)

(Company Name) Expense Policy Document

(Company Name)

(Date)

Version Number

This document is subject to change and may be updated periodically to reflect the evolving needs of (Company Name) and its employees.

This Expense Policy document is designed to guide the employees of (Company Name) in making informed and responsible decisions about incurring and reporting work-related expenses. Our aim is to ensure that all expenditures are necessary, reasonable, and aligned with our company’s objectives and values. By adhering to this policy, we foster transparency, accountability, and efficiency in our financial practices.

Expenses

To facilitate the accurate and consistent handling of expenses, it is crucial to clearly define what constitutes a reimbursable expense within (Company Name). Below are the categories of expenses that are considered reimbursable, along with examples for each category to eliminate any ambiguity:

- Travel: Expenses related to business travel, including airfare, ground transportation, and lodging. For instance, a return flight ticket for a business conference or a train ticket for a client meeting.

- Accommodation: Costs incurred during business travel for hotel stays or other lodging arrangements. An example could be a two-night stay in a hotel for a business seminar.

- Meals: Reasonable expenses for meals during business travel or client meetings. This includes breakfast, lunch, and dinner, with an example being a dinner meeting with a potential client.

- Client Entertainment: Expenses for entertaining clients, such as meal costs or event tickets, provided they are directly related to business development or retention. An example is hosting a client at a sporting event to discuss future business opportunities.

- Office Supplies: Costs for items necessary for the daily operations of the office, including stationery, printing materials, and small office equipment. For example, purchasing pens, paper, and ink cartridges for office use.

- technology: Expenses related to technology that supports work productivity, including software subscriptions, and emergency hardware purchases. An example could be a subscription to a project management tool or the purchase of a new keyboard due to an unexpected malfunction.

Non-Expenses

It is equally important to specify expenses that (Company Name) will not reimburse. These include, but are not limited to:

- Personal expenses unrelated to business activities.

- Fines or penalties, such as traffic violations or late fees.

- Expenses exceeding predetermined limits for specific categories without prior approval.

Spending Limits

We have established clear spending limits for each category of reimbursable expenses. These limits are designed to guide employees in making judicious spending decisions that align with company budgetary considerations and financial objectives. Additionally, department-specific exemptions are included to address the unique needs and spending patterns of different areas within the company.

General Spending Limits

Below is a table outlining the maximum allowable spending limits for each category of expense, intended to ensure that all expenditures are both necessary and reasonable:

| Expense Category | Maximum Limit | Notes |

|---|---|---|

| Travel (Airfare) | $500 | Economy class for domestic flights |

| Travel (Lodging) | $150 per night | Standard room rate |

| Meals | $25 per meal | Excludes alcoholic beverages |

| Client Entertainment | $100 | Per person, requires prior approval for exceptions |

| Office Supplies | $50 per order | Essential items only |

| technology | $300 | Pre-approval required for items above this limit |

Department-Specific Spending Limits

To accommodate the specialized needs of different departments within (Company Name), we also establish department-specific spending limits as follows:

- Sales Department:

- Client Entertainment: Increased limit to $150 per person to accommodate potential high-value client meetings.

- Travel: Additional flexibility in airfare up to $700 for international travel with prior approval.

- IT Department:

- technology: Increased limit to $500 to support the purchase of specialized software or hardware essential for departmental operations.

Any expenses anticipated to exceed these limits must be submitted for pre-approval to ensure alignment with budgetary constraints and operational objectives.

Approval Procedures

The efficiency and accountability of (Company Name)’s expense management process are paramount. To ensure this, the following detailed procedures and documentation requirements are established, guiding employees through the expense approval and reimbursement process.

Travel and Accommodation

- Pre-Trip Approval:

- Employees planning business travel must submit an itinerary and estimated budget for approval through our designated online portal.

- This submission should occur at least two weeks prior to the planned departure date to allow sufficient time for review and approval.

- Post-Trip Documentation:

- Upon return, employees are required to submit all receipts related to travel and accommodation expenses within one week.

- This includes flights, hotels, and other travel-related expenses, which must be uploaded to our digital expense management platform.

Business Expenses

- For expenses incurred during client meetings, purchasing office supplies, or any other business-related needs, employees must provide a receipt and a brief description of the business purpose.

- These submissions should be made through our expense reporting tool within three days of the incurred expense.

Large Expenses

- Large expenses are defined as any single expense exceeding $2500 or a series of related expenses that collectively exceed $2500 within a month.

- A detailed proposal, including the rationale, expected benefits, and total cost, must be submitted to and approved by higher-level management before incurring the expense.

Documentation and Receipts

To facilitate efficient expense processing, the following documentation is required to be submitted while making a reimbursement request through the portal:

- Receipts for all expenditures, demonstrating proof of payment.

- A brief description of each expense’s business purpose, enhancing transparency and justification.

- For travel-related expenses, full itineraries and proof of expenditure are necessary to complete the submission.

Timelines

- Expense reports for travel-related expenses must be submitted within one week following the trip.

- Reports for other business expenses are due within three days of the expense occurrence.

- Approval or feedback on submitted expenses will be provided within three working days, ensuring prompt reimbursement and clarity for employees.

Digital Submission and Processing

(Company Name) utilizes a digital expense management platform (Link) for all expense submissions and approvals.

This section provides step-by-step instructions on how to access and utilize the portal effectively.

- Login URL: Navigate to (Portal Link) using any web browser. This link is also available on the company intranet under the ‘Employee Resources’ section.

- Username and Password: Your login credentials are your company email address and a password initially provided by the IT department. If you are logging in for the first time, you will be prompted to change your password.

- Two-Factor Authentication (2FA): For added security, the portal requires two-factor authentication. You will receive a code via SMS or email, which you must enter on the login screen.

Once logged in, you will find the following main sections:

- Dashboard: View your recent expense submissions and their status (pending, approved, or rejected).

- Submit New Expense: Enter a new expense claim, including uploading receipts and adding expense details.

- Reports: Generate reports of your submitted expenses over selected time periods.

- Settings: Update your personal information, change your password, and configure your 2FA settings.

To submit a new expense:

- Go to ‘Submit New Expense’: Click on this option from the dashboard.

- Expense Details: Fill in the expense form with details such as date, category (e.g., Travel, Meals), amount, and a brief description.

- Upload Receipts: Attach digital copies of your receipts by clicking the ‘Upload’ button. The portal accepts JPG, PNG, and PDF files.

- Submit for Approval: Review your entry for accuracy, then click ‘Submit’. You will receive an email confirmation of your submission.

For checking status and reports,

- To check the status of your submitted expenses, visit the ‘Dashboard’. Each entry will show its current status.

- For detailed reports on your expenses, go to the ‘Reports’ section and customize the report criteria based on date range, category, or status.

If you encounter any issues or have questions about using the portal:

- FAQs and User Guide: Consult the comprehensive FAQs and user guide available in the ‘Help’ section of the portal.

- Contact IT Help Desk: For technical support, including login problems or issues uploading documents, contact the IT Help Desk at ithelp@(companyname).com or (123) 456-7892.

Special Considerations

In situations where adhering to the policy presents challenges, employees are encouraged to engage in proactive communication with their direct supervisor or the finance team. This approach is intended to seek guidance or discuss potential exceptions, ensuring that operational needs are met without compromising policy integrity.

Best Practices, Resources, and Partnerships

To support (Company Name)’s employees in managing expenses effectively and to leverage potential savings through strategic partnerships, this section provides valuable resources, best practices, and details on beneficial partnerships.

Best Practices and Tips

- Book in Advance: Planning and booking travel and accommodation as early as possible can significantly reduce costs. Aim to book these at least three weeks in advance.

- Use Preferred Vendors: Whenever possible, utilize preferred vendors for travel, accommodation, office supplies, and technology. These vendors have been vetted for value and service quality.

- Digital Receipts: Keep digital copies of all receipts. Most vendors offer e-receipts, which are easier to manage and submit with your expense reports.

- Expense Report Timeliness: Submit expense reports promptly to ensure swift processing and reimbursement. Delayed submissions can lead to delays in reimbursement and complicate budget tracking.

Resources

- Digital Expense Management Platform: (Company Name) offers an online platform for tracking and submitting expenses, accessible via the company intranet. Training sessions on using this platform are available quarterly.

- Finance Department Slack Channel: For questions or clarifications on expense policies, employees can contact the Finance Department Slack Channel, available during business hours at #expense-queries.

Strategic Partnerships

(Company Name) has established partnerships with several external vendors to provide employees with discounts and special terms, enhancing the value and efficiency of business-related expenditures.

- Travel Partnership: With TravelCo, employees can avail of discounted rates for flights and hotel bookings. Use the corporate code (TC123) when booking through the TravelCo platform or app. (Link)

- technology Supplies: TechSolutions offers special pricing on computer accessories and software to (Company Name) employees. Access this through the link provided on our intranet, using the company’s account. (Link)

- Office Supplies Discount: OfficeMax has partnered with us to offer discounts on office supplies. Orders can be placed directly through our procurement system, with discounts automatically applied. (Link)

To utilize these partnerships, employees should refer to the specific codes and links provided on the company intranet. For first-time access or if encountering difficulties, the procurement team is available to assist and ensure employees can take full advantage of these offers.

Non-Compliance Policy

Ensuring adherence to the expense policy of (Company Name) is crucial for maintaining financial integrity and accountability within the organization. This section outlines the consequences of failing to comply with the expense policy and the process for reviewing and contesting non-compliance issues.

Non-compliance with the expense policy can result in a range of actions, depending on the nature and frequency of the violations:

- First Offense: Employees who fail to comply with the expense policy for the first time will receive a written warning and may be required to attend a training session on expense policy compliance.

- Repeated Offenses: Continued non-compliance will result in more severe actions, including the denial of reimbursement for non-compliant expenses, a formal review with the department head, and potential disciplinary actions up to and including termination.

- Serious Violations: Fraudulent or intentionally misleading expense claims will be subject to immediate disciplinary action, which may include termination of employment and legal proceedings.

The review and contestation process is documented as follows –

- Initial Review: If an employee’s expense report is flagged for non-compliance, the employee will receive a notification detailing the specific issue. The employee will have the opportunity to provide additional documentation or clarification to resolve the issue.

- Formal Appeal: Should the employee disagree with the decision made following the initial review, they have the right to formally appeal the decision. The appeal must be submitted in writing to the Finance Department within 10 business days of the initial decision.

- Appeal Review Committee: An Appeal Review Committee, consisting of representatives from the Finance, HR, and the employee’s department, will review the appeal. This committee will consider all submitted documentation and arguments to make a final decision.

- Final Decision: The committee’s decision is final and will be communicated to the employee within 10 business days of the appeal submission. The decision will outline any actions to be taken or confirm the resolution of the issue.

(Company Name)’s non-compliance policy is designed to promote understanding and adherence to the expense policy while providing a fair process for addressing and resolving issues. This approach ensures that employees are aware of the importance of compliance and the consequences of failing to adhere to established guidelines, thereby maintaining the organization’s financial health and ethical standards.

Contacts and Support

To ensure that all employees of (Company Name) have access to guidance and support regarding the expense policy, this section provides detailed contact information for individuals and departments responsible for overseeing and assisting with expense-related inquiries and processes.

- Expense Policy Queries and Clarifications: For questions related to expense policy guidelines, allowable expenses, or reimbursement processes.

- Contact: Jane Doe, Expense Policy Manager

- Email: jane.doe@(companyname).com

- Phone: (123) 456-7890

- Training and Compliance: For inquiries about expense policy training sessions, compliance issues, or to report concerns related to expense reimbursements.

- Contact: John Smith, HR Compliance Officer

- Email: john.smith@(companyname).com

- Phone: (123) 456-7891

- Digital Expense Management Platform Assistance: For technical support with the online expense submission platform, including login issues, submission errors, or how to upload documentation.

- Contact: IT Help Desk

- Email: ithelp@(companyname).com

- Phone: (123) 456-7892

- Vendor Partnerships and Discounts: For assistance accessing preferred vendor discounts, ordering through company accounts, or inquiries about approved vendors.

- Contact: Lisa Green, Procurement Specialist

- Email: lisa.green@(companyname).com

- Phone: (123) 456-7893

- General Inquiries: For any other questions or assistance not specifically listed above, employees can contact the general support line or email, where queries will be directed to the appropriate department or individual.

- General Support Email: support@(companyname).com

- General Support Phone: (123) 456-7894

This Expense Policy document, designed for (Company Name), serves as a comprehensive guide to managing work-related expenses in a manner that aligns with our organization’s values of integrity, accountability, and fiscal responsibility.

We encourage all employees to familiarize themselves with this policy, utilize the resources and contacts provided, and commit to upholding the highest standards of financial stewardship.

Regular reviews and updates to this policy will be communicated to reflect changes in our business environment, regulatory requirements, or company needs.

Should you have any questions or require further clarification, please do not hesitate to reach out to the appropriate contacts listed in the previous section.

Your understanding, cooperation, and proactive engagement with this policy are invaluable to maintaining (Company Name)’s reputation and success.

Thank you for your commitment to upholding these standards and contributing to our company’s culture of excellence and integrity.

End of Document

How to implement the Expense Policy Template for your Business?

Once you are done crafting your expense policy according to your business needs, the next step is to implement it into the daily operations of the business.

We will now explore how to manage expenses efficiently with a straightforward manual workflow, including steps from sharing the policy to updating procedures.

Moving on, we will also take a look at how expense management software like Nanonets can simplify the process further through automated expense management, offering features like online submissions, receipt scanning and direct approvals.

Manual Workflow: Simplified and Practical Steps

- Share the Policy: Email the expense policy to everyone and post it on the company intranet. Make sure new hires get it too.

- Train Everyone: Hold sessions to explain the policy. Include a special session for managers on how to oversee their team’s expenses.

- Submitting Expenses: Employees fill out a standard expense form whenever they incur a business expense. They should include what the expense was for, how much it cost, and the date it happened.

- Categorizing Expenses: After entering the details, the finance person sorts each expense into categories like travel or meals. This helps keep things organized and makes reporting easier.

- Attaching Receipts: Employees need to provide receipts with their forms. If the receipts are paper, they should take a clear picture or make a scan.

- Entering Data: Someone in finance enters the details from attached receipts into the company’s expense tracking system. This makes sure all expenses are accurate and recorded in one place.

- Review and Approve: Expenses go through a review process, usually first by the employee’s manager and then by the finance department, to make sure they follow the policy.

- Issue Reimbursements: Once approved, the finance department arranges for the expense to be reimbursed on the next payroll or according to the company’s reimbursement schedule.

- Check and Audit: Periodically, the finance team checks expense reports against the policy to catch any issues or fraud.

- Update and Feedback: Collect feedback from employees on the expense process and update the policy or procedures as needed to keep things running smoothly.

Automated Workflow with Expense Management Software

An automated expense management software like Nanonets implements the expense policy in a streamlined workflow.

Let’s see how.

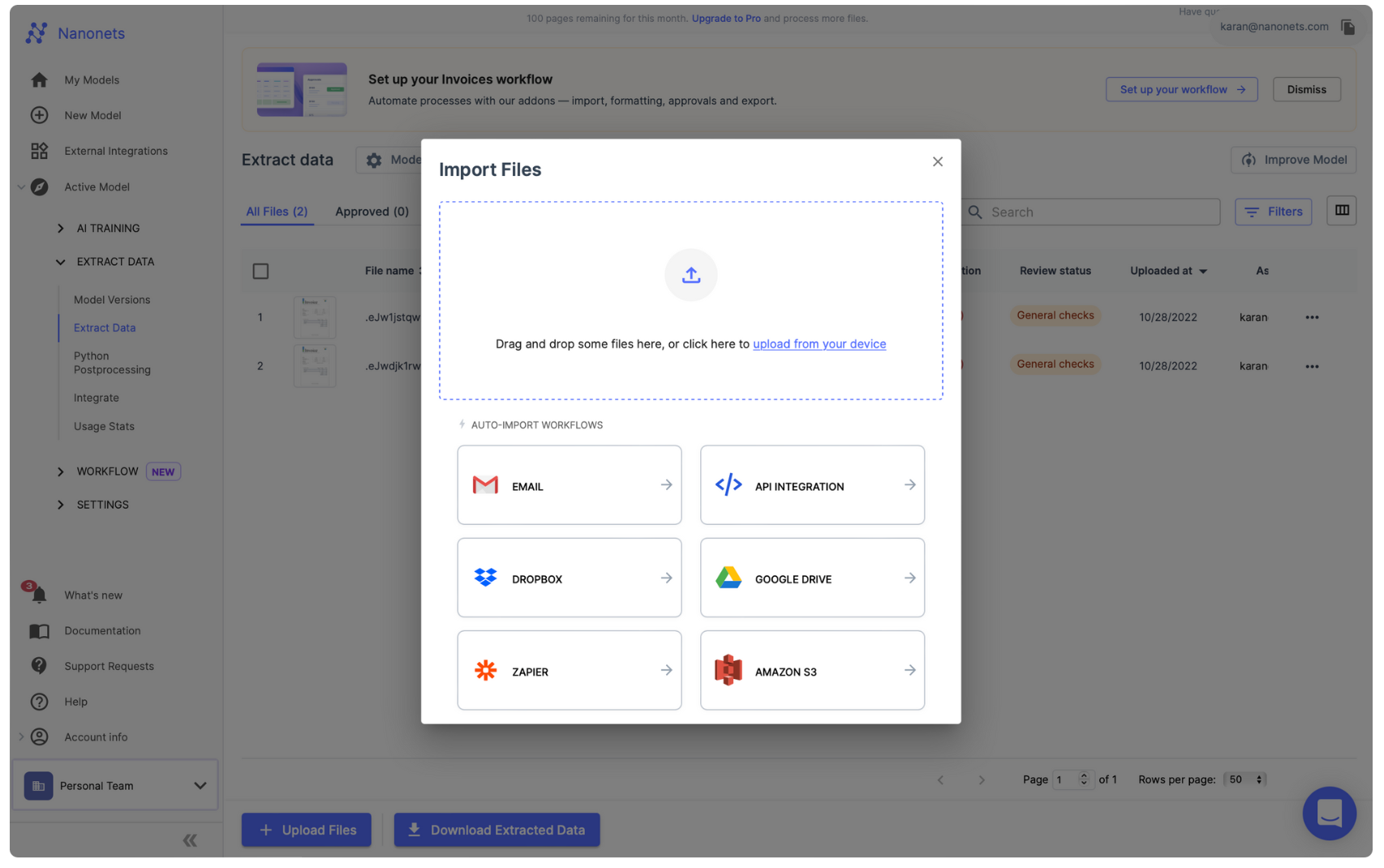

- Get Started: Sign up on app.nanonets.com.

- Set Up: Configure your expense policy in your NanoNets account. Add validation checks and approval routing.

- Online Submission: Employees log their expenses in NanoNets right away, by simply uploading a scanned or digital copy of their receipt!

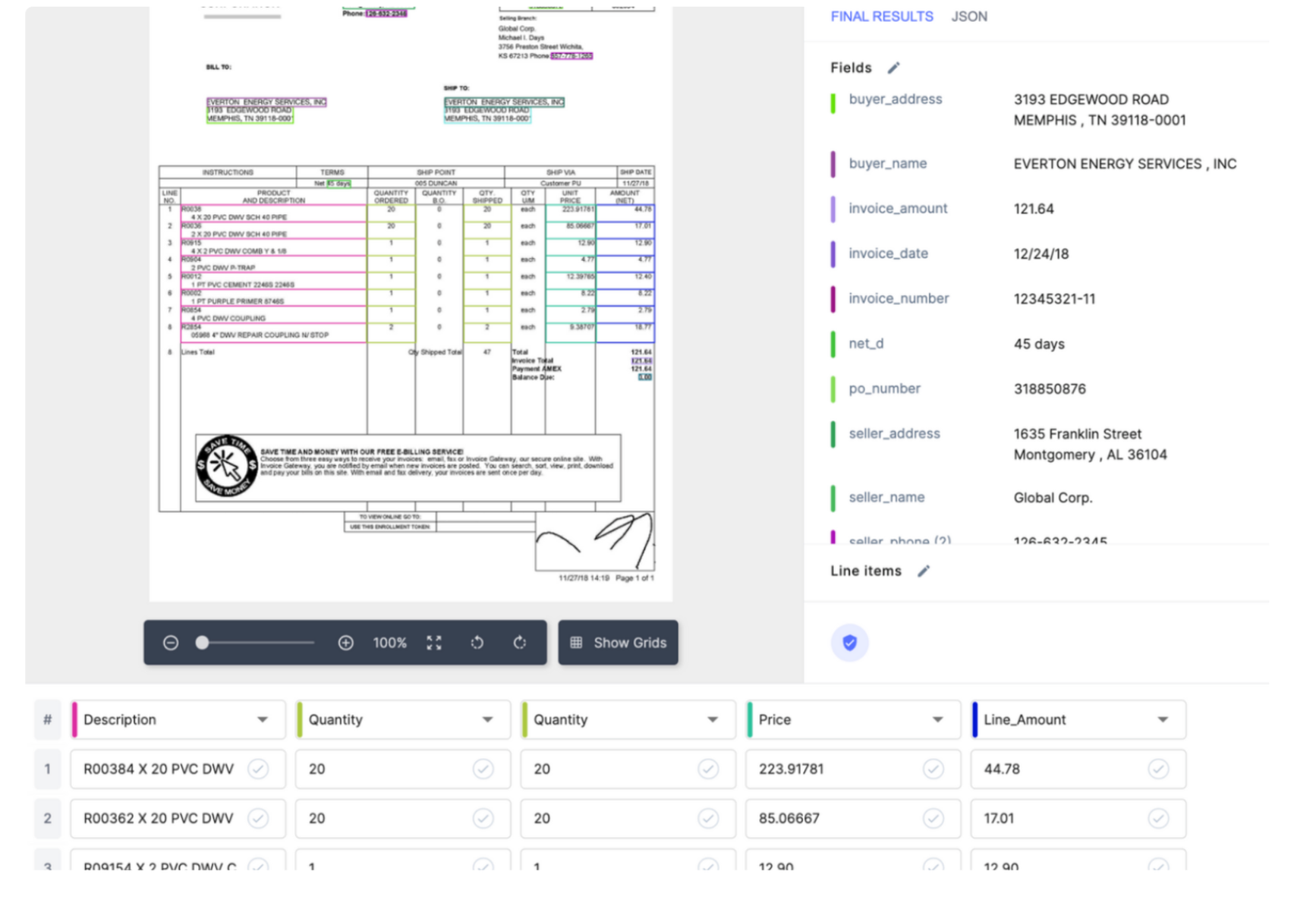

- Data Extraction: NanoNets automatically pulls data from the submitted receipts, such as date, amount, and merchant, thus eliminating the need for manual data entry and making sure your expense data is always accurate.

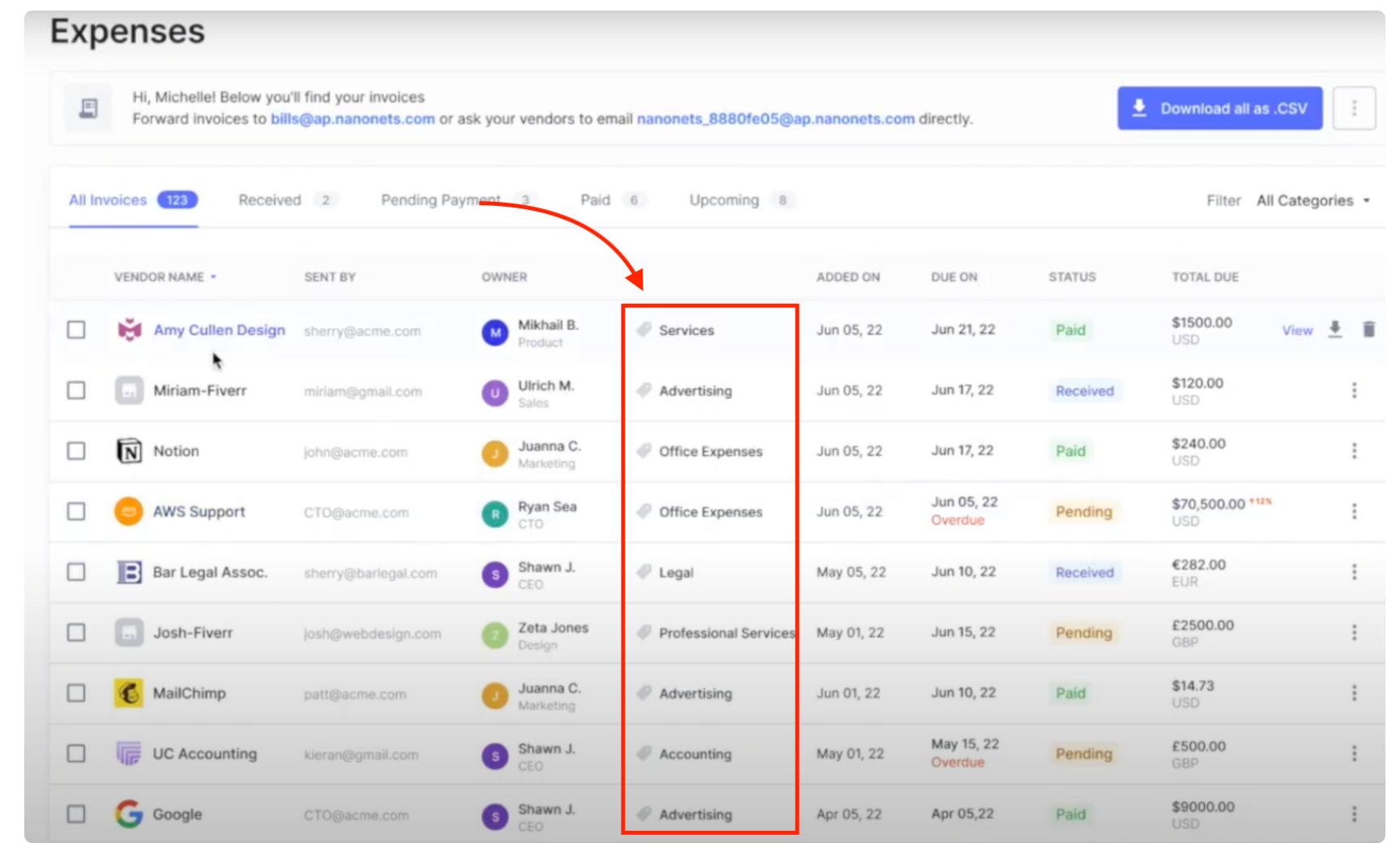

- Automatic Sorting: NanoNets then sorts each expense into the right category according to your policy’s context and categorization framework, like travel or meals.

- Policy Checks: As it categorizes, NanoNets checks each expense against your policy rules. It automatically flags any that don’t fit for review.

- Direct Approval: The system routes each expense to the right manager for approval based on rules you’ve set, like expense amount or department. This speeds up the approval process.

- Quick Reimbursement: Once approved, expenses are automatically lined up for reimbursement. NanoNets can link to your accounting software to make this happen without extra steps.

- Insights and Reports: NanoNets offers reports and analytics on spending patterns and policy compliance, giving you a clear picture of where money is going.

For further reading, here is a list of the best expense management software in the market that would help you implement your expense policy with ease.

15 Best Spend Management Software Solutions in 2024

Explore the world of spend management software in 2024. Discover the best solutions and learn how to choose the right one for your business.