hapabapa/iStock Editorial via Getty Images

Eli Lilly’s Sales (New York Stock Exchange:LLY) recently approved weight-loss drug Zepbound could reach $4.1 billion in 2031 in the U.S., a recent report from data analytics firm GlobalData indicates.

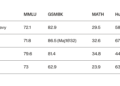

According to the report, that’s about half the level of its rival Novo. Nordisk (NGO) weight loss therapy that Wegovy could generate for that year.

Both Wegovy and Zepbound are also indicated for type 2 diabetes, as Ozempic and Mounjaro generated $8.6 billion and $482.5 million in global sales in 2022, respectively.

GlobalData’s latest forecast comes on the heels of the FDA’s approval of LLY’s GLP-1 receptor agonist, also known as tirzepatide, for chronic weight management in adults.

The Indiana-based pharmaceutical giant plans to launch the product before the end of the year at a monthly list price of about $1,060, a 20% discount to Wegovy, also known as semaglutide. In October, GlobalData projected wegovy sales in the United States it could reach $8.1 billion in 2031.

“Zepbound is Eli Lilly’s first drug indicated for obesity, and its arrival in the obesity space will increase competition for Novo Nordisk’s Wegovy (semaglutide) as a gold standard therapy,” Sara Reci, senior pharmaceutical analyst at GlobalData, noted.

Despite barriers to adoption, such as lack of insurance coverage and production limitations, the pharmaceutical industry’s focus on discovering more effective weight loss drugs will drive this indication to a value of $27.6 billion in the US. US by 2031, GlobalData said, citing a patient-based forecast.

Other large drugmakers developing weight loss drugs include Pfizer (PFE) and Amgen (AMGN). Last week, AstraZeneca (AZN) signed a deal worth up to $2 billion with Chinese biotech Eccogene to develop a once-daily oral GLP-1 receptor agonist for conditions including weight loss.

“However, competition between Eli Lilly and Novo Nordisk to win patient shares for this indication is expected to be fierce and we will need to be vigilant,” added GlobalData’s Reci.