The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Analysis of lower chain indicators

this week dash release, we’ve highlighted a few key on-chain metrics that we like to track. In this article, we want to discuss more of them in detail. Throughout bitcoin’s short history, many on-chain cyclical indicators are currently pointing to what appears to be a classic low in the bitcoin price. The extremes of the market (potential highs and lows) is where these indicators have proven to be most useful.

However, these indicators should be considered along with many other macroeconomic factors and readers should consider the possibility that this could be another bear market rally, as we are still below the 200-week moving average price of around $24,600. That being said, if the price can sustain above $20,000 any time soon, the bullish metrics paint a compelling sign for more long-term accumulation here.

A major tail risk is a potential market-wide sell-off of risk assets that are currently pricing in a “soft landing” style scenario coupled with potentially incorrect expectations of a Fed policy turn in the second half of this year. Many economic data and indicators still point to the likelihood that we are in the midst of a bear market similar to 2000-2002 or 2007-2008 and the worst is yet to come. This secular bear market is what is different about this bitcoin cycle compared to any other in the past and what makes it much more difficult to use historical bitcoin cycles post-2012 as perfect analogues for today.

All this said, from a native bitcoin perspective, the story is clear: the capitulation has clearly played out and the HODLers held the line.

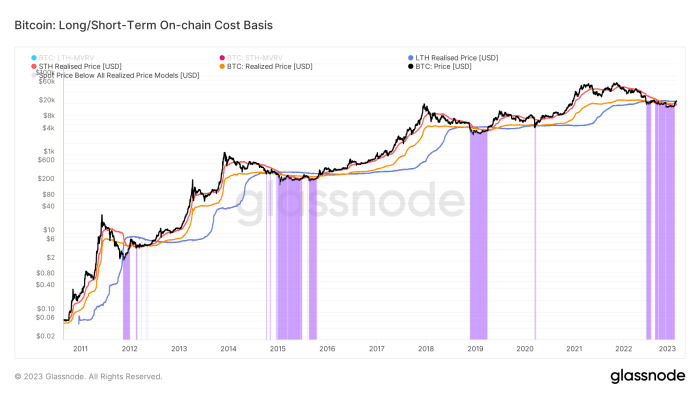

Given the transparent nature of bitcoin ownership, we can see various cohorts of bitcoin holders with extreme clarity. In this case, we are looking at the realized price for the average bitcoin holder, as well as the same metric for both long-term (LTH) and short-term (STH) holders.

Realized price, STH realized price and LTH realized price can give us an idea of where the various market cohorts are in gains or under water.

On a monthly basis, realized losses have turned into realized gains for the first time since last April.

Capitulation and taking losses have turned into gains across the entire network, which is a very healthy sign of full capitulation.

It can be argued that given the current elasticity of bitcoin supply, as evidenced by the historically small number of short-term holders, or rather the large number of long-term holders, it will be a challenge to shake current participants in the market. . Especially considering the challenge he endured over the past 12 months.

Statistically, long-term bitcoin holders are generally unfazed by bitcoin price volatility. The data shows a fair amount of accumulation throughout 2022, despite a massive risk aversion event in both the bitcoin and legacy markets.

While liquidity dynamics in legacy markets should be taken into account, the supply-side dynamics for bitcoin appear to be as strong as ever. All it takes for significant price appreciation will be a small influx of new demand.

Do you like this content? subscribe now to receive PRO articles directly in your inbox.