The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

The Chicago Board Options Exchange (CBOE), the largest US options exchange, has announced a move to open a new bitcoin futures trading model in 2024: a native exchange and clearinghouse cryptocurrency exchange offering margin trading and leveraged derivatives among many planned products.

CBOE Digital announced these plans on November 13, sending ripples throughout the bitcoin community with a radical list of planned features and trading options. The exchange offers a wide range of products and services, so that users can not only invest directly in these futures contracts, but also participate in multiple higher risk methods to increase their purchasing power. Margin trading involves using the assets in an account as collateral for a much larger loan from the exchange, which will be invested in these futures trades, while leveraged trading allows the user to essentially receive a line of credit to magnify their position. , obtaining profits and losses. several times the amount of your initial investment. CBOE plans to offer both features.

These are just some of the options described in their initial press release. bitcoin-and-ether-futures-on-january-11-2024-backed-by-crypto-and-traditional-finance-players-301986086.html”>releaseas the exchange claimed to present “a model that includes intermediaries” that “ensures the separation of functions to avoid conflicts of interest” and that CBOE’s ability to serve as an exchange and clearinghouse “will allow it to potentially offer more unique and innovative offerings “. in 2024.” The announcement also adds that its roadmap includes several physically delivered products, pending regulatory approval. By doing so, ordinary investors will have a lower physical barrier to entry if they wish to gain exposure to bitcoin, with the However, these margin and leverage options also carry additional risk.

Although CBOE’s plan to add these high reward options to the world of bitcoin futures trading is certainly a new experiment, the history of trading with this type of trading goes back quite a bit in bitcoin history. CBOE was in fact the bitcoin-futures-on-dec-10.html”>first options exchange in the world to offer bitcoin futures trading in December 2017, when it surpassed its Chicago-based rival CME at this milestone by 8 days. Although this particular period in cryptocurrencies was filled with excitement, showing an unprecedented rise in the price of bitcoin that would not be matched for several years, this rally would not last. Ed Tilly, then CEO, stated that “given the unprecedented interest in bitcoin, it is vital that we provide clients with the trading tools to help them express their views and hedge their exposure,” but even so, this initial project was bitcoin-idUSKCN1QW261″>closed in 2019 during the bear market.

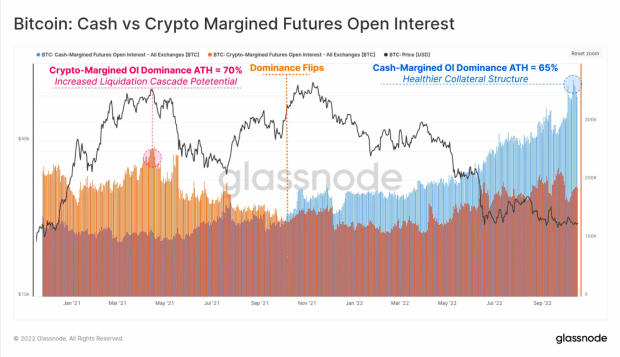

Still, although the CBOE, the world’s first in bitcoin futures trading, could not keep its distance, this type of real exposure to bitcoin has proven very popular with the test of time. The Chicago Mercantile Exchange (CME), for example, which launched the second futures trading program in its history, has seen years of lagging interest turn into dramatic ones. bitcoin-flipped-binance-in-futures-volumes-is-that-as-bullish-as-it-sounds/”>success. The CME has recently been enjoying a higher bitcoin futures trading rate than Binance, the world’s largest cryptocurrency exchange, in a development that commentators have called “an indicator of institutional activity.” It’s easy to see why there’s so much hype around the topic: The impending bitcoin ETF is frequently credited with bitcoin‘s success in late 2023, and the main point of interest is that a financial instrument like this would be an easy springboard for for a layman to become financially entangled with the world’s leading digital asset. If we go by the rates of futures trading realized in cash versus cryptocurrencies, bitcoin futures trading has also been doing the same.

So while CBOE put an end to their groundbreaking effort to pioneer bitcoin futures trading, they’ve seen the stock grow over the years and have decided to dust off the project with some new and expanded features. Regulations won crypto-unit-receives-cftc-approval-for-margined-digital-asset-futures/”>approval from the Futures and Commodities Trading Commission (CFTC) in June to carry out these revolutionary product offerings, and they have been in the running ever since. CBOE Digital Chairman John Palmer said at the time that margin trading is a “big driver” of derivatives trading around the world, adding that “we are always taking a very cautious approach with the products we list on the spot and derivatives markets.

To facilitate a smooth launch of these new services, CBOE has partnered with several different leaders at the intersection of digital assets and finance, including B2C2, BlockFills, CQG, Cumberland DRW, Jump Trading Group, Marex, StoneX Financial, Talos, tastytrade. , Business Technologies and Wedbush. Palmer told reporters that “our upcoming launch of margin futures represents an important milestone for CBOE Digital, and we are grateful to have the support of such a notable group of industry partners who share our commitment to building trusted and transparent crypto markets.” . “We couldn’t be more excited,” he added, “to further expand (futures) access to digital asset markets and offer margin trading to our clients.”

Currently, the new futures trading regime at CBOE is scheduled to open on January 11, 2024. Depending on its success and possible progress in regulatory approval, new features may be added in the coming months. However, although CBOE has also announced that Ether futures will also be available alongside bitcoin futures, Palmer firmly stated that there are “no plans in sight” for altcoins to be added any time soon.

The bitcoin community is waiting with bated breath to see how well these futures trades perform in January. Although margin and leverage trading includes the potential for larger losses and is not for the faint of heart, it does not change the fact that the vastly reduced amounts of upfront cash required to invest are a huge draw. If the bitcoin ETF is meant to turn newbies into Bitcoiners, with things as mundane as pension funds suddenly pegged to bitcoin, then this margin futures trading is sure to make smaller private traders jump head first.

As it stands today, existing bitcoin futures trading is already a major industry, and CBOE is betting that these riskier options will leave all types of traders looking for the action. Although the main goal of bitcoin is to change existing financial models, there is no denying that the marriage of bitcoin and finance has paid enormous dividends by increasing the popularity and value of bitcoin. If CBOE can set an industry trend for the second time in bitcoin futures trading, a whole world of opportunities will open up.