Image source: Getty Images

I'm building a list of the best FTSE 100 and FTSE 250 stocks to buy the next time you have cash to invest. Here are two I hope to buy before their stock prices rise.

Industry giant

Financial service providers such as Legal and General Group (LSE:LGEN) face an ongoing battle to boost profits as tough economic conditions undermine consumer spending.

Between January and June last year, this particular FTSE 100 company's operating profit fell 2%. But the prospect of more short-term stress doesn't discourage me. I opened a stake in the life insurance, wealth and pensions giant last year because I believe it will deliver exceptional returns over the long term.

And at current prices, I expect to increase my holdings. At 239 pence per share, it offers a brilliant 9% dividend yield by 2024, while its price-to-earnings (P/E) ratio sits at a low of 9.1 times.

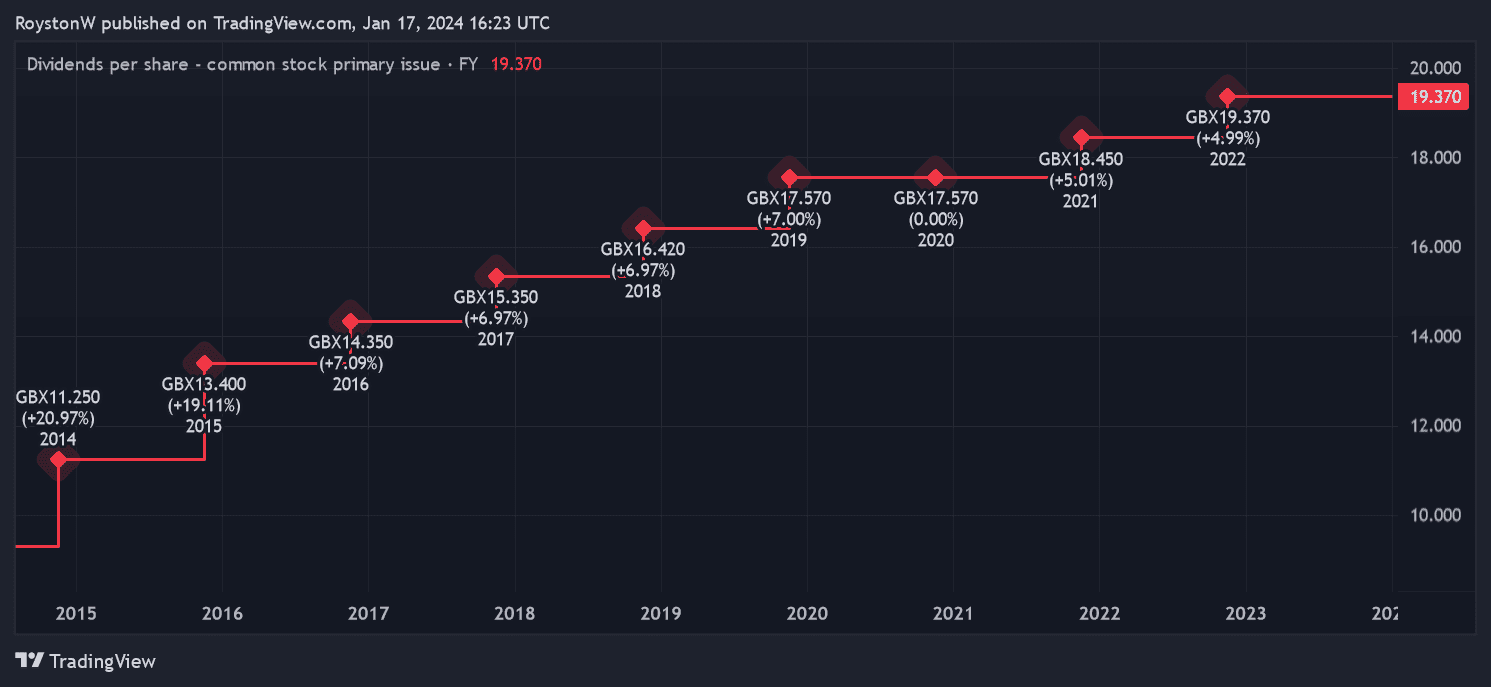

Dividend growth at Legal & General since 2014. Chart by TradingView

Legal & General is a leader in financial services and in the United Kingdom has around 10 million policyholders in the savings, protection, mortgage and retirement segments. As the population ages rapidly in your territories, you have a strong chance of dramatically increasing customer numbers from current levels.

I also like L&G stock because of the company's cash-rich balance sheet. A solid solvency ratio (which reached 230% in June) gives it firepower to make acquisitions, invest in the business and continue increasing the dividend.

sunny side up

Investing in renewable energy stocks could also help me earn fantastic returns as the shift away from fossil fuels accelerates. I already have shares in an investment trust. The Renewable Infrastructure Groupand I'm looking to buy more green energy stocks to increase my exposure.

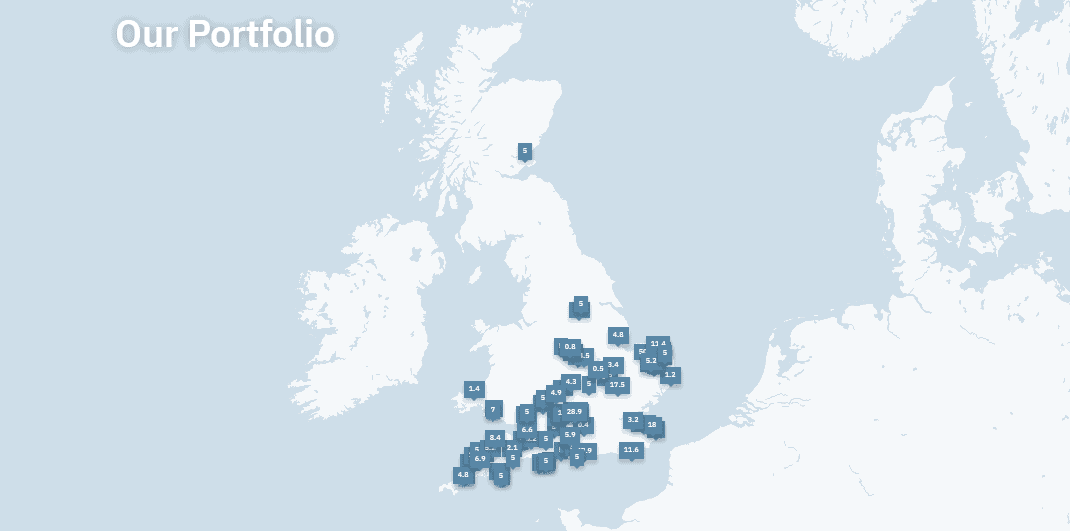

One of those businesses on my radar today is Bluefield Solar Income Fund (LSE:BSIF), which has a portfolio of over 200 solar parks in the UK.

Demand for green energy is increasing as oil and gas fall out of fashion. According to Carbon Brief, electricity generated from fossil fuels in the UK fell last year to its lowest level since 1957 as renewable energy capacity increased.

Of course, there is no guarantee that Bluefield will be able to profit from this growing industry. During cloudy conditions, power generation may drop, which, in turn, may reduce profits. technology glitches can also wreak havoc on your bottom line.

However, this FTSE 250 operator's extensive asset portfolio helps reduce this risk. As the map below shows, its portfolio of solar farms in the UK is quite impressive.

I think Bluefield is an especially good stock to buy at current prices. At 114p, the company's share price is trading at a huge discount to the value of the company's assets. Its net asset value (NAV) per share is currently estimated at around 136.7 pence.

The renewable energy sector today also carries a powerful dividend yield of 7.6%.

Like Legal & General, I think it could be a great way to generate significant (and growing) passive income for years to come.