There is a reason centralized exchanges have dominated despite being antithetical to the basics of cryptocurrency.

The following opinion editorial was written by Bitcoin.com CEO Dennis Jarvis.

Mismanagement and outright fraud in 2022 by many opaque centralized exchanges are driving people back to the basic tenets of cryptocurrency such as decentralization, self-custody, transparency, and censorship resistance. People are naturally turning to DeFi (decentralized finance). Unfortunately, much of DeFi is not yet ready to act as a suitable substitute.

In this article, I’ll talk about two of the biggest challenges: how to make DeFi more accessible to new users and how to improve its performance compared to centralized services.

The problem of incorporation and its solution

The problem of getting new users to adopt DeFi is partly due to the user experience (UX). bitcoin.comAlex Knight’s head of product experience did an excellent job describing the issues and solutions to UX challenges in web3 applications. To summarize: the self-custodial web3 model often leads developers to create a user experience that is fundamentally different than what people are used to in the custodial web2 model, and that creates a lot of friction.

Solving the UX problem is a combination of smart design, education, and incentives.

On the design front, the challenge is to create products that are as familiar and easy to use as the best web2 analogues. A bitcoin.com Our self-custody multi-chain wallet app has long provided an intuitive experience, but only for simple actions like buying, selling, sending, and receiving cryptocurrency. As we integrate more complex DeFi features, including our own decentralized exchange DEX versedirectly in the application, it is critical that the user experience remains as indistinguishable as possible from web2 while using the web3 rails exclusively.

However, even if web3 manages to reach parity with web2 in terms of ease of use, there is still the challenge of convincing people to switch. This is where education and incentives come in. Education will do two things: rebuild trust in cryptocurrencies and prepare users to take the plunge. The incentives will provide the boost often needed to try something new.

Fortunately, the cryptocurrency space is ideal for providing the perfect combination of education and incentives. I’ve written about the power of loyalty tokens in crypto and the importance of getting them right, and we’ve thought a lot about how to integrate them into the bitcoin.com ecosystem.

Now that we’ve launched our own VERSE ecosystem token, we can start experimenting with ways to use monetary incentives to safely guide people into decentralized finance, where they can take advantage of its advantages over CeFi (centralized finance). One way we plan to do this is to reward newcomers with VERSE tokens for doing things like backing up their wallet.

This is supported by our recently launched CEX Education Program which will reward people affected by centralized crypto company insolvencies while encouraging the adoption of decentralized finance and self-custody.

The execution problem

Even if it solves the problem of onboarding new users, DeFi in its current iteration fails on responsiveness and market size. If any of these are missing, people won’t come or leave soon after.

DeFi responsiveness has been bogged down under what would be considered light traffic on web2. On-chain capacity has not been able to handle the peak usage of DeFi in 2021. Even with the proliferation of alt-L1 and the beginnings of live L2, the on-chain block space was easily flooded.

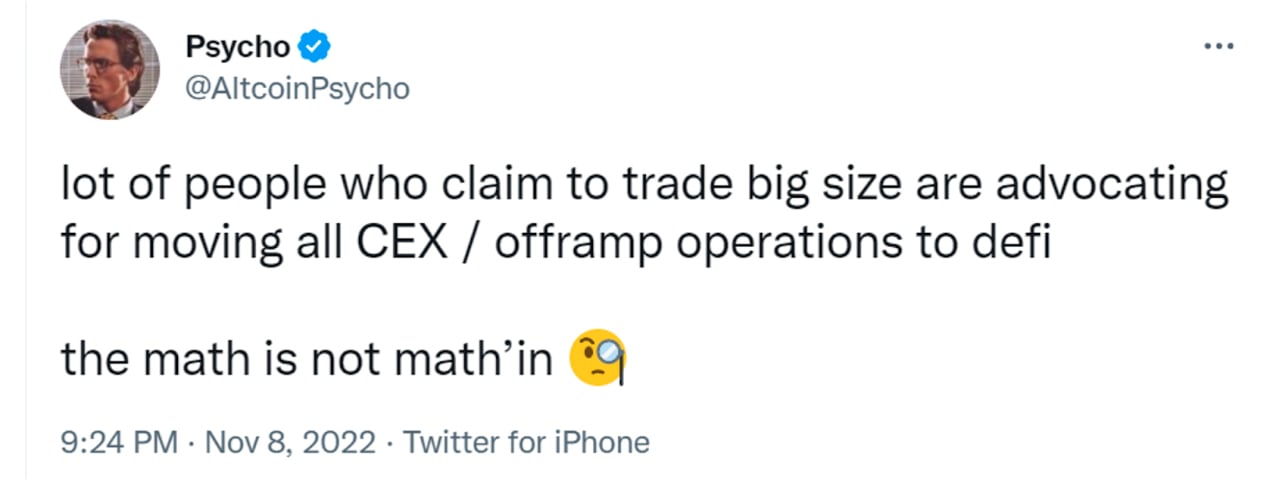

The size of the DEX market sums up DeFi’s capacity problem. I’ll let Crypto Twitter help me here:

Note that these comments were posted just before the FTX implosion. Tweeters’ views may have changed since then. Still, his criticisms ring true: current DeFi products simply cannot replace CEXs in terms of liquidity, volume, and order matching.

It is a problem for the cryptocurrency industry when many of the largest cryptocurrency traders, market makers and advocates are unable to execute trades or participate in size on decentralized platforms. They are forced to meet on centralized risk exchanges, creating a self-reinforcing cycle of dependency on CEXs.

In the past, CEXs seemed like an agreed stopgap until cryptographic technology was in a place where it was capable of taking over. As cryptocurrencies gained more attention, I feel like the industry as a whole became complacent, distracted by the amount of money coming in. The feeling was something like: “Those things will be resolved in time.”

Solution to the execution problem

I think the basic cryptographic technological tools are all here, or almost. An example of a DEX that can compete at an acceptable level with a CEX is the Layer 2-based exchange dYdX. By leveraging zero-knowledge proof systems, dYdX is able to execute trades cheaply and fast enough to compare the response capacity of the CEX. Now“The existing dYdX product processes about 10 trades per second and 1,000 orders/cancellations per second, with the goal of scaling larger orders.”

Now the only thing missing is comparable liquidity. Since good liquidity begets better liquidity, a constructive first step is for dYdX to use an order book and matching engine, a much more efficient and profitable way of creating markets. The use of an order book should attract market makers to provide enough liquidity to make DEXs comparable to CEXs.

Also, liquidity will come now that it is obvious (again!) that these centralized brokers cannot be trusted. The big cryptocurrency players need to make a concerted effort to move from CEX to DeFi protocols. bitcoin.com, for its part, prides itself on offering extensive DeFi solutions. He bitcoin.com Wallet, with over 35 million self-custody wallets created to date, continues to be an important onboarding tool, allowing newcomers to easily and securely interact with decentralized finance.

The future is DeFi

Don’t be put off by the shortcomings I’ve identified here. The truth of the matter is that all of DeFi’s shortcomings are trivial compared to its strengths. DeFi allows self-custody of your assets, but with the utility we trust from centralized financial institutions; for example, trading between assets, earning a return on your assets, or using your assets to borrow. Until now, these financial activities have always required trusted intermediaries. Solutions to DeFi problems are achievable, which is in stark contrast to entrenched problems in traditional finance. Ultimately, the answer to the problems of traditional finance is DeFi.

What do you think about the potential for decentralized finance to replace centralized finance? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.