The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

bitcoin miners have not been operating under normal circumstances for the past few months. The bitcoin blockchain has experienced a particularly intense degree of bitcoin-network”>demand over the last few months, and it appears that the BRC-20s and, to a lesser extent, the image inscriptions, all made possible by the Ordinals protocol, bear a large responsibility. Basically, this protocol allows users to inscribe unique data into the smallest denominations of bitcoin, allowing them to create new “tokens” directly on the bitcoin blockchain. This means that quantities of bitcoins worth pennies in terms of their fiat value can nevertheless be bought and sold multiple times, and each of these transactions must be processed through the same blockchain, not to mention the high demand seen. during the initial minting.

This is where bitcoin miners come in. Energy-consuming calculations performed by specialized mining hardware are not only intended to generate new bitcoins, but can also be used to verify blockchain transactions and keep the digital economy flowing smoothly. With network usage higher than ever, miners have more than enough opportunities to earn income simply by processing these transactions, and the actual production of newly issued bitcoin may take a backseat. As of February 2024, these conditions have created a bitcoin-mining-difficulty-hits-new-ath-after-record-7-3-spike/”>situation where the difficulty of mining is greater than ever in bitcoin history, but the industry is making huge profits. However, one of the most reliable patterns in the bitcoin market has been absolute chaos where fees rise and then plummet. So what will happen to miners after these conditions change?

It is this ecosystem that was significantly disrupted on January 31 when federal regulators declared a new crypto–bitcoin-mining-survey-us-energy-information-administration”>mandate: The EIA, a subsidiary of the US Department of Energy (DOE), was to begin a survey of the electricity use of all miners operating in the United States. Identified miners will be required to share data on their energy use and other statistics, and EIA Administrator Joe DeCarolis stated that this study “will specifically focus on how energy demand for cryptocurrency mining is evolving, identify geographic areas high growth and will quantify the sources of electricity used to meet cryptocurrency mining demand.” These goals seem simple enough at first glance, but several factors have given Bitcoiners pause. For one thing, Forbes bitcoin-vs-the-dollar-biden-administration-suddenly-declares-us-crypto-emergency-after-huge-price-surge/?sh=13d0f3da78ed”>reclaimed that this directive came from the White House, which referred to this action as an “emergency data collection request.” This survey was explicitly created with the goal of examining the “public harm” potential of the mining industry, and even included a comment that this “emergency” collection could lead to more routine collection expected of every miner in the world. near future.

Obviously, language like this has left many in the community extremely uncomfortable, and several prominent miners have already made statements. bitcoin-miners-slam-us-government-planned-survey-as-operation-chokepoint-3-0/”>condemning

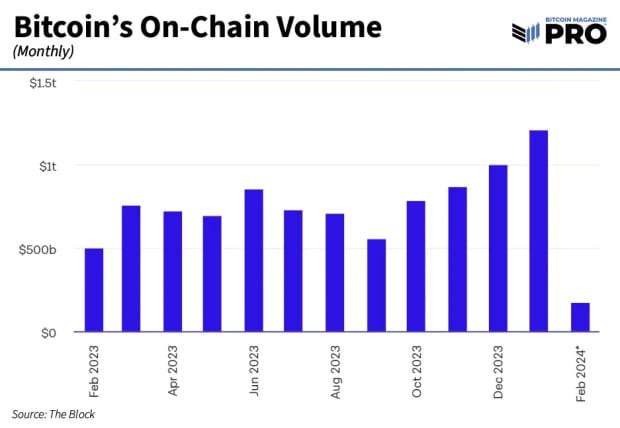

First, it is important to examine some of the factors inherent to bitcoin that are likely to affect miners, regardless of government pressure. Miners are in a strange market situation because transaction fees may generate revenue at the same level as actual mining, but the situation may be stabilizing. New data shows Ordinals sales bitcoin-ordinals-sales-decline-january-halving-hope”>plummeted by 61% in January 2024, showing that its impact on demand for block space is likely to decrease. So if certain miners rely on these tokens to maintain their profits, that income stream doesn't seem particularly reliable. However, while network usage for these microtransactions is likely to plummet, regular transactions are actually seeking excellent. bitcoin trading volume is higher than it has been since the end of 2022 and shows no signs of stopping. Surely then there will be a lot of demand for the minting of new bitcoins.

bitcoin traffic has been increasing for several months as the prospect of a legalized bitcoin ETF became more and more real, and now that this battle is over, trading volume has increased at a greater rate. While the halving may present opportunities and challenges for miners, no one can claim that it is an unexpected event. The companies have been bitcoin-miners-are-pressuring-btcs-price-bitfinex/”>preparing Of course, around $1 billion of this increase in trading volume comes from the miners themselves. bitcoin reserves held by miners are at their lowest point since before the 2021 peak, and miners are using the capital from these sales to upgrade their equipment and prepare.

In other words, regardless of any government action, it appears that market conditions are likely to change due to these factors. Some of the smaller companies operating on thin margins may have hit bottom, but the overall growth in bitcoin trading volume means there will always be opportunities to generate income. Since it is the best-capitalized companies that can make the most thorough preparations for the halving, it is quite possible that some of the most inefficient mining companies will not be able to survive. From a regulatory standpoint, perhaps that is the desired outcome.

The federal government seems primarily concerned with perpetuating the idea that the mining industry is a tax on society as a whole, consuming massive amounts of electricity for unclear benefit. However, only the most efficient operations will be guaranteed to survive the halving and its economic consequences. As the less efficient ones close their doors, the survivors will be left with a much larger slice of a smaller overall pie. Furthermore, if we go by the open letters of several leading companies, these companies are fully prepared to openly fight against any attempt to suppress the industry. Considering that the survey itself is still in its first week of data collection, it is difficult to say what conclusions it will draw or how the EIA will be empowered to act afterwards. So the most important thing to consider is that these new trends are occurring with or without the influence of the EIA.

The survey is just beginning and there are only a few months left to cut it in half. There are many reasons to be concerned about the impact of the EIA on the mining industry, but this is not the only factor. From where we stand, it looks like the entire ecosystem may have changed substantially by the time regulators are ready for any action, even if the action is harsh. The people who will have to face them will be hardened, survivors and innovators of a chaotic market. bitcoin's great strength has been its ability to change rapidly, allowing new enthusiasts the opportunity to take advantage of a set of rules and then move up or down as the rules change. It is this spirit that propelled bitcoin to its global heights over more than a decade of growth. Compared to that, what chance do his opponents have?