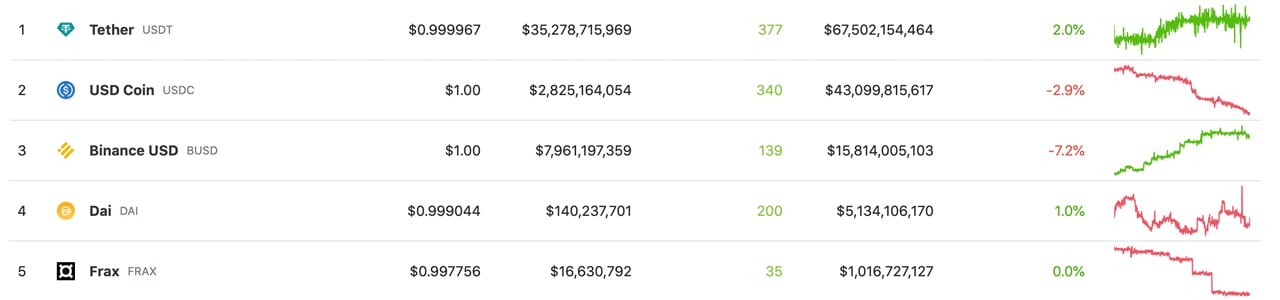

The stablecoin economy continues to dry up, as over $3 billion has been wiped out of the stablecoin market ecosystem in the last 44 days. While statistics show that tether market valuation has risen 2% in the last 30 days, usd coin market cap fell 2.9%, BUSD valuation fell 7.2% over the last month and the market capitalization of the gemini dollar fell 1.5%.

$3 Billion in Dollar-Pegged Tokens Wiped in 44 Days as Stablecoin Exchanges Account for Nearly 80% of Global Cryptocurrency Trading Volume

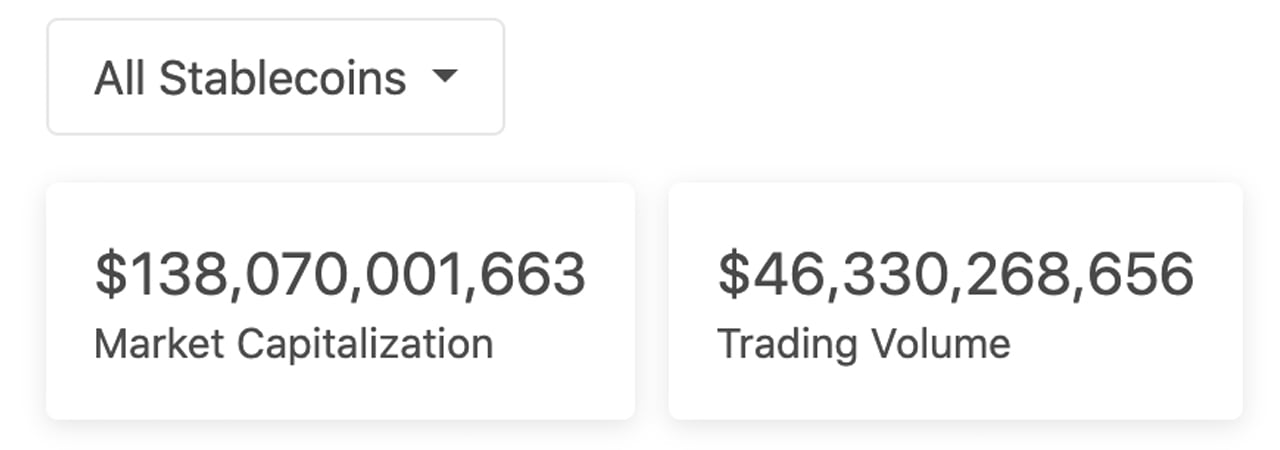

The overall value of the top stablecoins by market cap has lost roughly $3 billion over the past 44 days or since. December 15, 2022. At the time, the stablecoin economy was worth $141.07 billion. On that day, stablecoin exchanges accounted for $44.55 billion of the $53.91 billion in global trade volume.

After losing over $3 billion, the stablecoin economy is valued at $138.07 billionand stablecoin transactions are equal to $46.33 billion of the $58.76 billion in global transactions on January 28, 2023. Of the top ten stablecoin assets, three market caps have lost value over the past 30 days.

Statistics show that usd currency (USDC) it has lost 2.9% in the last month, with BUSD losing the most with a 7.2% decline in 30 days. The dollar-pegged token affiliated with Binance and managed by Paxos BUSD has seen a significant number of redemptions in recent months. At the time of writing, the overall market capitalization of BUSD in US dollars is $15.8 billion.

USDC market cap on Saturday is around $43 billion. On December 15, 2022, the valuation was around $45 billion. Similarly, Gemini Dollar (GUSD) the market capitalization was around $591 million 44 days ago, and today it is around $571 million. While there were a few stablecoin projects that saw market caps drop, tether, ICDTrueUSD (TUSD) and Pax Dollar (USDP) posted gains.

Tether (USDT) saw a 2% increase in coins in circulation over the last 30 days. from makerdao ICD increased by 1% and trueusd (USD) it rose a further 25.3%. The Pax dollar (USDP) rose 5.1% and the Tron USDD saw a small increase of around 0.6% over the past 30 days. Liquidity usd (LUSD) managed to rise 24.4% over the past month, and Abracadabra’s MIM stablecoin jumped 3.9%.

While tens of billions in stablecoin assets have been wiped out since last year, they still represent a dominant force in the crypto economy. Since May 2022, three stablecoin assets have held their own in the top ten positions by market capitalization: USDT, USDC and BUSD. Both USDT and USDC have been in the top ten for much longer.

Furthermore, the entire stablecoin economy, valued at $138 billion, accounts for 12.71% of the total value of the crypto economy. $1 trillion. In trading volume alone on Saturday, January 28, stablecoins accounted for 78.85% of all crypto asset transactions worldwide on both centralized and decentralized exchange (dex) platforms. That means more than seven out of ten crypto asset exchanges today have been traded against a stablecoin.

What does the recent decline in the stablecoin economy mean for the broader cryptocurrency market? Share your opinion in the comments.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.