Filing an insurance claim is often tedious for both clients and insurers. Collecting documents, filling out forms and waiting for decisions is frustrating, with a lot of manual overhead and outdated document management systems. This represents a significant inefficiency: ai-In-Insurance-Claims-And-Underwriting.pdf” rel=”noopener noreferrer nofollow”>Accenture Estimates a massive productivity loss of $160 billion over five years across the global insurance industry.

The introduction of artificial intelligence (ai) in document processing will revolutionize this industry. ai claims processing integrates machine learning (ML), optical character recognition (OCR), workflow automation, and data analytics to streamline the process and make it faster, more reliable, and more efficient.

This article explores how ai can help you achieve end-to-end automation in the insurance claims process.

Extract→Validate→Export documents in seconds

<h2 id="the-mechanics-of-ai-driven-claims-processing”>The Mechanics of ai-Powered Claims Processing

Traditionally, the claims process has been laborious. It involves multiple steps: claim initiation, data entry, validation, decision making and payment.

Let's say you have a car insurance claim. You would have to provide countless documents: accident reports, repair estimates, medical bills, if applicable, etc. These documents must be reviewed, verified, and approved manually, which requires time and resources.

ai claims processing replaces this tedious manual process with advanced technology to automate and streamline these tasks.

A video demonstrating how Nanonets can assist in claims processing.

Here's a simplified breakdown of how it works:

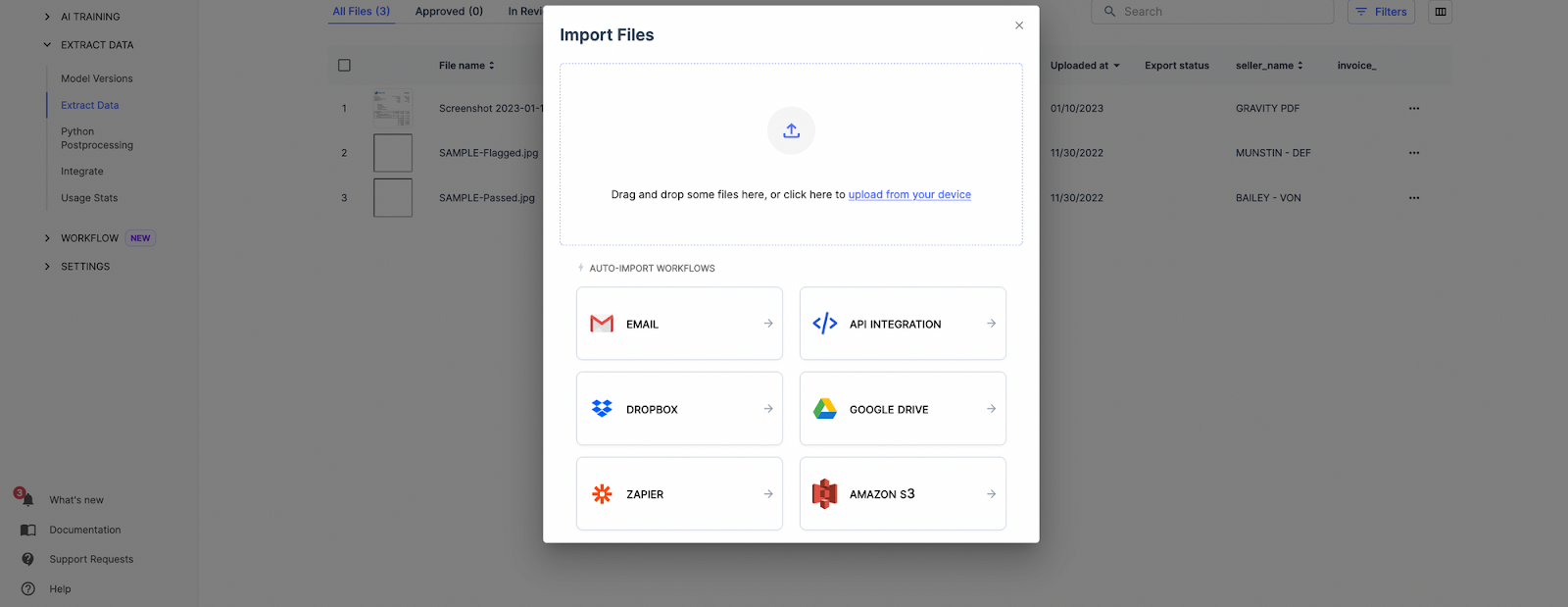

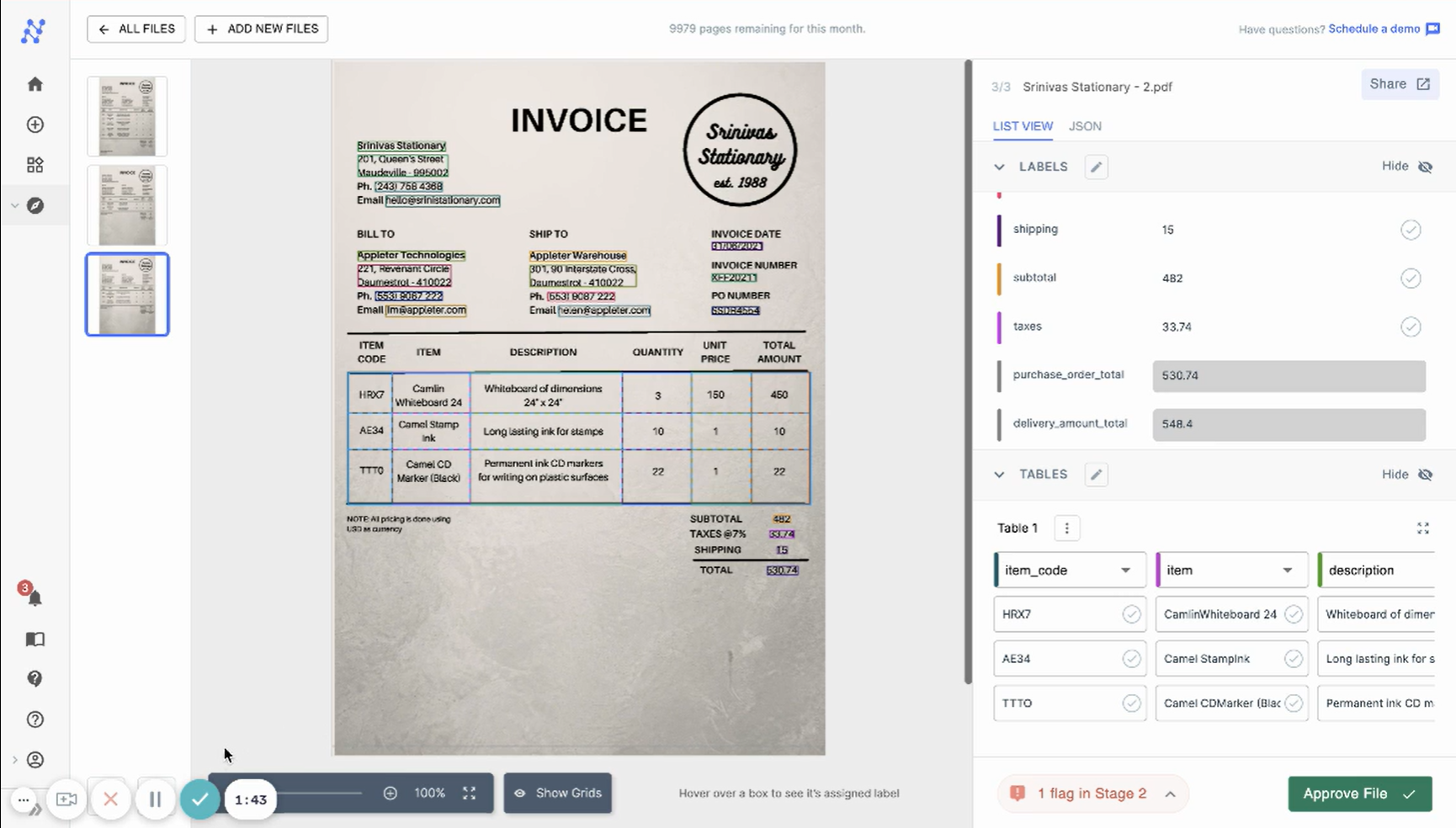

Step 1: document ingestion

The ai system ingests the documents digitally, either by scanning physical documents or accepting digital files. This could include formats such as PDFs, emails, and scanned images.

Step 2: Understanding the document

The ai then identifies and understands the information contained in the documents. You can extract key data points such as policy numbers, accident details and costs, even from unstructured data.

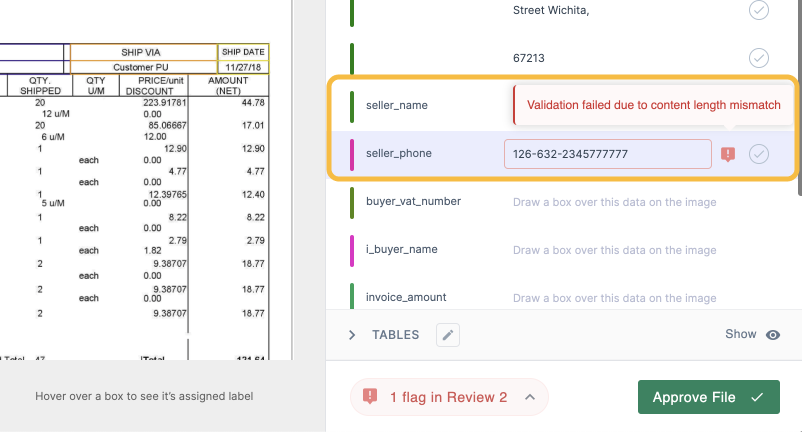

Step 3: data validation

The system will then validate the extracted data against predefined rules and databases. This could include verifying policy details, confirming accident details with third-party databases, and verifying cost estimates.

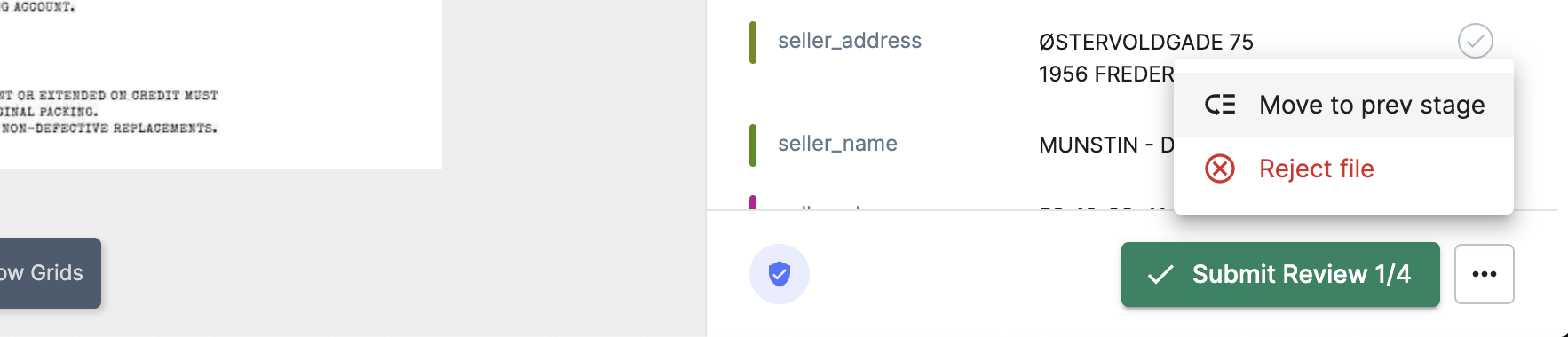

Step 4: Decision making

The ai system can then send the processed claim documents to the relevant department for final approval. You can also automatically approve claims based on specific criteria, which significantly speeds up the process.

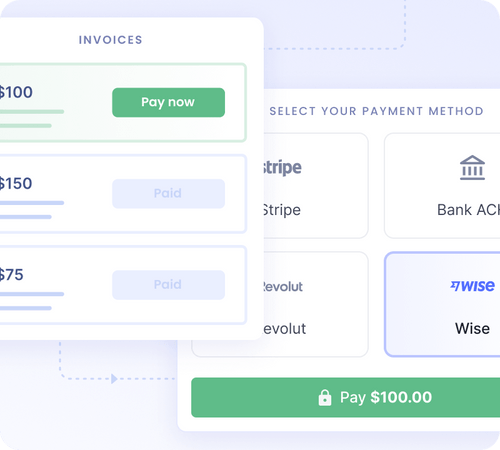

Step 5: Payment

Once approved, processed files can be exported directly to the payment system to initiate payment. The system can also notify the claimant of the final decision, providing transparency and improving customer satisfaction.

<h2 id="tips-to-streamline-your-claim-processing-workflow-with-ai“>Tips to Optimize Your Claims Processing Workflow with ai

Claims processing workflows are ready for automation with ai. By handling repetitive tasks such as data extraction and document routing, ai systems allow staff to focus on evaluating higher-value claims.

Here are some tips to leverage the capabilities of ai and optimize claims processing workflows for greater efficiency.

1. Improve data accuracy with best-in-class OCR

Manual data entry is prone to errors and inaccuracies. While traditional OCR technologies can help, they often fall short when it comes to complex or unstructured documents.

Nanonets' ai-powered OCR technology provides error-free data extraction capabilities, even from unstructured documents. Accurately captures and digitizes vital details of your documents, dramatically reducing manual entry errors and saving significant processing time. Plus, it overcomes language barriers, region-specific laws, and currency formats, making it a powerful tool in your claims processing workflow.

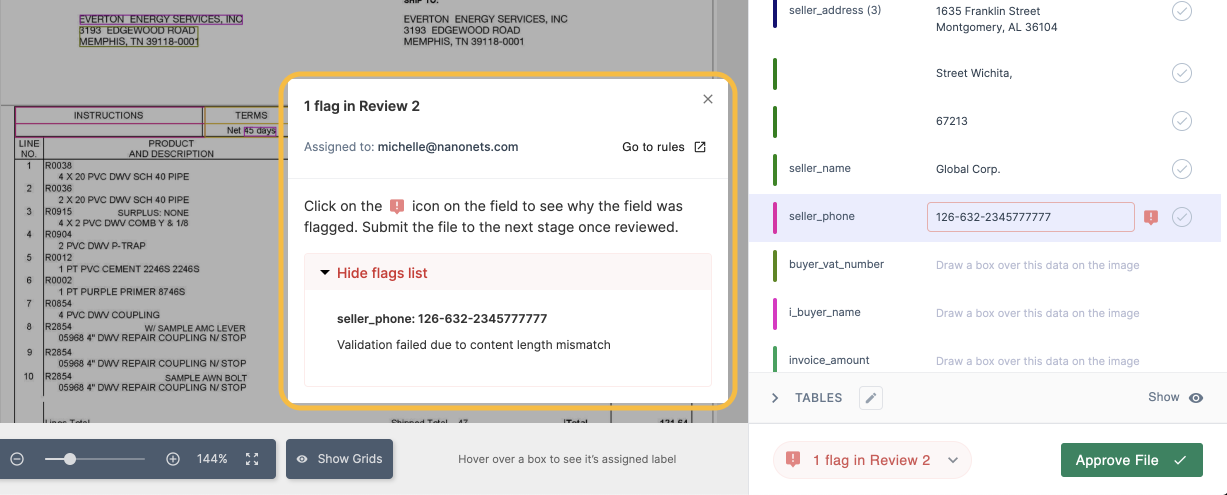

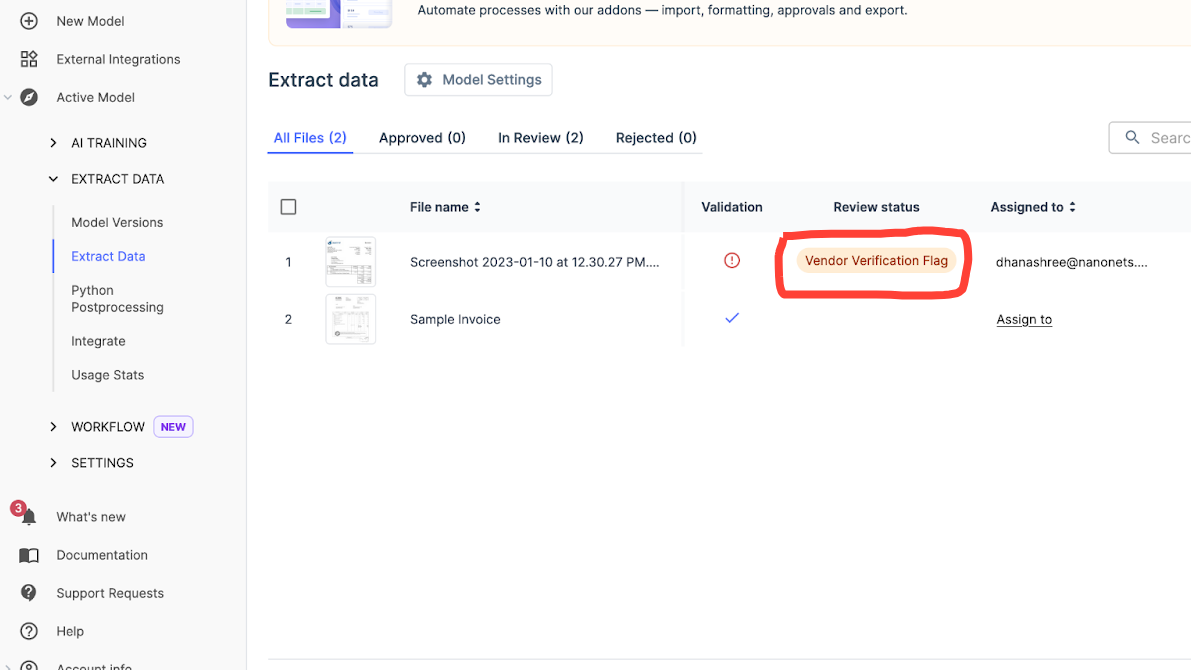

2. Enable real-time validation

Integrate rules-based validation of extracted claims data with policy databases, claims history, etc. This instantly flags any discrepancies for review before claims move forward, reducing fraud and errors.

With Nanonets, you can effortlessly verify a claimant's policy number, personal details, and accident description across multiple databases. This automated process ensures that any discrepancies are flagged and sent for manual verification, giving you accurate and reliable information every time.

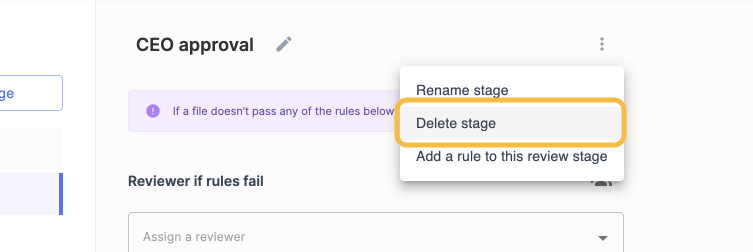

2. Automate document routing

Create automated workflows to sort and classify incoming claims based on their nature, value ranges, policy categories, and other relevant factors. These complaints can then be routed to the appropriate processing teams for timely and efficient management.

Nanonetworks can seamlessly capture and process crucial information from various sources, regardless of language or structure. Using its contextual understanding of documents, Nanonets efficiently classifies and routes data to the appropriate team, saving a lot of time and effort that would otherwise be spent manually sorting it.

3. Activate proactive alerts

Automatically notify stakeholders of claim progress via email, SMS, or in-app alerts to increase transparency and customer satisfaction.

Nanonets puts an end to the hassle of customers searching for updates on their claims by allowing you to send real-time alerts to claimants about the status of their claims, from review to approval and even initiation of payment. This adds convenience to your experience and improves your overall satisfaction.

4. Ensure scalable processing

Cloud-based ai solutions can seamlessly scale to handle increasing claim loads without additional infrastructure. This saves costs without requiring internal infrastructure upgrades to increase claim volume.

Nanonets offers pay-as-you-go pricing that allows you to quickly scale up or down based on your needs. Its cloud-based ai engine handles increasing volumes of claims effortlessly, ensuring consistent performance regardless of load.

5. Strengthen fraud detection

Improve your fraud detection strategies with ai-based predictive analytics. Implement rules to detect suspicious claims based on patterns identified from historical data.

With Nanonets, you can leverage ai to detect fraudulent patterns and flag suspicious claims for further investigation. This helps you minimize losses due to fraud.

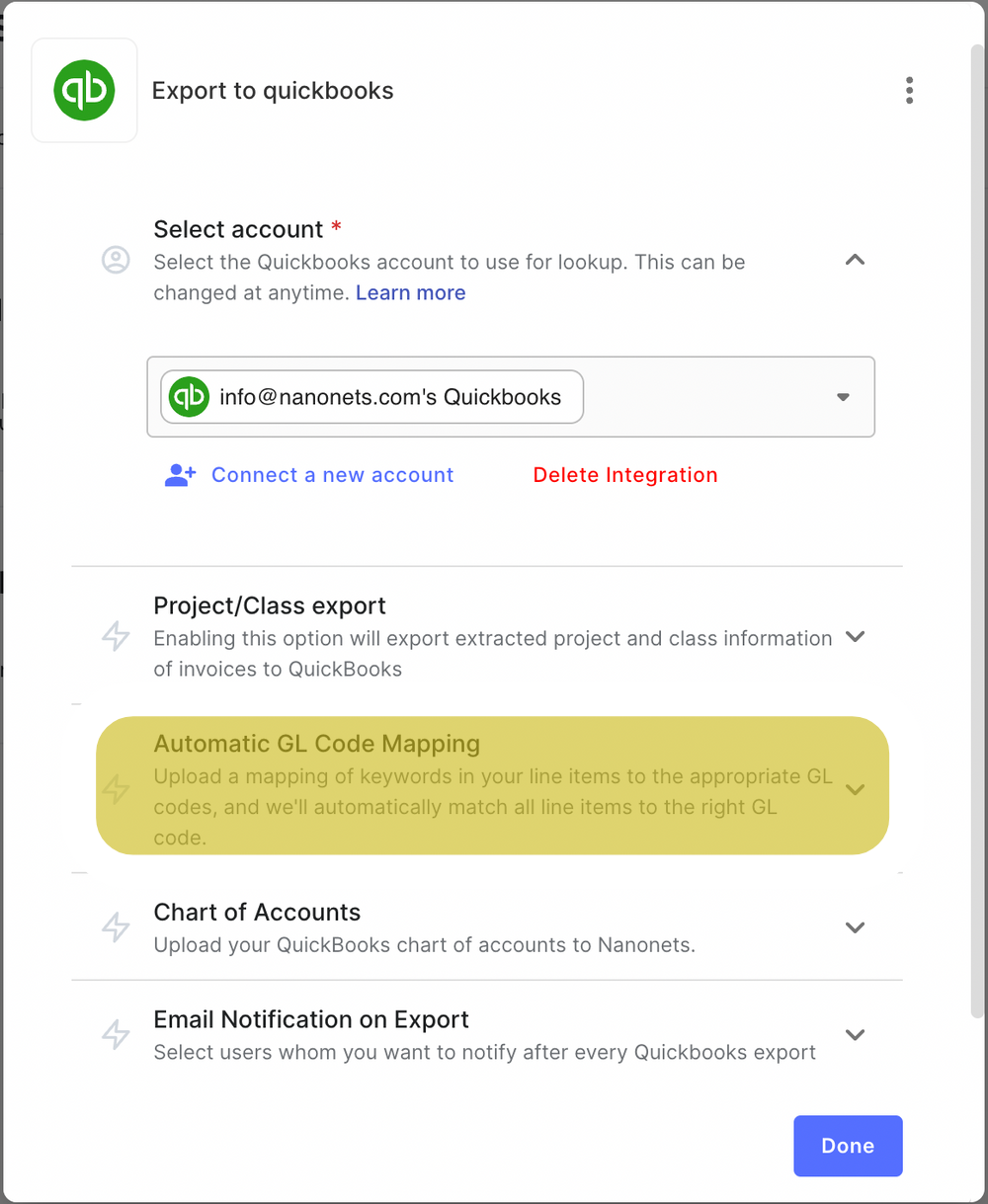

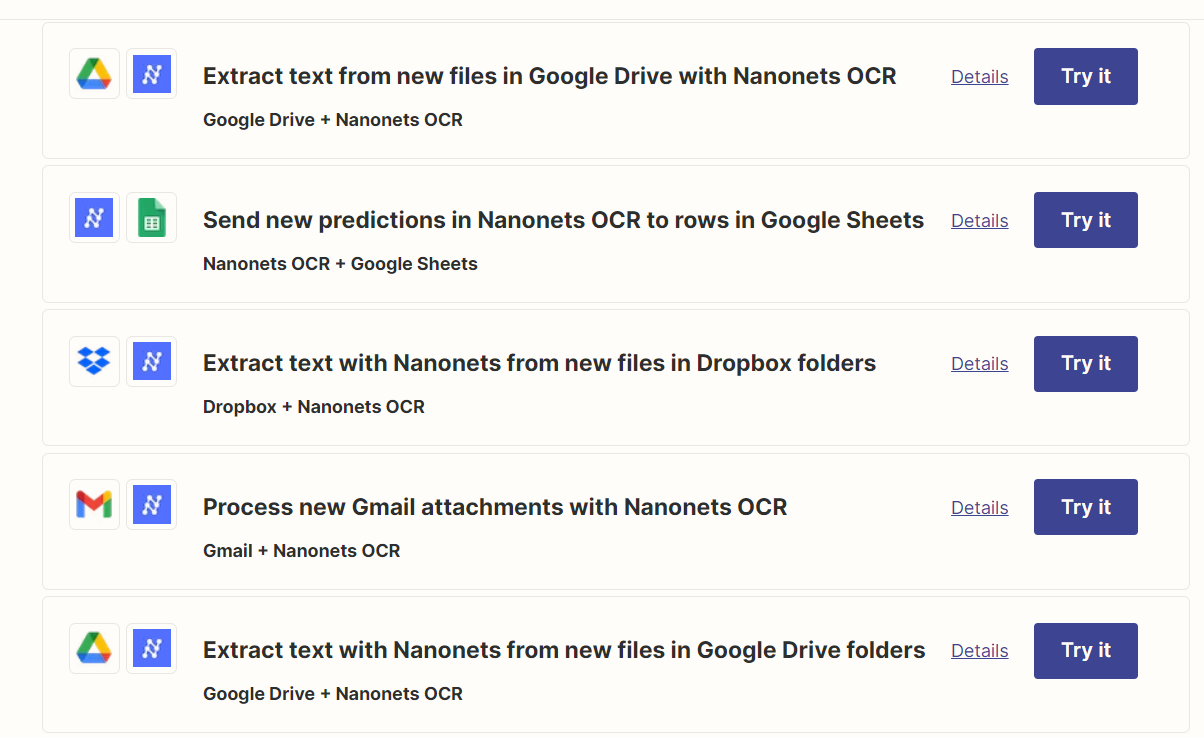

6. Ensure smooth data flow between systems

Let's say you have a form on your website where customers can submit complaints. The submitted information should automatically flow to your claims processing system. If you are a Nanonets user, you can configure Zapier integration to import and extract data from your Webflow or Shopify forms directly into your Nanonets dashboard.

This seamless data flow eliminates manual data entry, speeding processing times and reducing errors. Additionally, you will be able to act faster on complaints, creating an optimized customer experience.

7. Implement data transformation for better data quality.

Incorporate data from documents and forms in a standardized digital format for easy analysis. Clean noisy data, validate information, and enrich data with external sources.

With Nanonets, you can use our rule-based code-free workflows to automate data enhancement tasks such as date formatting, database searching, data comparison, and even removing commas or using capital letters in the data.

Final thoughts

Navigating the complex landscape of claims processing can be difficult for insurance providers. Manual processes are time-consuming, error-prone, and lack transparency and efficiency.

With the help of Nanonets' ai-OCR capabilities, insurance providers can automate and optimize their claims process. Embrace the future of claims processing with Nanonets. Increase your processing speed, reduce costs, and deliver a superior customer experience.