Image source: Getty Images

Earning a rich second income with little (or no) effort in retirement is every investor's dream. My plan is to achieve this by building a diversified portfolio of FTSE 100 and FTSE 250 dividend stocks.

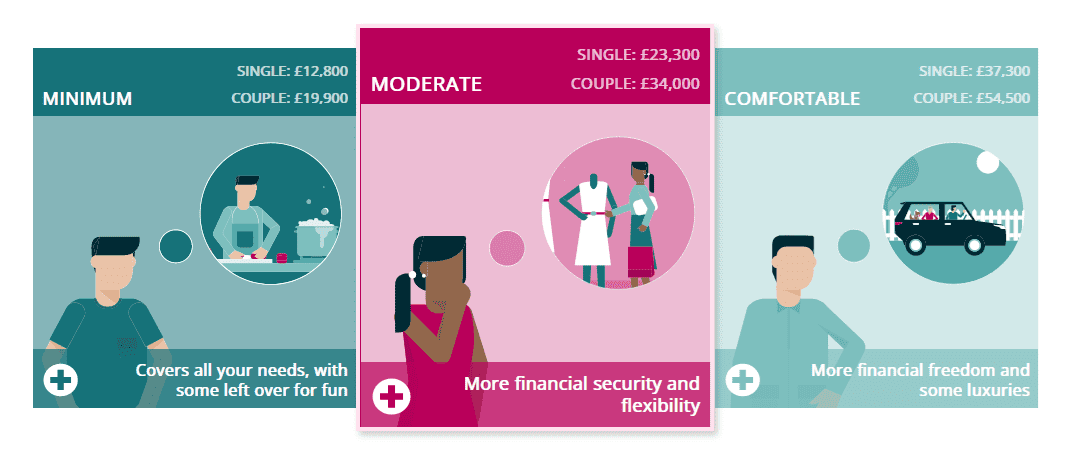

The amount that must have been accumulated before retirement age varies from person to person. But a good strategy might be to follow what the Pensions and Lifetime Savings Association believes the average Briton will need once they reach retirement age.

They believe retirees will need an annual income of £23,300 to enjoy a “moderate” standard of living. A much larger figure, £37,300, is needed for people to live comfortably.

Here is my plan

This is a big problem for people who rely on the state pension to fund their retirement. From April, the pension is due to rise to just £11,502 a year.

This leaves a shortfall of around £25,800 for those who want to enjoy a “comfortable” standard of living. And I believe this disparity will increase even further when I myself finally hang up my work apron as the cost of living and welfare skyrocket.

But I'm not panicking. While future profits are not guaranteed, the surprising returns that UK share investors have achieved over recent decades suggest you could live comfortably regardless of what the future holds for the state pension.

Compound Earnings

My optimism is based on the exceptional returns that FTSE 100 and FTSE 250 shares have generated over the long term.

Footsie investors who reinvested all their dividends between 2010 and 2019 enjoyed an average annual return of 8.3% between them. Meanwhile, those who bought FTSE 250 shares enjoyed an even better annual return of 13%.*

Reinvesting dividends is the key to boosting long-term wealth. Doing this with dividends allows me to accumulate more shares, resulting in higher dividend payments and therefore the ability to purchase additional shares.

Over time, this mathematical miracle (known as compounding) can help me earn market-beating returns.

*Figures courtesy of IG Group.

A second income of £3,337

Now I'm going to show you how compounding can help me generate passive income in retirement. Let's say I have a lump sum of £20,000 to build a balanced portfolio of UK blue chip shares.

Over the course of 30 years, and with an extra £200 invested each month, I would have built up an impressive savings of £1,001,225 for retirement. This is based on the 10.65% average return of FTSE 100 and FTSE 250 stocks over the 2010s.

If you then withdraw 4% of this amount each year, you would have an excellent monthly income of £3,337. Annually this works in £40,049.

That would be enough to give me that comfortable retirement that the PLSA describes. And that's not counting the extra boost the state pension will give to my finances.

There could be obstacles along the way. But I am sure that, with the right investment strategy (and the help of experts like The Motley Fool) I could earn great passive income for my later years.