Image Source: Getty Images

According to broker aj bellpayment of dividends for FTSE 100 The shares are expected to reach an all-time high this year. With that in mind, I have been buying these two high growth, high yielding miners to generate a fair amount of passive income for myself.

1.Glencore

With a decent dividend yield of 3.9%, the first stock on my list is glencore (LSE: GLEN). jefferies believes coal mining stocks are undervalued. This is especially the case given the high prices of coal. Gasoline prices have fallen due to warmer temperatures in Europe this season. However, due to a combination of factors including a colder Asian winter, the region’s heavy reliance on coal and the reopening of China, prices are forecast to remain strong in the coming months.

So it’s no surprise to see German recommend Glencore stock for its dividend and growth prospects. In addition to generating most of its revenue from coal, the commodities giant is also the world’s largest producer of base metals. Given its portfolio of metals such as copper, zinc and nickel, the company has a bright future ahead of it. Those metals are crucial to producing batteries for the electric vehicle revolution.

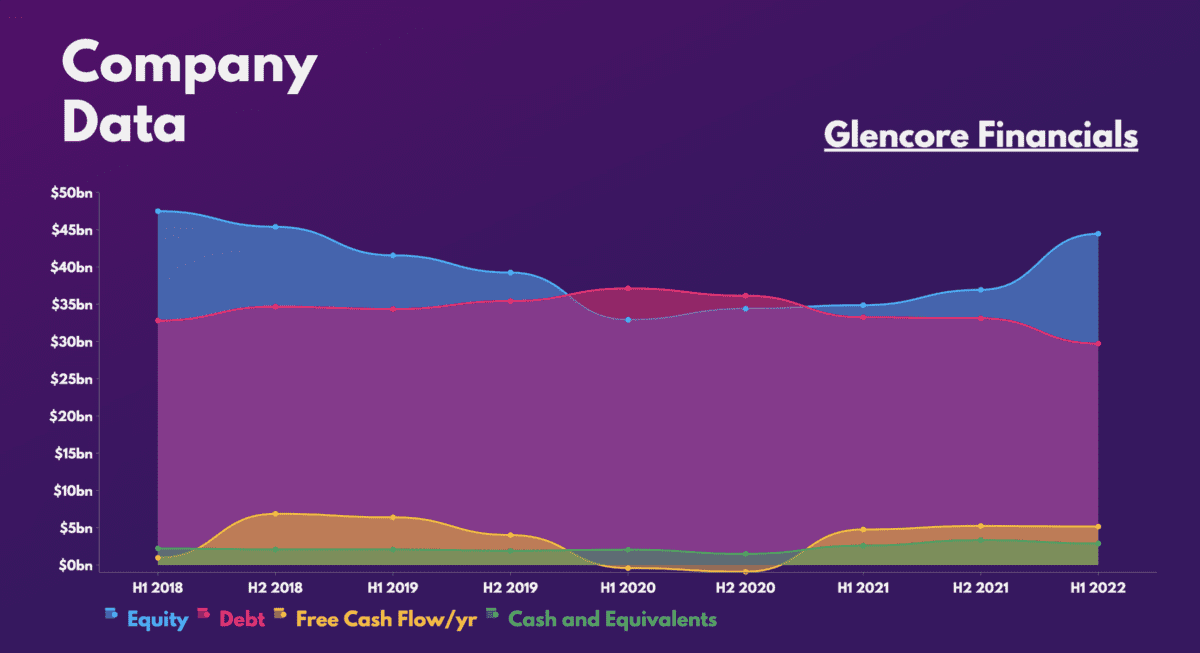

In addition, it is backed by several other investment banks. the likes of UBS, citi Y JP Morgan they also have ‘buy’ ratings on the stock, with the latter two labeling it one of their top picks for 2023. Combined with a strong balance sheet, excellent growth prospects for its bottom line and dividends, such optimism for its stock is certainly understandable.

Combine the above with fairly cheap valuation multiples, and it’s easy to see why Glencore is also one of the best choices for my portfolio.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Earnings Ratio (P/E) | 6.0 | 7.1 |

| Price-Sales Ratio (P/S) | 0.4 | 1.6 |

| Price-to-book (P/B) ratio | 2.0 | 1.2 |

| Forward price-earnings (P/E) ratio | 5.1 | 7.1 |

2. Rio Tinto

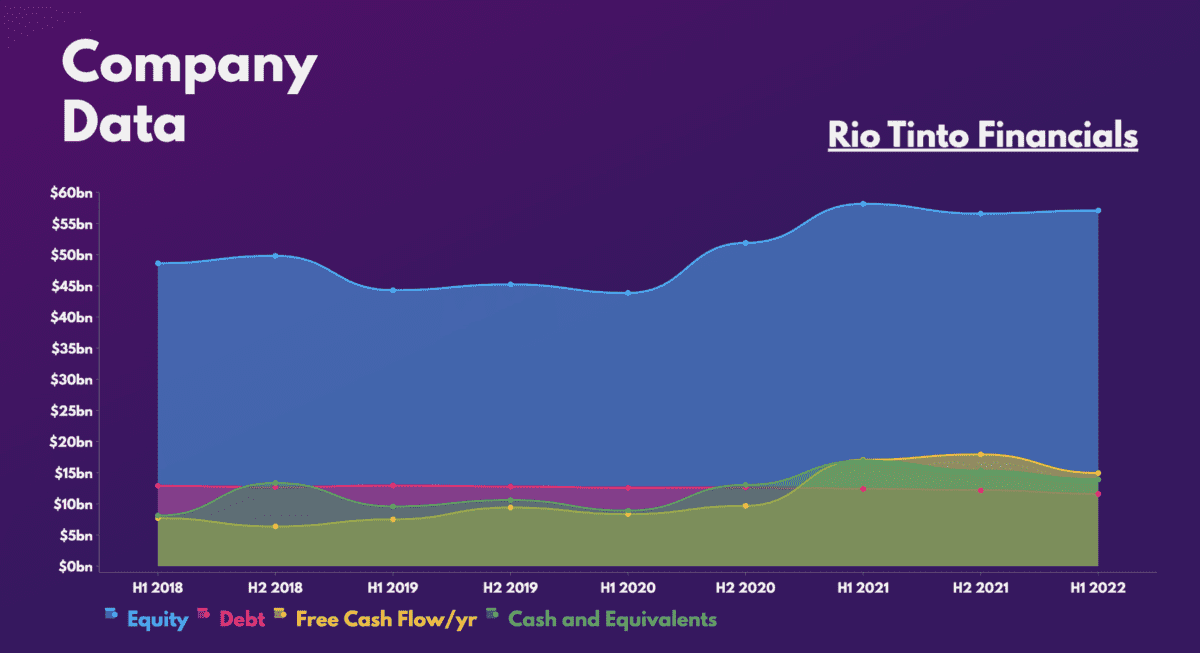

Another monster dividend stock in my portfolio is the iron ore giant, red river (LSE:RIVER). Despite a volatile 2022, I advocated buying its shares in early December due to its strong fundamentals. Since then, iron ore prices have continued to rally strongly. However, there are downside risks to consider, mainly a recession in Europe and the US Even so, analysts believe that a possible recession has already been priced in.

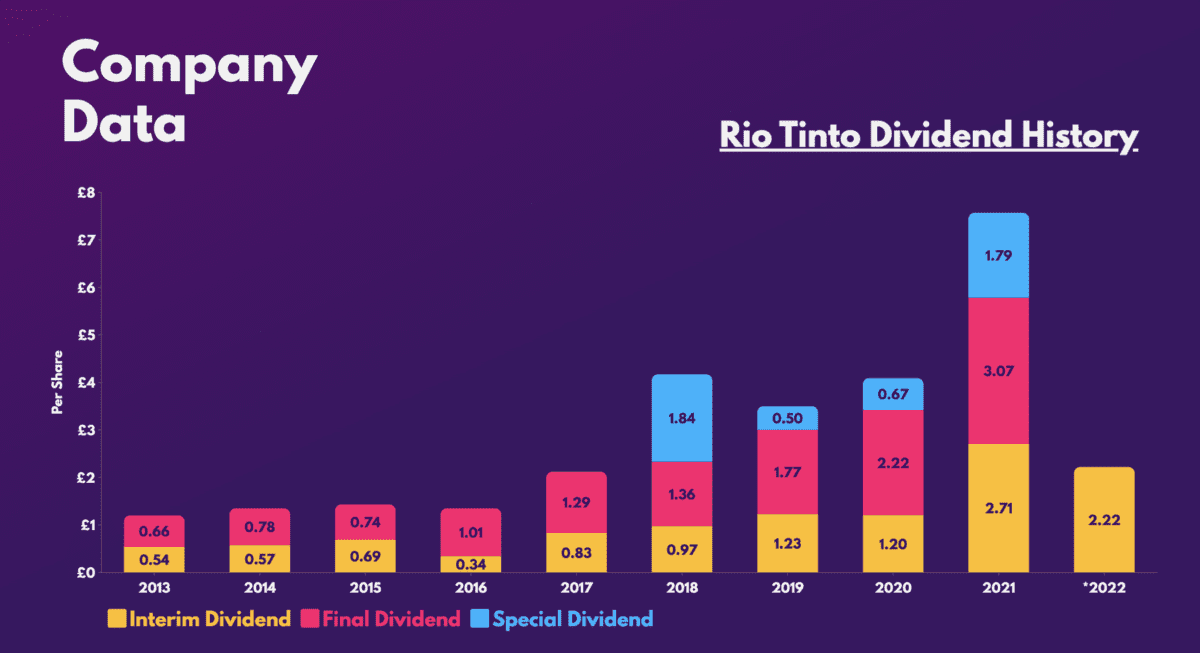

However, moving on to your bullish thesis, there are plenty of reasons to invest. The most lucrative is its status as a dividend aristocrat. Rio shares have a strong history of paying large and growing dividends.

To complement this, China’s abandonment of its zero-covid policy should allow construction and industrial activity to resume with fewer hiccups. In addition, the economic stimulus is widely expected to support metal prices. This should generate higher income, which usually translates to higher dividends.

In addition, other metals in Rio’s portfolio, such as copper and lithium, will be beneficial to its long-term growth, as they are key elements for green technology. After all, the mining titan shared its significant copper capacities in its latest business update. This has left companies like Berenberg and UBS wondering if their initial stock pessimism was correct all along.

However, their current valuation multiples don’t look particularly cheap. Therefore, I will not buy any more shares at this time. Instead, I’ll keep my original position of passive income and may buy more if Rio’s stock price goes down.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Earnings Ratio (P/E) | 7.2 | 7.1 |

| Price-Sales Ratio (P/S) | 2.1 | 1.6 |

| Price-to-book (P/B) ratio | 2.5 | 1.2 |

| Forward price-earnings (P/E) ratio | 10.1 | 7.1 |