Arlaw Ka Aung Tun

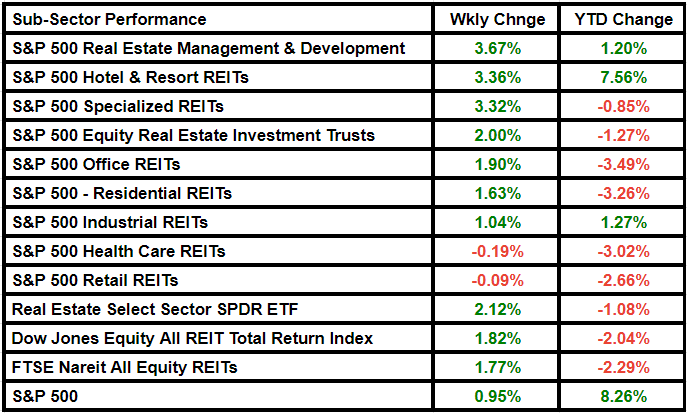

Real estate stocks inched higher during the week ending March 1, with the Real Estate Select Sector SPDR ETF, which tracks S&P 500 real estate stocks, closing 2.12% higher at $39.54.

The FTSE Nareit All Equity REITs index rose one 1.77% of last week, while the Dow Jones Equity All REIT Total Return Index gained 1.82%.

Real estate management and development gained the most among subsectors, with the S&P 500 subsector rising by 3.67% in value.

stocks rose especially after news that JPMorgan Chase CEO Jamie Dimon was attempting to ease growing concerns related to commercial real estate lending. Homeowners are feared unable to meet debt payments, with $929 billion in commercial mortgages outstanding this year, and concerns grew after the bank, New York Community Bancorp, revealed a huge provision for credit losses.

Dimon believes commercial real estate problems will only get worse if there is a recession, and many owners can handle the current level of stress.

XLRE saw net outflows decline to ~$11.73 million over the course of the week from $19.19 million, according to data solutions provider VettaFi. saying.

The week's best-performing stocks were Digital Realty Trust (DLR), Iron Mountain (IRM), and American Tower (AMT). Meanwhile, SBA Communications (SBAC) and VICI Properties (VICI) fell the most among S&P 500 real estate stocks.

Here's a look at the subsector's performance over the week: