bitcoin (btc) Starts a New Week Keeping Traders Uncertainty Near 18-Month Highs: What’s Next?

btc price action has remained bullish after breaking above $38,000 last week, but since then, a testing “microrange” has left bulls and bears locked in battle.

Whether a deeper pullback will occur or a trip to $40,000 will leave the naysayers behind is now the key short-term question for market participants.

In the coming days, there are several potential catalysts to help a trend emerge for bitcoin, while in the background, there are growing signs that the market needs a boost.

Volatility is expected to arrive later with the monthly close, but before that, a series of macroeconomic events have the ability to inject some surprise price action.

Cointelegraph discusses these issues and more in the weekly summary of bitcoin price volatility triggers for the week ahead.

Monthly close looms with btc price rise of less than 10%

The monthly close marks the key diary date for day traders this week, with bitcoin at a crossroads.

As Cointelegraph reported, untested liquidity levels on the downside and the appeal of $40,000 on the upside, surrounded by resistance, create a stubborn daily trading range.

Neither bulls nor bears have been able to dislodge a tightening corridor for btc/USD, and even new higher highs on daily time frames have been few and short-lived.

At the latest weekly close, a timely drop saw bids begin to fill, with bitcoin falling to lows of $37,100 before recovering, according to data from Cointelegraph Markets Pro and TradingView sample.

For popular trader Skew, the time has come to regain the bidding momentum.

“Cash buyers led the rebound and ultimately criminal buyers were the forced bid; mostly shorts driven out of the market,” he stated. wrote in part from a dedicated analysis on X (formerly Twitter).

“Now, as we move towards the EU session and the US session, it is important to see if there are spot offers or not.”

Skew also referenced blocks of liquidity both above and below the spot price, with $37,000 and $38,000 as key levels to watch.

“Lots of supply liquidity below $37,000, so if spot buyers continue to be net sellers, this would be the push needed to cover those limit bids below,” he wrote of the order book on the largest global exchange, Binance.

“As for requested liquidity, also known as supply, it remains between the $38,000 – $40,000 area ~ major major area.”

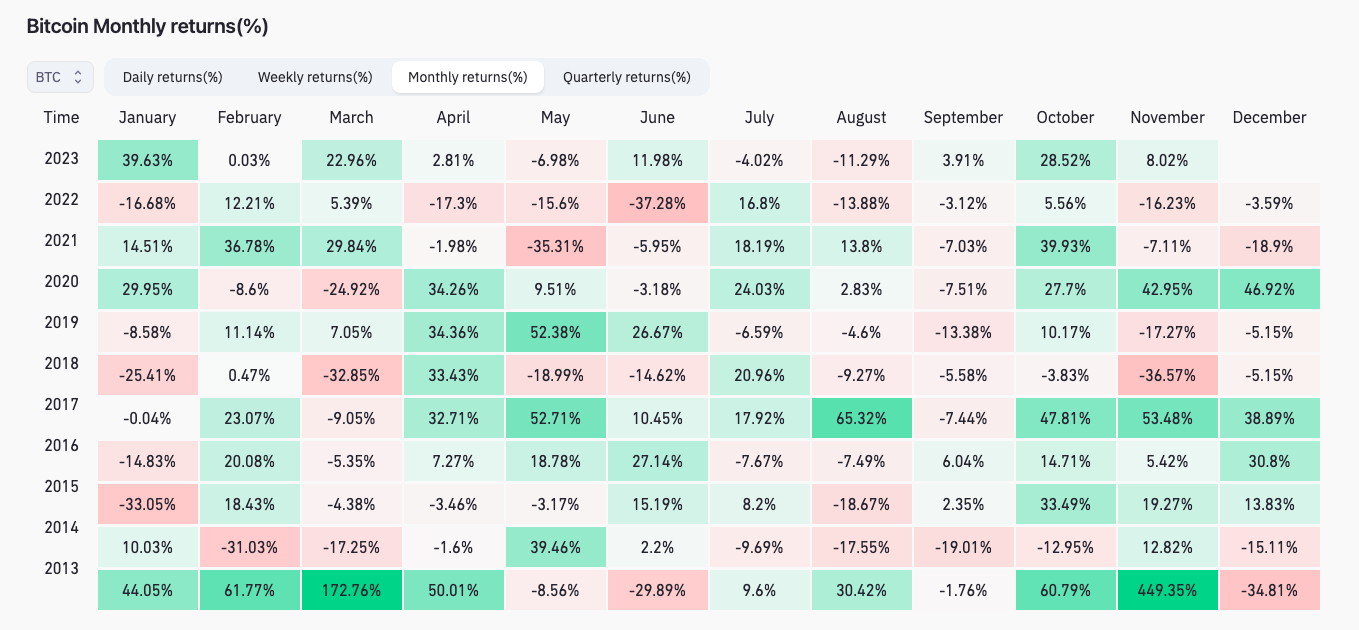

With just a few days left until the monthly close, bitcoin is currently up 7.8% so far this month, making November 2023 a total average compared to previous years.

Monitoring resource data glass coin shows that November is typically characterized by much stronger btc price movements, which can be both up and down.

Meanwhile, the fourth quarter overall has so far delivered gains of nearly 40%.

Fed’s main inflation markers lead macroeconomic catalysts

A classic macro week with volatility triggers to match awaits bitcoin traders as November draws to a close.

The US Federal Reserve will receive some key inflation data in the coming days, which will inform next month’s decision on interest rate policy.

Federal Reserve Chair Jerome Powell will speak on December 1, following comments from senior Fed officials throughout the week.

The data releases of most interest to markets will likely be third-quarter gross domestic product and October personal consumption expenditure (PCE), which will be released on November 29 and 30, respectively.

Earlier, US macroeconomic data began to show that inflation was declining faster than markets expected, prompting positive reassessments among risk assets.

This week’s key events:

1. New home sales data: Monday

2. Consumer confidence data – Tuesday

3. Third quarter GDP data: Wednesday

4. PCE inflation data – Thursday

5. Federal Reserve Chairman Powell speaks, Friday

6. Total of 10 Fed Speaker Events

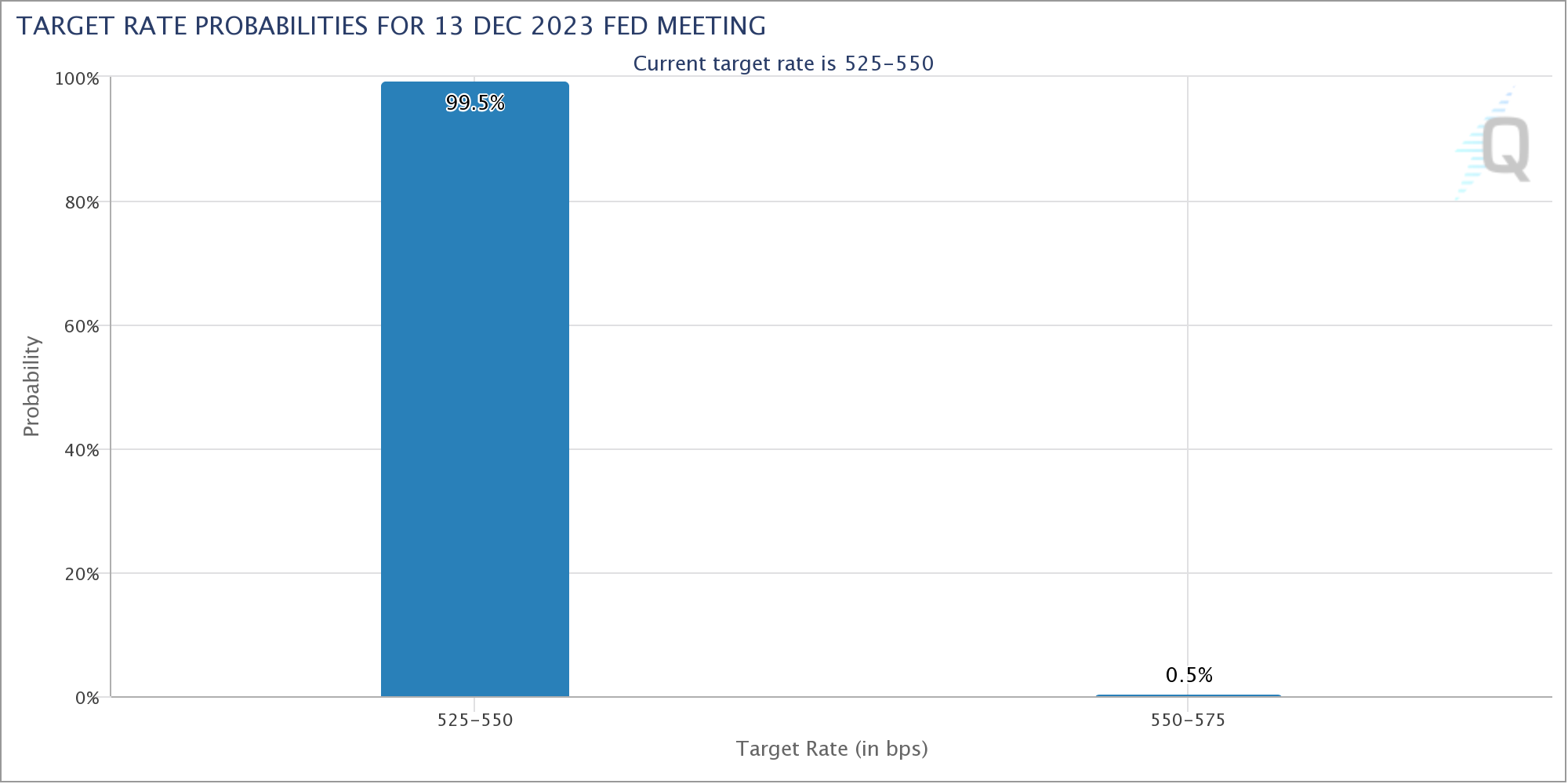

We are two weeks away from the December Federal Reserve meeting.

— Kobeissi’s letter (@KobeissiLetter) November 26, 2023

“A full trading week is coming up and volatility is here to stay,” financial commentary resource The Kobeissi Letter on X summarized.

Data CME Group’s FedWatch tool currently puts the odds of the Fed keeping rates at current levels at a near-unanimous 99.5%.

GBTC Targets btc Price Parity

While bitcoin is still waiting for US regulators to give the green light to the country’s first spot price exchange-traded fund (ETF), markets show that the mood continues to change for the better.

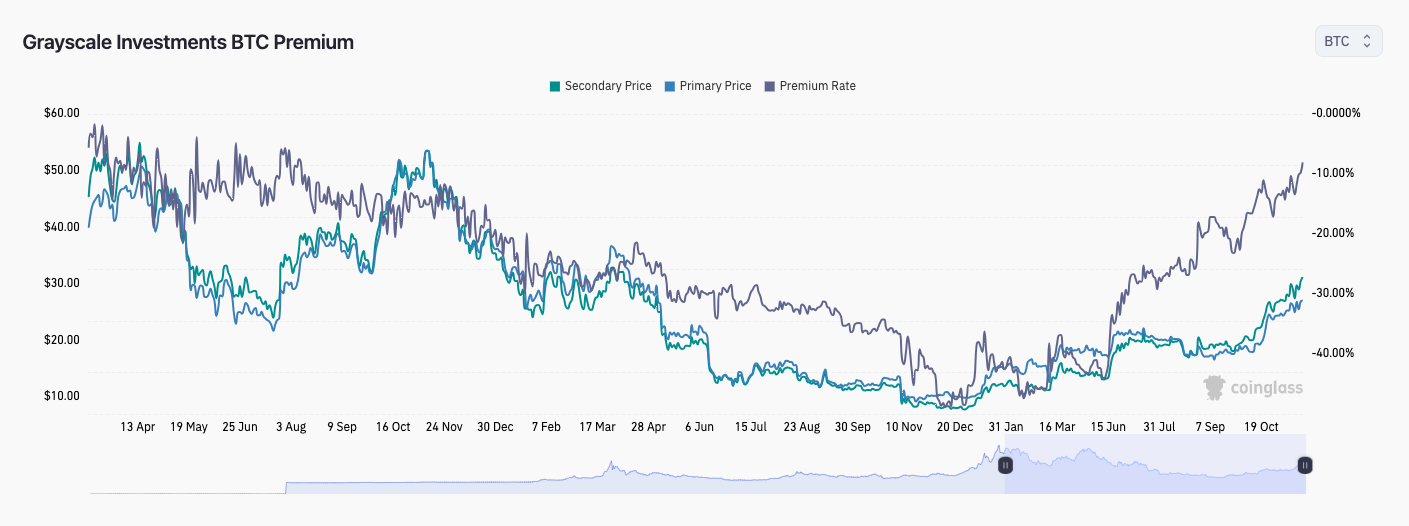

Nowhere is this more evident than in bitcoin‘s largest institutional investment vehicle, the Grayscale bitcoin Trust (GBTC).

GBTC, which will become a spot ETF, is quickly approaching parity with its underlying asset pair, btc/USD.

Once nearly 50% lower, GBTC’s share price was at a discount of just 8% to net asset value, or NAV, as of Nov. 24, according to data from CoinGlass.

The fund’s rebirth has formed a key narrative around both the upcoming successful approval of an ETF and the emergence of genuine mass institutional interest in bitcoin for the first time.

“It seems like the market is really expecting the approval of this ETF soon,” said William Clemente, co-founder of cryptocurrency research firm Reflexivity. Referrer to the weekend data.

However, in terms of decisive timing, all the notable dates now come after the new year.

In its latest market update sent to Telegram channel subscribers, trading firm QCP Capital argued that January 3, 2024 would be a timely approval date, coinciding with the 15th anniversary of the bitcoin genesis block.

Thereafter, January 10 marks a tentative deadline for the first spot ETF, that of ARK Invest, as “the final deadline for ARK’s application is included in the first approval batch.”

“And in the event that ARK is rejected and the rest are postponed once again, the real decisive deadline is March 15, 2024, where Blackrock and the main group of candidates face their own final deadline,” he added.

bitcoin hash rate surpasses 500 exahash dividing line

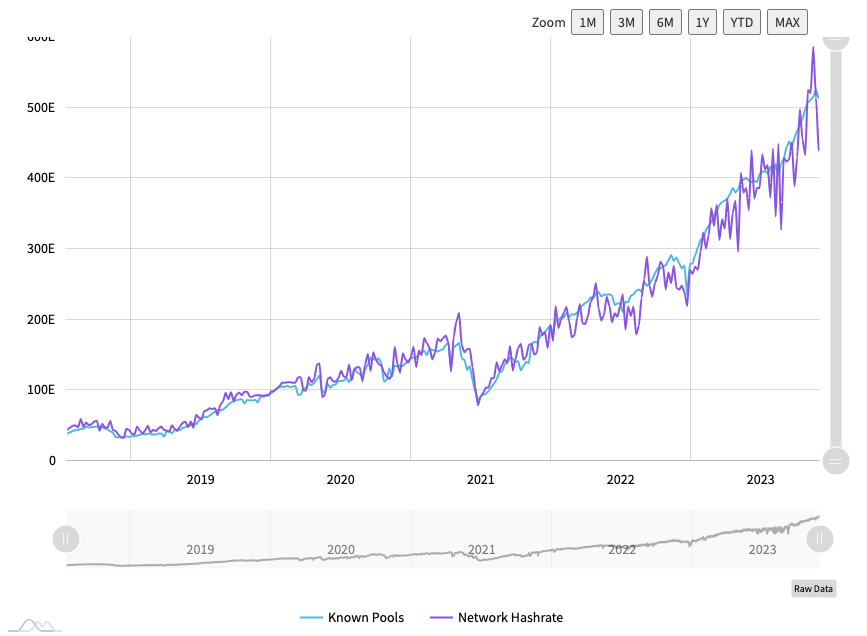

Ahead of the upcoming block subsidy halving in April 2024, bitcoin miners are deploying record processing power to the network.

Hash rate: the estimated one bitcoin” target=”_blank” rel=”noopener nofollow”>extent of this deployment, is now at its highest levels and this month surpassed 500 exahashes per second for the first time.

The achievement not only represents a psychological milestone, but also underlines miners’ conviction about future profitability, even as btc‘s price performance still remains 50% below its own peak.

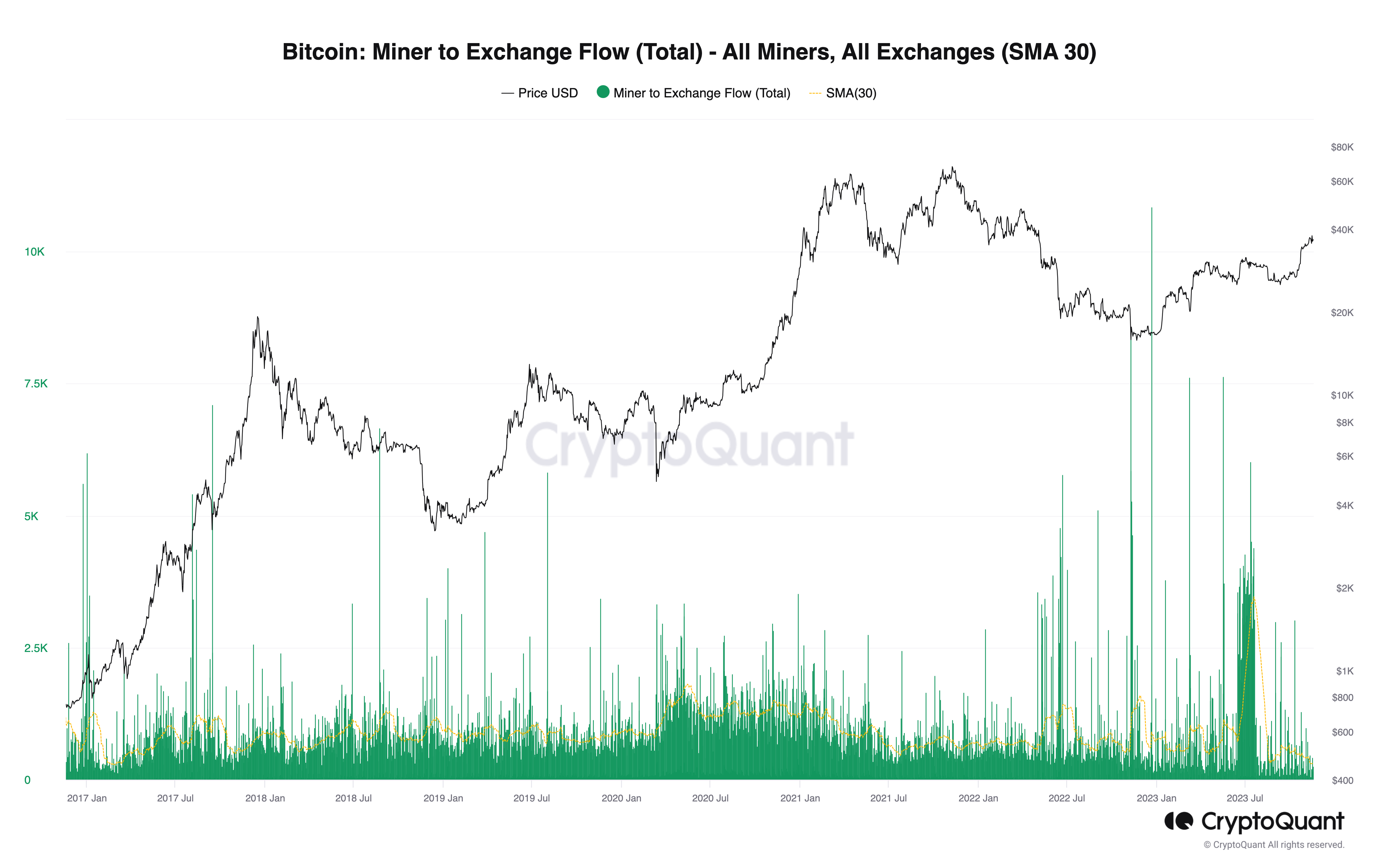

At the same time, wallet outflows from well-known miners to exchanges are at their lowest levels in seven years, according to data from on-chain analytics platform CryptoQuant.

“The flow of movement from bitcoin miners’ wallets to exchange wallets ultimately represents the activity of these entities in the open market,” wrote contributing analyst Caue Oliveira in one of his quick take market updates.

“The influx of coins into exchanges increases btc liquidity on these platforms, creating additional selling pressure in the market.”

Oliveira noted that miners are always selling a portion of their holdings, but the current monthly average of 90 btc is the lowest since 2017.

bitcoin stock balances resume bearish trend

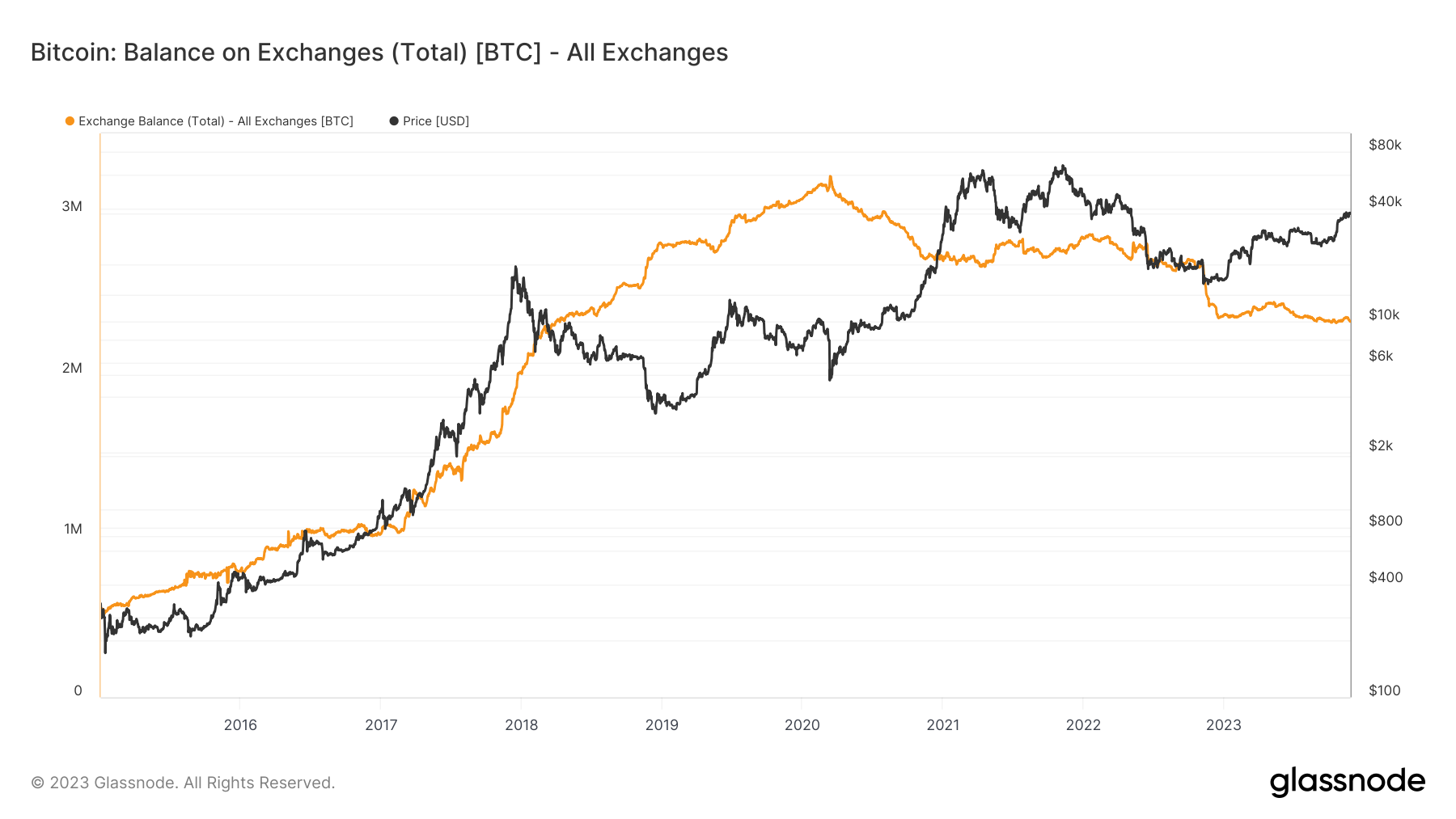

After a month of turmoil caused by withdrawal outages and legal action against some of the largest crypto exchanges, btc balances are trending lower once again.

Related: bitcoin at $1 million after ETF approval? btc price predictions diverge wildly

In line with the broader trend in place for five years, btc stocks on exchanges are falling further and further.

btc&category=&m=distribution.BalanceExchanges&s=1420159925&u=1700956800&zoom=” target=”_blank” rel=”noopener nofollow”>According According to the latest data from on-chain analytics firm Glassnode, the combined holdings of major exchanges amounted to 2,332 million btc as of November 26.

With the exception of the recent October lows, this is the smallest amount of btc available since April 2018. At its peak in March 2020, just after the COVID-19 cross-market crash, the account stood at 3,321 million btc.

The picture was complicated in November thanks to the reactions of traders when Binance received a record fine of 4.3 billion US dollars, in addition to Poloniex and HTX stopping withdrawals completely after a hack.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.