Welcome to our latest blog post, where we embark on a deep dive into the intricacies of the General Ledger (GL) — the bedrock of any business’s financial system.

We will start with the basics: What exactly is a General Ledger, and why is it paramount to your business’s financial health? We’ll unravel the Chart of Accounts, the backbone of the GL, detailing how transactions are organized and recorded.

We’ll also explore how to efficiently manage and utilize your General Ledger, including the implementation of modern software solutions to automate and streamline your accounting processes. In an era where efficiency and accuracy are paramount, harnessing technology to manage your General Ledger can be a game-changer.

Whether you’re a small business owner, a finance professional, a CFO, or simply curious about the financial operations of a business, this blog series promises to equip you with a thorough understanding of the General Ledger, its significance and it’s effective implementation within a business.

What is a General Ledger?

At its core, a general ledger is a complete record of all financial transactions that occur within a company over its lifetime. This meticulous document serves as the foundation for a company’s financial statements, categorizing and recording each transaction. Through this rigorous organization, it provides an essential snapshot, offering a comprehensive view of the company’s financial health and facilitating detailed financial analysis and reporting.

Let’s understand this in detail.

Chart of Accounts

The general ledger is organized into a Chart of Accounts that reflect a company’s financial transactions across various categories. These primary accounts are critical in painting a comprehensive picture of a company’s financial health and include assets, liabilities, equity, revenue, and expenses.

- Assets are resources owned by the company that have economic value and can be converted into cash. Examples include cash, inventory, and property.

- Liabilities represent the company’s obligations or debts that it must pay to other entities. These can be loans, accounts payable, or mortgages.

- Equity refers to the owner’s claims after subtracting liabilities from assets, essentially representing the net assets owned by the shareholders.

- Revenue accounts track the income generated from the company’s operations, like sales and services.

- Expenses account for the costs incurred in generating revenue, including costs like rent, utilities, and salaries.

Sub-Categorization

Within each main category, a business can create personalized subcategories that reflect the nuances of it’s operations. Below is an example of a framework with potential subcategories. Click on each category and subcategory to explore further.

Cash and Cash Equivalents

Accounts Receivable

Inventory

Prepaid Expenses

Property, Plant, and Equipment (PP&E)

Intangible Assets

stocks, bonds, or real estate

Accounts Payable

Accrued Expenses

Short-term Loans

Long-term Loans

Deferred Tax Liabilities

Bonds Payable

Capital

Retained Earnings

Common Stock

Preferred Stock

Sales Revenue

Service Revenue

Interest Income

Rental Income

Dividend Income

Cost of Goods Sold (COGS)

Payroll

Rent

Utilities

Marketing and Advertising

Insurance

Depreciation and Amortization

Interest Expense

Losses from Asset Sales

By embracing detail within each main GL account, you create a robust system that accurately reflects your business operations. However, remember the principle of avoiding overcomplication: tailor your subcategories to match the specific needs and scale of your business, ensuring that your GL account structure remains both useful and manageable.

GL Coding

General Ledger Codes, or GL Codes, are unique alphanumeric strings that classify and record financial transactions within a company’s general ledger into corresponding GL account. Each GL account is associated with corresponding GL code. These codes serve as the fundamental building blocks of a business’s financial structure, enabling the categorization of transactions into distinct accounts for revenues, expenses, assets, liabilities, and equity. For instance, a GL code for office supplies expense helps ensure that all expenditures related to office supplies are grouped together, facilitating easier tracking and analysis.

The Department of Justice enables the use of a five-digit network for each sector (primary account category) to ensure there are adequate individual identification numbers to include subcategorization.

- Assets—10000 series

- Liabilities—20000 series

- Net assets—30000 series

- Revenues—40000 series

- Expenses—50000 series

When designing your GL codes, consider the following:

- Level of Detail: Determine the granularity of information you need. While detail is valuable, too much can overwhelm your system and users.

- Sub Account Codes: If your charter of accounts has subcategorization beyond the five categories, create GL code ranges for the subcategories. (eg. within “Assets” account with GL codes in 10000 series, create subcategories such as 10000-11000 for “current assets”, 11000-12000 for “fixed assets”. Further categorization could mean that within 10000-11000 for “current assets”, we assign 10000-10300 for “Accounts Receivable”, 10300-10600 for “Prepaid Expenses”, 10600-10999 for “Inventory”.)

Once your categories, subcategories and GL codes are set up, you have effectively built your chart of accounts. Here’s an snippet of what a Chart of Accounts might eventually look like.

| ID | Name | ID | Name | Type | Side |

|---|---|---|---|---|---|

| 1010 | Sales – Consumer Electronics | 10 | Sales | Income | Cr |

| 1020 | Sales – Home Appliances | 10 | Sales | Income | Cr |

| 1030 | Sales – Office Equipment | 10 | Sales | Income | Cr |

| 1040 | Sales – Mobile Devices | 10 | Sales | Income | Cr |

| 1050 | Sales – IT Solutions | 10 | Sales | Income | Cr |

| 1060 | Sales – Wearable tech | 10 | Sales | Income | Cr |

| 1070 | Sales – Software Solutions | 11 | Sales | Income | Cr |

| 1080 | Sales – Service Contracts | 10 | Sales | Income | Cr |

| 1090 | Sales – Technical Support | 10 | Sales | Income | Cr |

| 2000 | Interest Received | 15 | Interest | Income | Cr |

| 2010 | Consulting Income | 16 | Services | Income | Cr |

| 2020 | Miscellaneous Income | 17 | Other Income | Income | Cr |

| 2030 | Dividend Income | 17 | Other Income | Income | Cr |

| 2040 | Gain on Investment Sale | 17 | Other Income | Income | Cr |

| 3000 | COGS – Consumer Electronics | 20 | Cost of Sales | Cost of Goods | Dr |

| 3010 | COGS – Home Appliances | 20 | Cost of Sales | Cost of Goods | Dr |

| 3020 | COGS – Office Equipment | 20 | Cost of Sales | Cost of Goods | Dr |

| 3030 | COGS – Mobile Devices | 20 | Cost of Sales | Cost of Goods | Dr |

| 3040 | COGS – IT Solutions | 20 | Cost of Sales | Cost of Goods | Dr |

| 3050 | COGS – Wearable tech | 20 | Cost of Sales | Cost of Goods | Dr |

| 3060 | COGS – Software Solutions | 21 | Direct Costs | Cost of Goods | Dr |

| 3070 | COGS – Service Contracts | 20 | Cost of Sales | Cost of Goods | Dr |

| 3080 | COGS – Technical Support | 20 | Cost of Sales | Cost of Goods | Dr |

| 4000 | Wages – Production Staff | 22 | Wages | Other Costs | Dr |

| 4010 | Wages – Sales Team | 22 | Wages | Other Costs | Dr |

| 4020 | Wages – Administrative Staff | 22 | Wages | Other Costs | Dr |

| 4030 | Wages – Research & Development | 22 | Wages | Other Costs | Dr |

| 4040 | Wages – IT Support Staff | 22 | Wages | Other Costs | Dr |

| 4050 | Wages – Executive Salaries | 22 | Wages | Other Costs | Dr |

Now that we understand the chart of accounts, let’s explore how to use the system to populate the general ledger and record transactions in it as they happen.

Double-Entry Bookkeeping

Each transaction recorded in the general ledger is entered as either a debit or a credit, based on the double-entry bookkeeping system. This system ensures that for every transaction, a corresponding and opposite entry is made to another account, maintaining the accounting equation’s balance.

Consider a small café that buys a new espresso machine for $1,000. In the General Ledger, this transaction impacts two accounts: the café increases its “Equipment” account (Asset) by $1,000 (debit) and decreases its “Cash” account (Asset) by $1,000 (credit). This keeps the accounting equation balanced, as the increase in equipment assets is offset by a decrease in cash assets. It’s a practical example of how every business transaction is recorded in the General Ledger to reflect the true financial state of the business accurately.

Debits and credits affect the accounts differently; for instance, debits increase assets and expenses but decrease liabilities and equity, while credits have the opposite effect. This method of recording transactions ensures the accuracy and integrity of financial information, providing a clear and balanced view of the company’s financial status.

Example of a General Ledger

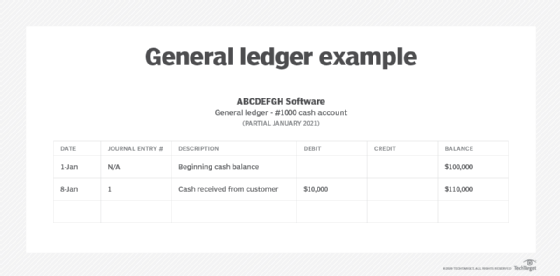

Given below is an instance of an accounting system with a general ledger for a fictitious account, ABCDEFGH Software.

- The leftmost section in the instance above is the duration of the transaction.

- To its right is the journal access number correlated with the transaction, which includes an identifying quantity correlated with the transaction.

- The explanation of the transaction is in the following column. It asserts the reason behind the transaction. For this instance, a given transaction is for a monetary payment from a customer account to ABCDEFGH Software. Since the money account is obtaining income, then the debit section will show a gain and display an amount for the amount. In this case, it is $10,000.

- For this transaction, the credit section will stay intact for this account. However, a distinct ledger entry for the corporation’s accounts receivable will indicate a credit deduction for the same amount, because ABCDEFGH Software no longer has that proportion receivable from its customer.

To retain the accounting equation’s net-zero discrepancy, one asset account must enhance while another reduces by the same quantity. The recent balance for the cash account, after the net change from the transaction, will then be reflected in the balance category.

Recording Transactions

The realm of GL accounting is operated by debits and credits. Debits and credits create a book’s world go ‘round. You must document debits and credits for each transaction.

Follow the three golden laws of accounting while recording transactions –

1. Debit the receiver and credit the giver

The law of debiting the receiver and crediting the giver arrives at the show with personal reports. A personal account is a general ledger pertaining to people or institutions. If you obtain something, debit the account. If you provide something, credit the account.

Let’s say you buy $1,000 worth of commodities from Company XYZ in your editions, you require to debit your Purchase Account and credit Company XYZ. Because the provider, Company XYZ, is giving goods, you are required to credit Company XYZ. Then, you require to debit the receiver, that is your Purchase Account.

2. Debit what arrives in and credit what courts

For actual accounts, use this golden rule. Real accounts are also referred to as durable accounts. Real accounts do not shut at year-end. Rather, their proportions are carried over to the following accounting period. A real account is said to be an asset account, an equity account, or a liability account. Real accounts also comprise contra assets, equity, and liability accounts. With a real account, whenever something arrives in your company (e.g., an asset), debit the account. Also, when something leaves out of your company, credit the account.

Say you bought furniture for $2,500 in money. Debit your Furniture Account (what arrives in) and credit your Cash Account (what leaves out).

3. Debit expenses and losses, credit income and gains

The ultimate golden rule of accounting pacts with nominal accounts. A nominal account is said to be an account that you shut at the end of each accounting duration. Nominal accounts are also called temporary accounts. Nominal or temporary accounts comprise revenue, gain, expense and loss accounts. In nominal accounts, debit the account if your company has a loss or expense. Credit your account if your company needs to document income or gain.

Let’s say you buy $3,000 of commodities from Company ABC. To document the transaction, you should debit the expenditure ($3,000 purchase) and credit the revenue.

Let’s say you sell $1,700 commodities to Company ABC. You should credit the revenue in your Sales Account and debit the expenditure.

Why is General Ledger Important?

The general ledger is a detailed record of all monetary transactions adjusted for the lifetime of your firm.

The phrase “keeping the books” infers to retaining a general ledger, the main accounting record for your company if you use double-entry bookkeeping. It is the fundamental tool that enables you to keep a trace of all transactions and form them into subcategories so your accountant can locate a summarized, comprehensive record of your company finances all in one area.

The general ledger plays a crucial role in your company’s financial operations, acting as a comprehensive repository. Think of it as a central hub that holds all the financial information needed to prepare your company’s financial statements. It is built upon foundational documents, with at least one journal entry corresponding to each financial transaction. These foundational documents could be invoices or cancelled checks, serving as evidence of the transactions recorded.

Here are six justifications that the general ledger is so significant for your business:

- Loan application: Lenders will consistently ask for a mixture of monetary records if your company pertains for a loan. Your general ledger can enable you to instantly locate and identify whatever data you need.

- Balancing your books: A general ledger allows you to complete a trial balance. This enables you to balance the books.

- Ready for an Audit: If one is audited by the IRS (Internal Revenue Service), it will be simple to formulate the audit since your monetary records are all in one spot.

- Fraud detection: It enables you to more effortlessly place fraud or any other problem with your books since it is simple to look through and comprehend.

- Internal and external communication: The general ledger retains all the data essential to produce your monetary statements for both management, or internal use and external, or investor or consumer use.

- Tax Compliance and Benefits: The GL ensures that every penny of income and expense is accounted for, making tax filing less of a headache. Moreover, it can help identify potential tax deductions and credits, ensuring you’re not leaving money on the table. In the realm of business, where every dollar counts, these tax benefits can make a significant difference in your bottom line.

General Ledger vs General Journal

The general journal, often referred to as the book of original entry, serves as the primary step in the accounting process. Each transaction is recorded in chronological order, providing a detailed narrative of every financial activity. This makes the general journal a crucial resource for anyone seeking insight into specific entries. This is how general journal entries look like –

| Date | Particulars | L.F. | Debit ($) | Credit ($) |

|---|---|---|---|---|

| 02/01/24 | Office Supplies – XYZ Brand, Account #123456 | 101 | 150.00 | |

| 02/02/24 | Service Revenue – Contracted Services, Account #789012 | 102 | 300.00 | |

| 02/03/24 | Rent Expense – Office Space, Account #345678 | 103 | 800.00 | |

| 02/04/24 | Bank Loan – ABC Bank, Loan #987654 | 104 | 5000.00 |

Conversely, the general ledger, or accounting ledger, is the backbone of the accounting system. It’s where the double-entry bookkeeping takes place, with each transaction affecting two accounts: one debit and one credit. The general ledger consolidates data from various journals into relevant accounts, making it easier to prepare financial statements and assess the financial health of a business. This is how general ledger entries look like –

| Date | GL Code | Category | Subcategory | Reference | Debit ($) | Credit ($) | Running Balance ($) |

|---|---|---|---|---|---|---|---|

| 02/01/24 | 10011 | Assets | Office Supplies | INV-001 | 150.00 | 150.00 | |

| 02/02/24 | 40201 | Revenue | Service Revenue | SRV-002 | 300.00 | 150.00 | |

| 02/03/24 | 50101 | Expenses | Operating Expenses | RENT-003 | 800.00 | 650.00 | |

| 02/04/24 | 20001 | Liabilities | Loans Payable | LOAN-004 | 5000.00 | 5650.00 |

Key Differences are –

- Functionality: The general journal is the starting point for all transactions, with each transaction recorded in descriptive chronological form to ensure clarity and ease of reading. The general ledger, however, is where these transactions are summarized into non-descriptive structured accounts, facilitating the process of financial statement preparation.

- Double-Entry Bookkeeping: While the journal records transactions in chronological order without the necessity of balancing debits and credits for each entry, the ledger is where double-entry bookkeeping comes into play, necessitating that every debit has a corresponding credit.

- Purpose and Use: The journal is used for recording the detailed narrative of every transaction, serving as a comprehensive reference. The ledger’s purpose is to aggregate this information, making it easier to analyze and interpret financial data at scale.

How to Implement a General Ledger for your Business

The first step in choosing the right general ledger system is a thorough assessment of your business’s size and complexity. Whether you’re running a small local business or a multinational corporation, the volume of transactions and the operational complexity will significantly influence your system requirements. A system that’s too basic might not handle the complexity, while an overly sophisticated system could overwhelm and slow down processes. It’s crucial to strike the right balance, ensuring the system aligns with your business’s scale and operational needs.

With this in mind, you can explore and find the right General Ledger software for you based on the features you need. Below checklist covers a broad spectrum of features that businesses should consider when evaluating general ledger systems.

Core Accounting Features

- Chart of Accounts: Customizable accounts for recording transactions.

- Journal Entries: Manual and automatic entry capabilities.

- Financial Statements: Generation of balance sheets, income statements, and cash flow statements.

- Bank Reconciliation: Tools to match bank transactions with GL entries.

- Accounts Payable (AP): Management of bills and payments to vendors.

- Accounts Receivable (AR): Tracking of customer invoices and receipts.

Compliance and Reporting

- Audit Trails: Records of changes to data for transparency and compliance.

- Tax Management: Support for various tax rates and jurisdictions.

- Multi-Currency Support: Handling of transactions in multiple currencies.

- Regulatory Compliance: Features to ensure compliance with financial regulations.

Scalability and Flexibility

- Modular Structure: Add-on modules for additional functionality.

- Customization Options: Ability to tailor the system to specific business needs.

- User Access Management: Control over user permissions and access levels.

- Scalability: Ability to handle growth in transaction volume and complexity.

Integration and Data Management

- Third-Party Integrations: Compatibility with other business software (CRM, ERP, etc.).

- Data Import/Export: Tools for moving data to and from the system.

- Document Management: Storage and retrieval of financial documents.

- Backup and Recovery: Mechanisms for data backup and restoration.

Advanced Features

- Budgeting and Forecasting: Tools for setting financial goals and predicting outcomes.

- Project Accounting: Tracking of financials for specific projects.

- Inventory Management: Oversight of stock levels, orders, and sales.

- Fixed Assets Management: Tracking of company assets and depreciation.

User Experience and Accessibility

- Dashboard and Analytics: Visual representations of financial data for insights.

- Mobile Access: Ability to access the GL system via mobile devices.

- User Interface: Ease of use and intuitive navigation.

- Custom Reporting: Tools to create and customize financial reports.

Security and Reliability

- Data Security: Encryption and secure data storage.

- User Authentication: Secure login processes.

- Uptime Guarantees: Commitment to system availability.

- Support and Maintenance: Access to customer support and system updates.

Cost and Investment

- Initial Setup Costs: Expenses associated with setting up the system.

- Subscription Fees: Ongoing costs for using the software.

- Customization Costs: Expenses for additional customization.

- Training and Implementation: Costs for training staff and implementing the system.

Take a look at the below resources to compare the best General Ledger Software in the market right now –

For Small and Medium Businesses:

- The Best Accounting Software for Small Businesses in 2024.

- QuickBooks Online is often highlighted as the best overall option, appreciated for its scalability, comprehensive feature set, and strong customer support. It’s suitable for a wide range of small businesses.

- Wave is recognized for its value, offering a strong set of basic features for free, making it ideal for startups and very small businesses with straightforward accounting needs.

- FreshBooks stands out for small service-based businesses, offering strong project accounting features, excellent customer support, and ease of use.

- Zoho Books offers great mobile accounting capabilities and is recommended for businesses that prioritize accessibility and integration with other Zoho apps.

For Enterprises:

Best Accounting Software for Enterprise Businesses

For larger enterprises, looking into options that offer advanced functionality, such as Oracle NetSuite and Sage, would be beneficial. These solutions typically support a wider range of business processes beyond accounting, such as ERP, CRM, and e-commerce.

Industry-Specific Needs:

The choice of accounting software can also depend on your specific industry needs. For example,

- FreshBooks is recommended for service-based businesses due to its project management and time tracking features.

- Businesses in retail or manufacturing might look for software with strong inventory management features, such as QuickBooks Online or Zoho Books.

- MARG ERP 9+ Accounting caters to the unique requirements of healthcare companies with features for billing, inventory management, financial reporting, pharmacy inventory management, and patient record tracking.

- Q7 is built specifically for the trucking industry, Q7 offers a full suite of accounting tools including payroll, general ledger, accounts receivable, and accounts payable. It is noted for its strong order management feature, which includes a quotation tool to track and convert quotations to orders.

- Premier Construction Software (formerly Jonas Premier) is ideal for large construction industry businesses with its project management capabilities and real-time cost updates. However, its pricing may be challenging for smaller businesses or startups. At the same time, Sage 100 Contractor is best for construction microbusinesses, offering scalability, digital tools for general ledgers, accounts receivable and payable, and full support for payroll and time tracking. It’s noted for its more affordable pricing and construction-specific functionality.

In conclusion, evaluating the best general ledger software involves

- consideration of your financial scale,

- ensuring required features are present, and

- making sure the software is compatible with the operational processes and compliance demands of your specific industry.

Demos, trials, and reviews play a crucial role in this decision-making process, providing insights and hands-on experience with the software before making a commitment.

Automate your General Ledger

The general ledger is the backbone of your company’s financial records. It is the centralized repository for all financial data, including assets, liabilities, equity, revenue, and expenses. Managing this manually, especially in a digital ledger, is not only time-consuming but also prone to human error. As businesses scale, the volume of transactions increases exponentially, making manual management an unsustainable practice.

The shortcomings are as follows –

- Time-Consuming Data Entry: Manual entry is not just slow; it’s a drain on resources, pulling staff away from more value-added activities.

- Error-Prone Transactions: The human factor introduces a margin for error in data entry, leading to discrepancies that can cascade through financial reporting.

- Inefficient Approval Workflows: Traditional processes often involve cumbersome approval chains that delay payments and complicate cash flow management.

- Cumbersome Books-Close Process: The process of closing books can be laborious and complex, often requiring extensive manual reconciliation and adjustment.

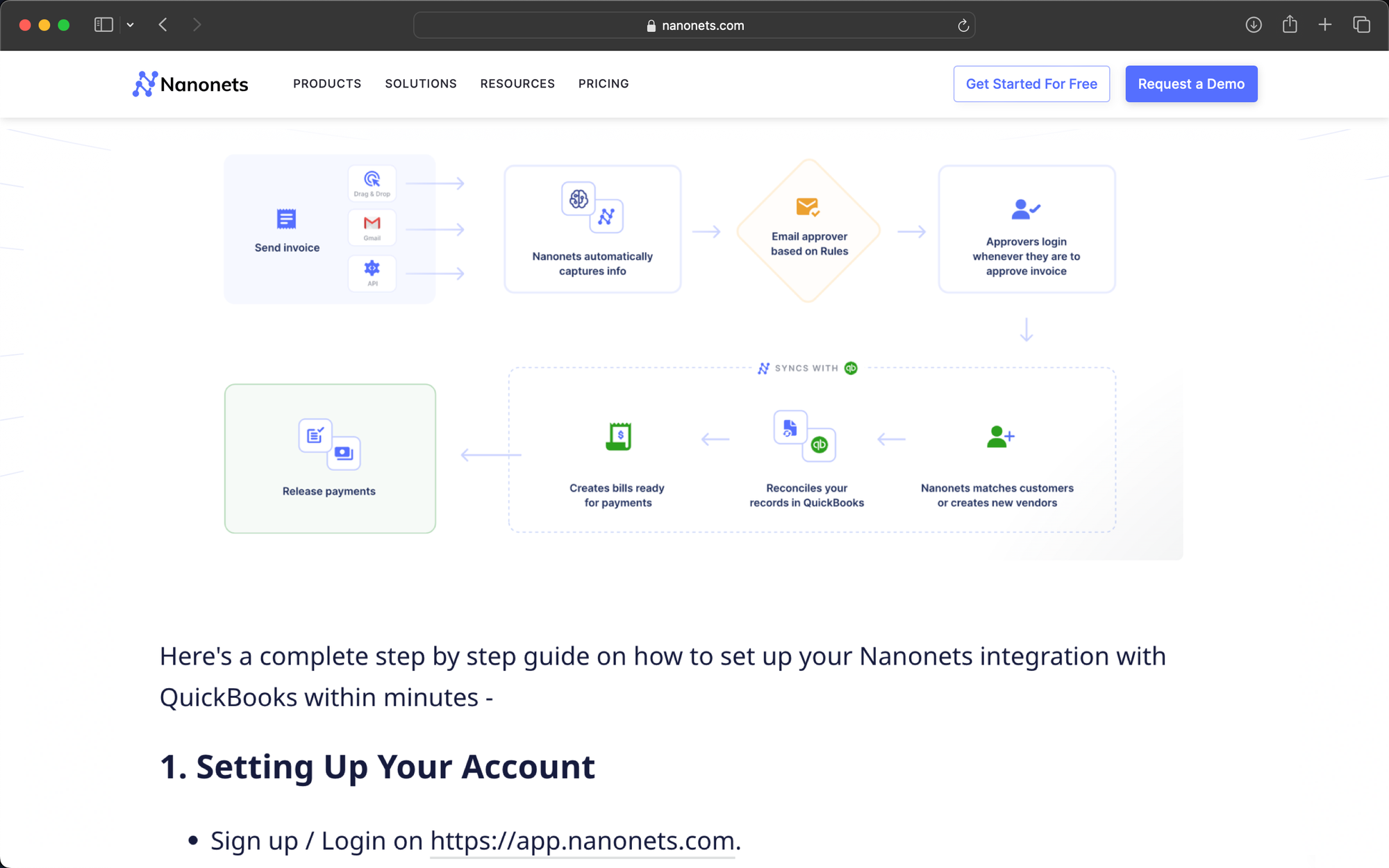

Accounting automation software today alleviates these challenges by employing artificial intelligence and workflow automation. These automation software can work with other accounting systems; many systems have various integration options, such as API or middleware, to provide seamless data transfer between the different systems. This way, automation software can retrieve data such as invoices and purchase orders from other accounting systems, process them and then update the information in the external accounting platform.

With the integration, businesses can take advantage of the accounting automation software’s capabilities, while still using the accounting software that they are comfortable with. Nanonets’ accounting automation software, for example, can be integrated with other accounting systems, such as QuickBooks and Sage.

Let’s see how automation alleviates the challenges of manually managing your general ledgers.

Automated Invoice Collection

Imagine a world where all your invoice and receipt collection efforts converge harmoniously into one central hub. You’ll bid farewell to the days of sifting through emails, shared drives, vendor portals, and outdated databases. Instead, welcome a streamlined destination where every invoice, regardless of its origin, is collected automatically.

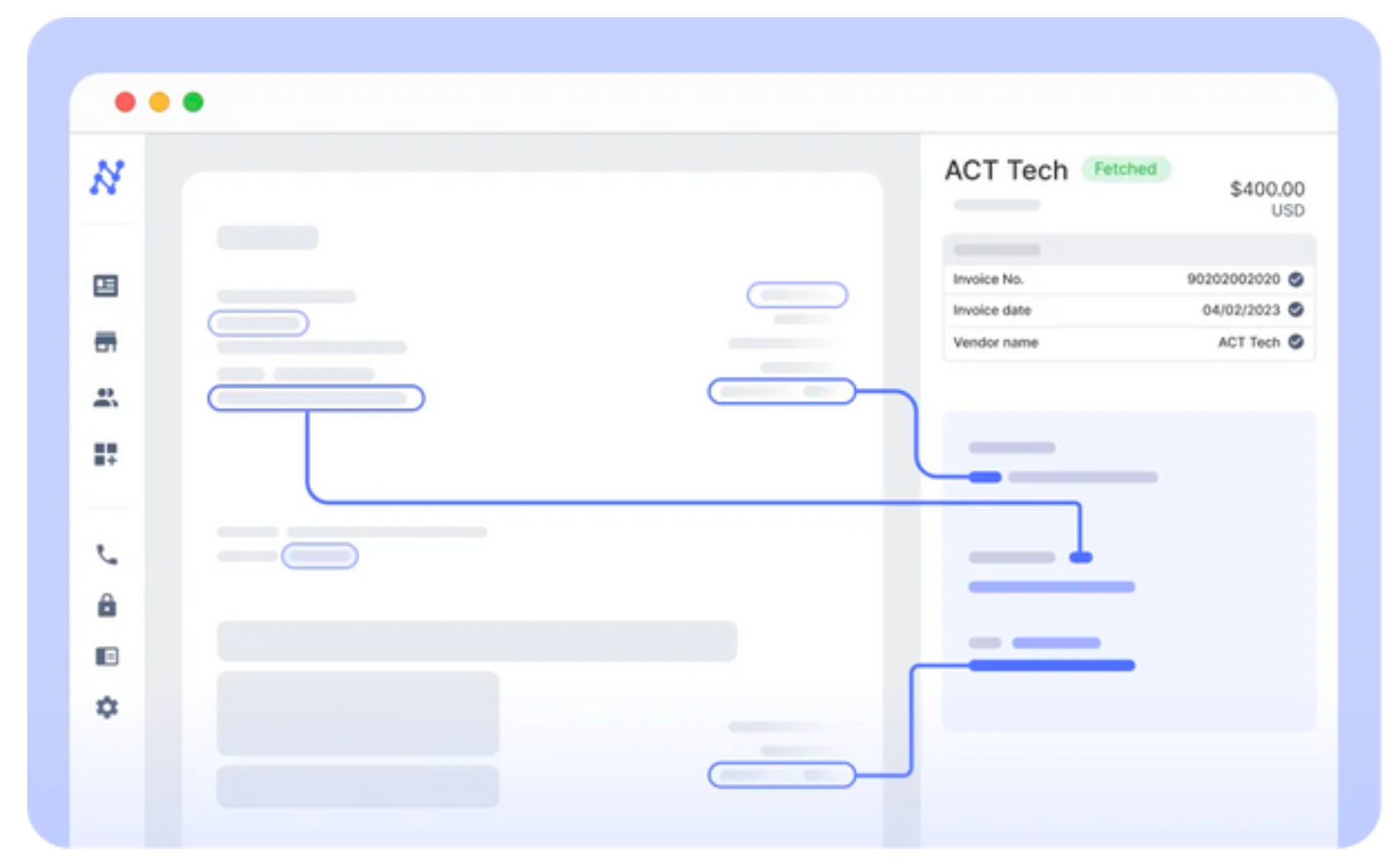

Automated Data Entry

Data entry is often the bane of efficiency, but it doesn’t have to be. Accouting automation software today brings to the table ai-powered Data Extraction that boasts an impressive 99%+ accuracy rate. This means your invoices, receipts and purchase orders are read and processed without the painstaking effort of manual entry. The hours or even days of labor this could save your team are invaluable. It’s the kind of change that makes your team want to come to work in the morning, knowing they can focus on tasks that truly need their expertise.

Automated General Ledger Data Export & Coding

The extracted data is seamlessly exported to your accounting software’s General Ledger in real-time. Moreover, coding these exported GL entries can be extremely tedious and error-prone. Advanced ai techniques like NLP and LLM are here to tackle the grunt work. By automating GL coding along with data export, your department can work smarter, not harder, and ensure the team’s efforts skills are used where they’re most needed.

Enhancing Accuracy with Automated Verification

The magic of Automated 3-way matching cannot be overstated. Integrating invoices, purchase orders, and delivery notes reduces both the time spent and the potential for errors—no more chasing down discrepancies or sending countless follow-up emails. This system handles the verification process with such precision that it feels like having an extra set of infallible eyes.

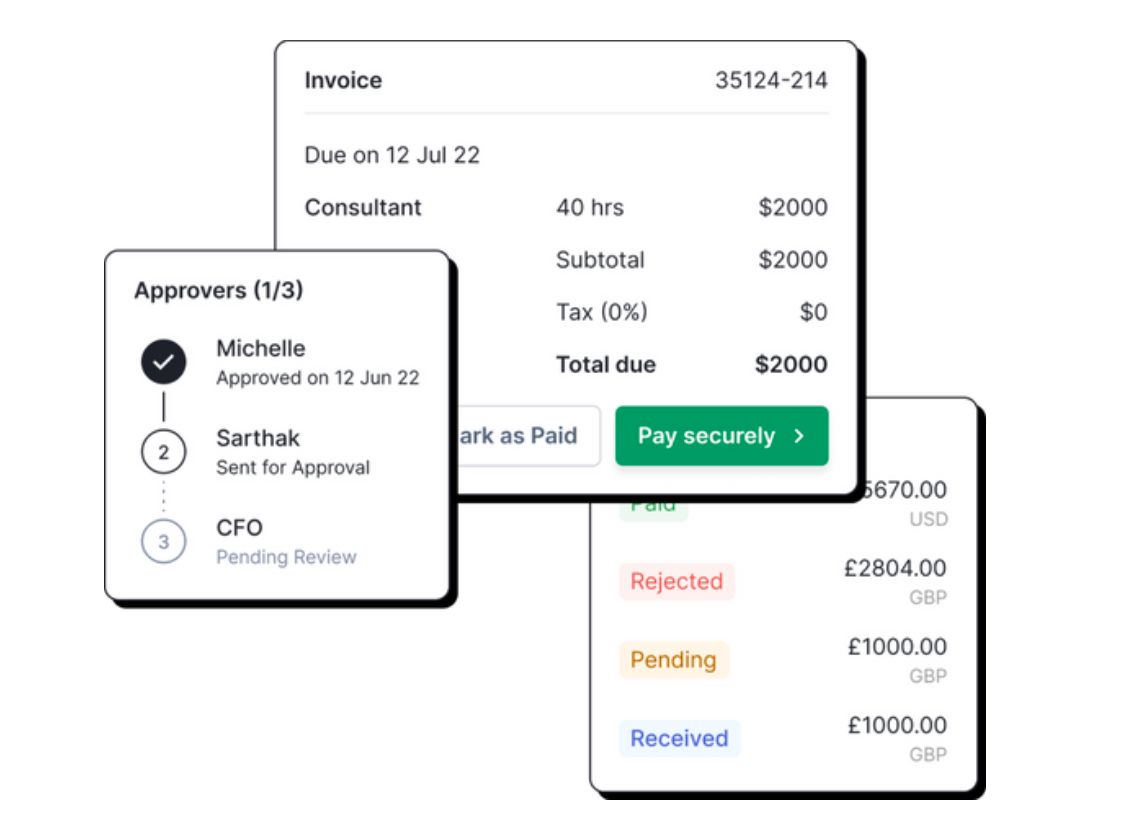

Simplifying Processes with Easy Approvals

Workflow automation means approvals are no longer a bottleneck. They become flexible and live where your organization does—whether that’s on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders. Your approval process becomes as agile as your team, adapting to the flow of your daily operations seamlessly.

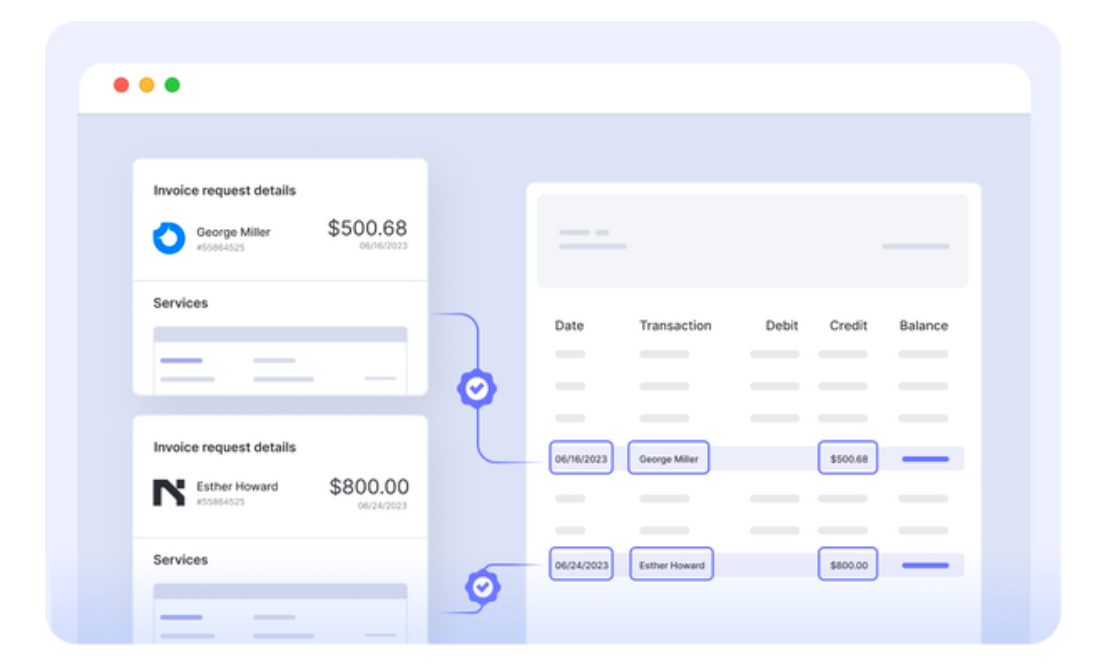

Mastering Finances with Automatic Reconciliation

Finally, let’s talk about closing the books. Automatic reconciliation transforms this often arduous task, matching bank transactions with ledger entries in a fraction of the time it used to take. What once took days can now be done in minutes. Imagine closing your monthly books with such speed and precision that you can almost hear the collective sigh of relief from your team.

Nanonets for GL Automation

Integrating Nanonets into your current general ledger can revolutionize the way you handle your GL processes. By leveraging the power of Nanonets, you can seamlessly automate invoice collection, data entry, data export, coding, verification, approvals, and reconciliation. This not only saves time but also significantly reduces the margin for error, ensuring your financial data is accurate and up-to-date.

Sign up on app.nanonets.com.

Now, you can –

Day 0: Start a Conversation

Schedule a call at your convenience to discuss your needs with our automation experts, and they’ll provide a personalized Nanonets demo.

Day 1: Assess your Needs

We will evaluate your current accounting process, pinpoint how Nanonets can make the biggest impact, ensuring our solution aligns with your goals.

Day 2: Setup and Customization

We’ll guide you on using Nanonets. You’ll set up & automate your accounting workflow suited for you based on our discussion.

Day 3: Testing

After setup, test your workflow with real data during a standard 7-day trial (extendable on request). Our team will assist in fine-tuning your workflow.

Day 7: Purchase & Go Live

After successful testing, we’ll propose a tailored, cost-effective pricing plan. Once you’re happy with it, we’ll go live!

Forever: Empowering your Team

We provide resources, sessions, and continuous customer service to ensure your team’s adoption, proficiency and confidence.

Customer Stories

From small enterprises to multinational corporations, these stories showcase the transformative impact of accounting automation with Nanonets across industries.

SaltPay: Streamlining Vendor Management with SAP Integration

Industry: Payment Services and Software

Location: London, England

Challenge: SaltPay faced the daunting task of manually handling thousands of invoices, which was both impractical and inefficient for managing their extensive vendor network.

Solution: Nanonets stepped in with its ai-powered tool for invoice data extraction, seamlessly integrating with SAP. This integration not only enhanced data accuracy but also significantly improved process efficiency.

Results: The implementation led to a 99% reduction in manual effort, enabling SaltPay to manage over 100,000 vendors efficiently. This drastic improvement has also led to a significant increase in productivity and automation capabilities.

Tapi: Automating Property Maintenance Invoicing

Industry: Property Maintenance Software

Location: Wellington, New Zealand

Challenge: With over 100,000 monthly invoices, Tapi needed a scalable and efficient solution for invoice management in property maintenance.

Solution: Utilizing Nanonets’ ai tool, Tapi automated invoice data extraction, facilitating quick integration with existing systems that could be maintained by non-technical staff.

Results: The process time was reduced from 6 hours to just 12 seconds per invoice, alongside a 70% cost saving in invoicing and achieving 94% automation accuracy.

Pro Partners Wealth: Automating Accounting Data Entry in Quickbooks

Industry: Wealth Management and Accounting

Location: Columbia, Missouri

Challenge: Pro Partners Wealth sought to improve the accuracy and efficiency of data entry for invoicing, as existing automation tools fell short.

Solution: Nanonets offered a tailored solution with precise data extraction and integration capabilities with QuickBooks, enabling streamlined invoicing and automated data validation.

Results: The accuracy of data extraction exceeded 95%, with a 40% time saving compared to traditional OCR tools and an over 80% Straight Through Processing rate, minimizing the need for manual intervention.

Augeo: Advancing Accounts Payable Automation on Salesforce

Industry: Accounting and Consulting Services

Location: United States

Challenge: Augeo needed an efficient accounts payable solution that could integrate seamlessly with Salesforce, to manage thousands of monthly invoices without the heavy burden of manual processing.

Solution: Nanonets provided an ai-driven platform tailored for automated invoice processing, facilitating easy integration with Salesforce for efficient data management.

Results: The solution reduced invoice processing time from 4 hours to 30 minutes daily, achieved an 88% reduction in manual data entry time, and processed 36,000 invoices yearly with heightened accuracy and efficiency.

These customer stories illustrate the broad applicability and significant benefits of accounting automation with Nanonets. By leveraging ai-powered tools and seamless integrations, companies are not only optimizing their GL processes but also paving the way for broader operational excellence. The journey of these organizations underscores the potential of accounting automation to revolutionize financial operations, driving efficiency, accuracy, and growth across industries.