The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

Last week, I outlined the enormous buying pressure coming to bitcoin. bitcoin-etf-inflows-in-context”>in contextBut there is another (perhaps the largest) source of potential demand that is entering the picture.

We already know the bitcoin ETFs, MicroStrategy bitcoin“>issuing more shares to buy more bitcoins, Tether bitcoin-holdings-latest”>constant purchaseand halving will be important sources of demand in this cycle. For example, in just the first two weeks of trading, the “newborn 9” accumulated 125,000 btc. This has so far been offset by GBTC outflows, but it is unlikely that all GBTC holders will be captive sellers exiting as soon as possible. This output should begin to decrease in the coming weeks.

A somewhat unexpected event is emerging precisely in China. Readers of my content here and on bitcoinandmarkets.com will be no stranger to what is happening in China over the past few years. They are experiencing the transition of the end of an economic model. The China we have come to know was built on debt and produced goods for over-indebted foreign customers. They depend heavily on globalization and a highly elastic monetary environment. That era is coming to an end, and the decline of China's real estate market, and now its stock market, are visible signs of the end of that paradigm.

In January On January 24, China Asset Management Company (China AMC), a giant fund manager and ETF provider in China, halted trading in its Nasdaq 100 and S&P 500 ETFs to stop the flood of money flowing out of other funds and into in these funds connected to the United States. On Tuesday, other US-connected ETFs in Chinese markets opened capped and were at a 21% premium to NAV. The flight to safety is also affecting Japanese ETFs based in China. On Tuesday, the China AMC Nomura Nikkei 225 ETF rose more than 6% to a 22% premium.

Chinese investors are in complete panic and the authorities are closing the door. It's only a matter of time until more Chinese investors start turning to bitcoin as a store of value and portability. Many Chinese are already familiar with bitcoin. China used to be a dominant source of bitcoin demand until the CCP banned it in 2021.

While bitcoin is still officially banned in mainland China, investors can still use exchanges like Binance and OKX. They can also purchase OTC, person-to-person or through offshore bank accounts. Last year, Hong Kong publicly opened up to bitcoin again. They have followed in the footsteps of American regulators who gave bitcoin the official blessing in Hong Kong. It is unlikely that Hong Kong authorities made a public effort to legalize bitcoin and then banned it the following year.

This morning, a technology/bruised-by-stock-market-chinese-rush-into-banned-bitcoin-2024-01-25/”>Reuters piece quotes a senior executive at a Hong Kong-based bitcoin exchange, who confirms this capital flight story. “Investing on the continent is risky, uncertain and disappointing, so people are looking to allocate assets abroad. (…) Almost every day we see continental investors enter this market.”

The source added: “If you are a Chinese brokerage facing a sluggish stock market, weak IPO demand and a contraction in other businesses, you need a growth story to tell your shareholders and board.”

We've been talking about bitcoin providing a parallel world of green shoots, and now it's being recognized everywhere.

Flows from China will be a big source of demand in this cycle, and the approval of bitcoin spot ETFs in the US will create a perfect synergy by allowing sophisticated foreign investors to buy bitcoin and US-based assets . at the same time.

Nor can we forget the faltering European markets. Europe is likely already in recession. In December, EU manufacturing activity had contracted 18 months in a row. Germany just avoided a technical recession despite the fact that the 2023 GDP was negative (-0.2%). The relative attractiveness of bitcoin is very high in a world of capital flight and negative growth. Many bitcoiners are worried that a recession would cause a stock market crash, forcing them to sell off bitcoins like they did in March 2020, but this time it could be the opposite. As investors realize that the old system is stagnant and in decline, bitcoin's unique convergence of properties as a revolutionary technology, a fixed supply asset, and potential for economic growth will be where capital will flee.

bitcoin Price Update

bitcoin price performance has been disappointing since the launch of the ETF. However, in the context of the FTX receivership's $1 billion sale of GBTC and other large entities selling GBTC to rotate toward lower capital fees of new ETFs, the price has held steady. Extremely good.

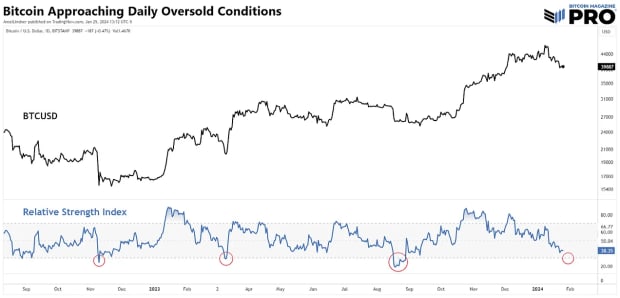

The RSI is one of the most used indicators and as such has a Schelling point effect. People and robots are watching for the daily RSI to reach oversold. Therefore, it is likely that we will not see any significant increase in price until the 30 level on the RSI is broken. That can be achieved with a sell-off further towards support, given that we are already very close to 30. A more unlikely possibility is that we could form a hidden bullish divergence, where the price makes slightly higher lows, but the RSI makes higher lows. low. I also don't expect any significant downside with the demand confluence described above – we are at a temporary stalemate.

Staying on the daily chart below but zooming in, we see that the 100 DMA is currently providing support. I am also keeping an eye on the $37,877 level; An important November price. Any dip that pushes the RSI into oversold may not close below that.

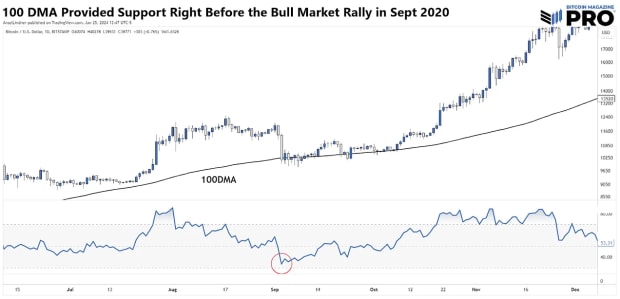

The 100-day typically does not provide much support in bitcoin, with the 50-day and 200-day moving averages being the most influential. However, below I show September 2020, just before the monster bull rally that will end that year. The 100 days were the star back then. It is possible to hold the 100-day price and then recover with a pause in GBTC sales. Another interesting note from that period in 2020: the RSI stopped below oversold, catching many off guard as it shot towards the moon. That's not my base case, but it takes precedence.

Simply put, we are seeing massive new sources of demand for bitcoin coming from ETFs and now capital flight from China. The ETF's launch dynamics have been complicated, but all things considered the price has remained relatively stable. It is only a matter of time until demand becomes evident in the price.