Join our Telegram channel to stay up to date on breaking news coverage

Explore the latest news on the 5 best altcoins to invest in on December 7, including Algorand, Monero, and bitcoin ETF Token. Discover its growth prospects, market analysis and distinctive attributes, allowing you to confidently navigate the cryptocurrency market.

The current state of the bitcoin-surges-to-44000-for-the-first-time-since-april-2022-cnbc-crypto-world.html”>cryptocurrency market reflects several key metrics. The global crypto market capitalization currently stands at $1.58 trillion, indicating a slight intraday decline of 1.28%.

In the last 24 hours, the total volume of the crypto market amounted to $66.17 billion, which is a notable drop of 29.14%. Specifically within the decentralized finance (DeFi) sector, the volume is recorded at $6.65 billion, which represents approximately 10.06% of the total crypto market volume.

The 5 best altcoins to invest in right now

bitcoin, a dominant player in the cryptocurrency space, currently has a market dominance of 53.49%, indicating a slight decline of 0.43% on the day. These metrics show fluctuations and changing dynamics within the cryptocurrency landscape.

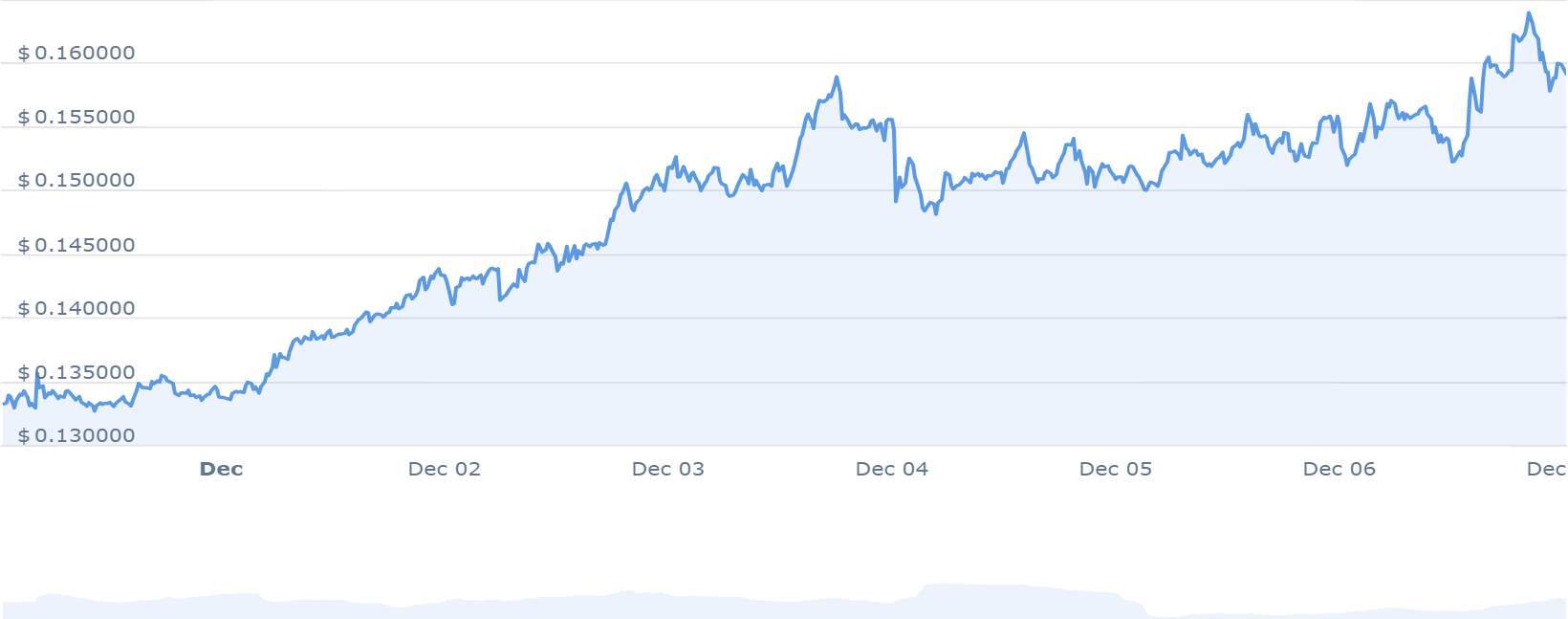

1. Algorand (SOMETHING)

Quantoz Payments recently obtained registration of EURD as a Community trademark through the European Union Intellectual Property Office (EUIPO). At the same time, the company issued 500,000 EURD in Algorand under its Dutch e-money license. This has positioned EURD as the largest euro-backed token on Algorand, as reported by DeFillama.

Furthermore, emphasis is placed on the expected rapid increase in EURD circulation in the coming months. This increase is expected due to the extension of its electronic money institution (EMI) license to other countries in the European Economic Area (EEA). As such, it will help expand the accessibility of your services.

Quantoz Payments strives for transparency by allowing users to track the amount of EURD in circulation through AlgoExplorer. Maintaining user privacy remains a priority, ensuring that users maintain control over the information they share.

He #BuildABull The grand finale demo day is one week away!

Meet @Compxlabswinner of DeFi track sponsored by @BuildOnCircle.

CompX is a comprehensive DeFi platform that provides a complete set of DeFi tools under one roof.

See the project: https://t.co/BNh3rUTdxZ pic.twitter.com/3mKQlpxrxI

– Algorand Developers (@algodevs) December 7, 2023

Furthermore, recent performance metrics reflect bullish sentiment. The token is trading above the 200-day simple moving average. Additionally, it experienced 18 positive trading days out of the last 30 (60%). Additionally, it is trading near the cycle high and has high liquidity based on its market capitalization.

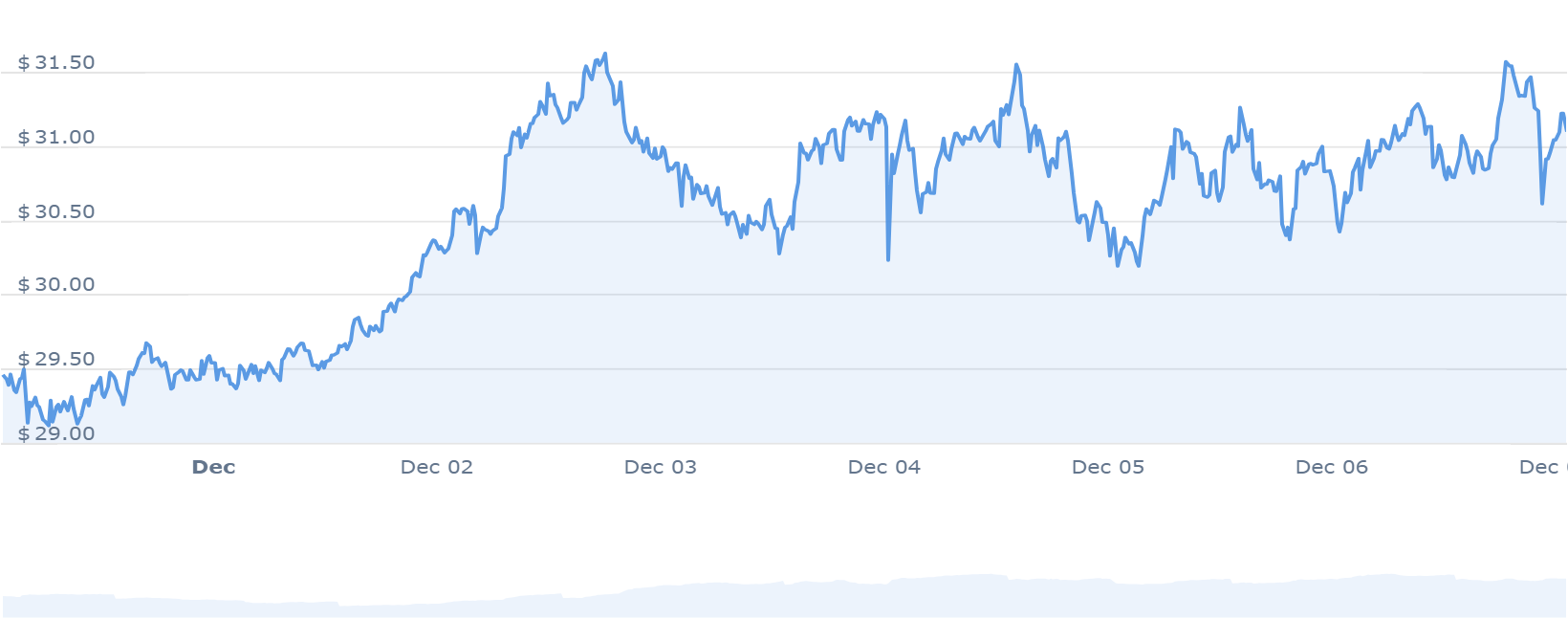

2.Monero (XMR)

Monero (XMR) has seen a 22% price rise over the past year, trading above its 200-day simple moving average. This positive trend is accompanied by 17 green days in the last 30 days, which represents a 57% success rate in positive trading sessions. The cryptocurrency has high liquidity, as demonstrated by its significant market capitalization.

According to the latest data, Monero is valued at $174.06, with a 24-hour trading volume of $145.24 million and a market capitalization of $3.20 billion. Its market dominance is 0.20%, indicating a notable presence in the digital currency landscape. The recent increase of 1.79% in the last 24 hours indicates a continued upward trajectory.

Historically, Monero reached its highest price of $593.42 on January 9, 2018, and its lowest point of $0.212967 on January 14, 2015. Notably, the cryptocurrency's lowest price since its all-time high It was $26.23. On the contrary, its highest price after that low was $514.43.

Current projections suggest bullish sentiment regarding Monero's price trajectory. This is complemented by a fear and greed index showing a value of 72, indicating a state of greed among investors.

We are pleased to announce that CLI v0.18.3.1 'Fluorine Fermi' has been released!https://t.co/PIc629rHWK

– Monero (XMR) (@monero) October 10, 2023

Monero has a circulating supply of 18.37 million XMR out of a maximum supply of 18.20 million XMR. Its annual supply inflation rate is 0.89%, which translates to the creation of 162,338 XMR last year. Within the crypto sectors, Monero is ranked 5th in proof-of-work coins, 1st in privacy coins, and 16th in the layer 1 sector.

3. Gnosis (GNO)

Gnosis has seen a notable increase in its price, marking a 125% increase over the past year. This increase has positioned it ahead of 77% of the top 100 crypto assets in the same period. Notably, it is trading above its 200-day simple moving average, a trend indicator used in technical analysis.

Over the past month, Gnosis has seen positive momentum, with 15 out of 30 days showing gains, representing a 50% positive trading trend. Its liquidity appears strong, as indicated by its market capitalization.

Gnosis historical data reveals its peak price on November 8, 2021, reaching an all-time high of $644.58. On the contrary, its all-time low of $7.22 was recorded on March 13, 2020. Notably, the price has fluctuated since its peak, reaching a cycle low of $77.08 and a cycle high of 212, 88 dollars.

Hello wise validators!

Join us for Validator Meetup #11!

We'll delve into the next Dencun update, discuss the latest Gnosis Chain news, and address any questions you may have.

December 21, 2023

4 pm UTC / 5 pm CEThttps://t.co/jS3Rl4KTc8– Gnosis Chain (@gnosischain) December 6, 2023

The current sentiment around Gnosis is bullish and aligns with a fear and greed index indicating a level of 72 (greed). In terms of supply dynamics, Gnosis has a circulating supply of 2.59 million GNO out of a maximum supply of 3.00 million GNO, with an annual inflation rate of 0.39%. This is equivalent to the creation of 10,001 GNOs in the last year.

4. Zcash (ZEC)

Gnosis, a major cryptocurrency, has seen notable changes in its price dynamics over the past year. In this period, its price increased by 125%, outperforming approximately 77% of the top 100 crypto assets. This increase puts it in a favorable position, trading above the 200-day simple moving average. Furthermore, it experienced 15 positive trading days in the last 30, representing a 50% positive streak.

In terms of market performance, Gnosis exhibits high liquidity, as evidenced by its substantial market capitalization. Currently valued at $518.24 million, Gnosis maintains a 0.03% market dominance.

Reflecting on its price history, Gnosis reached its highest price of $644.58 on November 8, 2021. Meanwhile, its lowest point was $7.22 on March 13, 2020. Notably, the subsequent low The all-time high (ATH) was set at $77.08, with the subsequent cycle high reaching $212.88. This price movement reflects fluctuations within its performance in the market.

Lock time: 75 seconds

Maximum supply: 21,000,000 ZEC

Next halving: ~November 2024

Average Transaction Fee: 0.0001 ZEC

Privacy: Halo 2 zk-SNARK (no trusted configuration)https://t.co/Rkh7jgigff

— Zcash (@zcash) December 5, 2023

The current inflation rate is 0.39% annually, which generated 10,001 GNOs last year. Gnosis holds an important position with a circulating supply of 2.59 million GNO out of a maximum supply of 3.00 million GNO. Furthermore, it is ranked 14th in the DeFi coin sector and 29th in the ethereum token sector (ERC20). The sentiment surrounding Gnosis is leaning towards a bullish projection. This is accompanied by a fear and greed index reading of 72, indicating a state of greed in the market.

5. bitcoin ETF Token (BTCETF)

He bitcoin ETF Token has emerged as an intriguing cryptocurrency company, attracting the attention of investors. This project aims to provide a consolidated investment avenue through a single token, aligning with the possible approval of a bitcoin Exchange Traded Fund (ETF).

The main objective of this initiative revolves around anticipating the approval of a bitcoin ETF. The BTCETF token distinguishes itself within the market by emphasizing its alignment with this approval process. It anticipates potentially higher returns due to its comparatively smaller market capitalization and its linkage to the ETF approval scenario.

Industry experts have suggested that approving a bitcoin ETF could significantly increase the value of bitcoin, estimated at 1 to 3 times its current price. The BTCETF token is uniquely positioned by emphasizing its connection to this fundamental ETF approval process.

Next Block Expo discussions revealed deep insights into bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoinpsychology, the cyclical impact of the halving and the potential #ETF approval.

Estimated revenue between 10,000 and 12,000 million dollars #BitcoinETF generates great enthusiasm in the market.

As bitcoin Halving and ETF Prospects Dominate… pic.twitter.com/xxdvj7qjbL

– BTCETF_Token (@BTCETF_Token) December 6, 2023

Regarding its financial situation, the project has successfully raised $1,954,712 of its funding goal of $2,498,109. This increase in investor interest indicates growing confidence and curiosity in the bitcoin ETF Token as a possible investment opportunity in the cryptocurrency domain.

Visit bitcoin ETF Token Presale.

Read more

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage