bitcoin (btc) rallied above $41,000 at the December 13 Wall Street open as eyes focused on the US Federal Reserve.

The exceeding of the PPI target occurs hours before the Fed's rate movement

Data from Cointelegraph Markets Pro and TradingView showed that btc price strength is gaining momentum in the latest US macroeconomic data releases.

November Producer Price Index (PPI) print was below expectations, further reinforcing the existing narrative of declining inflation. He Consumer Price Index (CPI) printalthough less encouraging, it did not cause new pain for risk assets.

“This is the lowest PPI inflation reading since December 2021,” commercial resource The Kobeissi Letter wrote partly from a reaction on X (formerly Twitter).

“Since the last Federal Reserve meeting, we have seen multiple favorable inflation numbers. “All eyes are on the Federal Reserve today and a possible sign of a ‘Federal Pivot.’”

Kobeissi referred to the main macroeconomic event of the week, the meeting of the Federal Open Market Committee (FOMC) and the decision on changes in interest rates. The decision will be made at 2:00 p.m. ET, and Federal Reserve Chairman Jerome Powell will hold a press conference at 2:30 p.m.

Both events may cause temporary volatility in cryptocurrencies and beyond, while bitcoin itself's reactions to the macro data remained muted.

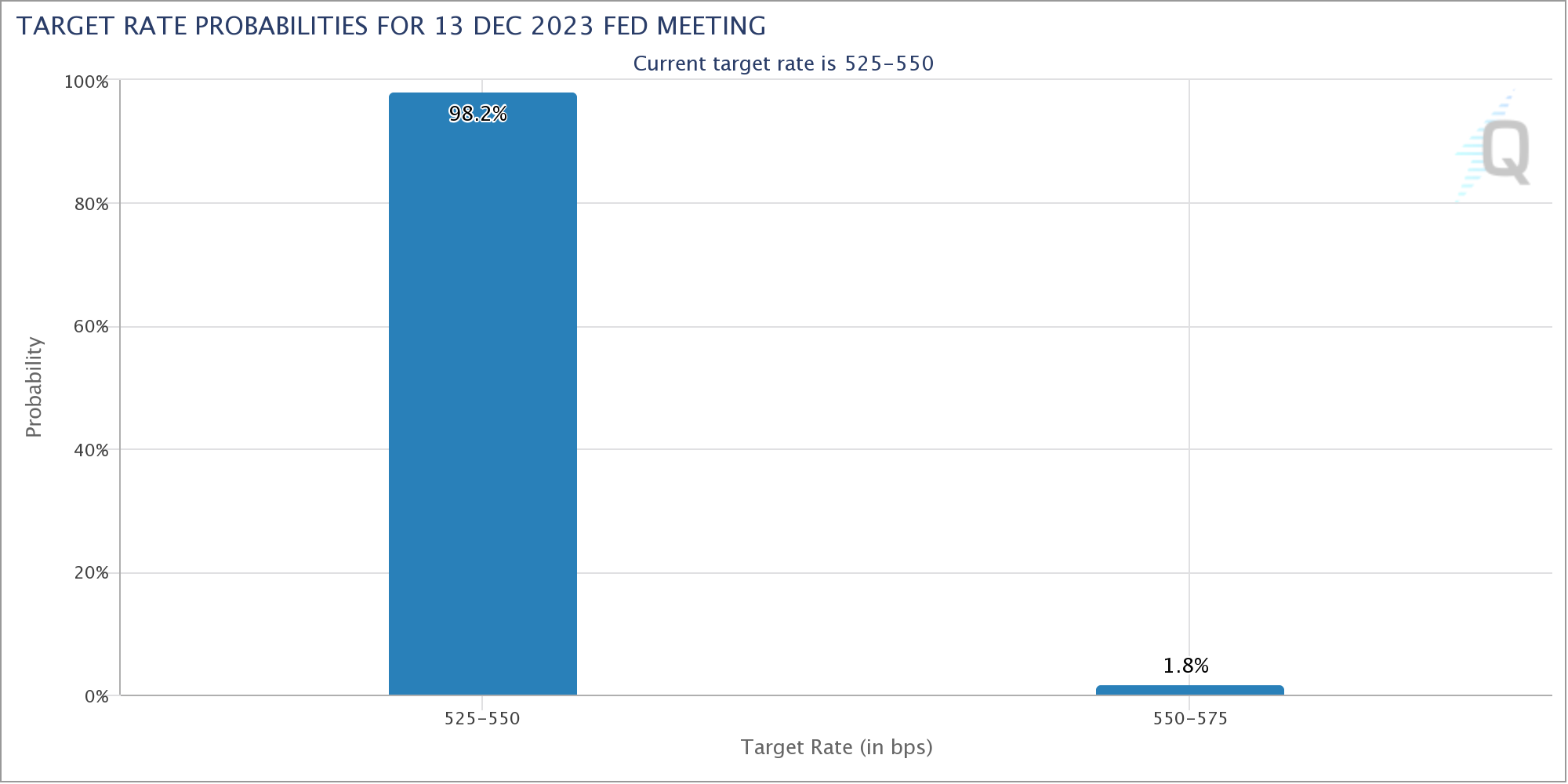

According to data from CME Group FedWatch ToolAt the time of writing, markets remained convinced that no rate changes would occur as a result of the FOMC meeting.

Trader Eyes Key btc Price Levels for 'Stock'

Meanwhile, btc price action on a low time frame lacked a clear trend.

Related: bitcoin 'sodlers' dump $4 billion in two days as btc sales hit 18-month high

Existing support and resistance levels held, with popular trader Jelle also reiterating the importance of the $48,000 overhead.

“While the lower timeframes appear choppy, bitcoin appears to be shifting the mid-level. $48,000 remains the main level to overcome, after which price discovery is within reach,” he stated. said X subscribers in the day.

The day's analysis contained a prediction of further sideways behavior, with Jelle betting on “most of the downside.” having already passed for bitcoin.

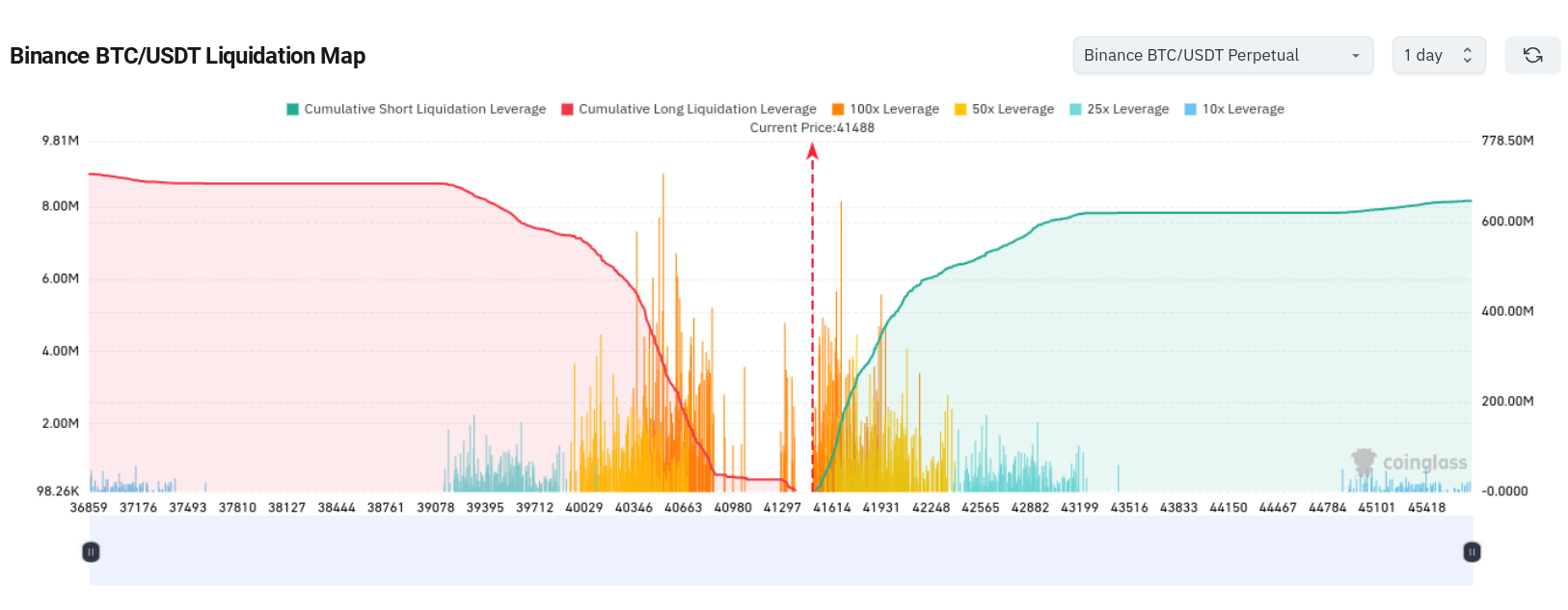

Looking at the liquidation levels, trader Daan crypto Trades noted an increase in leveraged bets in an area where the spot price was now clearing.

“Large liquidation pools are being built as you cut sideways,” he said. wrote together with data from the statistical resource glass coin.

“Most notable: $40,500 and $41,400. Expect some action around those levels.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.