Our free bank reconciliation template provides a simple way to reconcile your cash book with your bank statement. Hit the download button and follow our guide to learn more.

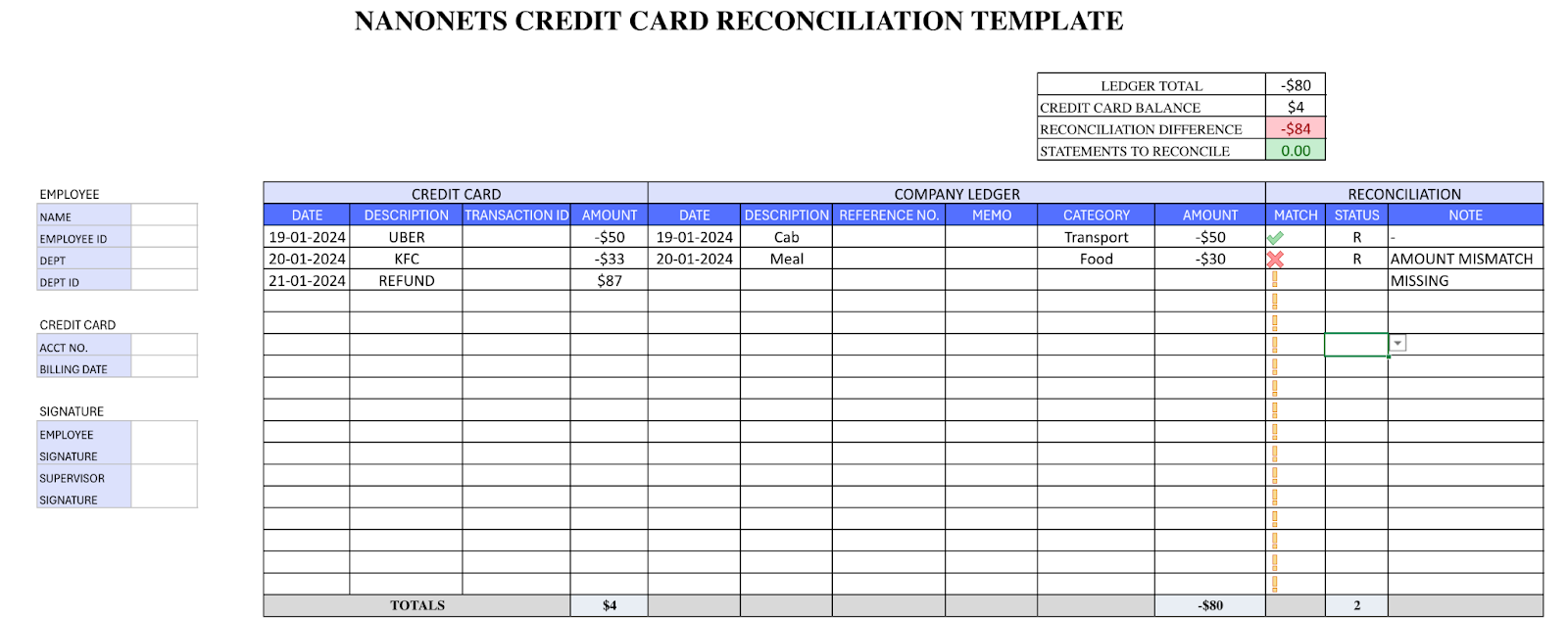

Example of our credit card reconciliation template in Excel:

How to reconcile credit cards?

Credit card reconciliation is the process of matching credit card records to your company's general ledger. This is a routine process performed by finance teams to ensure that the company's financial records are accurate and detect any errors or fraud.

Let's start with the process:

- Gather documents

You will need the company general ledger and the latest credit card statement. Download them in CSV format and paste them into individual Excel sheets. Also, find all invoices/receipts related to credit card payments. In case of any discrepancy, this will help you confirm the transaction details, transaction authorization and expense categorization.

- Match documents

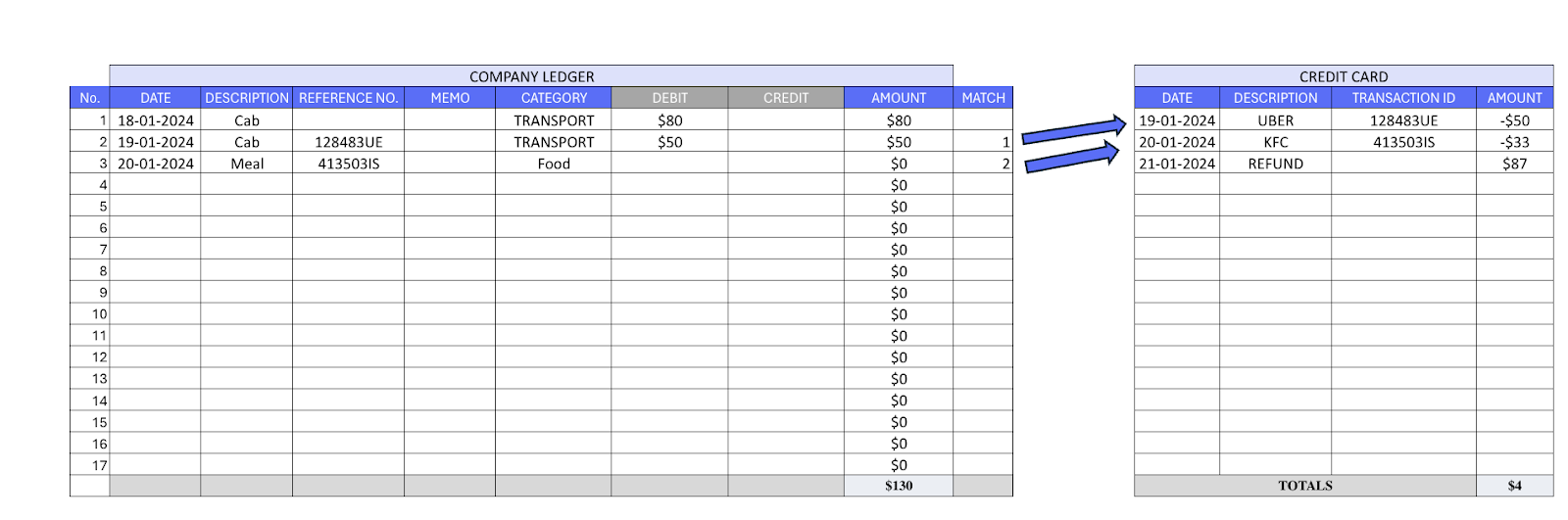

We need to find out the matching transactions on the credit card statement and in the general ledger. You can do an exact match if your GL records the transaction ID.

If the transaction ID is not recorded, you can match the transaction based on other information such as date, amount, or description.

Example: We have a $50 Uber charge recorded in the company's general ledger; The transaction can be compared to the credit card statement using the transaction ID.

- Create a credit card reconciliation statement.

Create a reconciliation statement that flags all transactions that match and tracks all transactions that do not match. You can update the general ledger to reflect any valid transactions that may have been skipped. In case of unauthorized transactions or banking errors, please contact your bank.

Why reconcile credit cards?

Credit cards offer instant balloon payments and a line of credit, making them popular in the business world. Corporate credit cards are the preferred method for employees to make work-related expenses.

However, credit cards are prone to theft and fraud. It is the most common banking-related fraud, with hundreds of thousands of cases each year and billions in stolen value. It is essential to reconcile credit card statements to detect errors, fraud or unauthorized transactions.

Automate credit card reconciliation

Using tools like Excel requires a lot of manual intervention. If you want to scale up your process, you should look for software that can automate your process end-to-end. This would require aggregating data from multiple financial sources, extracting relevant data from documents, comparing data from different sources, and performing fraud checks.

Reconciliation software can automate 3 key elements for you:

- Data collection – Automation software like Nanonets can integrate seamlessly with your ERP or email to collect documents such as credit card statements, invoices, receipts, and the company's general ledger. The software will only extract relevant information from each document through OCR technology.

- Data Matching – Without code automation, you can easily set up rules to match the two documents. You can establish new rules over time and you won't have to fight with formulas.

- Error identification and fraud verification – Configure indicators to identify any type of irregular transactions, duplicates or unauthorized transactions.

Find the suitable reconciliation software depending on your business needs and whether the tool has the features you need.