The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

bitcoin has seen a slight reversal in its current rally during the final months of 2023. However, this price fluctuation may suggest an upcoming bull market as the asset finds new backers.

Throughout its history, bitcoin has been a wildly fluctuating asset. In the nearly 15 years since the Genesis Block was mined, its highest valuations have always come as a result of dramatic spikes, and the decline from these highs has always been just as steep. However, it has always shown a strange tendency to end up in a better situation once the dust settles. This volatile nature has even been seen as positive in many ways, as it reinforces a central truth for bitcoin: it is ultimately a currency, with a new vision for how economic relationships in society should operate. bitcoin has gained a lot from those who want to treat it as a pure investment asset, but these people cannot form the heart of the community.

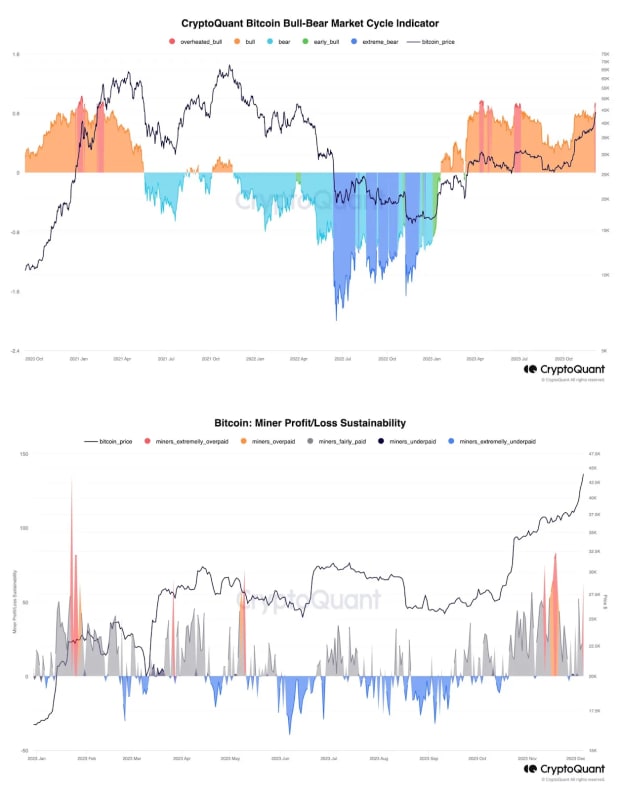

All of this is to say, bitcoin prices. bitcoin-price-sell-off-continues-but-data-highlights-need-for-healthy-correction”>fell on December 11 after a prolonged bull market that lasted several months. Generally driven by positive rumors surrounding a bitcoin ETF gaining federal regulatory approval, the price continued to rise despite setbacks such as the CEO change at Binance, the industry's largest exchange. Despite the appearance that this new rally could withstand shocks that would have been significant even a year earlier, its invincibility could not last as the price fell almost 6% from midnight Sunday to the time of writing. As the price hovers around the $41,000 range, one development worth noting is the apparent lack of fear in all corners of the bitcoin world.

bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Although it may seem pretty standard for die-hard Bitcoiners to view every price drop as a “healthy correction” or a cooldown for an “overheated” market, even more traditional financial media outlets like Barron have bitcoin–ethereum-price-crypto-market-today-80435362″>reclaimed that “tea leaves in crypto derivatives still point to bullish animal spirits.” Speaking primarily of a number of potential catalysts, the estimated weekly circulation seemed to indicate only reasons why this setback is minor. In particular, he quoted FxPro analyst Alex Kuptsikevich as stating: “A wave of profit-taking hit the cryptocurrency market on Monday morning… we saw a massive outflow of long positions with low liquidity… Strong demand for risk assets in traditional markets suggests that the market will attempt to return to its previous growth trajectory.”

These particular long positions are at the center of the recent recession. After months of success, indirect investors showed particular interest in risky investments. bitcoin-bears-strike-333-crypto-longs-squeezed/”>bets When it comes to bitcoin: These investors were more eager to initiate futures contracts in heavily leveraged positions. Although bets like this would be easier to set up and make money without a larger initial capital, they would be automatically liquidated if bitcoin were to suddenly drop. A sudden drop in price could quickly erase some $330 million of these bets, a figure that bitcoin-ether-drop-spurs-500m-in-liquidations-but-btc-entering-never-seen-before-era/”>swollen to $500 million the next day. These leveraged positions appear to be the biggest victims of the price decline so far.

In other words, as analysts were quick to point out, the market was too hot. A series of bitcoin-price-sell-off-continues-but-data-highlights-need-for-healthy-correction”>figures Add weight to the claim that bitcoin's success has encouraged these risky bets: Not only did the bull market enter historically unstable rates for the first time since before the bull market, but other factors like mining difficulty serve as a canary in the coal mine. with the next bitcoin-halving-is-poised-to-unleash-darwinism-on-miners/”>reduce by half Becoming more and more imminent, miners are not in a position to expect a continuous scenario where mining rewards increase faster than mining difficulty. But that is exactly the scenario that has been developing.

Thus, although some experts have crypto-trader-warns-bitcoin-correction-could-be-a-test-dump-says-btc-may-witness-slow-grind-down/”>reclaimed

Last weeks technology/us-bitcoin-etf-issuer-talks-with-sec-have-advanced-key-details-sources-2023-12-07/”>rumors that major ETF applicants were on the verge of a breakthrough in their negotiations with the SEC have turned into new negotiations: BlackRock in particular has expanded a new bitcoin-etf-now-invites-participation-from-wall-street-banks/”>invitation for Wall Street's biggest banks to get into action. BlackRock requested a change in the ETF protocol of its proposals, allowing certain authorized participants to use cash instead of bitcoins to invest. Considering that some large banks are prohibited from directly owning bitcoin or other digital assets, this change directly opens the door to some of the biggest players in the industry. An offer like this seems to further suggest that BlackRock's talks with the SEC have stabilized to a new degree.

Additionally, Google has also updated its advertising policies, quietly making changes to a platform that has historically had high skepticism toward bitcoin-related products. With certain caveats, Google will now allow advertising of “Cryptocurrency Coin Trusts” to users in the United States, specifically stating that financial assets representing real digital currency are fair game. In addition to this, Google has even relaxed its enforcement strategy for violations of this type, turning the immediate suspension into a 7-day warning. Surely changes like this seem to suggest that the search engine giant is also awaiting approval soon.

In other words, this setback is just a natural part of bitcoin's life cycle, and bitcoiners appreciate it. Sometimes the currency's runaway success attracts newcomers who don't fully understand that bitcoin's volatility cuts both ways. Traders saw overleveraged positions as a cheap way to potentially make large sums of cash thanks to the rally in bitcoin prices, and now a temporary setback has caused hundreds of millions to evaporate. But this is nothing new. Slowdown phases like this prevent the market from growing too unsustainably for too long and ensure that anyone who is interested in bitcoin for a long time will appreciate more than a quick profit opportunity. bitcoin's capacity for meteoric rise is what draws people into the fold, and meteoric falls are what tempers their expectations. Through all of these moves, bitcoin is only getting stronger.