Despite the recent setback in Solana's price, which saw a 10% drop to fall below the $100 mark in the first week of the new year, the overall resilience and vitality of its ecosystem remains remarkably strong. .

This pullback represents a notable pullback from its recent high of $115 on January 3, prompting market watchers to take a closer look at the factors influencing this correction.

Interestingly, while the price may have seen a temporary dip, fundamental indicators within the Solana ecosystem paint a contrasting picture of strength and growth.

Solana: Record transaction volume indicates resurgence

Transaction volumes on the Solana blockchain have increased, demonstrating increased network activity and utilization. This increase in transaction volume not only underlines the continued interest and engagement within the Solana community, but also suggests broader adoption of the platform for various decentralized applications (dApps) and financial activities.

Source: The Block

Solana Trading Volume has reached its highest level since December 2022. According to The Block Data Dashboard, transaction load recorded a solid 700% increase in just 30 days, with daily economic activity on the network surpassing $42 billion. This isn't just a blip: it's a potential sign of Solana's resurgence.

This increase suggests growing adoption in DeFi, nft, and other applications. More and more people are choosing Solana, validating its scalability and transaction processing capabilities. It could also be a vote of confidence from investors, which could boost the price of SOL and generate positive repercussions on the ecosystem.

SOL market cap currently at $41.11 billion. Chart: TradingView.com

One of the best performing cryptocurrencies in 2023 was Solana, which saw an incredible increase of around 1000%. Although most of this expansion occurred towards the end of the year, it was accompanied by an increase in network activity and a revival of Solana's DeFi sector.

Based on early data, several commentators had predicted that this upward trend would continue into the new year. SOL was trading at $103 as of December 31. By January 2, it had rapidly risen to $115.

At the time of writing, SOL was trading at $94.81, up 2.3% in the last 24 hours, but lost 7.0% of its value in the last week, Coingecko data shows .

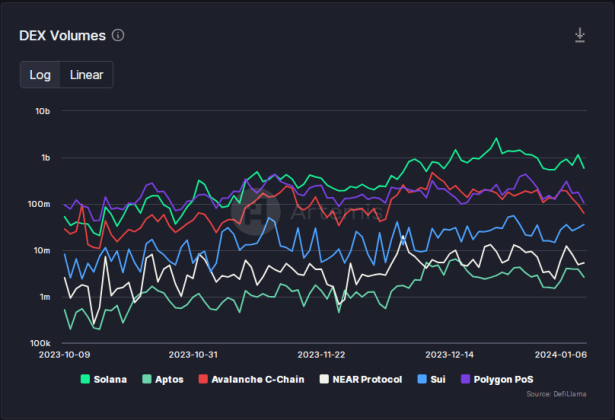

Source: Defillama

Solana DEX boom: 40% increase in transactions

Decentralized exchanges (DEXs) hosted on Solana have completed more than 40% more transactions overall, according to data from Defillama. In summary, this amounted to a total of $1.15 billion as of December 5. Solana's DEX volume was $813 million a month ago.

Starting with just 1.5 $SOL($92), this trader made $2 million in 22 days, a 21,715x profit!

This merchant saw $FOOL 5 minutes after you opened trades and spent 1 $SOL($62) to buy 43.1 million $FOOL.

Then it sold 33.34M $FOOL for $528K, and currently has 9.76M $FOOL($1.5 million) remaining,… pic.twitter.com/ByY1Tpupah

— Lookonchain (@lookonchain) December 27, 2023

Meanwhile, on social media, there has been news of substantial profits thanks to profitable Solana-based memecoin trading. Lookonchain, a blockchain analysis tool, reports that a trader who bought a memecoin made $2 million.

Starting with just 1.5 SOL, this trader made an impressive $2 million in just 22 days, which is an extraordinary profit of 21,715 times. This remarkable success story was shared on X by Lookonchain.

Featured image from Shutterstock