There has been a notable increase in transaction activity on major ethereum virtual machine (EVM) chains lately. About 95% of these transactions have inscriptions, according to blockchain analysis tool Etherscan.

Ordinal inscriptions have gained popularity as a direct means of creating non-fungible tokens (NFTs) on the blockchain by incorporating unique data into transaction call data.

Imagine small capsules, embedded within bitcoin itself, containing images, text or even videos. That's what Ordinal Inscriptions are: digital artifacts permanently recorded on the bitcoin blockchain. Each inscription sits on a single Satoshi, the smallest unit of bitcoin, creating unique and indestructible assets. Think of them as NFTs forged within the bitcoin network itself.

Decoding the enrollment drop

These inscriptions have the same durability and security as bitcoin, while offering interesting possibilities. Artists can directly upload their work, creating verifiable digital art. Limited edition items and collectibles can be minted, unlocking a new realm for digital ownership.

However, after a brief surge a few weeks ago, the growth of the enrollment protocol on networks supporting EVM smart contracts has increased. slowed down.

Share of weekly transactions driven by inscriptions. Source: Dune Analytics.

Signups continue to account for a disproportionate amount of activity on Avalanche and ethereum's Goerli testnet, according to data from dune analysis, but have since decreased on other popular Layer 2 networks such as the Polygon PoS sidechain and the BNB chain.

A recent analysis of the charts reveals a notable drop in these transactions. According to the most recent data, the highest number of registrations recorded on the Avalanche network was approximately 370,000.

As of today, the market cap of cryptocurrencies stood at $1.596 trillion. Chart: TradingView.com

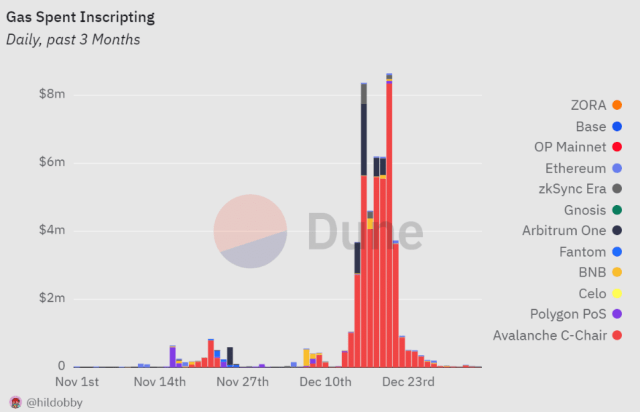

In terms of gas rates, some networks paid more than $1 million in gas costs in December, when the sign-up frenzy was at its peak. Notably, Avalanche and Arbitrum reported gas fees of over $5 million and $2 million, respectively, on December 16.

While some networks began to see gas rates which were less than $1 million, the Avalanche maintained this pattern until December 21. Gas prices fell dramatically after that, with the highest recorded gas price being approximately $16,000 at the time of this writing.

Signups accounted for 77% of Avalanche transactions over the past seven days, 67% of Goerli transactions, 10% of Base transactions, 7.5% of ZkSync Era transactions, less than 5 % of BNB Chain and OP Mainnet transactions and 1% of Polygon. PoS chain transactions.

Is the party over?

By contrast, as of mid-December, signups accounted for more than 40% of transactions on BNB Chain and Polygon PoS Chain, and between 50% and 75% of transactions on Gnosis, Arbitrum, and ZkSync Era.

The decline in enrollment activity comes after an increase in recent weeks as enrollment protocols were extended to networks that support EVM.

Following the release of native sign-up procedures in late November, there was a surge in activity resulting in transaction fees on Near, Polygon and Fantom increasing by 4,500%, 6,900%, and around 9,000%, respectively. .

This significant cut suggested a sharp drop in the contribution to network tariffs at the end of the year. It is not yet clear whether this indicates a brief lull in the popularity of EVM enrollments or their eventual demise.

Featured image from Shutterstock