Reply Listen/iStock via Getty Images

As Congress winds down saber rattling on broader healthcare reforms through 2024, Morgan Stanley has taken a more constructive view on the managed care and retail pharmacy space, primarily due to the biosimilar/GLP-1 opportunity.

However, analysts led by Erin Wright highlighted implications of rising healthcare utilization rates and cited opportunities/risks related to the upcoming 2025 Medicare Advantage advanced rate notice.

Despite cost trends seen with rising utilization rates through 2024, “election cycle risk will also be front and center,” MS analysts wrote, releasing their 2024 outlook for the health care services.

Electoral risk

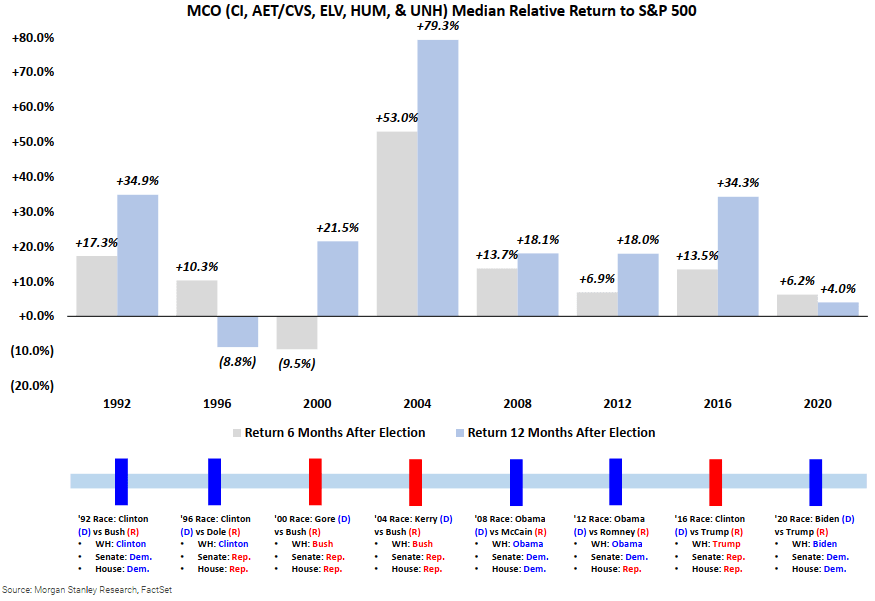

MS highlighted the sector's poor performance this year, noting that managed care organizations are down 15% while pharmacies are down 49% year to date. According to the firm, managed care organizations have historically lost an average of ~31% over the past six election cycles to a mid-March low.

However, following the vote, managed care has historically outperformed the S&P 500, leading to average relative outperformance of ~12% and ~20% over the six and 12 months following Election Day, respectively. .

Compared to previous elections, the firm cites a lack of support among lawmakers for broader health reforms, or Medicare for All. “The fact that President Biden declared his candidacy for re-election greatly reduced the risk of Medicare for All being a surplus by keeping more progressive Democrats on the sidelines,” the MS analysts added.

“While past experience tells us to avoid managed care in the US presidential election, we actually believe this will be a relatively benign cycle from a healthcare perspective,” the analysts wrote, noting that owning shares of MCO this year ahead of possible depressions “may not be a good option”. as punitive, in any case.”

GLP-1/biosimilar opportunity

The firm highlights Pharma Benefit Managers as a key MCO theme in the sector, highlighting their potential to benefit from the GLP-1 class of biosimilar and weight loss medications.

Despite regulatory hurdles, Morgan Stanley sees value and growth prospects in the PBM space. The group that acts as a middleman between health plans, pharmaceutical manufacturers and pharmacies has recently come under intense scrutiny from Congress for its role in driving up health care costs.

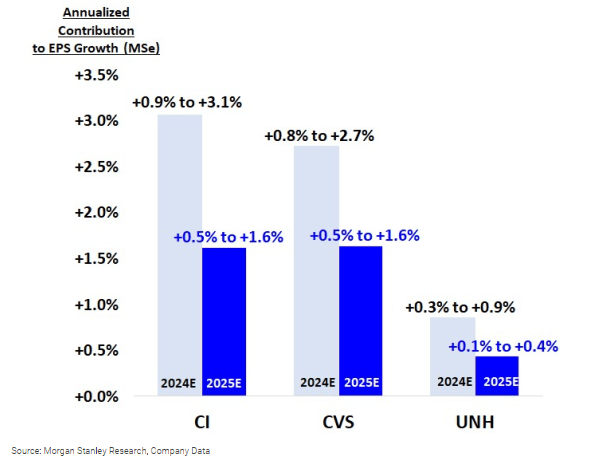

MS also projects PBM's potential to benefit from GLP-1 drugs, a new class of obesity drugs marketed by Eli Lilly (LLY) and Novo Nordisk (NVO) (OTCPK:NONOF).

According to the company, rising demand for GLP-1 may improve the 2024E and 2025E EPS of three leading PBMs, namely CVS's Caremark unit (CVS), UnitedHealth (New York Stock Exchange: UNH) OptumRx and Cigna (New York Stock Exchange:CI) Evernorth, at ~26 bp–~307 bp and ~13 bp–~163 bp, respectively.

There will be additional opportunities from the end of US market exclusivity for AbbVie's (ABBV) blockbuster arthritis drug Humira, given the $38 billion market size and upcoming biosimilars, including those with interchangeable designations. .

In January, Amgen introduced its Humira biosimilar, Amjevita, the first of many off-patent versions launched in the U.S. against the top-selling injectable this year.

Increased healthcare utilization

Additionally, Morgan Stanley pointed to rising cost trends in the MCO space after UNH said in June that the company's healthcare ratio, the portion of premiums spent on healthcare costs, will come under pressure in amid an increase in medical activity post-COVID.

While higher healthcare utilization, a key investor concern in 2023, “will remain elevated through 2024, it is encouraging that it is not getting worse, a dynamic that we will monitor but that is adequately integrated into expectations for MCOs,” the analysts said.

MA Advance Rate Notice

Commenting on the 2025 Medicare Advantage advance rate notice expected in late January or early February, analysts argued that MCOs have been preparing for a post-pandemic normalization in the rate environment.

MS estimated that the MA rate advance notice for calendar year 2025 could reach +0.2%, in line with pre-pandemic levels. The analysts also wrote that any weakness in MCO stock following the announcement will be a compelling buying opportunity.

In recent history, 2022 and 2023 saw the largest increases in final Medicare Advantage rates before the 2024 final rate stabilized.

Medicaid Redeterminations

MS believes the ongoing Medicaid eligibility reviews, which it expects to continue until at least 2024, will be among the key MCO issues to watch for next year.

Analysts maintain that commercial insurer Cigna (CI) will become a major beneficiary of the ongoing redeterminations, which resumed in April after a pandemic-era pause in recent years.

“CI does not participate in MDCD's managed care programs and MDCD's redeterminations represent a positive opportunity for its commercial/employer-sponsored plans and exchange market that is not currently included in the guidance,” the analysts wrote.

Ratings

The Bloomfield, Connecticut-based company is a key overweight for MS in its biosimilars opportunity and its minority investment in healthcare provider VillageMD, which is majority owned by Walgreens (NASDAQ: AMB). Its CI price stands at $365 per share.

However, Walgreens (WBA) has become a key underweight for MS, and its price target, adjusted to $22 from $27, reflects a weaker growth outlook for FY24. The company cites minor, macro challenges COVID-19 testing and vaccine volumes, a weaker respiratory season, and continued changes to the company's retail footprint as reasons for its bearish outlook.

Given its scale and diversification, UnitedHealth (UNH) was crowned Morgan Stanley's Top Pick in the MCO space. Citing its growth prospects and diversified business model, the firm raised UNH's price target to $618 from $579 per share with an Overweight rating.

Other MCOs included on the list include Centene (CNC), CVS Health (CVS), Elevance Health (ELV), Humana (HUM), Molina Healthcare (MOH), Alignment Healthcare (ALHC), and Clover Health Investments (CLOV).