Image source: Getty Image

These FTSE 100 and FTSE 250 The shares are for sale right now. Here's why they're on my shopping list of top stocks to buy the next time I have cash to invest.

Tritax Big Box REIT

The value of real estate investment trusts (or REITs) fell sharply last year as interest rates steadily rose. The Bank of England's action lowered its net asset values (NAV) and They raised the borrowing costs of their large debts.

This will remain a threat in 2024 as inflationary pressure continues. But I still believe Tritax Big Box REIT (LSE:BBOX) shares are a brilliant buy right now.

This is not just because interest rates still seem likely to fall from their recent highs. It is also thanks to the FTSE 250 the exceptional integral value of the company.

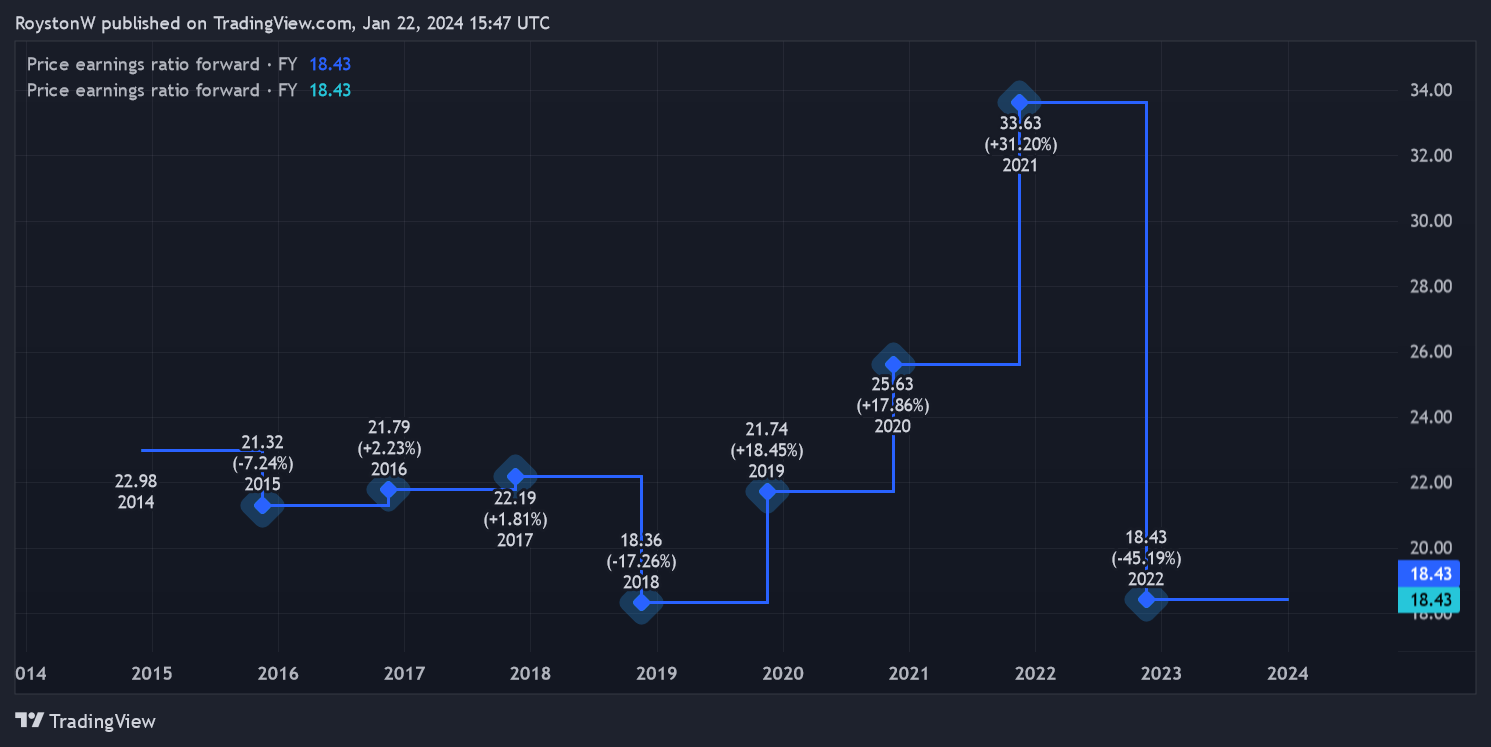

Created with TradingView

As the chart above shows, Tritax's share price is trading at a forward price-to-earnings (P/E) ratio of 18.4 times. This is well below its historical average, which is in the low to mid-20s.

What's more, the FTSE 250 company's forward dividend yield stands at a healthy 4.9%.

But don't just think that Tritax is a great value stock in 2024. I'm confident that the company, which owns and operates warehouses and fulfillment centers, will generate excellent long-term returns as e-commerce growth drives real estate demand.

Consultancy Knight Frank believes an additional 45 million square feet of warehouse space will be needed in the UK between 2023 and 2027 as online sales increase. In this climate, companies like Tritax, whose comparable rental growth accelerated to 3.6% in the first half of 2023, should deliver healthy earnings growth.

Please note that tax treatment depends on each client's individual circumstances and may be subject to change in the future. The content of this article is provided for informational purposes only. It is not intended to be, nor does it constitute, any type of tax advice.

Hellenic Coca-Cola Bottling Company

beverage bottler Hellenic Coca-Cola Bottling Company (LSE:CCH) is one of my favorite calls SWAN (either Yessleep W.Ana TOt northright) actions. Demand for your product remains stable at all points in the economic cycle. And then I don't have to worry too much about future earnings.

Granted, competition is intense in the soft drink and energy drink markets. Therefore, the Footsie company (like any UK stock) is not entirely immune to risk.

But overall I think it's rock solid. I also think it's too cheap to miss out on at current prices. Today, Coca-Cola HBC shares trade at a forward price-to-earnings ratio of 12 times, well below its 10- to 20-year historical average.

This is not everything. As the chart below shows, the British company is also trading at a discount to other multinational beverage companies. PepsiCo and The Cola-Cola Company It even trades at P/E ratios twice as high as Coca-Cola HBC!

Chart created with TradingView. Shows forward P/E ratios. of (in descending order) PepsiCo, Coca-Cola Company, Pure Dr. Pepper, Britishand Coca-Cola HBC.

This seems difficult to justify given the exceptional drive of the British company. Organic revenue soared 17% between January and September, a result that led the company to raise its medium-term annual growth targets to 6%-7%.

In my opinion, the company has the right to be increasingly optimistic. It has its finger on the pulse of consumer tastes and, by extension, has an excellent track record when it comes to product innovation. Their winning labels like Coke, Elfand fantasyMeanwhile, they provide the foundation for strong sales and profit growth almost every year.

This is a blue chip FTSE 100 stock that I plan to never sell.