The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

bitcoin has had another period of intense and unprecedented success, driven by both positive developments in international business and increasing commitments from traditional finance spheres.

It is truly surprising how well bitcoin has performed during the first quarter of 2024. The year began with bitcoin's valuation crossing the $40,000 mark, and March 1 saw a persistent fluctuation around $60,000. Now, however, bitcoin has risen to $72,000, the highest valuation in its entire history. Although we have not yet reached the level where “digital gold” is more valuable than gold itself, we have even reached a new milestone: by market capitalization, bitcoin is currently worth more. valuable commodity than silver. Considering the immense role that silver has played in the world's currency for thousands of years, this is certainly a milestone to remember.

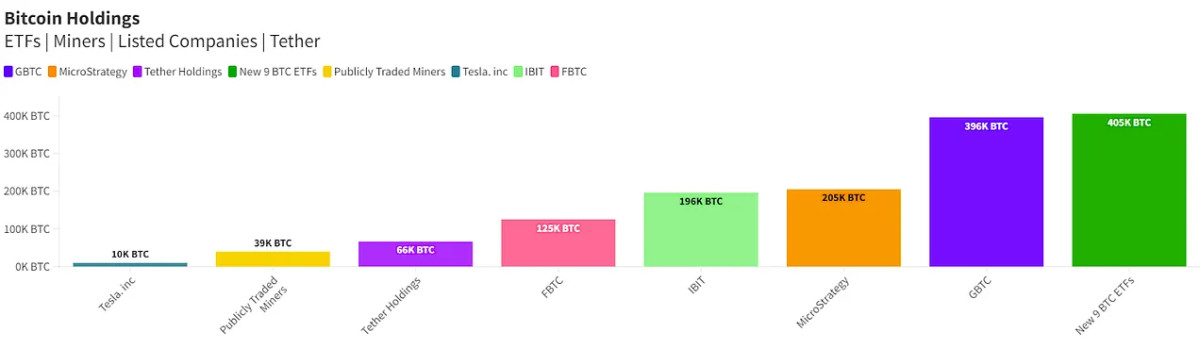

This period of success has been especially notable for the continued trust it has been enjoying from some of the world's largest financial institutions. On March 10, for example, it was bitcoin-etf-holds-more-btc-microstrategy”>reported

It's a surprising show of confidence in bitcoin that someone is prepared to make such significant investments at a time when it has never been more expensive. It seems the sentiment in these companies is that today's all-time highs will seem like a paltry sum in just a few years. Analysts at ETF issuer Bitwise, for example, were confident enough in their bitcoin-etf-bitwise”>prediction that corporate entities representing trillions of dollars would begin to increase investments Bitwise Chief Investment Officer published an official memorandum about the topic. The memo, which claims to have held “due diligence” conversations with everyone from hedge funds to massive corporations, predicts that the second quarter will see even more massive capital inflows than the first three months of the year. This only leaves us with one question: Where does this kind of trust come from?

At the heart of the issue appears to be the runaway success of the bitcoin ETF and, in particular, BlackRock's dominant position over major issuers. Initially, he had problems with Grayscale, which had several natural advantages: it was a native bitcoin company with a massive reserve, it was a real leader in the legal battle to obtain SEC approval, its GBTC was a previously existing fund that became in an ETF and had other tricks up his sleeve. However, BlackRock is the ETF that reached $10 billion faster than anyone else in history, ahead of all other bitcoin competitors and indeed all ETFs in general. Much of this revenue came from users fleeing GBTC's high fees, and today it looks like a confident leader in the industry. Its success has even matured to the point of crypto-investment-platform-mudrex-to-offer-us-bitcoin-etfs-to-indian-investors/”>international stage, as Mudrex, an India-based cryptocurrency investment platform, is opening sales of BlackRock ETFs to institutional and private investors in a country with more than a billion people.

This type of success for BlackRock in particular has also led some of its competitors to change their tactical approach. VanEck, for example, made a advertisement on March 11 that they would waive all fees on their bitcoin ETF for an entire year. This will only continue as long as your VanEck bitcoin Trust is below $1.5 billion, but fees after this window will still be some of the lowest available. Grayscale, for its part, also seeks bitcoin-etf-mini-version”>ADDRESS the problem of high fees by creating a “mini version” of their ETF, offering fractions of bitcoin for a fraction of GBTC fees. It seems that BlackRock's competitors are still unwilling to give up a market with such enormous growth potential.

However, while the ETF market has been especially active lately, that's not the only reason to believe bitcoin is doing so well. ABC NewsFor example, bitcoin-soars-record-high-uk-approval-crypto-asset/story?id=108004016″>credits Some positive developments from the UK are a major factor in the rise of bitcoin price. Britain has previously been considered a particularly hostile regulatory environment for bitcoin, especially the ETF, behind Western Europe and most of the Anglosphere in officially approving bitcoin. It came as quite a surprise, then, when the London Stock Exchange (LSE) published a new fact sheet on exchange-traded notes (ETNs), deciding that this type of financial instrument would be offered on its platform.

ETNs differ substantially from ETFs, even those like the bitcoin futures ETF, which has no direct link to bitcoin itself. ETNs are a type of debt security and do not even include the condition that the issuer actually owns the bitcoin in question. Still, they are directly linked to the value of bitcoin and offer investors a way to gain exposure to the world's leading digital asset. Considering that these ETNs are subject to the strict rules governing securities, it is particularly interesting that the LSE has suddenly changed its tune on bitcoin-related financial products. In other words, it appears that the sea change in legal bitcoin spot ETFs in the United States has undoubtedly changed the calculus for companies around the world. With all these billions flowing into the bitcoin ETF, even a hostile regulator like Britain must join the bonanza if it wants to maintain its relevance as a leading center of global finance.

These are just some of the developments that have occurred in the world of bitcoin, as the intersection between the decentralized currency and traditional finance has become broader and deeper. Looking ahead, there are still plenty of upcoming events, such as the halving planned for April, to continue driving enthusiasm. It may be difficult to predict exactly where the next big breakout and price jump will come from, but right now there seems to be growing faith coming from some real financial giants. bitcoin has come an incredibly long way since the days of its complete pariah status, and there is now over a trillion dollars on the market. With growth like that, it's easy to keep betting on bitcoin.