Image Source: Getty Images

He Alternative Investment Market (AIM) is a submarket of the main London stock exchange. The index houses many small-cap components with high-growth prospects. So here are two penny stocks that I have on my watch list that I think have the potential to grow my money exponentially.

1.Chocolate Hotel

After its share price fell as much as 75% last year, Hotel Chocolate Stocks in (LSE:HOTC) may seem like an odd choice, especially with a recession on the cards. However, I do believe that there are key catalysts that the bears have ruled out.

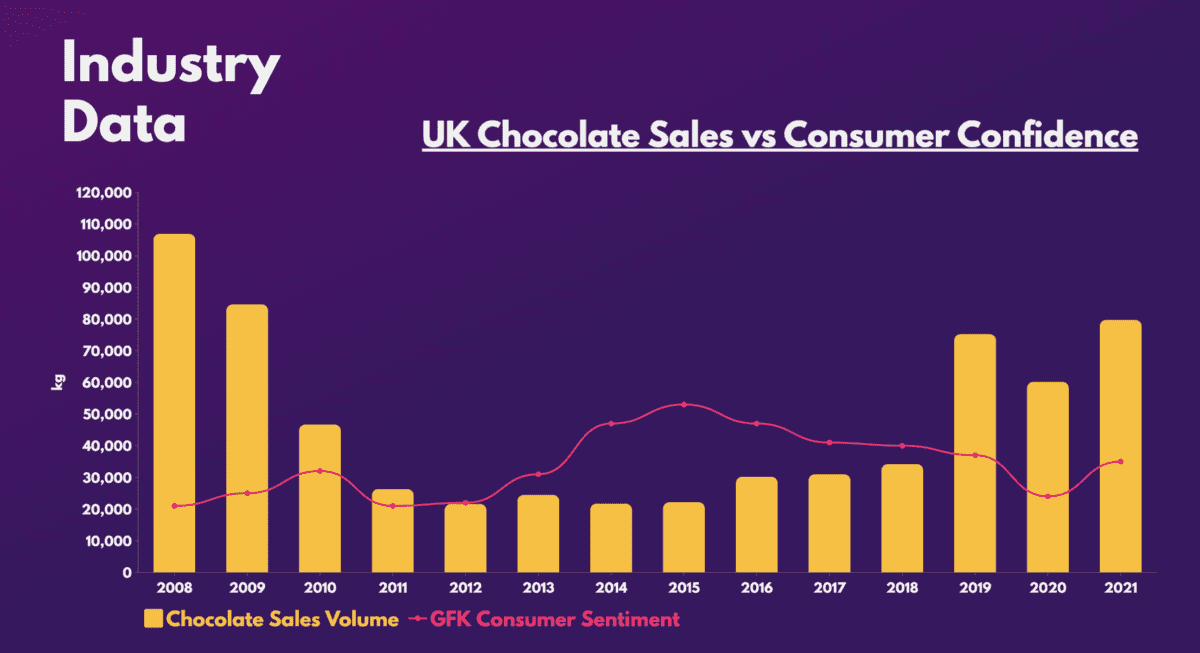

The first is consumer behavior during a recession. It is interesting to note that chocolate sales have an inverse relationship with consumer confidence. This can be attributed to the lipstick effect: the behavior of indulging in little luxuries when there is economic uncertainty. This was evident in their latest semi-annual update, where UK sales increased by 7%.

Still, the company can’t stop its total revenue from falling 9% due to weak international supply, as it always underperforms abroad. Even so, penny stocks are determined to try again in Japan. Only this time, it’s doing it with much less capital and more expertise, as it partners with local conglomerate Eat Creator.

More lucratively, the stock is currently trading at a decent value with a great balance sheet with no debt. Its current valuation isn’t cheap by any means, but if the chocolatier achieves its target of a 20% EBITDA margin for FY25, starting a position now could present great upside potential. After all, broker Leberium rates the shares a ‘buy’ with a £3.00 price target.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Sales Ratio (P/S) | 1.2 | 0.5 |

| Price-to-book (P/B) ratio | 3.0 | 1.0 |

In fact, if you had bought the stock when I first recommended it in late November, it would have gone up 35%. So I don’t want to miss this time, and I plan to start a small position soon.

2. Concurrent Technologies

Like many other technology-related companies in 2022, stocks in Concurrent Technologies (LSE:CNC) suffered a recession. Fortunately, however, its decline was not as drastic as many, due to its customer base (aeronautics, defense and telecommunications), which is more insulated from economic downturns.

In its latest business update, the company mentioned that it expects its 2022 revenue to beat consensus (£16m) by 10%, with pre-tax profit as expected (£0.1m). And with the semiconductor industry seemingly bottoming out, a rally could be on the cards, with Concurrent standing to benefit.

The company ended last year with the largest order book in its history, as order intake increased by more than 25%. As such, the board expects to see significant revenue growth in 2023 as it plans to increase its production capacity.

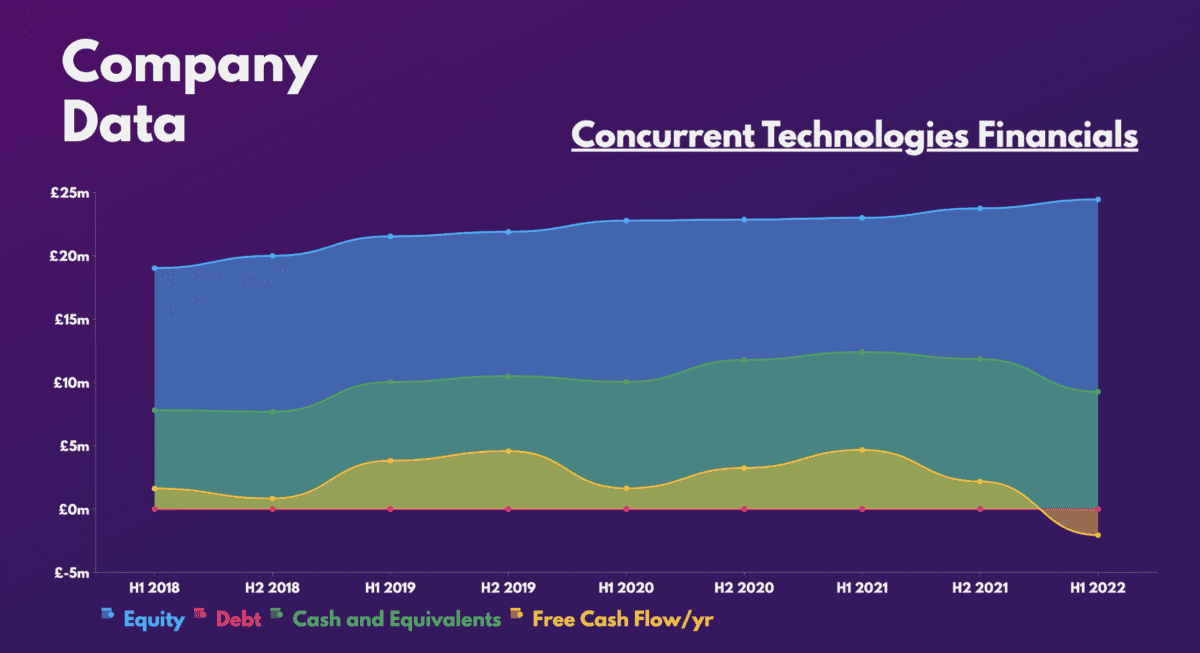

However, Concurrent’s investments in components, R&D and upgrading its systems to alleviate supply shortages in 2022 saw its free cash flow fall. As a result, its 3.4% dividend yield will not be paid in the future as the AIM stalwart seeks to recoup its capital. But with a pristine balance sheet, you certainly have the right foundation to boost your free cash flow.

The penny stock isn’t exactly the cheapest based on its current multiples, which is something I’m wary of. That being said, its long-term growth still appeals to me to start a small position given its upside potential.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Earnings Ratio (P/E) | 30.0 | 33.9 |

| Price-Sales Ratio (P/S) | 3.0 | 1.1 |

| Price-to-book (P/B) ratio | 23 | 1.1 |

| Forward Price to Earnings (P/E) Ratio | 40.9 | 25.3 |