Stock markets started the day in the red after the latest corporate earnings reports from some of the world’s biggest firms, including Microsoft. The tech giant’s recent conference call was seen as disappointing, and earnings from firms including Boeing, Texas Instruments and 3M were also lackluster. Gold and silver prices fell between 0.43% and 0.72% on Wednesday, and the cryptocurrency economy fell 2.79% against the US dollar in the last 24 hours.

US recession concerns rise as corporate earnings disappoint

After a bullish couple of weeks, stocks, precious metals, and cryptocurrencies fell on January 25, 2023. As investors waited for the upcoming US Federal Reserve meeting, the state of the US economy. The US showed great weakness. earnings reports Microsoft, Pacific Union, Texas Instrumentsand others indicated Wednesday that the economy was not improving, adding to lingering concerns about a possible US recession.

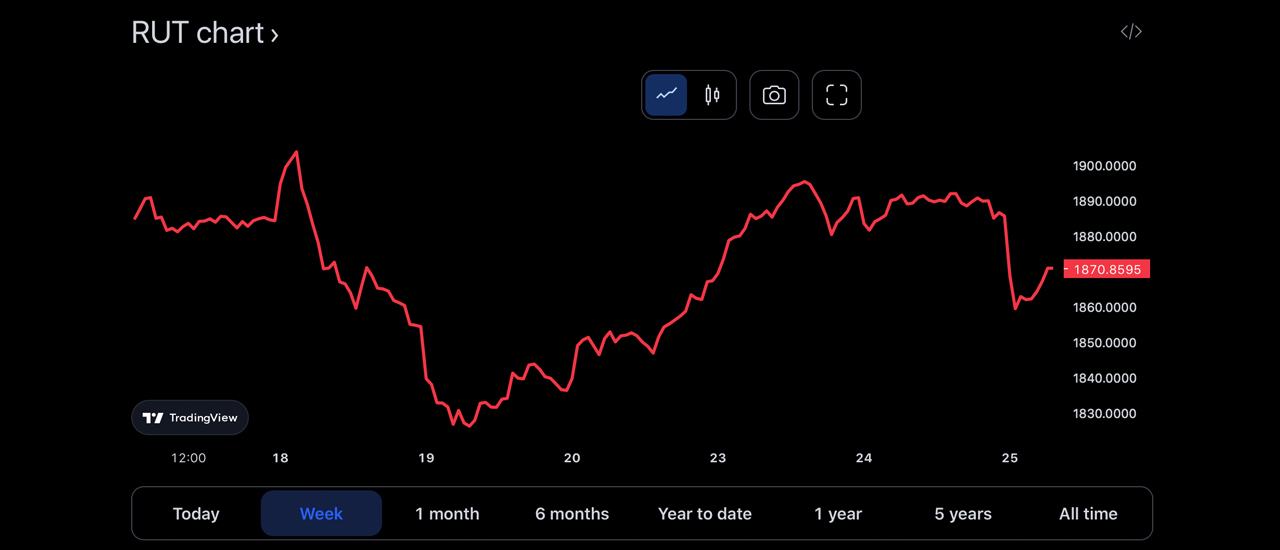

On Wednesday morning through afternoon, the four benchmark US stock indices: the Dow Jones Industrial Average (DJIA), the S&P 500 (SPX), the Nasdaq Composite (IXIC) and the Russell 2000 (RUT) , all fell between 1% and 2.05%. In addition to lackluster earnings reports from some of the country’s largest companies, US industrial production fell roughly 0.7% in December 2022.

Industrial production also fell in November 2022, falling 0.6% year-on-year. Another surprise was the fact that retail sales during the holiday season were also down in November and December 2022. Data indicates that retail sales fell 1.1% last month And, while the holidays were in full effect, it was the biggest drop of the year.

Precious metals and crypto assets continue to fall amid economic uncertainty

Precious metals such as gold, silver and platinum have also posted losses against the US dollar in the last 24 hours. He New York Spot Price on January 25, 2023, indicates gold is trading at $1,931.70 per troy ounce, down 0.43%. An ounce of silver is down 0.72% and is trading at $23.59 per unit on Wednesday at 11 am ET. Kenneth Broux, a strategist at Société Générale, says rising tensions in Ukraine, low corporate profits and recession fears are weighing on investors.

“The market is definitely worried about slowing earnings growth, especially in technology, so there has been a sense that the market wants to continue to sell technology and dollars,” Broux said. commented on Wednesday. “But a big tail risk now is what happens in Ukraine, if there is an escalation in the conflict and Europe gets drawn into the conflict,” the strategist added.

The cryptocurrency economy sits just above the $1 trillion mark at $1,019,712,653,474, according to metrics recorded Wednesday. Crypto markets are down 2.79% as a whole, and Bitcoin (BTC) has lost 1.49% on Wednesday. The second leading cryptocurrency, Ethereum (ETH)it has lost even more, with 4.66% erased from its value since Tuesday.

Global cryptocurrency trade volumes were above $100 billion per day in the region not too long ago, but today, global trade volume is around $55.98 billion across the entire cryptocurrency economy. . Despite Wednesday’s pullback, precious metals, stocks, and cryptocurrency assets are still doing much better than they were last month. As of 11:30am ET on Wednesday, gold is higher against the US dollar but is still 0.2% lower and silver is also higher and is currently 0.13% higher.

What do you think the future holds for markets and the economy? Share your opinion in the comments.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.