There was a brief, beautiful moment over a few months in 2021 when it felt like robotic investing might be immune to broader market forces. We all fundamentally and implicitly understood that this was not the case, but it was a good time nonetheless.

The truth is that there was a bit of isolation there. There was still enough forward momentum to keep sailing for a bit, even as headwinds grew. But it all comes down to Earth eventually. Now that we are about a month away from 2023, we can begin to assess the damage. looking at these charts compiled by Crunchbasethings look pretty raw.

Image Credits: crunchbase

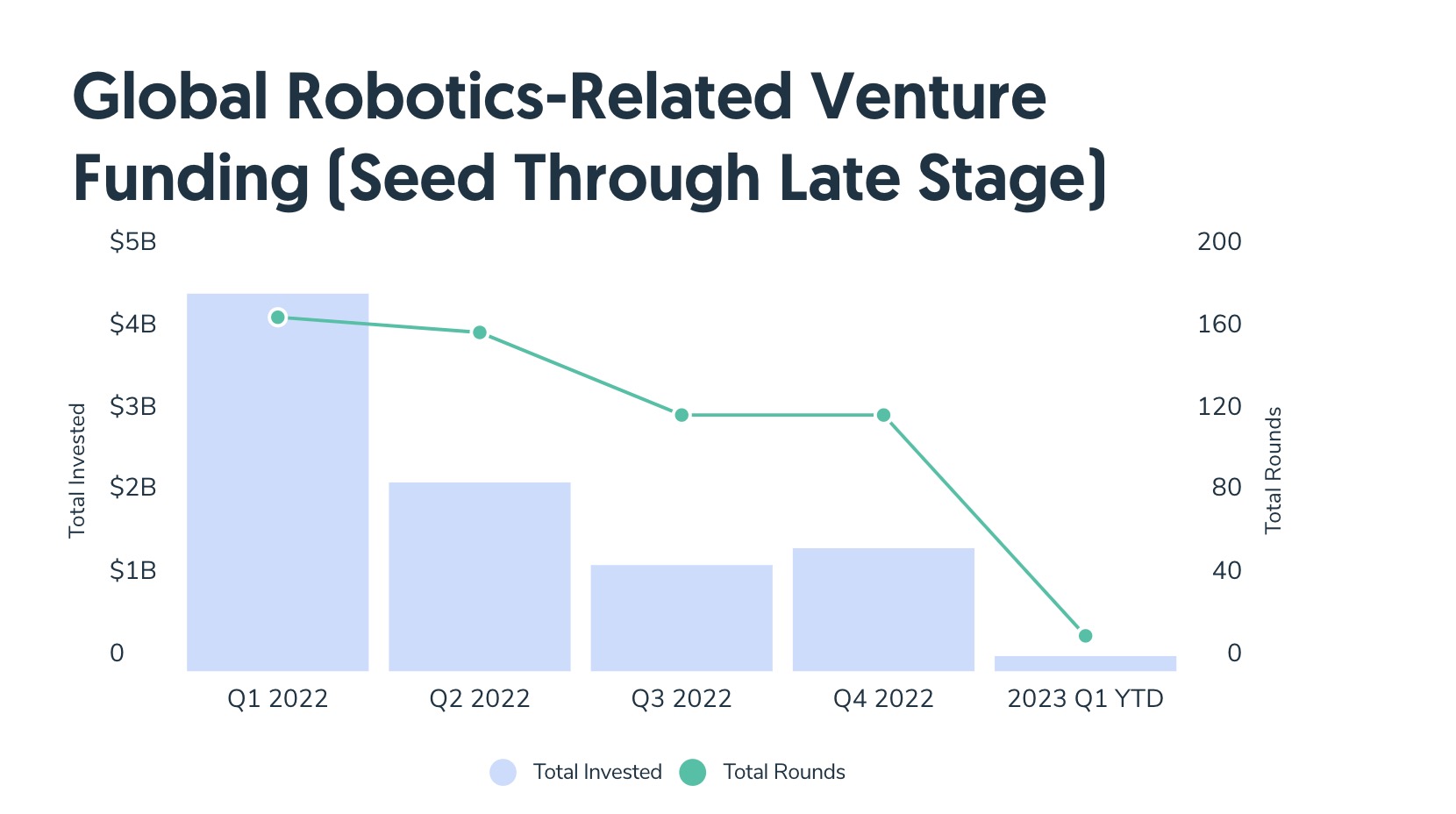

A couple of front line points:

- 2022 was the second worst year for robotics investments in the last five years.

- The numbers have been on a fairly steady decline for the past five quarters.

According to the first point, 2020 was the lowest. It was also an anomaly, with the global pandemic. Uncertainty does not generate confidence in investment. The full-year figure is all the more surprising given that investor confidence extended into early last year. Things really started to slow down in the second quarter. A cursory look at the bar chart might suggest that 2021 is an anomaly. Yes and no. Yes, in terms of acceleration. No, in terms of long-term vision. The question is not if those bars will start to grow year after year, but when.

Image Credits: crunchbase

The same thing that paralyzed investments in 2020 accelerated them the following year. Even as things reopened, jobs were getting harder to fill and businesses across the board were in a desperate effort to automate. As nice as it is, we’re not quite ready to classify automation and robotics as “recession-proof” yet. However, I suspect that those who control the money strings fundamentally understand that these downtrends are more a product of the macro environment than something specific to robotics.

However, for some early-stage startups, that’s cold comfort. Many tracks were drastically shortened this year. Solace could come at some point, but in many cases decisive action must be taken for those who suddenly find themselves unable to close a round that might have felt like a foregone conclusion 12 months ago.

Given the choice between being acquired and going out of business that some will inevitably face, M&A activity seems likely to skyrocket. Sure there’s less money floating around, but few can turn down a good clearance sale. In some cases, that will help strengthen products and portfolios.

Anecdotally, I see investments pick up throughout the year, but that seems to be part of the natural cycle of companies waiting until after the holidays to announce. A proper bounce, on the other hand, seems inevitable, but only those with high-powered crystal balls can accurately tell when.