ethereum (eth) continued its upward trajectory on Wednesday, posting a 10% gain in 24 hours to surpass the vaunted $2,600 mark. Market watchers attribute this rise to a confluence of factors, driven primarily by anticipation of an upcoming ethereum exchange-traded fund (ETF) in the wake of the expected approval of a bitcoin ETF in the US.

In a historic move that cryptocurrency fans hope will attract more individual and institutional investors to the market, the US Securities and Exchange Commission. technology/bitcoin-etf-hopefuls-still-expect-sec-approval-despite-social-media-hack-2024-01-10/” target=”_blank” rel=”nofollow”>approved the first place bitcoin exchange-traded funds on Thursday.

ethereum ETF Rumor Sparks Strategic Moves

“There is a notable trend towards leading the ether ETF,” Alex Onufriychuk, CEO of Kaminari, noted in a Telegram message. This sentiment aligns with the prevailing belief that eth-jumps-on-bets-token-is-next-for-sec-etf-approval” target=”_blank” rel=”nofollow”>ethereumthe second largest cryptocurrency by market capitalization, would be the next candidate for an ETF after bitcoin.

To add fuel to the fire, a prominent investor, dubbed a “whale” in the crypto universe, made a strategic move by transferring 9,705 eth (nearly $23 million) from Binance to Compound. This was followed by a Tether (USDT) loan of 12 million, apparently used to accumulate even more eth. The whale subsequently executed three profitable eth transactions, generating approximately $5 million.

This decisive action signaled two things: confidence in the future of ethereum and the potential for profit-taking, which could introduce short-term volatility. Despite the risk, the whale activity reinforced positive market sentiment.

ethereum currently trading at $2,607.8 on the daily chart: TradingView.com

To further validate this optimism, ethereum network metrics saw an increase. Both network growth and token velocity saw increases, indicating increased interest from new addresses and increased token movement. These on-chain metrics paint a promising picture for the future of eth.

eth Futures Rise Amid ETF Optimism

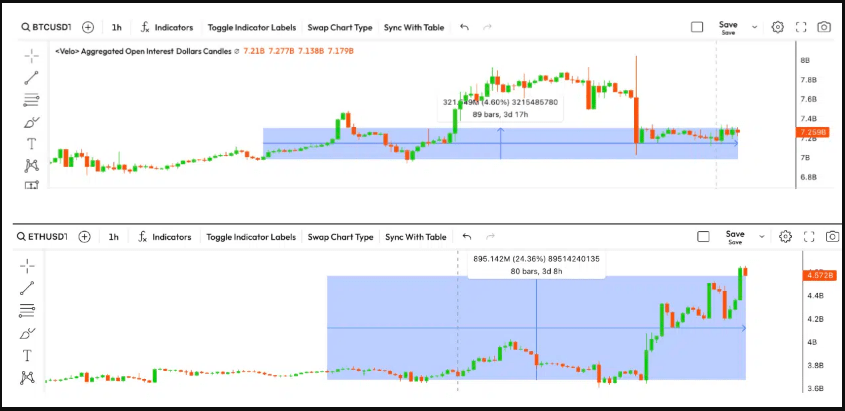

Adding to the bull case, open interest for eth futures contracts has increased by 15% in recent days, reaching $4.57 billion at the time of writing. This means more traders are entering the market and anticipating significant price gains following potential ETF approval.

ethereum vs. bitcoin Open Interest | Source: Velo Data

Cryptocurrency traders reportedly expect ethereum price to rise following a favorable ETF ruling, even though bitcoin is receiving more media attention. If this situation develops, the price of eth could soon surpass $2,600.

However, it is essential to remember that the cryptocurrency market remains volatile and unforeseen factors could still affect prices.

The timeline for approval of an ethereum ETF is uncertain and regulatory hurdles could lead to delays. Additionally, broader market conditions and news regarding ethereum development could also play a role.

Investors should carefully consider their risk tolerance and conduct extensive research before making any investment decisions, particularly in the dynamic and unpredictable world of cryptocurrencies.

Featured image from Medium

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.