bitcoin (btc) could be the next “sell” for at least $110,000 as its new bull cycle unfolds, a classic on-chain indicator suggests.

Data from on-chain analysis platform Look Into bitcoin bitcoin-price-prediction/” target=”_blank” rel=”noopener nofollow”>sample bitcoin’s “Terminal Price” hints at a possible six-figure high.

btc price to six figures in the next cycle?

As btc price action reaches its highest levels in 18 months, forecasters are already considering how high it could go in the coming months and even years.

After the next block grant is halved in April 2024, targets include $130,000, with late 2025 being a popular deadline for the next maximum cycle.

Analyzing its terminal price, Look Into bitcoin creator Philip Swift described its value as a “simple” method for estimating long-term btc price peaks.

The terminal price is calculated from the so-called “transfer price” of bitcoin, a value obtained by dividing the “coin days destroyed” (CDD) by the existing supply.

CDD is a popular metric that measures how many down days are reset each time an amount of btc moves on-chain. It is useful as an indicator of the hodler’s intention and activity.

Created by Checkmate, lead on-chain analyst at data firm Glassnode, Terminal Price comes into play at the top of each btc price cycle.

Not all all-time highs reach the terminal price, but btc/USD did reach the trend line during its 2017 all-time high and its initial peak in April 2021. The current all-time high of $69,000, seen in November of that year, is came up short.

Therefore, Swift suggested that selling “close” to the terminal price would be an appropriate policy. Its bear market counterpart, the “Balanced Price,” also signals useful market lows.

Buy near the Balanced Price, sell near the Terminal Price.

Could it be that simple?bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin cycles. pic.twitter.com/llHytNVuxr

– Philip Swift (@PositiveCrypto) November 10, 2023

As the terminal price rises over time, $110,000 may ultimately end up being a conservative target in case the next all-time high occurs later in the next cycle.

Waiting for a Pi cycle crossover

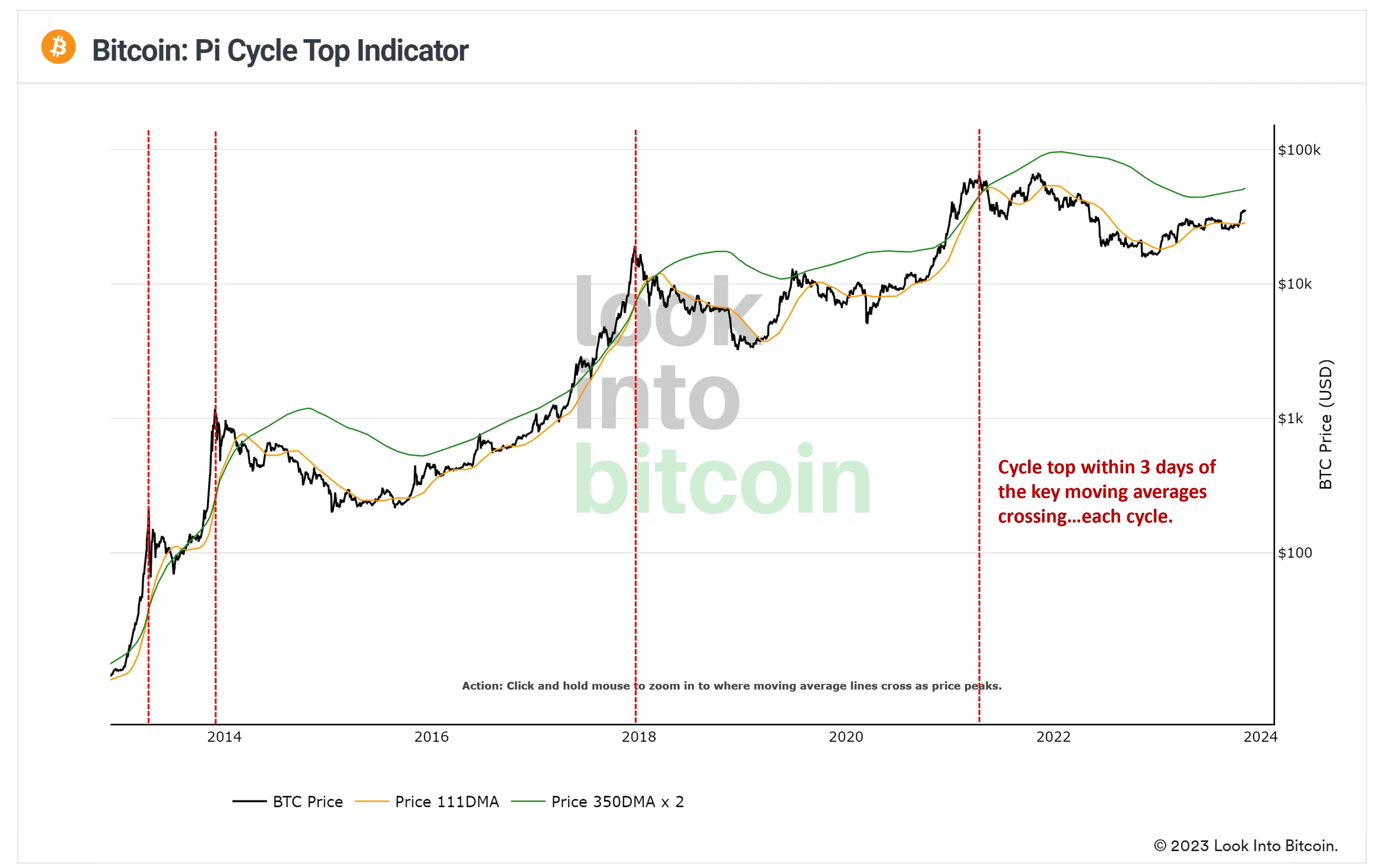

In more extensive analysis This week, Swift also highlighted the “Pi Cycle Top” indicator for providing reliable long-term high estimates.

Related: CME Tops bitcoin Futures OI as ‘Real Facts’ Drive Institutional Adoption

Pi uses two moving averages for its forecasts, and their crossovers herald the next high, albeit only a few days in advance.

“The Pi Cycle Top indicator took many by surprise last cycle, including me, by perfectly identifying the top…again! Will you identify bitcoin‘s top again this cycle? -Swift asked.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER