Lockdowns are like wildfires: they need a combination of conditions to start.

A forest fire needs a long period without rain, high temperatures and then strong winds at the ignition point.

Yes, the wildfires have been exacerbated by methane emissions record which bitcoin helps mitigate, but that's not what this article is about: this time it's just an analogy.

Halvings cause new bitcoin supply to run out (no rain). They generate greater interest in timing the entry into the bitcoin market (high temperature). But they also need strong winds and an ignition event.

That strong wind is the winds of change around bitcoin's ESG narrative.

The lighting event will be the first major ESG Investment Committee to endorse bitcoin for ESG reasons.

The problem with the growing volume of ESG investors

By 2026, ESG-focused institutional investing will have skyrocketed to 33.9 billion dollars. That's more than $1 for every $5 of assets under management, according to a PwC report.

But the most important takeaway from the report that should alert current and future bitcoin hodlers is that right now ESG investors have a problem: Demand for sound ESG investments outstrips supply. ESG investors take a long time to find suitable ESG investments: a very high 30% of investors say that struggle to find attractive ESG investment opportunities.

bitcoin is now in the first position to answer that problem. This is why:

The opportunity for bitcoin

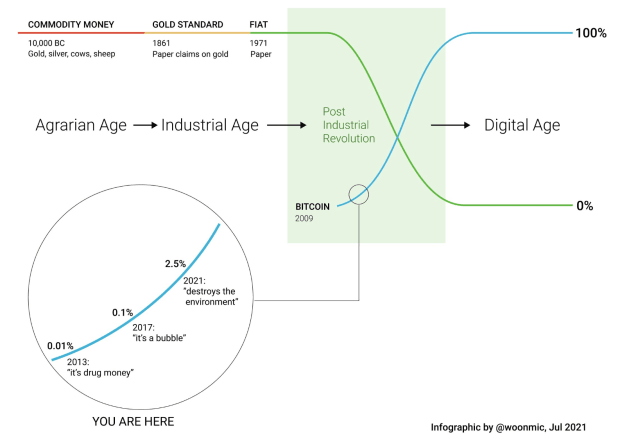

2023 marked the turning point in the ESG narrative around bitcoin.

In just 53 happy days, from August 1 to September 22 of this year, five events helped change bitcoin's ESG narrative. They were:

1. KPMG report concludes that bitcoin supports ESG imperative (August 1)

2. Peer Reviewed Research supports the thesis that bitcoin can be good for the environment (August 8)

3. Cambridge recognizes bitcoin Energy Overestimation (August 30)

4. Bloomberg Intelligence Charts Show bitcoin Mining Leads Decarbonization (September 14)

5. Risk Management Institute Concludes that bitcoin helps the renewable transition (September 22)

These reports and articles were produced independently, by highly reputable researchers and organizations, and instead of concluding that bitcoin “is not as bad for the environment as we thought,” they came to the much stronger conclusion that bitcoin was clearly positive as an ESG asset.

This wind of change has the potential to intensify into the strong wind bitcoin needs to complete the set of conditions necessary for a bull run.

What does this mean

Information is power. At this moment there is an information asymmetry. The narrative has changed based on new data. But most ESG investors don't have this data. Still. Until they get this new data, they will continue to believe the old narrative that “bitcoin is net negative for the environment.”

In case we needed evidence of that, here's a DM I received from a fund manager the other day.

This type of ESG investor cannot yet implement a higher percentage in bitcoin because their ESG information on bitcoin is several years out of date and they are not yet aware of the five narrative change events described above.

While ESG Investment Committee members' opinions on bitcoin are typically very negative, in my experience, unlike environmental NGOs, their opinions are also vague. When I was in Sydney recently, a young Australian came up to me enthusiastically and said, “Dan, I used your charts to beat up our investment committee!”

So what will happen when this information asymmetry is blown away by the strong winds of bitcoin's new ESG narrative?

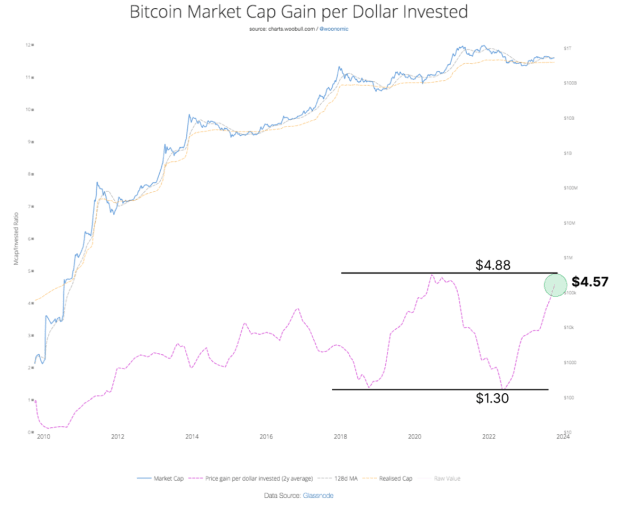

Thanks to Willy Woo's analysis, we can quantify what that will mean for bitcoin's market cap within a range.

Quantifying how ESG = NGU

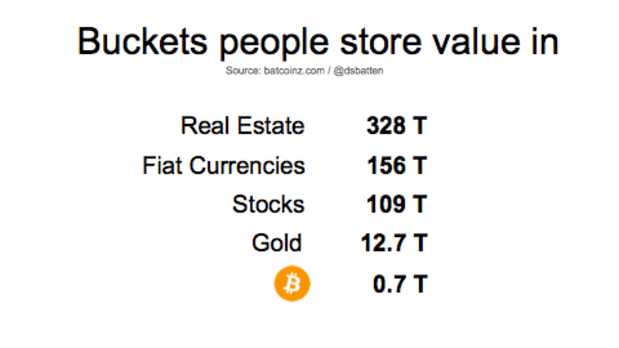

bitcoin's ESG adoption is very bullish for the relatively thimble-sized $713 billion bitcoin market at the time of writing. Woo maintains that bitcoin should stay above 1 Tr. before the institutions that own the wealth of nation states and/or retirement funds feel comfortable investing in it en masse.

What would happen to bitcoin's market cap then if ESG investors deployed 1% of their investment by 2026? AUM (Assets under management) in bitcoin?

At the current ratio of market capitalization growth per dollar invested, bitcoin's market capitalization would increase to a healthy $2.26 trillion. That's more than triple what it is today.

If 2.5% of ESG funds' AUM were invested in bitcoin, it would increase the market capitalization to $3.87 trillion. That's more than five times the current market cap. This puts it squarely on the roadmap of institutional investors, leading to further deployment of capital, which in turn creates a very bullish positive feedback loop.

However, even without this feedback loop, a 2.5% ESG implementation could catalyze a bitcoin price of around $193,000 during a potential bear market in 2026.

This is not a prediction but a simulation. I am saying Yeah ESG ICs deployed between 1% and 2.5% of assets under management. so The consequence for bitcoin's market capitalization could be 2 to 5 times.

That said, bitcoin has the unique potential to become the world's first negative greenhouse industry without offsets – something that would require methane mitigation from bitcoin mining in just bitcoin-a-zero-emission-bitcoin-network/”>35 medium-sized ventilation weirs. If that were to happen in the aggressive but possible 2026 time frame, I would be surprised if bitcoin didn't achieve a deployment of 2.5% of ESG investors' AUM or more.

Switched on

As if we needed further confirmation that the winds of ESG narrative change are swirling, I recently spoke at the Plan₿ 2023 Forum in Lugano in the subject “bitcoin is the best ESG asset in the world”. I had the idea of using a claim both Michael Taylor and Base load have previously made and converted it into a keynote supported by supporting data.

The recording is currently the most viewed talk of the 2023 conference on YouTube not because it has great notoriety on my part (there were much better known speakers) but because as Victor Hugo He once remarked, “Nothing is more powerful than an idea whose time has come.”

bitcoin as an ESG asset is an idea whose time has come. bitcoin Has Now Demonstrated Its Ability to Rise renewable energy capacity and reduce methane emissions at a time when the world urgently needs solutions for both. On the contrary, now that ethereum has migrated to Proof of Stake, it can no longer help with any of these urgent needs.

In early 2022, most Bitcoiners were still trying to “defend” bitcoin against ESG attacks via me too like “But dryers use more energy than we do.” But in 2023, Bitcoiners began to take the game to the opponent's field, with consistent success. The strategy of sharing fact-based reports and inspiring stories on the positive ESG case for bitcoin is working: this year both bitcoin-mining-is-energizing-sustainability-through-green-innovation/”>The hill and bitcoin–btc-miners-like-bit-digital-draw-from-iceland-s-renewable-energy-surplus”>Bloomberg began publishing positive press about bitcoin mining. Positive news coverage bitcoin-esg-outnumbers-negatives-51-so-far-in-2023/”>negative counts exceeded 4:1. And then, of course, there were those 53 days of narrative changes.

Every four years a new false narrative emerges.

However, every four years, it's also “tick tock, the next false narrative for the chopping block.”

The story of bitcoin “destroying the environment,” if not dead, is at least one Almost headless Nick.

The upcoming halving will further deplete the supply of bitcoin and at the same time increase investor interest. Meanwhile, the winds of change in the ESG narrative are intensifying. The conditions are now perfect for the inevitable spark of the deployment of large ESG funds in bitcoin.

ESG = ES.

Daniel Batten is founder of CH4Capitalwhich provides infrastructure financing to bitcoin mining companies that run on vented methane from landfills.

This is a guest post by Daniel Batten. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.